Nc State Tax Refund Status

If you're a North Carolina resident awaiting your state tax refund, staying informed about the status of your refund is essential. This article aims to provide an in-depth guide on how to track the progress of your Nc State Tax Refund, ensuring you receive your refund promptly and efficiently.

Understanding the Nc State Tax Refund Process

The North Carolina Department of Revenue (NCDOR) handles the processing and distribution of state tax refunds. It’s important to note that the time it takes to receive your refund can vary based on several factors, including the method of filing, payment, and the complexity of your tax return.

The NCDOR processes refunds in the order they are received, with a focus on accuracy and compliance with state tax laws. This ensures that taxpayers receive the correct refund amount, free from errors or discrepancies.

Typical Processing Times

For taxpayers who file their returns electronically and choose direct deposit as their refund method, the NCDOR aims to process refunds within 7-14 business days. This efficient turnaround time is a result of the department’s commitment to utilizing modern technology and streamlining its processes.

However, if you opt for a paper return or request your refund via check, the processing time may extend up to 6-8 weeks. This is due to the additional steps involved in manually processing and verifying paper returns, as well as the time required to issue and mail a physical check.

| Filing Method | Refund Method | Typical Processing Time |

|---|---|---|

| Electronic Filing | Direct Deposit | 7-14 Business Days |

| Paper Return | Check | 6-8 Weeks |

Checking Your Nc State Tax Refund Status

The NCDOR offers multiple convenient ways for taxpayers to check the status of their state tax refund. These methods ensure that you can stay informed about the progress of your refund, regardless of your preferred mode of communication.

Online Refund Status Check

The most efficient way to check your Nc State Tax Refund status is through the NCDOR’s online portal. This portal provides real-time updates on the progress of your refund, offering transparency and peace of mind.

To access this service, you'll need to provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as the exact refund amount shown on your return. This security measure ensures that only authorized individuals can access your refund information.

Once logged in, you'll be able to view the current status of your refund, including whether it's been approved, is in progress, or if there are any issues delaying its processing. The portal also provides estimated refund dates, helping you plan your finances accordingly.

Telephone Refund Status Inquiry

If you prefer a more traditional approach, you can also check your Nc State Tax Refund status by calling the NCDOR’s toll-free number. This option is particularly useful for those who may not have easy access to the internet or prefer a more personal touch.

When calling, you'll be guided through a series of automated prompts to verify your identity. You'll need to provide the same information as the online portal, including your SSN/ITIN and the exact refund amount. A customer service representative will then assist you in retrieving your refund status.

While the telephone option may not offer the real-time updates of the online portal, it provides a convenient alternative for those who may face challenges with internet access or prefer a more conversational approach.

Resolving Nc State Tax Refund Delays

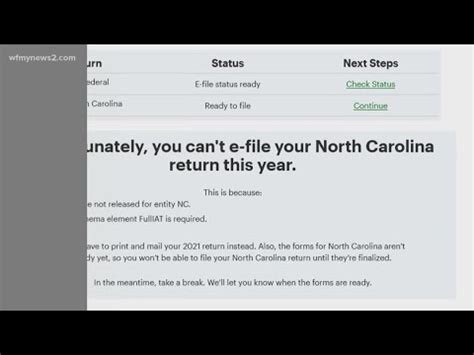

In some cases, your Nc State Tax Refund may encounter delays. This could be due to a variety of reasons, including errors on your tax return, missing information, or additional reviews required by the NCDOR.

Common Reasons for Refund Delays

- Inaccurate or incomplete tax return information.

- Suspicious activity or potential fraud indicators.

- Complex tax situations requiring manual review.

- System errors or technical issues during processing.

- Errors in claiming tax credits or deductions.

If your refund is delayed, the NCDOR will typically send a notice explaining the reason for the delay and providing instructions on how to resolve the issue. It's crucial to address these issues promptly to ensure your refund can be processed without further delays.

Addressing Refund Delays

If you receive a notice regarding a delay in your Nc State Tax Refund, the first step is to carefully review the notice to understand the specific issue. The NCDOR provides detailed instructions on how to correct the error or provide the missing information.

For instance, if the delay is due to a missing form or document, you'll need to obtain the required item and submit it to the NCDOR as soon as possible. If there's an error on your tax return, you may need to file an amended return to correct the mistake.

It's important to keep a record of all communications with the NCDOR, including any notices received and actions taken to resolve the delay. This documentation can be helpful if you need to reference the issue at a later date.

Conclusion: Stay Informed, Stay Patient

Waiting for your Nc State Tax Refund can be a tedious process, but staying informed about the status of your refund can help ease the anxiety. By utilizing the NCDOR’s online portal or telephone services, you can easily track the progress of your refund and address any potential delays promptly.

Remember, the NCDOR processes refunds in a timely manner, but external factors and complex tax situations can occasionally cause delays. Maintaining patience and staying informed will ensure a smoother experience throughout the refund process.

Frequently Asked Questions

How can I check the status of my Nc State Tax Refund online?

+To check your Nc State Tax Refund status online, visit the NCDOR’s official website and navigate to the ‘Refund Status’ section. You’ll need to provide your SSN/ITIN and the exact refund amount shown on your return to access your refund status.

What should I do if my Nc State Tax Refund is delayed due to an error on my return?

+If your Nc State Tax Refund is delayed due to an error on your return, the NCDOR will typically send a notice explaining the issue. Carefully review the notice and follow the instructions provided to correct the error. You may need to file an amended return to rectify the mistake.

How long does it usually take to receive my Nc State Tax Refund after filing electronically with direct deposit?

+When you file your Nc State Tax Return electronically and choose direct deposit as your refund method, the NCDOR aims to process refunds within 7-14 business days. This efficient turnaround time ensures you receive your refund promptly.

Can I track my Nc State Tax Refund status by calling the NCDOR?

+Yes, you can track your Nc State Tax Refund status by calling the NCDOR’s toll-free number. You’ll be guided through a series of automated prompts to verify your identity, and a customer service representative will assist you in retrieving your refund status.

What if I don’t receive my Nc State Tax Refund within the estimated timeframe provided by the NCDOR?

+If you don’t receive your Nc State Tax Refund within the estimated timeframe provided by the NCDOR, it’s important to check the status of your refund using the online portal or by calling the NCDOR. If there are no issues with your refund, you may need to contact the NCDOR directly to inquire about the delay.