Checking Ohio State Tax Refund

Discovering the status of your Ohio State tax refund is a straightforward process. Ohio offers multiple methods to check the status of your refund, ensuring convenience and accessibility. This guide will walk you through the various options available, providing you with the information you need to track your refund with ease.

Online Refund Status Check

The Ohio Department of Taxation provides an online refund status checker on its official website. This tool is designed to offer taxpayers a quick and convenient way to check the progress of their refund. Here’s a step-by-step guide to using this online service:

Step 1: Access the Refund Status Checker

Navigate to the Ohio Department of Taxation’s website and locate the Refund Status section. You can usually find this on the homepage or under the Taxpayer Services tab.

Step 2: Enter Your Information

The online tool will require you to input specific details to verify your identity and locate your refund. This typically includes your Social Security Number, Tax Year, and the Exact Amount of Your Refund. Make sure to have these details handy before proceeding.

Step 3: Submit and View Your Refund Status

Once you’ve entered the required information, click the Submit or Check Status button. The tool will process your request and display the current status of your refund. It may show the date your refund was processed, the method of refund (direct deposit or check), and any pending actions required.

Ohio Tax Refund Hotline

For those who prefer a more personalized approach, the Ohio Department of Taxation provides a dedicated tax refund hotline. This service is operated by trained professionals who can assist you in checking your refund status and answering any related questions.

Calling the Refund Hotline

To reach the Ohio Tax Refund Hotline, dial (800) 282-1780 (toll-free). The hotline is typically available during standard business hours, Monday through Friday. When calling, be prepared to provide the same information as the online checker, including your Social Security Number, Tax Year, and Refund Amount.

Advantages of the Hotline

The tax refund hotline offers several advantages, especially for those who may not be comfortable with online tools or prefer a more personalized experience. Trained representatives can guide you through the process, answer specific questions about your refund, and provide updates if there are any delays or issues.

Other Methods to Check Ohio State Tax Refund

In addition to the online checker and hotline, Ohio provides a few alternative methods to check your tax refund status:

- Email Inquiry: You can send an email to the Ohio Department of Taxation with your refund-related queries. While not as immediate as the hotline, this method allows you to receive a written response, which can be helpful for future reference.

- Postal Mail: If you prefer a more traditional approach, you can write a letter to the department, including your personal details and refund inquiry. This method might take longer, but it's an option for those without access to online services.

- In-Person Visit: For taxpayers in the vicinity of Columbus, Ohio, a visit to the Ohio Department of Taxation office might be an option. While not the most convenient method, it allows for face-to-face interaction and can be beneficial for complex refund issues.

Understanding Ohio Tax Refund Processing Times

It’s important to understand that the processing time for Ohio tax refunds can vary depending on several factors. The Ohio Department of Taxation aims to process refunds within a specific timeframe, but certain circumstances might lead to delays.

Standard Processing Times

In general, if you e-file your tax return and choose direct deposit, you can expect your refund within 7-10 business days. For paper returns or refunds sent via check, the processing time may be slightly longer, taking up to 21 business days or more.

Factors Affecting Processing Times

Several factors can impact the processing time of your Ohio tax refund, including:

- Errors or Inconsistencies: If your tax return contains errors or inconsistencies, it might be held for further review, leading to delays.

- Peak Tax Seasons: During the peak tax filing season (typically late March to mid-April), the department experiences a surge in filings, which can slow down processing times.

- Additional Reviews: In some cases, the department may select returns for further review or audit, which can extend the refund processing timeline.

Common Issues and Solutions

While Ohio’s refund process is generally efficient, there may be instances where taxpayers encounter issues. Here are some common problems and potential solutions:

Refund Not Received

If you haven’t received your refund within the expected timeframe, it’s essential to check the status using the methods mentioned above. If the status shows a delay or error, contact the Ohio Tax Refund Hotline for assistance.

Incorrect Refund Amount

In rare cases, taxpayers may receive an incorrect refund amount. If this occurs, promptly contact the Ohio Department of Taxation to report the issue. They will guide you through the process of correcting the error and issuing a revised refund.

Missing or Incorrect Personal Information

If your refund is delayed due to missing or incorrect personal information (e.g., an outdated address), update your details with the Ohio Department of Taxation immediately. This ensures that future correspondence and refunds are sent to the correct location.

Future Refund Improvements and Initiatives

The Ohio Department of Taxation continuously works to enhance its refund process and improve taxpayer experience. Here are some initiatives and improvements to look forward to:

- Enhanced Online Services: The department is investing in upgrading its online platforms to provide more robust and user-friendly services, including a more intuitive refund status checker.

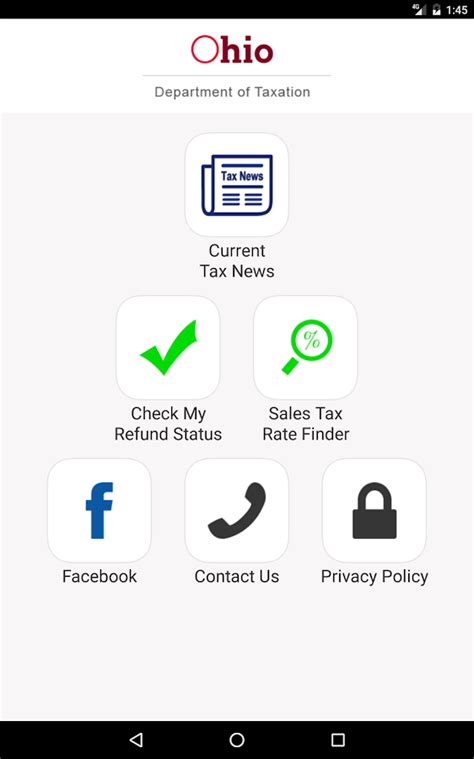

- Mobile App Development: Ohio is exploring the development of a mobile app, which could offer taxpayers a convenient way to check refund status, receive updates, and access other tax-related services on their smartphones.

- Streamlined Processing: Ongoing efforts are focused on streamlining the refund process to reduce processing times and minimize delays. This includes investing in technology and training to ensure a more efficient and accurate system.

Conclusion

Checking the status of your Ohio State tax refund is a simple process, thanks to the various methods provided by the Ohio Department of Taxation. Whether you prefer the convenience of online tools, the personalized assistance of the hotline, or traditional methods like mail or in-person visits, you have options to suit your needs. Understanding the processing times and potential issues can help you navigate the refund process with confidence. As Ohio continues to enhance its services, taxpayers can expect an even smoother and more efficient refund experience in the future.

How long does it take to receive an Ohio tax refund?

+The timeframe for receiving an Ohio tax refund varies. If you e-file and choose direct deposit, you can expect your refund within 7-10 business days. For paper returns or refunds sent by check, the process may take up to 21 business days or more.

What should I do if my refund status shows a delay or error?

+If your refund status indicates a delay or error, it’s advisable to contact the Ohio Tax Refund Hotline at (800) 282-1780 for assistance. They can provide guidance and help resolve any issues.

Can I track my Ohio tax refund by mail or email?

+Yes, you can track your Ohio tax refund by sending an email inquiry to the Ohio Department of Taxation. Additionally, you can write a letter to the department for a postal mail response. However, these methods may take longer than online or hotline inquiries.

Are there any upcoming improvements to the Ohio tax refund process?

+The Ohio Department of Taxation is committed to enhancing its services. Upcoming improvements include enhanced online platforms, potential mobile app development, and streamlined processing to reduce refund delays.