Taxes In Montana

Montana, known for its stunning landscapes and outdoor adventures, has a unique tax system that plays a crucial role in shaping the state's economy and lifestyle. Understanding the tax landscape in Montana is essential for residents, businesses, and investors alike. In this comprehensive guide, we will delve into the various aspects of taxes in Montana, covering everything from income tax rates to property tax assessments and sales tax exemptions.

Income Tax in Montana: A Flat Rate System

One of the distinctive features of Montana’s tax structure is its flat-rate income tax system. The state imposes a uniform tax rate on all individual and corporate taxable income, which provides a certain level of simplicity and predictability for taxpayers. As of my last update in January 2023, the Montana income tax rate stands at 6.9%, making it relatively moderate compared to some neighboring states.

Montana's flat tax rate applies to all taxable income, including wages, salaries, business profits, interest, dividends, and other forms of income. This simplicity ensures that residents and businesses can easily calculate their tax liabilities without the complexities often associated with progressive tax systems. However, it's important to note that there are certain deductions and credits available to individuals and families, which can help reduce their overall tax burden.

Deductions and Credits in Montana’s Income Tax System

Montana offers a range of deductions and credits to assist taxpayers in managing their income tax obligations. These include:

- Standard Deduction: Montana residents can claim a standard deduction based on their filing status, providing a basic reduction in taxable income. For 2022, the standard deduction amounts are:

- Single: 2,225</li> <li>Married Filing Jointly: 4,450

- Head of Household: 3,338</li> </ul> </li> <li><strong>Personal Exemptions</strong>: Montana allows personal exemptions for each taxpayer and dependent, further reducing taxable income. For 2022, the personal exemption amount is 2,225.

- Tax Credits: Montana offers various tax credits to promote specific activities or assist certain groups. These include credits for childcare expenses, education expenses, and property tax payments, among others.

It's worth noting that Montana's tax laws are subject to change, and it's essential for taxpayers to stay updated with the latest regulations and amendments. The Montana Department of Revenue provides comprehensive resources and guidelines for individuals and businesses to navigate the state's tax system effectively.

Property Taxes in Montana: Assessed Values and Tax Rates

Property taxes are a significant source of revenue for local governments in Montana, and they play a vital role in funding essential services such as schools, fire departments, and infrastructure projects.

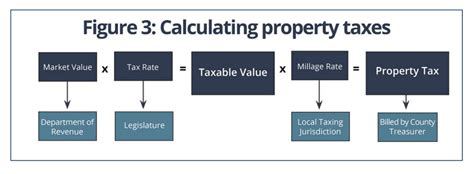

Property Tax Assessment Process

In Montana, the process of assessing property taxes involves several key steps:

- Property Valuation: The first step is to determine the fair market value of the property. This is typically done by a county assessor who considers factors such as location, size, improvements, and recent sales of comparable properties.

- Assessment Ratio: Montana law mandates that the assessed value of property cannot exceed 100% of its market value. However, the state allows counties to set their own assessment ratios, which can be lower than 100%.

- Taxable Value Calculation: The taxable value of a property is derived by applying the assessment ratio to its fair market value. This taxable value is then used to calculate the property tax liability.

It's important to note that Montana's property tax system is designed to be equitable, with the goal of ensuring that similar properties are taxed similarly. However, property values and tax rates can vary significantly between counties and even within the same county.

Property Tax Rates in Montana

Property tax rates in Montana are established by local taxing jurisdictions, which include counties, cities, and special districts. These jurisdictions set their tax rates based on the revenue needed to fund their operations and services.

As of my last update, the average effective property tax rate in Montana was approximately 0.97% of a property's assessed value. However, this rate can vary significantly depending on the location and type of property. For instance, residential properties typically have lower tax rates compared to commercial or industrial properties.

County Effective Property Tax Rate (%) Cascade County 1.24 Lewis and Clark County 0.92 Missoula County 0.94

💡 It's essential for property owners in Montana to understand the assessment process and tax rates in their specific county to accurately estimate their property tax liabilities.Sales and Use Taxes in Montana: A Complex System

Montana’s sales and use tax system is a bit more intricate compared to its income and property tax structures. The state imposes a statewide sales and use tax rate of 4%, which applies to most retail sales and leases of tangible personal property.

Local Sales and Use Tax Rates

In addition to the statewide rate, Montana allows local jurisdictions to impose additional sales and use taxes. These local option taxes can significantly increase the overall tax burden for consumers. As of my last update, several cities and counties in Montana have implemented local option taxes, with rates ranging from 1% to 3%.

Jurisdiction Local Option Tax Rate (%) Missoula County 2 Yellowstone County 3 Flathead County 1 The combination of the statewide rate and local option taxes can result in a total sales and use tax rate of up to 7% in certain areas of Montana. This complexity often requires businesses and consumers to stay informed about the tax rates in their specific locations.

Sales Tax Exemptions and Special Considerations

Montana offers several sales tax exemptions and special considerations to specific industries and purchases. These include:

- Groceries and Food Products: Montana does not impose sales tax on most groceries and food products, making it more affordable for residents to purchase essential items.

- Agricultural Equipment: Sales of agricultural equipment and supplies are exempt from sales tax in Montana, supporting the state’s agricultural industry.

- Resale Exemption: Businesses that purchase goods for resale are generally exempt from sales tax, as the tax is ultimately passed on to the end consumer.

It's crucial for businesses operating in Montana to stay updated with the latest sales tax regulations and exemptions to ensure compliance and avoid potential penalties.

Business Taxes in Montana: A Supportive Environment

Montana has a reputation for being business-friendly, and its tax system reflects this ethos. The state offers a range of tax incentives and a generally low tax burden to attract and support businesses of all sizes.

Corporate Income Tax

Montana imposes a corporate income tax on C corporations and S corporations doing business in the state. The corporate income tax rate is the same as the individual income tax rate, which, as mentioned earlier, is 6.9% as of January 2023.

However, Montana provides a small business tax credit to corporations with taxable income below a certain threshold. This credit can reduce the effective tax rate for small businesses, making it more affordable to operate in the state.

Business Equipment Tax Incentives

Montana offers a Business Equipment Tax Exemption program to encourage businesses to invest in new equipment and machinery. This program exempts qualifying business equipment from property taxes for a specified period, typically up to 5 years.

The exemption applies to a wide range of equipment, including computers, machinery, tools, and vehicles used in business operations. This incentive can significantly reduce the tax burden for businesses, especially those investing in capital-intensive projects.

Research and Development Tax Credits

Montana encourages research and development activities by offering tax credits to businesses engaged in qualifying R&D projects. These credits can offset a portion of the corporate income tax liability, making it more financially viable for companies to invest in innovation and technological advancements.

Conclusion: Navigating Montana’s Tax Landscape

Montana’s tax system is designed to be relatively straightforward and supportive of residents, businesses, and investors. The state’s flat income tax rate, moderate property tax rates, and business-friendly incentives create a positive tax environment.

However, it's crucial to stay informed about the specific tax laws and regulations that apply to your situation. Whether you're a resident, a business owner, or an investor, understanding Montana's tax landscape can help you make informed financial decisions and ensure compliance with the state's tax obligations.

What is the current income tax rate in Montana?

+As of January 2023, the income tax rate in Montana is 6.9%.

Are there any sales tax exemptions in Montana?

+Yes, Montana exempts groceries and food products from sales tax, as well as agricultural equipment and supplies.

How often do property tax rates change in Montana?

+Property tax rates can change annually based on the revenue needs of local taxing jurisdictions. It’s important to stay updated with the rates in your specific county.

Are there any tax incentives for businesses in Montana?

+Montana offers various tax incentives for businesses, including small business tax credits, business equipment tax exemptions, and research and development tax credits.