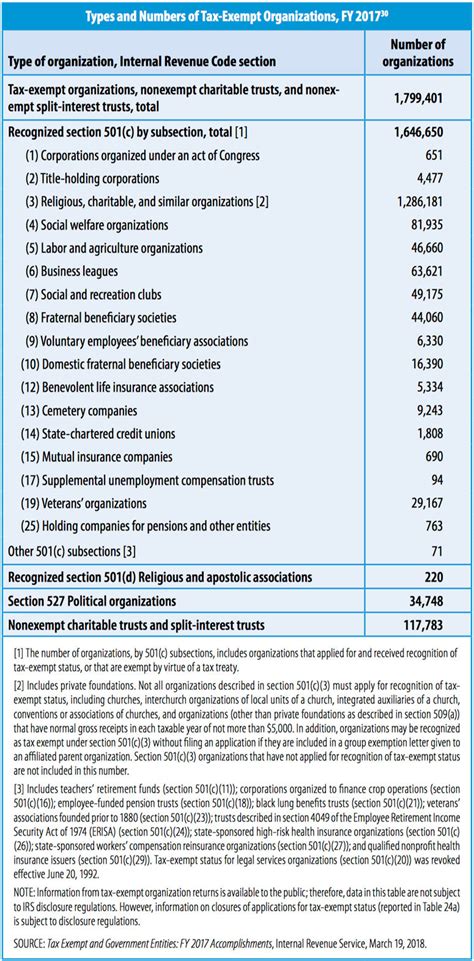

Irs Tax Form 4852

The IRS Tax Form 4852, also known as the "Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc." is an essential document for taxpayers who are unable to obtain an original W-2 or 1099-R form from their employers or payers. This substitute form allows individuals to report their income and taxes accurately, even in situations where the official forms are lost, missing, or not provided.

Understanding Form 4852

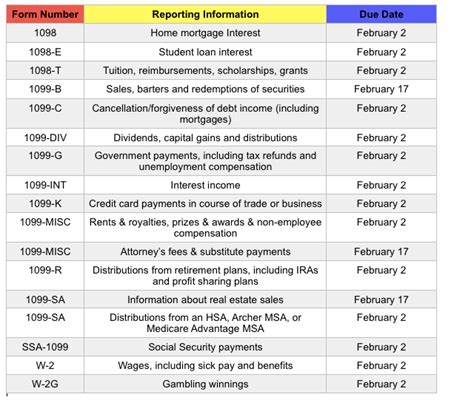

Form 4852 serves as a crucial tool for taxpayers facing various scenarios. For instance, if an individual has not received their W-2 form by the tax filing deadline, they can use Form 4852 to estimate their income and tax withholdings. This form also comes in handy when taxpayers need to report wages from multiple jobs, especially when some employers have failed to issue the necessary W-2 forms.

Additionally, Form 4852 is beneficial for those who receive pension or retirement plan distributions. If the Form 1099-R is not received or contains errors, taxpayers can utilize Form 4852 to accurately report their retirement income. It's important to note that the IRS recommends attaching any relevant documentation, such as pay stubs, to support the information provided on Form 4852.

Key Sections of Form 4852

Form 4852 consists of several sections, each designed to gather specific information. The first part of the form requests personal details, including the taxpayer’s name, address, and Social Security Number. This information ensures that the IRS can accurately identify the taxpayer and match the provided information with their records.

The subsequent sections of the form require taxpayers to provide details about their income. For wages, taxpayers need to specify the employer's name, address, and Employer Identification Number (EIN). They must also report the dates of employment, the amount of federal income tax withheld, and any other relevant information. Similar details are required for pension or retirement plan distributions, including the plan administrator's contact information and the distribution dates.

A unique feature of Form 4852 is its flexibility in accommodating various income types. It allows taxpayers to report not only wages and pension distributions but also other forms of income such as tips, bonuses, and even foreign income. This versatility makes Form 4852 a valuable tool for a wide range of taxpayers facing diverse income scenarios.

| Section | Information Required |

|---|---|

| Personal Details | Name, Address, Social Security Number |

| Wages | Employer's Name, Address, EIN, Employment Dates, Federal Income Tax Withheld |

| Pension/Retirement Plan Distributions | Plan Administrator's Contact Info, Distribution Dates |

Instructions and Requirements

Completing Form 4852 requires careful attention to detail. Taxpayers must ensure that all information provided is accurate and complete. The IRS emphasizes the importance of attaching supporting documentation, such as pay stubs, to substantiate the reported income. This step is crucial as it helps the IRS verify the accuracy of the information and prevents potential delays in processing tax returns.

One key instruction provided by the IRS is to complete only one Form 4852 per payer. This means that if a taxpayer has multiple jobs with different employers, they should use separate forms for each employer's income. This practice ensures that the IRS can match the information with the correct employer and avoids any confusion during the tax return processing.

It's worth noting that while Form 4852 is a valuable substitute, it does not replace the official W-2 or 1099-R forms. Taxpayers should continue to request these forms from their employers or payers and use Form 4852 only as a temporary solution. The IRS recommends contacting employers or payers directly to resolve any issues related to missing or incorrect forms.

Common Scenarios and Considerations

Form 4852 is particularly relevant in situations where taxpayers face challenges obtaining their official forms. For example, if an employer goes out of business or fails to provide W-2 forms, taxpayers can use Form 4852 to estimate their income. Similarly, if a payer makes errors on a 1099-R form, taxpayers can correct these mistakes using Form 4852 and attach it to their tax return.

However, it's important to remember that using Form 4852 does not relieve taxpayers of their responsibility to pay taxes accurately. Taxpayers must ensure that the estimated information provided on Form 4852 aligns with their actual income and tax withholdings. Inaccurate estimates can lead to tax liabilities or penalties, so it's crucial to be as precise as possible.

| Scenario | Consideration |

|---|---|

| Employer Out of Business | Use Form 4852 to estimate income and attach supporting documentation. |

| Errors on 1099-R | Correct mistakes using Form 4852 and attach it to your tax return. |

| Multiple Jobs | Complete one Form 4852 per employer to ensure accurate reporting. |

Submitting Form 4852

Once completed, Form 4852 should be included with the taxpayer’s income tax return. It’s important to ensure that the form is attached securely to the return to prevent any misplacement during processing. Taxpayers should also retain a copy of the completed form for their records, as it may be needed for future reference or in case of an IRS audit.

The IRS recommends using certified mail or another method that provides a receipt when submitting Form 4852. This step ensures that taxpayers have proof of submission, which can be beneficial if there are any discrepancies or issues with their tax return.

It's worth noting that the IRS may contact taxpayers who use Form 4852 to request additional information or documentation. Taxpayers should respond promptly to these requests to avoid delays in processing their tax returns. Providing accurate and complete information from the outset can help streamline this process and ensure a smoother tax filing experience.

Conclusion and Expert Insights

Form 4852 is a vital tool for taxpayers facing challenges with obtaining their official income forms. It provides a structured and organized way to estimate and report income, ensuring compliance with tax regulations. While it serves as a substitute, it is crucial to treat it with the same level of attention and accuracy as one would with the official forms.

In the event of missing W-2 or 1099-R forms, taxpayers should not delay their tax filing. Instead, they should promptly complete Form 4852 and include it with their tax return. This proactive approach can help minimize potential penalties and ensure a more seamless tax filing process. Additionally, by attaching supporting documentation, taxpayers can further strengthen their tax return and provide added credibility to the information reported on Form 4852.

Experts recommend staying organized and keeping track of all income-related documents throughout the year. This practice can simplify the tax filing process and reduce the need for substitutes like Form 4852. By being proactive and maintaining good record-keeping habits, taxpayers can navigate the complex world of tax filings with greater ease and confidence.

Can I use Form 4852 for multiple payers or employers?

+No, you should complete one Form 4852 per payer or employer. This ensures accurate reporting and helps the IRS match the information with the correct entity.

What happens if I make a mistake on Form 4852?

+If you realize you’ve made a mistake, you should correct it as soon as possible. File an amended tax return (Form 1040X) to rectify any errors. The IRS recommends including a brief explanation of the correction and any supporting documentation.

Can I use Form 4852 if my W-2 or 1099-R form has errors but I still have it?

+Yes, you can use Form 4852 to correct errors on your W-2 or 1099-R form. Attach both the original form and Form 4852 to your tax return, clearly indicating the corrections made.