Ct Income Tax Refund

Welcome to a comprehensive guide on the Connecticut Income Tax Refund, a topic that impacts many residents of the Nutmeg State. In this article, we will delve into the intricacies of the Connecticut income tax refund process, providing you with valuable insights and information to navigate this financial aspect of your life.

Understanding the Connecticut Income Tax Refund

The Connecticut Income Tax Refund is a crucial component of the state's tax system, offering relief to residents who have overpaid their taxes throughout the year. It is an essential aspect of financial planning and can significantly impact your financial well-being.

Connecticut, like many other states, follows a progressive tax system, meaning that higher incomes are taxed at a higher rate. This system ensures that the state's tax revenue is distributed fairly across different income levels. As a result, understanding your tax liability and the potential for a refund is vital for effective financial management.

Eligibility and Qualifications

To be eligible for a Connecticut Income Tax Refund, taxpayers must have overpaid their taxes during the tax year. This overpayment can occur due to various reasons, including changes in income, deductions, or tax credits claimed. It is essential to keep accurate records of your income, expenses, and deductions to determine if you are entitled to a refund.

Additionally, Connecticut offers several tax credits and deductions that can reduce your tax liability and potentially increase your refund. These include credits for dependent children, education expenses, and property taxes, among others. Understanding these credits and ensuring you meet the eligibility criteria can further enhance your refund.

The Refund Process

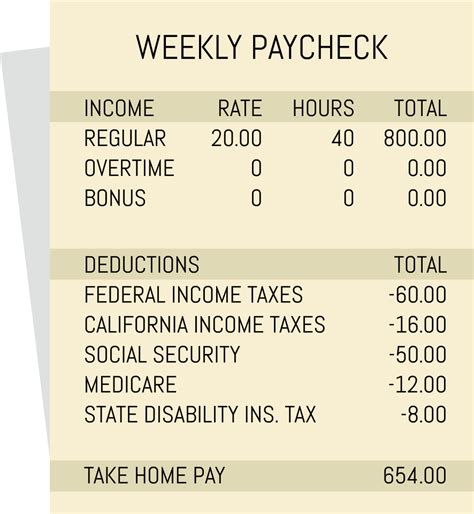

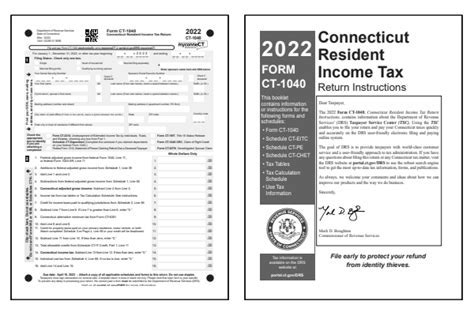

The Connecticut Income Tax Refund process begins with the completion of your state income tax return. This involves gathering all relevant financial documents, such as W-2 forms, 1099 forms, and records of deductions and credits. It is crucial to ensure the accuracy of these documents to avoid any delays or discrepancies in your refund.

Once you have gathered your financial information, you can proceed to file your tax return. Connecticut offers both electronic filing and paper filing options. Electronic filing is often the faster and more convenient method, as it allows for real-time error checking and quicker processing. However, if you prefer a more traditional approach or have complex tax situations, paper filing is also an option.

After submitting your tax return, the Connecticut Department of Revenue Services (DRS) will review your information and calculate your tax liability. If you are entitled to a refund, the DRS will process it and issue it to you. The refund amount will depend on various factors, including your income, deductions, and any applicable tax credits.

Timelines and Expectations

The timeline for receiving your Connecticut Income Tax Refund can vary depending on several factors. Generally, if you file your tax return electronically and choose direct deposit, you can expect to receive your refund within 2-3 weeks. However, if you file a paper return or opt for a refund check, the processing time may take longer, typically around 6-8 weeks.

It is important to note that the DRS processes refunds in the order they are received. Therefore, filing your tax return as early as possible can increase your chances of receiving your refund sooner. Additionally, ensuring the accuracy of your return and providing all necessary supporting documents can help expedite the process.

Maximizing Your Connecticut Income Tax Refund

Maximizing your Connecticut Income Tax Refund requires careful planning and a thorough understanding of the state's tax laws and regulations. Here are some strategies to consider:

Utilize Tax Credits and Deductions

Connecticut offers a range of tax credits and deductions that can reduce your taxable income and increase your refund. These include:

- Dependent Child Tax Credit: If you have qualifying dependent children, you may be eligible for this credit, which can provide a significant reduction in your tax liability.

- Education Credits: Connecticut residents pursuing higher education may be able to claim credits for tuition and related expenses, helping to offset the cost of education.

- Property Tax Credit: Homeowners may qualify for a credit based on the property taxes they pay, providing some relief on their overall tax burden.

- Elderly and Disabled Tax Credit: Older adults and individuals with disabilities may be eligible for this credit, which can provide financial assistance and reduce their tax liability.

It is essential to research and understand the eligibility criteria for these credits and ensure you meet the requirements to maximize your refund potential.

Take Advantage of Deductions

In addition to tax credits, Connecticut offers various deductions that can further reduce your taxable income. These deductions include:

- Standard Deduction: All Connecticut taxpayers are entitled to claim a standard deduction, which reduces their taxable income. The amount of the standard deduction varies based on your filing status.

- Itemized Deductions: If your expenses exceed the standard deduction, you may benefit from itemizing your deductions. This involves listing specific expenses, such as medical costs, charitable donations, and certain tax-related expenses.

- Retirement Contributions: Contributions to certain retirement plans, such as IRAs or 401(k)s, may be deductible, allowing you to reduce your taxable income and potentially increase your refund.

Consulting with a tax professional or utilizing tax preparation software can help you identify and maximize the deductions available to you.

Stay Informed About Tax Changes

Connecticut's tax laws and regulations are subject to change, and staying informed about these changes can help you optimize your tax strategy. Keep an eye on any updates or amendments to the state's tax code, as they may impact your eligibility for certain credits or deductions.

Additionally, Connecticut occasionally offers tax relief programs or initiatives to assist residents during economic downturns or natural disasters. Staying aware of these programs can provide opportunities to reduce your tax liability and potentially increase your refund.

Real-World Examples and Success Stories

To illustrate the impact of the Connecticut Income Tax Refund, let's explore a few real-world examples:

Case Study: The Johnson Family

The Johnson family, consisting of two working parents and two dependent children, had a combined income of $80,000 in the tax year. They took advantage of the Dependent Child Tax Credit, which provided them with a $2,000 credit. Additionally, they itemized their deductions, including medical expenses and charitable contributions, totaling $3,500. As a result, their taxable income was significantly reduced, leading to a refund of $1,800.

Example: Single Taxpayer with Education Expenses

Sarah, a single taxpayer, had a taxable income of $45,000 and was pursuing a master's degree. She utilized the Education Credits offered by Connecticut, claiming a credit of $1,500 for her tuition expenses. Additionally, she contributed to a retirement plan, which allowed her to deduct $3,000 from her taxable income. These strategies resulted in a refund of $1,200.

Success Story: Small Business Owner

John, a small business owner, had a challenging year with fluctuating income. He worked closely with his accountant to maximize his deductions, including business-related expenses and retirement contributions. By carefully documenting and claiming these deductions, he was able to reduce his taxable income and receive a refund of $4,500, providing much-needed financial relief for his business.

The Future of Connecticut Income Tax Refunds

The future of Connecticut's income tax refunds is closely tied to the state's economic outlook and tax policies. As the state's economy evolves, so too will the tax landscape. Here are some potential implications and considerations for the future:

Economic Growth and Tax Revenue

A thriving economy can lead to increased tax revenue for the state, which may impact the availability and size of income tax refunds. As businesses and individuals prosper, the state's tax base expands, potentially allowing for more generous refunds or additional tax relief programs.

Tax Policy Changes

Connecticut's tax policies are subject to legislative changes, which can influence the structure and availability of tax credits and deductions. Staying informed about proposed tax reforms or amendments is crucial for taxpayers to understand how these changes may affect their refunds.

Technological Advancements

Advancements in technology continue to shape the tax landscape. The Connecticut Department of Revenue Services may implement new systems or online tools to streamline the refund process, making it more efficient and accessible for taxpayers. Additionally, tax preparation software and online resources can provide valuable assistance in maximizing refunds.

Frequently Asked Questions

When can I expect to receive my Connecticut Income Tax Refund?

+

The timeline for receiving your refund depends on various factors, including the filing method and payment preference. Generally, electronic filing with direct deposit can result in a refund within 2-3 weeks. Paper returns or refund checks may take up to 6-8 weeks.

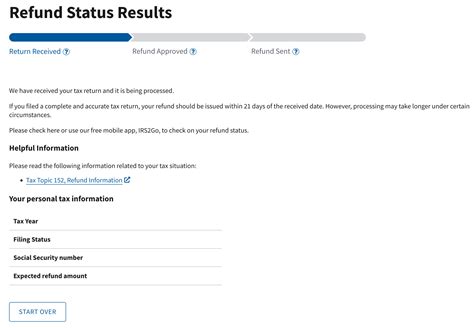

How can I check the status of my Connecticut Income Tax Refund?

+

You can check the status of your refund by visiting the Connecticut Department of Revenue Services website. They provide an online tool that allows you to track the progress of your refund using your social security number and filing status.

What if I don’t agree with the amount of my Connecticut Income Tax Refund?

+

If you believe there is an error in the calculation of your refund, you can contact the Connecticut Department of Revenue Services to discuss the matter. They will review your case and provide guidance on resolving any discrepancies.

Are there any penalties for claiming incorrect information on my tax return?

+

Yes, providing incorrect or fraudulent information on your tax return can result in penalties and legal consequences. It is crucial to ensure the accuracy of your financial information to avoid any issues.

Can I split my Connecticut Income Tax Refund between multiple bank accounts?

+

Yes, when filing your tax return electronically, you have the option to split your refund between multiple bank accounts. This can be beneficial for those with specific financial goals or obligations.