Illinois Sales Tax Vehicle

The sales tax on vehicles in Illinois is a crucial aspect of the state's tax system, impacting both individuals and businesses alike. Understanding the intricacies of this tax is essential for anyone looking to purchase a vehicle in the state, as it can significantly affect the overall cost. In this comprehensive guide, we will delve into the specifics of Illinois' vehicle sales tax, exploring its rates, exemptions, and the process of calculating and remitting this tax. Whether you're a resident or a business owner, this article will provide you with the knowledge you need to navigate the complexities of vehicle sales tax in Illinois.

Understanding Illinois' Vehicle Sales Tax

Illinois imposes a sales tax on the purchase of vehicles, which is a percentage of the total sales price. This tax is collected by the state and is used to fund various government programs and services. The revenue generated from vehicle sales tax plays a significant role in supporting the state's infrastructure, education, and other essential public services.

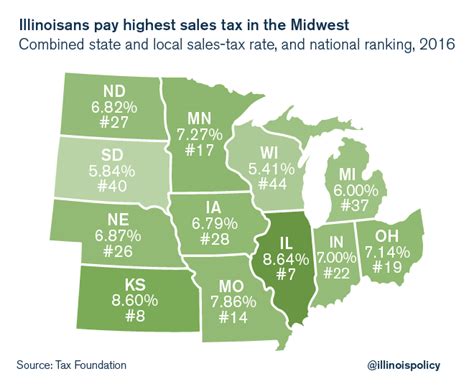

The sales tax rate for vehicles in Illinois varies depending on the county in which the vehicle is purchased. While the state sales tax rate is set at 6.25%, individual counties have the authority to impose additional local sales taxes. This means that the total sales tax rate on vehicles can differ from one county to another. It's crucial for buyers to be aware of the specific tax rate in the county where they plan to make their purchase.

Additionally, Illinois has implemented several programs aimed at incentivizing the purchase of environmentally friendly vehicles. These programs offer tax credits and exemptions for qualifying electric and hybrid vehicles, encouraging residents to make more sustainable choices. The state's commitment to promoting eco-friendly transportation is reflected in these initiatives, making Illinois a leader in sustainable mobility.

Vehicle Sales Tax Rates in Illinois Counties

The following table provides a comprehensive overview of the sales tax rates for vehicles in various counties across Illinois. These rates are accurate as of [date of publication] and are subject to change. It's recommended to check with the Illinois Department of Revenue for the most up-to-date information.

| County | Sales Tax Rate |

|---|---|

| Cook County | 7.25% |

| DuPage County | 7.00% |

| Lake County | 7.00% |

| McHenry County | 6.75% |

| Will County | 7.00% |

| Kane County | 6.75% |

| Winnebago County | 6.75% |

| St. Clair County | 7.25% |

| Champaign County | 7.00% |

| Peoria County | 7.00% |

Note: The above rates are examples and may not represent the current rates accurately. Always refer to official sources for the most recent information.

Calculating and Remitting Vehicle Sales Tax in Illinois

When purchasing a vehicle in Illinois, it's essential to accurately calculate the sales tax owed. Here's a step-by-step guide to help you through the process:

Step 1: Determine the Purchase Price

Start by identifying the total purchase price of the vehicle, including any additional fees and charges. This price is typically negotiated between the buyer and the seller and may include options, accessories, and dealer fees.

Step 2: Identify the Applicable Tax Rate

Based on the county where the purchase is made, determine the applicable sales tax rate. As mentioned earlier, this rate can vary significantly, so it's crucial to know the precise rate for your specific county.

Step 3: Calculate the Sales Tax

Multiply the purchase price by the applicable tax rate. For example, if the purchase price is $25,000 and the tax rate is 7.00%, the sales tax would be calculated as follows:

$25,000 x 0.07 = $1,750

So, in this case, the sales tax owed would be $1,750.

Step 4: Remit the Sales Tax

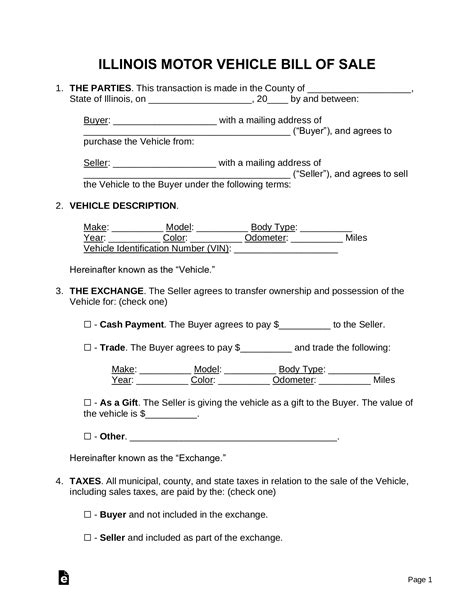

Once you have calculated the sales tax, you must remit it to the appropriate tax authority. In Illinois, this is typically done through the Illinois Department of Revenue. You can usually pay the sales tax at the time of purchase, either directly to the dealer or by submitting the payment to the department.

It's essential to keep accurate records of your sales tax payment, as you may need to provide proof of payment during vehicle registration or for other legal purposes.

Exemptions and Special Considerations

Illinois offers certain exemptions and special considerations when it comes to vehicle sales tax. Understanding these can help you navigate the tax system more efficiently and potentially save money.

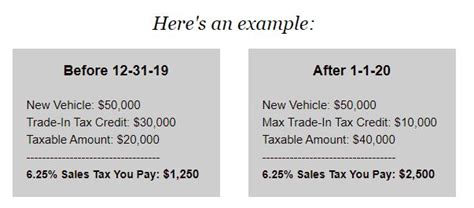

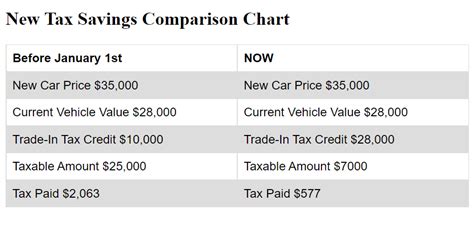

Vehicle Trade-Ins

If you're trading in your old vehicle as part of the purchase, the sales tax calculation may be affected. In Illinois, the trade-in value of your old vehicle can be deducted from the purchase price of the new vehicle, reducing the overall sales tax owed. This incentive encourages residents to upgrade their vehicles, promoting a more sustainable and efficient transportation system.

Military Personnel and Veterans

Illinois recognizes the service of military personnel and veterans by offering certain tax exemptions. Active-duty military members and veterans may be eligible for reduced or waived sales tax on vehicle purchases. This initiative shows the state's appreciation for their service and dedication.

Electric and Hybrid Vehicles

As mentioned earlier, Illinois actively promotes the adoption of electric and hybrid vehicles through tax incentives. These vehicles often qualify for tax credits or exemptions, making them more affordable and environmentally friendly options for residents. By encouraging the use of these vehicles, Illinois aims to reduce carbon emissions and improve air quality.

The Impact of Vehicle Sales Tax on Illinois' Economy

Vehicle sales tax plays a significant role in the economic landscape of Illinois. The revenue generated from this tax contributes to the state's overall financial stability and helps fund critical public services. By understanding the impact of vehicle sales tax, we can better appreciate its role in supporting the state's infrastructure, education, and social programs.

Funding Essential Services

The revenue from vehicle sales tax is directed towards various essential services, including education, healthcare, public safety, and transportation infrastructure. This funding ensures that Illinois residents have access to high-quality public services and a well-maintained transportation network.

Economic Stimulus

Vehicle sales tax also acts as an economic stimulus, encouraging residents to make vehicle purchases. By providing tax incentives and exemptions, the state promotes consumer spending, which, in turn, boosts the local economy. This cycle of consumption and economic growth benefits businesses and creates job opportunities, further strengthening the state's economy.

Sustainable Transportation Initiatives

Illinois' commitment to sustainable transportation is evident in its vehicle sales tax policies. By offering tax incentives for electric and hybrid vehicles, the state not only reduces its carbon footprint but also stimulates the market for these eco-friendly options. This approach not only benefits the environment but also positions Illinois as a leader in sustainable transportation innovation.

Conclusion: Navigating Illinois' Vehicle Sales Tax

Understanding the intricacies of Illinois' vehicle sales tax is crucial for anyone planning to purchase a vehicle in the state. From calculating the tax accurately to taking advantage of exemptions and incentives, this knowledge can save you time and money. By exploring the rates, processes, and special considerations, you can navigate the tax system with confidence and make informed decisions.

Remember, staying informed about the latest tax rates and regulations is essential. The state's tax system is dynamic, and changes may occur. Always refer to official sources, such as the Illinois Department of Revenue, for the most up-to-date information. By staying vigilant and proactive, you can ensure a smooth and efficient vehicle purchase process.

Frequently Asked Questions

What is the average sales tax rate for vehicles in Illinois?

+

The average sales tax rate for vehicles in Illinois varies depending on the county. While the state sales tax rate is 6.25%, counties can impose additional local taxes, resulting in rates ranging from 6.75% to 7.25%.

Are there any exemptions or discounts for vehicle sales tax in Illinois?

+

Yes, Illinois offers several exemptions and discounts for vehicle sales tax. Active-duty military members and veterans may be eligible for reduced or waived sales tax. Additionally, electric and hybrid vehicles often qualify for tax credits or exemptions, making them more affordable options.

How do I calculate the sales tax on a vehicle purchase in Illinois?

+

To calculate the sales tax on a vehicle purchase in Illinois, you need to multiply the purchase price of the vehicle by the applicable sales tax rate. For example, if the purchase price is 25,000 and the tax rate is 7.00%, the sales tax would be 1,750.

Can I pay the vehicle sales tax online in Illinois?

+

Yes, you can pay the vehicle sales tax online in Illinois through the Illinois Department of Revenue’s website. They provide a convenient online payment portal for your convenience.

What happens if I don’t pay the vehicle sales tax in Illinois?

+

Failure to pay the vehicle sales tax in Illinois can result in penalties and interest charges. Additionally, it may impact your vehicle registration and hinder your ability to legally operate the vehicle on Illinois roads.