Md State Tax Forms

When it comes to managing your taxes in Maryland, having access to the correct state tax forms is essential. These forms play a crucial role in ensuring compliance with state tax laws and regulations. In this comprehensive guide, we will delve into the world of Maryland state tax forms, exploring the various types, their purposes, and how to navigate the process seamlessly. By the end of this article, you'll have a thorough understanding of the ins and outs of Maryland state tax forms, empowering you to tackle your tax obligations with confidence.

Understanding Maryland State Tax Forms

Maryland’s tax system is designed to support the state’s budget and infrastructure. The state collects various taxes, including income tax, sales and use tax, corporate income tax, and more. Each of these taxes has its own set of forms and guidelines, ensuring accurate reporting and payment.

The Maryland Comptroller of Maryland is responsible for administering and enforcing the state's tax laws. They provide a comprehensive suite of tax forms, instructions, and resources to assist taxpayers in fulfilling their obligations.

Key Maryland State Tax Forms

Let’s take a closer look at some of the most common and important Maryland state tax forms and their purposes:

- Form 502 - Individual Income Tax Return: This form is used by Maryland residents to report their income, deductions, and credits. It covers various income sources, including wages, self-employment income, interest, dividends, and capital gains.

- Form 502R - Resident Income Tax Return: Similar to Form 502, this form is specifically for Maryland residents who have income sourced from other states. It allows taxpayers to apportion their income and calculate their Maryland tax liability accurately.

- Form 505 - Corporate Income Tax Return: Corporations doing business in Maryland must use this form to report their profits, deductions, and credits. It ensures that corporations pay their fair share of taxes based on their activities within the state.

- Form 503 - Partnership Return of Income: Partnerships operating in Maryland are required to use this form to report their income, gains, losses, and distributions. It helps the state tax authorities understand the partnership's financial position and assess the appropriate tax liability.

- Form 507 - Sales and Use Tax Return: Businesses registered for sales and use tax in Maryland must file this form to report and remit the sales tax collected from customers. It is a crucial form for ensuring compliance with sales tax regulations.

- Form 501 - Withholding Tax Return: Employers in Maryland use this form to report and remit the income tax withheld from their employees' wages. It is an essential component of the state's payroll tax system.

- Form 500 - Estimated Income Tax Payment Voucher: Taxpayers who expect to owe income tax for the year can use this form to make estimated tax payments. It helps taxpayers avoid penalties for underpayment and ensures a steady revenue stream for the state.

These are just a few examples of the critical Maryland state tax forms. Each form has specific instructions and requirements, and it's essential to refer to the official sources for accurate and up-to-date information.

Where to Find Maryland State Tax Forms

The Maryland Comptroller of Maryland offers a user-friendly online platform where taxpayers can access all the necessary tax forms, instructions, and resources. The website provides a searchable database of forms, making it easy to find the specific form you need.

Additionally, the state offers various resources and tools to assist taxpayers, including:

- Taxpayer guides and publications: Comprehensive guides that explain the tax filing process, common tax issues, and best practices.

- Tax calculators and estimators: Online tools to help taxpayers estimate their tax liability and understand the impact of various deductions and credits.

- Frequently Asked Questions (FAQs): A comprehensive list of common questions and answers to address common taxpayer concerns.

- Contact information: Details on how to reach the Maryland Comptroller's office for assistance, including phone numbers, email addresses, and physical addresses.

By utilizing these resources, taxpayers can ensure they have the latest information and forms necessary to fulfill their tax obligations accurately and efficiently.

Navigating the Tax Filing Process

Filing Maryland state taxes involves a series of steps, each designed to ensure compliance and accuracy. Here’s a simplified breakdown of the tax filing process:

Step 1: Gather Necessary Information

Before you begin, collect all the relevant documents and information required for your tax return. This may include:

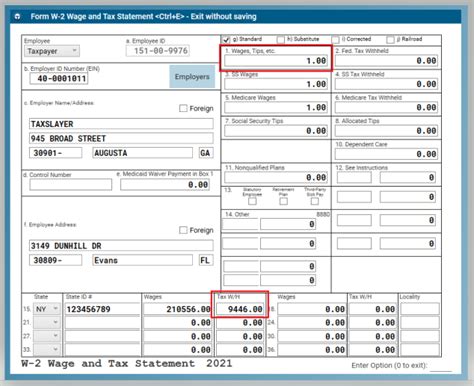

- Wage and income statements (e.g., W-2, 1099 forms)

- Expenses and deductions documentation

- Records of interest, dividends, and capital gains

- Business income and expenses (if applicable)

- Previous year's tax return (for reference)

Step 2: Choose the Right Tax Form

Based on your tax situation, select the appropriate Maryland state tax form. As mentioned earlier, the state offers various forms for individuals, businesses, partnerships, and corporations. Ensure you choose the form that aligns with your specific circumstances.

Step 3: Complete the Tax Form

Carefully read the instructions provided with the tax form and complete it accurately. Pay attention to the specific guidelines and requirements for each section. If you have any doubts or questions, refer to the official resources provided by the Maryland Comptroller’s office.

Step 4: Calculate Your Tax Liability

Using the information provided on the tax form, calculate your tax liability. This involves adding up your taxable income, applying any deductions and credits, and determining the final tax amount owed or refund due.

Step 5: Remit Payment or Claim Refund

If you owe taxes, you must remit the payment along with your tax return. The state accepts various payment methods, including electronic funds transfer, credit card, and check. If you are due a refund, the state will process it and issue the refund accordingly.

Step 6: File Your Tax Return

Once you have completed the tax form, calculated your tax liability, and (if applicable) remitted the payment, it’s time to file your tax return. You can file your return electronically or by mail, depending on your preference and the specific requirements of the tax form.

Step 7: Keep Records

After filing your tax return, it’s essential to maintain accurate records. Keep a copy of your tax return, supporting documents, and any correspondence with the tax authorities. This ensures you have the necessary information for future reference and audits.

Tips for a Smooth Tax Filing Experience

To make the tax filing process as seamless as possible, consider the following tips:

- Start early: Don't wait until the last minute to gather your tax information and complete your return. Starting early gives you ample time to address any potential issues and seek assistance if needed.

- Seek professional help: If you're unsure about any aspect of your tax filing, consider consulting a tax professional or accountant. They can provide expert guidance and ensure your return is accurate and compliant.

- Stay informed: Keep yourself updated on any changes or updates to Maryland's tax laws and forms. The state may introduce new forms or modify existing ones, so staying informed is crucial.

- Utilize online resources: The Maryland Comptroller's website offers a wealth of resources and tools to assist taxpayers. Take advantage of these resources to streamline your tax filing process.

- Double-check your calculations: Before submitting your tax return, review your calculations carefully. Mistakes in calculations can lead to incorrect tax liabilities, so take the time to ensure accuracy.

Conclusion

Understanding and navigating Maryland state tax forms is an essential part of fulfilling your tax obligations. By familiarizing yourself with the various forms, their purposes, and the filing process, you can ensure compliance and avoid potential penalties. Remember to utilize the resources provided by the Maryland Comptroller’s office and seek professional assistance when needed.

Stay informed, stay organized, and approach your tax filing with confidence. With the right knowledge and tools, managing your Maryland state taxes can be a straightforward and stress-free process.

How do I know which Maryland state tax form to use?

+The choice of tax form depends on your specific tax situation. Individuals use Form 502 or Form 502R, while businesses and partnerships use different forms. Refer to the Maryland Comptroller’s website or consult a tax professional for guidance on selecting the appropriate form.

What if I can’t find the tax form I need on the Maryland Comptroller’s website?

+If you’re unable to find the specific tax form you need, contact the Maryland Comptroller’s office directly. They can provide guidance and assistance in locating the correct form or offering an alternative solution.

Can I file my Maryland state tax return electronically?

+Yes, Maryland offers electronic filing for many tax forms. Visit the Maryland Comptroller’s website for information on which forms can be filed electronically and the steps to do so.

What happens if I miss the tax filing deadline?

+Missing the tax filing deadline may result in penalties and interest charges. It’s crucial to file your tax return by the due date. If you cannot meet the deadline, consider requesting an extension to avoid penalties.

Are there any tax credits or deductions available for Maryland taxpayers?

+Yes, Maryland offers various tax credits and deductions to eligible taxpayers. These can include credits for education expenses, childcare costs, and certain business-related expenses. Consult the Maryland Comptroller’s website or a tax professional to explore the available credits and deductions.