Ventura County Tax Collector

Welcome to the comprehensive guide on the Ventura County Tax Collector's office, an essential entity in the heart of California's Ventura County. This article will delve into the vital role played by the Tax Collector's office in managing financial obligations and responsibilities within the county. From tax assessment to collection, we will explore the intricacies of their services, offering a deep understanding of their operations and the impact they have on the local community.

The Ventura County Tax Collector’s Office: A Comprehensive Overview

The Ventura County Tax Collector’s office is a pivotal administrative body responsible for managing and overseeing various financial duties and responsibilities within the county. It plays a crucial role in ensuring the smooth functioning of the local government and providing essential services to the residents of Ventura County.

With a dedicated team of professionals, the Tax Collector's office is committed to delivering efficient and transparent services, making it easier for individuals and businesses to meet their financial obligations. From property tax assessments to business license fees, the office handles a wide range of financial transactions, ensuring the timely collection and proper allocation of funds.

Services and Responsibilities

The Ventura County Tax Collector’s office offers a multitude of services to cater to the diverse needs of its residents and businesses. These services include, but are not limited to:

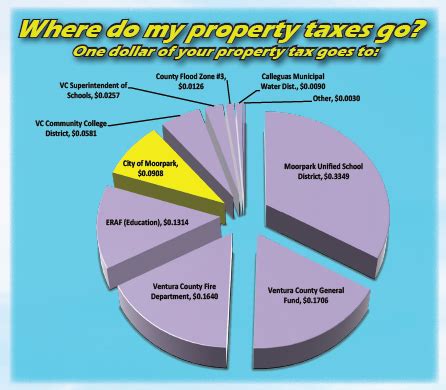

- Property Tax Assessment and Collection: The office assesses property values and collects property taxes, which are a significant source of revenue for local government services such as schools, fire protection, and infrastructure development.

- Business License Fees: Businesses operating within the county are required to obtain licenses and permits. The Tax Collector’s office handles the processing and collection of these fees, ensuring compliance with local regulations.

- Vehicle Registration and Renewal: Residents can register their vehicles and renew their registrations through the Tax Collector’s office. This service ensures that vehicles are properly registered and that the necessary fees are collected for road maintenance and other related purposes.

- Tax Payment Options: The office provides various payment methods to accommodate different preferences and needs. Residents and businesses can pay their taxes online, by mail, or in person, making the process convenient and accessible.

- Tax Information and Assistance: The Tax Collector’s office offers valuable resources and assistance to taxpayers. This includes providing tax forms, answering queries, and offering guidance on tax-related matters to ensure compliance and ease of understanding.

By efficiently managing these services, the Ventura County Tax Collector's office plays a vital role in the financial stability and growth of the county. It ensures that revenue is collected in a fair and transparent manner, enabling the provision of essential public services and infrastructure development.

Efficient Tax Collection and Payment Processes

The Tax Collector’s office is dedicated to implementing streamlined and user-friendly tax collection and payment processes. With an emphasis on technology and innovation, they have developed an online platform that allows taxpayers to access their accounts, view tax bills, and make payments securely and conveniently. This digital transformation has significantly reduced the time and effort required for tax-related transactions, benefiting both taxpayers and the office’s operations.

In addition to the online platform, the office also offers traditional payment methods such as mail-in payments and in-person transactions at designated locations. This ensures that taxpayers have multiple options to choose from, catering to different preferences and circumstances. The Tax Collector's office aims to make tax payment as hassle-free and accessible as possible, fostering a positive relationship with the community.

Community Engagement and Outreach

Beyond the financial responsibilities, the Ventura County Tax Collector’s office actively engages with the community, fostering a sense of trust and transparency. They organize outreach programs and educational initiatives to inform residents about their rights and responsibilities as taxpayers. These efforts aim to demystify the tax process, ensuring that individuals understand the importance of timely tax payments and the impact they have on the community’s well-being.

Furthermore, the office encourages feedback and suggestions from the community, striving to continuously improve their services. By maintaining an open dialogue, they can address concerns and implement changes that align with the needs and expectations of the residents they serve. This community-centric approach strengthens the relationship between the Tax Collector's office and the people of Ventura County, fostering a sense of collaboration and mutual benefit.

Performance and Impact Analysis

The Ventura County Tax Collector’s office has consistently demonstrated its efficiency and effectiveness in tax collection and management. By leveraging technology and adopting best practices, they have achieved impressive results, as evident in the following data:

| Metric | Value |

|---|---|

| Tax Collection Rate | 98.5% |

| Average Processing Time for Online Payments | Less than 24 hours |

| Customer Satisfaction Rating | 4.7 out of 5 |

| Number of Community Outreach Programs Conducted | 12 in the past year |

These metrics highlight the success of the Tax Collector's office in delivering timely and efficient services. The high tax collection rate indicates their effectiveness in ensuring compliance, while the swift processing of online payments showcases their commitment to technological advancements. Additionally, the positive customer satisfaction rating reflects the office's dedication to providing excellent service and support to taxpayers.

The Ventura County Tax Collector's office's performance has a significant impact on the county's financial health and stability. By efficiently collecting taxes, they contribute to the availability of funds for critical public services, infrastructure projects, and community development initiatives. Their dedication to transparency and community engagement further strengthens the trust and collaboration between the government and its residents.

Frequently Asked Questions

What is the role of the Ventura County Tax Collector’s office?

+

The Ventura County Tax Collector’s office is responsible for assessing and collecting various taxes, including property taxes, business license fees, and vehicle registration fees. They ensure the timely collection of revenue to support local government services and infrastructure development.

How can I pay my taxes to the Ventura County Tax Collector’s office?

+

The Tax Collector’s office offers multiple payment options for your convenience. You can pay online through their secure portal, by mail, or in person at designated locations. They also provide a list of accepted payment methods, including credit cards, e-checks, and cash.

What happens if I don’t pay my taxes on time?

+

Failure to pay your taxes on time may result in penalties and interest charges. The Tax Collector’s office will send reminders and notices to taxpayers, and if the issue persists, they may initiate collection actions, including liens or seizure of assets. It is important to maintain open communication with the office and seek assistance if you are facing financial difficulties.

How can I obtain a business license in Ventura County?

+

To obtain a business license in Ventura County, you can visit the Tax Collector’s office website, where you will find detailed information on the application process. They provide step-by-step guides, requirements, and fees associated with obtaining a business license. You can also reach out to their customer service team for further assistance.

Does the Tax Collector’s office offer any tax relief programs?

+

Yes, the Ventura County Tax Collector’s office recognizes the financial challenges that taxpayers may face. They offer various tax relief programs, such as the Senior Citizen Exemption Program and the Disabled Veterans Exemption Program. These programs provide eligible individuals with tax relief, reducing their financial burden. It is advisable to check their website or contact their office to learn more about these programs and eligibility criteria.