State Of Texas Vehicle Sales Tax

The State of Texas has a unique approach to vehicle sales tax, with a system that varies depending on the type of vehicle purchase and the location of the transaction. Understanding the intricacies of Texas vehicle sales tax is crucial for both buyers and sellers, as it can significantly impact the overall cost of a vehicle and the financial obligations of the parties involved. This comprehensive guide will delve into the specifics of Texas vehicle sales tax, covering everything from the basic rates to the special considerations and potential exemptions.

Texas Vehicle Sales Tax: An Overview

The Lone Star State, known for its diverse landscape and thriving automotive market, has a sales tax structure that reflects its unique identity. Texas imposes a state sales tax on vehicle purchases, but the rates and rules can differ based on various factors. This section provides an overview of the basic Texas vehicle sales tax rates and their applicability.

Basic Sales Tax Rates

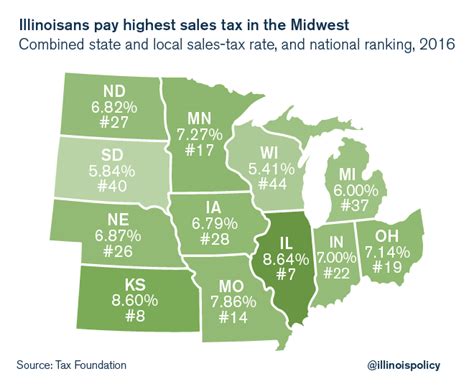

Texas has a state sales tax rate of 6.25%, which applies to most tangible personal property, including vehicles. This base rate is consistent across the state and forms the foundation of the vehicle sales tax structure. However, it’s important to note that local municipalities and counties can also levy additional sales taxes, creating a more complex tax landscape.

The following table provides a snapshot of the basic sales tax rates in Texas:

| Type of Tax | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Local Sales Tax (Average) | 2% |

The average local sales tax rate in Texas is approximately 2%, but this can vary significantly depending on the county. For instance, counties like El Paso and Fort Bend have higher local sales tax rates, while others, like Loving County, have no local sales tax. This variation can result in considerable differences in the total sales tax paid for vehicle purchases across the state.

Vehicle Purchase Considerations

When buying a vehicle in Texas, the sales tax calculation is not solely based on the vehicle’s purchase price. Several other factors come into play, including:

- Vehicle Type: Texas has different tax rules for new and used vehicles, with potentially varying rates and exemptions.

- Location of Purchase: As mentioned, local sales taxes can differ, so the county where the vehicle is purchased plays a crucial role in determining the total sales tax.

- Delivery and Installation: Costs for delivery, installation, and any additional accessories can be subject to sales tax.

- Trade-Ins: The value of a trade-in vehicle may impact the taxable amount, reducing the overall sales tax liability.

Special Cases and Exemptions

Texas vehicle sales tax also has several special cases and exemptions that can significantly affect the overall tax burden. These exceptions are designed to accommodate various scenarios and promote specific economic or social objectives.

New vs. Used Vehicles

Texas distinguishes between new and used vehicle sales when it comes to sales tax. New vehicles are subject to a different set of rules compared to used vehicles, primarily due to the Texas Motor Vehicle Purchase Tax.

New Vehicles

For new vehicles, Texas imposes an additional Motor Vehicle Purchase Tax, which is typically 6.25% of the purchase price. This tax is in addition to the standard state and local sales taxes. However, it’s important to note that this tax is often included in the advertised price of new vehicles, so buyers may not see it as a separate line item.

Used Vehicles

When purchasing a used vehicle, the Motor Vehicle Purchase Tax does not apply. Instead, buyers will only pay the standard state and local sales taxes, which can result in a lower overall tax burden compared to new vehicle purchases.

Exemptions and Special Cases

Texas offers several exemptions and special cases for vehicle sales tax, which can provide significant savings for eligible buyers. Here are some notable exemptions:

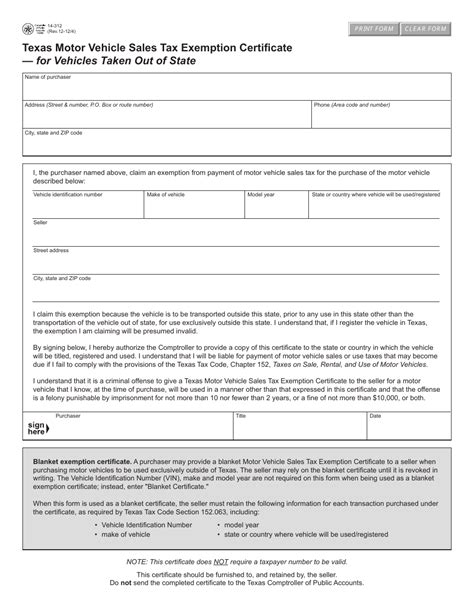

- Military Sales Tax Exemption: Active-duty military personnel and their spouses may be eligible for a sales tax exemption on vehicle purchases. This exemption applies to both new and used vehicles and can save a considerable amount of money.

- Disabled Veteran Exemption: Texas offers a sales tax exemption to qualifying disabled veterans. This exemption applies to the purchase of a vehicle equipped with specialized adaptive equipment.

- Trade-In Exemption: When trading in a vehicle, the value of the trade-in is deducted from the purchase price of the new vehicle. This can reduce the taxable amount, resulting in a lower sales tax liability.

- Lease Turn-Ins: If you're returning a leased vehicle, you may not be subject to sales tax on the purchase of a new vehicle, provided certain conditions are met.

Calculating Texas Vehicle Sales Tax

Calculating the exact sales tax for a vehicle purchase in Texas can be complex due to the varying rates and exemptions. Here’s a step-by-step guide to help you estimate the sales tax for a vehicle purchase:

- Determine the purchase price of the vehicle, including any additional accessories and delivery charges.

- Identify the applicable sales tax rates for the specific county where the vehicle will be purchased. This includes the state sales tax (6.25%) and the local sales tax.

- For new vehicles, add the Motor Vehicle Purchase Tax (6.25%) to the total.

- If applicable, deduct the value of any trade-in vehicle from the purchase price.

- Calculate the sales tax by multiplying the total taxable amount (after any deductions) by the combined sales tax rate.

It's important to note that while this guide provides a general framework, the actual sales tax calculation can be more intricate, especially when considering special cases and exemptions. Consulting with a tax professional or using online sales tax calculators can provide more precise estimates tailored to your specific circumstances.

Performance Analysis and Industry Insights

Understanding the performance and impact of Texas vehicle sales tax requires a deeper analysis of industry trends and consumer behavior. Here, we delve into the implications of the state’s sales tax structure on the automotive market and offer insights into how it shapes the purchasing landscape.

Impact on Vehicle Sales

The sales tax structure in Texas can influence vehicle sales in several ways. While the state’s competitive tax rates may attract buyers, the complexity of the system, with varying local tax rates and exemptions, can also introduce challenges. Here’s how it affects the market:

- Price Sensitivity: Buyers in Texas are often highly sensitive to vehicle prices, including the sales tax component. This sensitivity can drive price negotiations and impact the overall market demand.

- County-Level Variations : The significant differences in local sales tax rates across counties can create a competitive landscape. Buyers may choose to shop in counties with lower tax rates, potentially affecting the sales volume in certain regions.

- Exemptions and Incentives: Exemptions like those for military personnel and disabled veterans can encourage vehicle purchases in these demographic groups. This not only boosts sales but also aligns with the state's social objectives.

Industry Strategies

Automotive dealers and manufacturers in Texas often employ various strategies to navigate the state’s sales tax landscape and enhance their competitiveness.

- Price Transparency: Dealers often provide transparent pricing, including sales tax, to build trust with customers and simplify the purchasing process.

- Exemption Awareness: Promoting awareness of sales tax exemptions can attract eligible buyers and increase dealership traffic.

- Strategic Location: Dealers may choose to operate in counties with lower sales tax rates to offer more competitive prices.

- Trade-In Incentives: Offering attractive trade-in values can reduce the taxable amount, making vehicle purchases more affordable for customers.

Future Implications and Potential Changes

The Texas vehicle sales tax landscape is dynamic and can evolve based on legislative changes and economic trends. Here, we explore some potential future developments and their implications.

Legislative Updates

Texas legislators regularly review and adjust tax laws, including sales tax rates and exemptions. Future changes could include:

- Uniform Tax Rate: There have been discussions about implementing a uniform sales tax rate across the state, eliminating the variations in local sales taxes. This could simplify the tax structure but may also impact the revenue of certain counties.

- Exemption Expansion: The state may consider expanding existing exemptions or introducing new ones to support specific industries or demographics.

- Online Sales Tax: With the growth of e-commerce, Texas may need to address the taxation of online vehicle sales to ensure a level playing field with traditional dealerships.

Economic Factors

Economic conditions can also influence the future of Texas vehicle sales tax. During economic downturns, the state may consider tax breaks or incentives to stimulate vehicle sales. Conversely, in robust economic times, tax rates may be adjusted to align with changing market dynamics.

Conclusion

The State of Texas’ vehicle sales tax structure is a complex yet intriguing system that reflects the state’s diverse landscape and economic priorities. From the basic sales tax rates to the special cases and exemptions, understanding this system is essential for both consumers and industry professionals. As the automotive market continues to evolve, staying informed about the nuances of Texas vehicle sales tax will be crucial for making informed purchasing decisions and staying competitive in the industry.

How often are Texas vehicle sales tax rates updated?

+Texas sales tax rates, including the state and local rates, can be adjusted periodically by the Texas Comptroller of Public Accounts. However, significant changes to the sales tax structure are less frequent and often occur as part of legislative sessions.

Can I get a refund for overpaid sales tax on my vehicle purchase?

+Yes, if you believe you have overpaid sales tax on your vehicle purchase, you can file for a refund with the Texas Comptroller’s office. This process involves providing documentation and proof of the overpayment.

Are there any online resources to help calculate Texas vehicle sales tax?

+Yes, there are several online sales tax calculators available, both from government sources and private companies. These tools can provide estimates based on your specific purchase details and location.