Colorado Capital Gains Tax

Colorado's tax system, like that of many states, includes a capital gains tax as part of its revenue collection strategy. Capital gains taxes can significantly impact investors, businesses, and individuals, so understanding the specifics of Colorado's regulations is crucial for financial planning and compliance. This article aims to provide an in-depth analysis of Colorado's capital gains tax, offering clarity and insights into its structure, rates, and implications.

Understanding Capital Gains Tax in Colorado

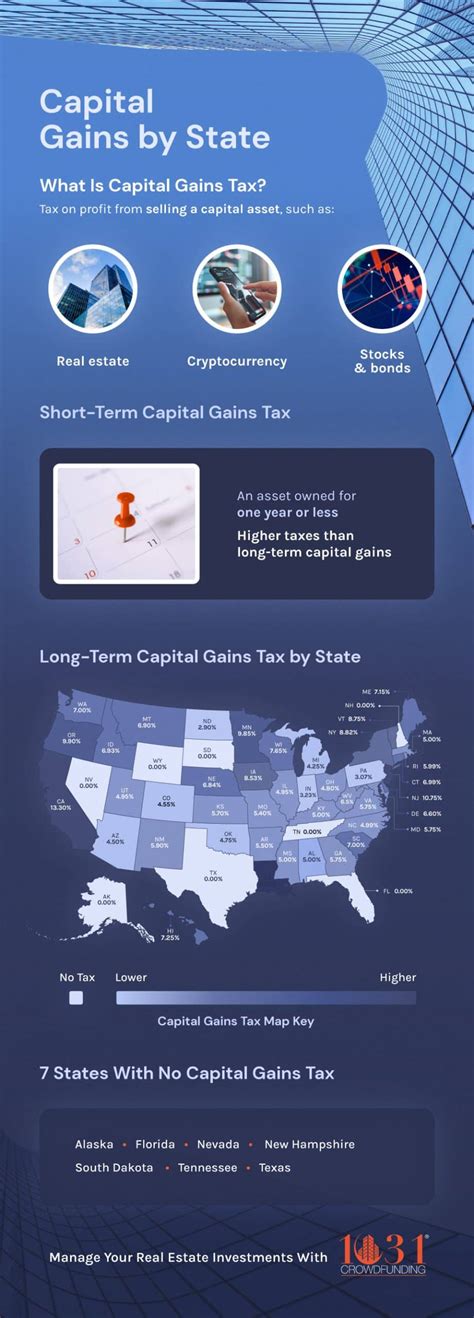

Capital gains refer to the profits earned from the sale of investments and assets, such as stocks, bonds, real estate, and collectibles. These gains are subject to taxation, and the rate at which they are taxed can vary based on several factors, including the type of asset, the holding period, and the jurisdiction in which the transaction takes place.

In Colorado, the Department of Revenue oversees the assessment and collection of capital gains taxes, ensuring compliance with state laws and regulations. The state's tax system is designed to generate revenue for essential public services while also promoting economic growth and investment.

Taxable Events and Holding Periods

Capital gains in Colorado are triggered by various taxable events, primarily the sale or exchange of capital assets. These assets can include:

- Stocks and mutual funds

- Bonds and other debt instruments

- Real estate properties (residential, commercial, or land)

- Business interests and partnerships

- Cryptocurrencies and digital assets

- Artwork, collectibles, and antiques

The holding period, or the length of time an asset is owned before it is sold, is a critical factor in determining the tax rate. Colorado, like many states, differentiates between short-term and long-term capital gains, with the latter benefiting from a potentially lower tax rate.

| Holding Period | Tax Treatment |

|---|---|

| Short-Term Capital Gains (held for less than a year) | Taxed at ordinary income tax rates |

| Long-Term Capital Gains (held for more than a year) | Subject to lower capital gains tax rates |

For instance, if an investor buys a stock and sells it within a year, the profits are considered short-term capital gains and are taxed at the investor's ordinary income tax rate, which can be as high as 6.25% in Colorado. However, if the investor holds the stock for over a year before selling, the profits are taxed at a lower long-term capital gains rate, currently set at 4.45% in Colorado.

Tax Rates and Calculations

Colorado’s capital gains tax rates are determined by the state’s income tax brackets, which are progressive, meaning that higher income levels are taxed at higher rates.

| Income Bracket | Capital Gains Tax Rate |

|---|---|

| $0 - $5,750 | 2.9% |

| $5,751 - $28,750 | 4.45% |

| $28,751 - $57,500 | 5.04% |

| $57,501 - $205,000 | 5.43% |

| Over $205,000 | 6.25% |

It's important to note that these rates are subject to change, and taxpayers should refer to the most recent tax guidelines provided by the Colorado Department of Revenue for the most accurate information.

Exemptions and Special Considerations

Colorado, like many states, offers certain exemptions and allowances to reduce the tax burden on specific types of capital gains. These exemptions can provide significant tax savings for individuals and businesses.

- Exemption for Certain Small Business Stock: Under certain conditions, gains from the sale of qualified small business stock may be exempt from capital gains tax.

- Exclusion for Primary Residences: The sale of a primary residence may be exempt from capital gains tax, provided the homeowner meets specific residency and holding period requirements.

- Retirement Account Rollovers: Rollovers from one retirement account to another are generally not considered taxable events, thus avoiding capital gains tax implications.

Additionally, Colorado offers tax credits and incentives for specific types of investments, such as those in renewable energy or low-income housing. These incentives can offset capital gains taxes and encourage investment in certain sectors.

Impact and Considerations for Investors

Understanding Colorado’s capital gains tax structure is crucial for investors, as it directly affects their overall investment strategy and potential returns. Here are some key considerations for investors operating in Colorado:

Tax Planning Strategies

Investors can employ various tax planning strategies to minimize their capital gains tax liability. Some common approaches include:

- Holding Period Optimization: By strategically timing the sale of assets, investors can take advantage of lower long-term capital gains tax rates. This strategy often involves holding assets for over a year before selling.

- Harvesting Losses: Selling assets at a loss can offset capital gains from other investments, reducing the overall tax liability. This strategy is particularly useful for investors with a diverse portfolio.

- Tax-Efficient Investing: Certain investment vehicles, such as tax-free municipal bonds or retirement accounts, can provide tax advantages and reduce the impact of capital gains taxes.

State vs. Federal Capital Gains Tax Rates

Colorado’s capital gains tax rates are distinct from federal rates. While federal capital gains tax rates are progressive, with a top rate of 20% for high-income earners, Colorado’s rates are relatively lower. However, the interplay between state and federal taxes can impact an investor’s overall tax liability.

For instance, an investor with a high income may face a combined federal and state capital gains tax rate of over 25%, which can significantly reduce their investment returns. Therefore, understanding both state and federal tax implications is crucial for effective tax planning.

Real Estate Investments

Real estate investments, a popular asset class for many investors, are subject to capital gains taxes in Colorado. The state’s tax treatment of real estate gains can impact an investor’s decision-making process, particularly when considering the holding period and potential tax liability.

For example, an investor who purchases a residential property with the intention of flipping it within a year may face short-term capital gains tax rates, which could reduce their profits. On the other hand, long-term investors in real estate may benefit from lower capital gains tax rates, especially if they meet the residency requirements for the primary residence exemption.

Compliance and Reporting

Adhering to Colorado’s capital gains tax regulations is essential to avoid penalties and legal issues. Here’s an overview of the compliance and reporting process:

Reporting Capital Gains

When filing their state income tax return, individuals and businesses must report any capital gains earned during the tax year. This includes gains from the sale of stocks, bonds, real estate, and other capital assets. The reporting process involves providing detailed information about the assets sold, the dates of purchase and sale, and the profits or losses realized.

Tax Forms and Filing Deadlines

The specific tax forms and deadlines for reporting capital gains in Colorado depend on the taxpayer’s situation. For most individuals, the Form 1040, Schedule D, is used to report capital gains and losses. The deadline for filing Colorado state tax returns aligns with the federal tax filing deadline, typically April 15th of the following year.

Estimated Tax Payments

In certain cases, taxpayers may be required to make estimated tax payments throughout the year to cover their capital gains tax liability. This is particularly relevant for taxpayers with significant capital gains or income from other sources, as it helps ensure they are meeting their tax obligations on a timely basis.

Future Outlook and Policy Changes

Colorado’s tax policies, including capital gains taxes, are subject to change based on economic conditions, legislative decisions, and public opinion. While the state’s current tax structure is relatively stable, there have been discussions and proposals for potential reforms.

Proposed Changes

Some recent proposals for capital gains tax reform in Colorado include:

- Increasing Tax Rates: Certain lawmakers have proposed increasing capital gains tax rates, particularly for high-income earners, to generate additional revenue for state programs and services.

- Exemption Expansion: There have been suggestions to expand the primary residence exemption to cover a wider range of real estate investments, potentially benefiting more taxpayers.

- Tax Simplification: Simplifying the tax code and reducing the number of income brackets could make the tax system more efficient and easier to navigate for taxpayers.

Economic Impact

Changes to capital gains tax policies can have significant economic implications. Higher tax rates may discourage investment and capital flow into the state, potentially impacting job creation and economic growth. On the other hand, lower tax rates could attract more investors and promote economic development.

The balance between generating sufficient tax revenue for public services and maintaining a competitive tax environment for investors is a delicate one, and policymakers in Colorado continually evaluate these factors when considering tax reforms.

Conclusion

Colorado’s capital gains tax system, while relatively straightforward, offers a range of considerations and strategies for investors and taxpayers. Understanding the state’s tax rates, holding periods, and exemptions is crucial for effective financial planning and compliance. By staying informed about the latest tax regulations and employing strategic tax planning, individuals and businesses can navigate Colorado’s tax landscape successfully.

As with any tax-related matter, it's essential to consult with tax professionals and financial advisors to ensure compliance and optimize tax strategies. The dynamic nature of tax policies means that staying up-to-date with the latest developments is key to making informed financial decisions.

What is the current capital gains tax rate in Colorado for long-term gains?

+

The current capital gains tax rate in Colorado for long-term gains (assets held for more than a year) is 4.45%.

Are there any exemptions or special considerations for capital gains tax in Colorado?

+

Yes, Colorado offers exemptions for certain small business stock and primary residences. Additionally, retirement account rollovers are generally not taxable events.

How do I report capital gains on my Colorado state tax return?

+

Capital gains must be reported on Form 1040, Schedule D. Provide details about the assets sold, purchase and sale dates, and profits or losses.

Are there any proposed changes to Colorado’s capital gains tax policies?

+

Yes, there have been proposals to increase tax rates for high-income earners and expand the primary residence exemption. Tax simplification measures have also been suggested.