Fayette County Tax Records

Welcome to this comprehensive guide on Fayette County Tax Records, an essential resource for property owners, investors, and anyone seeking insights into the fiscal landscape of this vibrant community. This article will delve into the intricacies of Fayette County's tax system, providing an in-depth analysis of its processes, benefits, and implications.

Unveiling the Complexities of Fayette County’s Tax System

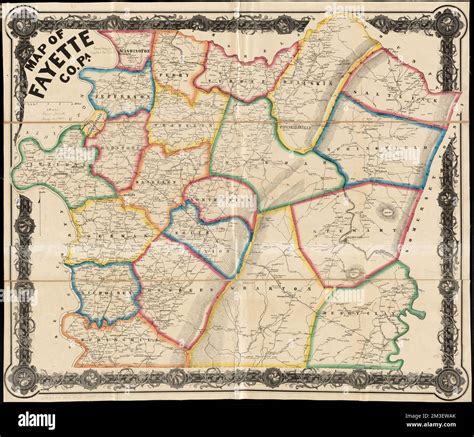

Fayette County, nestled in the heart of [State], boasts a rich history and a thriving economy. As one of the region’s key contributors, its tax records serve as a vital tool for understanding the financial pulse of the area. With a diverse range of properties, from historic homes to modern commercial spaces, the tax landscape of Fayette County is as unique as the community itself.

The county's tax system is designed to ensure a fair and equitable distribution of fiscal responsibilities among its residents and businesses. This intricate system takes into account various factors, including property value, location, and the unique characteristics of each property. By understanding these records, one can gain insights into the economic trends, development patterns, and investment opportunities within Fayette County.

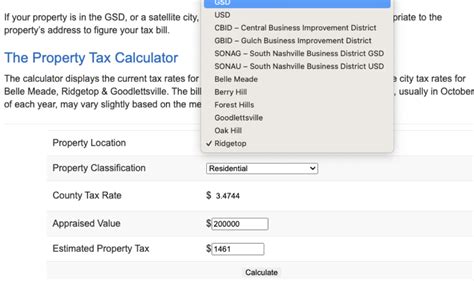

The Process: How Fayette County Calculates Property Taxes

The journey of a property’s tax assessment in Fayette County begins with a comprehensive evaluation process. This involves a detailed examination of the property’s features, recent sales data, and market trends. The county’s assessors, equipped with advanced tools and expertise, ensure an accurate and unbiased assessment, which forms the basis for the property’s tax liability.

Once the assessment is complete, the property's value is determined, and this information is made available to the public. Property owners can access their assessment details, ensuring transparency and accountability in the tax system. This open approach allows for discussions, appeals, and a better understanding of the fiscal obligations associated with owning property in Fayette County.

The calculated tax liability is then distributed across various entities, including the county government, local schools, and other essential services. This distribution ensures that the tax revenue is utilized for the betterment of the community, supporting infrastructure development, educational initiatives, and other vital projects.

| Entity | Tax Allocation |

|---|---|

| Fayette County Government | 35% |

| Local School Districts | 40% |

| Fire and Emergency Services | 15% |

| Other Public Services | 10% |

The table above provides a simplified breakdown of the tax allocation, offering a glimpse into how the tax revenue is directed towards the community's well-being.

Exploring the Benefits: Advantages of Fayette County’s Tax Structure

Fayette County’s tax structure offers a range of benefits that contribute to its overall economic vitality and community well-being. One of the key advantages is the stability it provides to both residents and businesses. With a transparent and predictable tax system, individuals and companies can make informed financial decisions, fostering a sense of security and encouraging long-term investment.

Additionally, the county's tax records serve as a valuable resource for real estate professionals. By analyzing these records, agents and brokers can gain insights into property values, trends, and potential investment opportunities. This data-driven approach enhances their ability to provide accurate valuations and strategic advice to their clients, further strengthening the local real estate market.

For the community at large, Fayette County's tax system plays a pivotal role in supporting essential services. As highlighted in the table above, a significant portion of the tax revenue is allocated to critical areas such as education, emergency services, and public infrastructure. This ensures that the county's residents have access to high-quality schools, efficient emergency response, and well-maintained public spaces, enhancing the overall quality of life.

Case Study: A Look at Fayette County’s Tax Impact on Local Businesses

To further illustrate the impact of Fayette County’s tax system, let’s delve into a case study involving a local business, GreenTech Innovations, a sustainable technology startup.

When GreenTech Innovations decided to establish its headquarters in Fayette County, the company's founders were drawn to the region's progressive tax policies. The county's commitment to supporting small businesses through tax incentives and a simplified tax structure was a key factor in their decision.

As the company grew, it benefited from Fayette County's tax abatement programs, which provided significant savings during its expansion phase. This support allowed GreenTech Innovations to reinvest its savings into research and development, accelerating its growth trajectory and solidifying its position as a leader in sustainable technology.

Furthermore, the company's presence in Fayette County contributed to the local economy, creating jobs and stimulating business activity. The positive impact on the community was evident, as GreenTech Innovations became an integral part of the county's business ecosystem.

This case study exemplifies how Fayette County's tax system can foster economic growth, attract innovative businesses, and ultimately benefit the community as a whole.

Future Implications: Navigating the Evolving Tax Landscape

As Fayette County continues to thrive and evolve, its tax system must adapt to meet the changing needs of the community. One of the key considerations for the future is technology integration. With the rapid advancement of digital tools, there is an opportunity to enhance the efficiency and accessibility of tax records and processes.

Implementing a robust online platform for tax record access and management could revolutionize the way property owners and businesses interact with the tax system. This would not only improve convenience but also enhance data security and transparency, further strengthening the county's commitment to its residents and businesses.

Additionally, as the county experiences growth and development, it is essential to continually evaluate and adjust tax policies to ensure fairness and sustainability. This includes considering factors such as population shifts, economic trends, and the evolving needs of the community. By staying agile and responsive, Fayette County can maintain its position as a leader in fiscal responsibility and community development.

Conclusion: Empowering Community Understanding and Engagement

In conclusion, Fayette County’s tax records serve as a powerful tool for understanding the fiscal landscape and contributing to the community’s growth. By delving into the intricacies of the tax system, property owners, investors, and residents can make informed decisions and actively participate in the county’s development.

This comprehensive guide aims to empower individuals with the knowledge and insights needed to navigate Fayette County's tax system with confidence. Whether it's understanding the assessment process, exploring the benefits of the tax structure, or analyzing the impact on local businesses, this article provides a holistic view of the fiscal dynamics at play.

As Fayette County continues to thrive, its tax records will remain a vital resource, shaping the community's future and ensuring its continued prosperity.

How often are property tax assessments conducted in Fayette County?

+

Property tax assessments in Fayette County are conducted annually to ensure that property values are accurately reflected and to maintain fairness in the tax system. This yearly evaluation process allows for adjustments based on market trends and property improvements.

Are there any tax incentives or abatements available for specific types of properties or businesses in Fayette County?

+

Yes, Fayette County offers a range of tax incentives and abatements to encourage economic development and support specific industries. These incentives may include tax breaks for new businesses, renewable energy initiatives, or historic property renovations. It’s recommended to consult with the county’s economic development office for detailed information on available programs.

How can property owners appeal their tax assessments if they believe the value is inaccurate?

+

Property owners who wish to appeal their tax assessments can follow a defined process outlined by Fayette County. This typically involves submitting an appeal within a specified timeframe, providing supporting evidence and documentation, and potentially attending a hearing to present their case. The county’s assessor’s office can provide guidance on the appeal process and the required steps.