Federal Unemployment Tax Rate

The Federal Unemployment Tax (FUTA) is a crucial component of the United States' unemployment insurance system, providing financial support to eligible individuals who have lost their jobs through no fault of their own. FUTA rates are an essential aspect of this system, as they determine the contributions employers must make to fund unemployment benefits. In this comprehensive article, we will delve into the intricacies of the Federal Unemployment Tax rate, its history, its current status, and its implications for both employers and employees.

Understanding the Federal Unemployment Tax (FUTA)

The Federal Unemployment Tax Act, established in 1939 as part of the Social Security Act, introduced FUTA as a means to provide a safety net for workers during periods of unemployment. The tax is levied on employers and is used to fund unemployment compensation programs administered by individual states. This federal-state partnership ensures a consistent safety net across the nation while allowing for some flexibility at the state level.

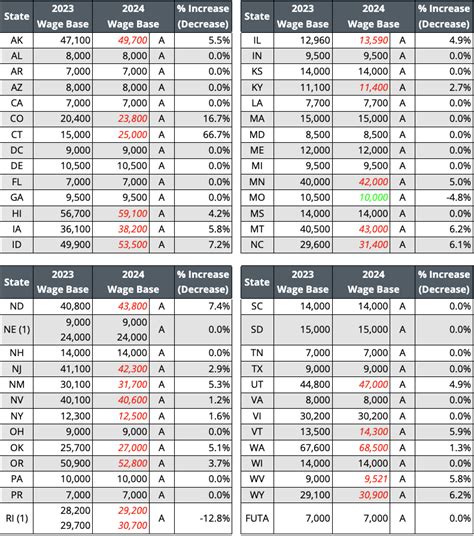

FUTA is distinct from the state unemployment taxes (SUTA) that employers must also pay. While SUTA rates vary significantly from state to state, the FUTA rate has remained relatively stable over the years, serving as a consistent component of the overall unemployment tax burden for employers.

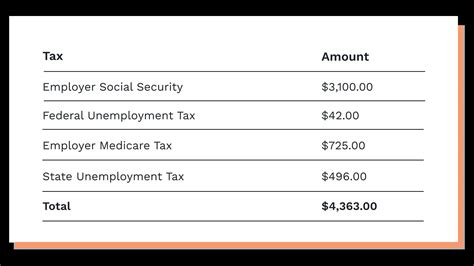

FUTA Tax Calculation

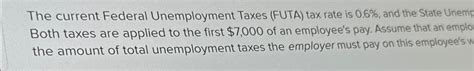

The FUTA tax is calculated as a percentage of the first 7,000 in wages paid to each employee during a calendar year. This wage base amount is subject to change periodically to keep pace with inflation and economic conditions. For the year 2023, the wage base remains at 7,000, unchanged from the previous year.

The current FUTA tax rate is set at 6.0%, but employers can claim a credit of up to 5.4% for payments made to state unemployment funds, effectively reducing the net FUTA rate to 0.6%.

| Federal Unemployment Tax Rate | Effective Rate |

|---|---|

| 6.0% | 0.6% |

This credit mechanism is a key feature of the FUTA system, designed to encourage employers to contribute to state unemployment funds and maintain the solvency of these funds. The credit rate can vary depending on the state's unemployment fund balance and its loan status with the federal government.

Employer Liability and Exemptions

Not all employers are subject to the FUTA tax. Certain types of organizations, such as non-profit educational institutions, state and local governments, and certain agricultural workers, are exempt from FUTA. Additionally, employers who pay wages for domestic service in a private home are exempt if their total cash remuneration paid for domestic service during the year is less than $2,000.

For employers who are liable for FUTA, the tax is due quarterly and is typically calculated and reported on IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. Late payments or failures to pay FUTA can result in penalties and interest charges.

Historical Context of FUTA Rates

The FUTA rate has seen some fluctuations since its inception. When the FUTA was first introduced, the tax rate was set at 3.0%, and the wage base was $3,000. Over the years, the rate has been adjusted to address various economic and social changes.

Rate Adjustments and Policy Changes

One significant rate adjustment occurred in 1982 when the FUTA rate was increased to 6.2% to address a surge in unemployment claims during the early 1980s recession. This rate remained in effect for several years until 1996 when it was reduced to the current 6.0% rate.

The FUTA rate has also been a tool for policy changes. For instance, in 2011, Congress extended the FUTA credit reduction temporarily to fund an extension of federal unemployment benefits. This measure effectively increased the FUTA rate to 6.2% for a period of time.

Impact of Economic Conditions

Economic conditions have played a significant role in shaping FUTA rates. During periods of high unemployment, the demand for unemployment benefits increases, putting pressure on state unemployment funds. In response, the federal government has sometimes adjusted FUTA rates to ensure the sustainability of these funds.

For instance, the Great Recession of 2008-2009 saw a significant strain on state unemployment funds, leading to a series of federal interventions, including the extension of federal unemployment benefits and adjustments to FUTA rates to ensure the solvency of these funds.

Current Status and Future Implications

As of 2023, the FUTA rate remains at 6.0%, with a credit of up to 5.4%, resulting in an effective rate of 0.6%. This rate is expected to remain stable for the foreseeable future, barring any significant economic or policy changes.

Future Economic Considerations

Looking ahead, the stability of the FUTA rate is contingent upon the health of the economy and the state of unemployment funds. If the economy experiences a significant downturn, leading to a surge in unemployment claims, the federal government may need to adjust FUTA rates to ensure the financial stability of these funds.

Additionally, the long-term sustainability of unemployment insurance programs may require periodic reviews and adjustments to the FUTA rate to account for changes in the labor market, inflation, and other economic factors.

Policy and Legislative Considerations

The FUTA rate is also subject to legislative and policy considerations. While the current rate is broadly supported, future policy debates could lead to adjustments, either to address specific economic conditions or to modify the unemployment insurance system.

For instance, discussions around expanding unemployment benefits, such as providing benefits to certain self-employed individuals or gig workers, could impact the FUTA rate and the overall funding structure of unemployment insurance.

Conclusion: The Importance of FUTA

The Federal Unemployment Tax rate is a critical component of the United States’ unemployment insurance system, providing a stable funding source for unemployment benefits. While the rate has seen adjustments over the years, it has generally remained consistent, offering predictability for employers and ensuring the financial stability of unemployment funds.

As the economy continues to evolve, the FUTA rate will remain a crucial element in the nation's economic safety net, providing support to workers during periods of unemployment and contributing to the overall resilience of the labor market.

How is FUTA calculated and reported?

+FUTA is calculated as a percentage of the first 7,000 in wages paid to each employee during a calendar year. The current rate is 6.0%, but employers can claim a credit of up to 5.4%, effectively reducing the net FUTA rate to 0.6%. FUTA is typically reported and paid quarterly on IRS Form 940.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exemptions from FUTA?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, certain organizations and employers are exempt from FUTA. This includes non-profit educational institutions, state and local governments, and certain agricultural workers. Employers who pay wages for domestic service in a private home are also exempt if their total cash remuneration paid for domestic service during the year is less than 2,000.

How does FUTA relate to state unemployment taxes (SUTA)?

+FUTA and SUTA are both components of the unemployment insurance system, but they are distinct taxes with different rates and requirements. FUTA is a federal tax that funds unemployment benefits at the federal level, while SUTA is a state tax that funds unemployment benefits at the state level. Employers typically pay both FUTA and SUTA, with FUTA providing a consistent federal contribution and SUTA rates varying by state.