Tax Free Day Ohio

Tax Free Day is an eagerly anticipated milestone for many Americans, offering a temporary respite from the burdens of taxation. In the state of Ohio, this day holds special significance as it provides residents with a much-needed break from their usual financial obligations. But what exactly is Tax Free Day, and why is it important for Ohioans? This comprehensive article will delve into the intricacies of Tax Free Day in Ohio, exploring its origins, impact, and future implications.

Understanding Tax Free Day in Ohio

Tax Free Day is a concept that has gained popularity across the United States, and it refers to the day on which the average worker has earned enough income to cover their total tax obligations for the year. In essence, it marks the point at which individuals begin to retain more of their earnings for personal use or savings.

In Ohio, Tax Free Day is an especially notable event due to the state's unique tax structure and the significant tax burden borne by its residents. The state imposes a range of taxes, including income tax, sales tax, property tax, and various other levies, all of which contribute to the overall tax liability of Ohioans.

The idea behind Tax Free Day is to highlight the cumulative effect of these taxes and provide a tangible measure of when the average person has effectively worked "for free" to meet their tax obligations. It serves as a powerful reminder of the financial impact of taxation and the potential benefits of tax reform or relief measures.

Calculating Tax Free Day: A Complex Equation

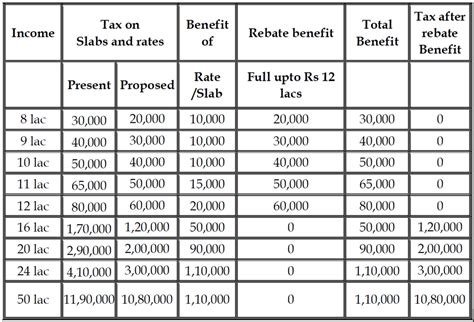

Determining Tax Free Day in Ohio is a complex endeavor, as it involves considering various factors and tax rates. The calculation takes into account the state’s income tax rates, which vary based on income brackets, as well as the impact of federal income taxes, social security contributions, and other deductions.

Additionally, Ohio's sales tax and property tax rates play a significant role in the overall tax burden. These taxes, which are imposed on a wide range of goods and services, can have a substantial impact on the average worker's disposable income.

To illustrate the complexity, let's consider a hypothetical example. Imagine a single Ohio resident earning an annual income of $50,000. This individual would be subject to both federal and state income taxes, with deductions for social security and other expenses. Furthermore, they would also pay sales tax on their purchases and property tax on their home or rental property.

| Tax Category | Rate | Amount |

|---|---|---|

| Federal Income Tax | Varies based on income and deductions | $7,000 |

| State Income Tax | Varies based on income brackets (e.g., 2.87% to 4.799%) | $1,435 |

| Social Security Contributions | 6.2% (employer and employee) | $3,100 |

| Sales Tax | 6.25% (state average) | $3,125 |

| Property Tax | Varies based on location and property value | $2,500 |

| Total Tax Liability | $17,160 |

In this example, our hypothetical Ohioan would need to work for a significant portion of the year just to cover their tax obligations. Only after surpassing this threshold would they begin to retain a larger portion of their earnings.

The Impact of Tax Free Day on Ohio’s Economy

Tax Free Day has a profound impact on Ohio’s economy and the financial well-being of its residents. When workers retain more of their earnings, they have increased purchasing power, which can stimulate economic activity and consumer spending.

During the period following Tax Free Day, Ohioans may feel more inclined to make discretionary purchases, invest in their homes or businesses, or simply save more for their future. This boost in consumer confidence and spending can lead to a positive ripple effect throughout the state's economy, benefiting businesses, job creation, and overall economic growth.

Furthermore, Tax Free Day serves as a powerful advocacy tool for tax reform and relief initiatives. It highlights the financial strain that taxes impose on individuals and businesses, prompting discussions on potential reforms to ease the tax burden and stimulate economic growth.

Benefits for Businesses

Businesses in Ohio also stand to gain from Tax Free Day. With increased consumer spending, companies may experience a surge in sales, leading to potential expansion, hiring, and investment opportunities. Additionally, a more favorable tax environment can attract new businesses and investments to the state, further bolstering economic growth.

Impact on Personal Finances

For individuals, Tax Free Day offers a sense of financial relief and an opportunity to reassess their financial goals. It serves as a reminder to review personal finances, explore tax-efficient strategies, and consider ways to maximize their earnings and savings.

A Historical Perspective: Ohio’s Tax Journey

To fully understand the significance of Tax Free Day in Ohio, it’s essential to explore the state’s tax history and the factors that have shaped its tax landscape.

Evolution of Ohio’s Tax System

Ohio’s tax system has undergone significant changes over the years, with various reforms and adjustments aimed at balancing the state’s budget and providing essential services to its residents. Here’s a brief overview of some key moments in Ohio’s tax evolution:

- 1912: Ohio introduced an income tax, making it one of the earliest states to do so. The initial tax rate was 1%, and it applied to all income above $3,000.

- 1935: The state experienced a significant tax overhaul, introducing a graduated income tax with rates ranging from 1.5% to 6%.

- 1970s: Ohio faced economic challenges, leading to tax increases to fund state services. The income tax rate was raised to 3.5% for individuals and 4.5% for corporations.

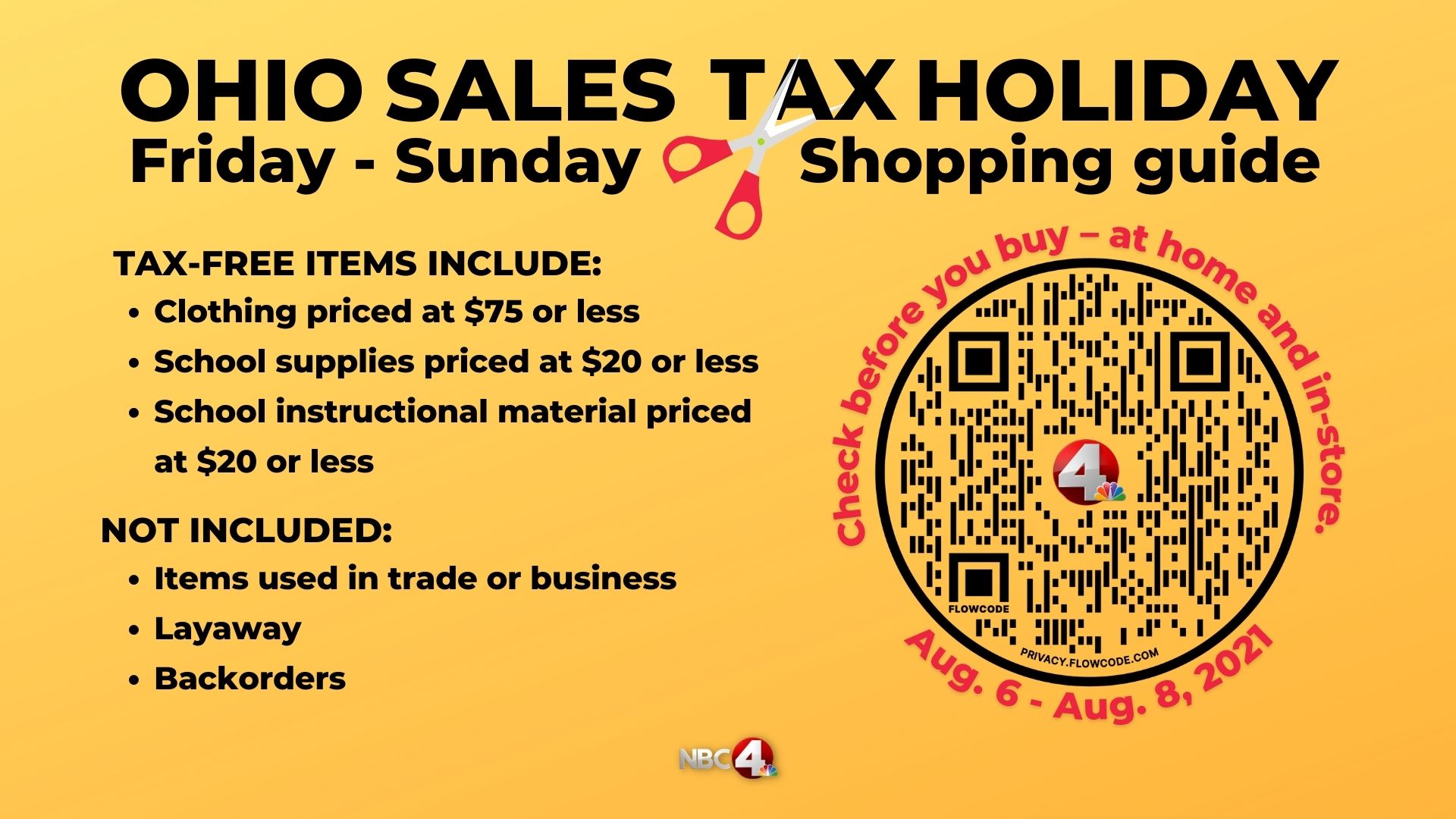

- 1980s: Efforts to reduce the tax burden began, with tax cuts and reforms to stimulate economic growth. The state also introduced a sales tax holiday during this period.

- 2000s: Ohio implemented a state sales tax of 6%, which is currently the state's primary source of revenue. The state also offers various tax credits and incentives to attract businesses.

Throughout its history, Ohio has aimed to strike a balance between generating sufficient revenue for essential services and providing tax relief to its residents and businesses.

The Role of Federal Taxes

It’s important to note that Tax Free Day calculations in Ohio also consider federal taxes. The federal government imposes income taxes, social security contributions, and other levies, which significantly impact the overall tax burden of Ohioans.

Federal tax reforms, such as the Tax Cuts and Jobs Act of 2017, have had a direct influence on Ohio's tax landscape. These reforms, which included changes to tax brackets and deductions, have altered the tax obligations of individuals and businesses in the state.

Comparative Analysis: Tax Free Day in Other States

To gain a broader perspective, let’s compare Tax Free Day in Ohio with other states across the United States.

State-by-State Comparison

Tax Free Day varies significantly from state to state, influenced by factors such as tax rates, economic conditions, and the overall cost of living. Here’s a glimpse at Tax Free Day in a few select states:

- Texas: Texas has no state income tax, making its Tax Free Day one of the earliest in the country. Residents effectively retain more of their earnings throughout the year.

- New York: With high income tax rates and a heavy reliance on property taxes, New York has a later Tax Free Day, typically falling in the latter half of the year.

- Florida: Florida, like Texas, has no state income tax, resulting in an early Tax Free Day. However, the state's sales tax rate is higher, impacting consumer spending.

- California: California's Tax Free Day tends to be relatively late due to its high income tax rates and various other state-specific taxes.

- Ohio: Ohio's Tax Free Day falls in the middle range, influenced by its moderate income tax rates and the cumulative effect of other taxes.

These variations demonstrate the diverse tax landscapes across the country and the unique challenges faced by residents in each state.

Implications for Interstate Migration

The differences in Tax Free Day can have significant implications for interstate migration. Individuals and businesses may consider tax burdens when deciding where to live or establish operations. States with earlier Tax Free Days or lower tax rates may attract residents and businesses seeking tax relief.

For Ohio, this presents both opportunities and challenges. While the state offers a balanced tax system, it must also compete with other states to attract and retain talent and businesses.

Future Outlook: Tax Reform and Relief in Ohio

As Ohio looks toward the future, tax reform and relief measures are likely to remain on the agenda. The state’s policymakers and stakeholders will continue to assess the impact of taxation on its residents and businesses, aiming to strike a delicate balance between revenue generation and economic growth.

Potential Tax Reform Initiatives

Here are some potential tax reform initiatives that could shape Ohio’s future:

- Income Tax Reform: Ohio could explore income tax rate adjustments or brackets to provide relief to specific income groups.

- Sales Tax Modifications: The state might consider adjusting sales tax rates or introducing targeted sales tax holidays to boost consumer spending.

- Property Tax Relief: Providing property tax relief or incentives could help ease the burden on homeowners and stimulate the housing market.

- Tax Incentives for Businesses: Ohio could offer tax incentives or credits to attract new businesses and encourage existing businesses to expand.

These reforms would aim to reduce the tax burden on individuals and businesses while promoting economic growth and investment.

Advocacy and Public Awareness

Tax Free Day serves as a powerful tool for advocacy and public awareness. By highlighting the financial impact of taxation, Ohioans can engage in meaningful discussions about tax policy and its implications. This awareness can drive change and encourage policymakers to consider tax reform initiatives that benefit the state’s residents and economy.

Conclusion: Embracing Tax Free Day’s Potential

Tax Free Day in Ohio is more than just a calendar date; it’s a symbol of the financial challenges and opportunities faced by the state’s residents. By understanding the complexities of taxation and its impact on the economy, Ohioans can make informed decisions about their finances and advocate for tax policies that promote economic growth and prosperity.

As we've explored, Tax Free Day is a powerful reminder of the need for ongoing tax reform and relief initiatives. It encourages us to consider the cumulative effect of taxes and the potential benefits of a more favorable tax environment.

Whether it's through income tax adjustments, sales tax holidays, or property tax relief, Ohio has the potential to shape its tax landscape and create a more prosperous future for its residents and businesses. By embracing the potential of Tax Free Day, Ohio can continue to thrive and adapt to the ever-changing economic landscape.

FAQ

What is Tax Free Day, and why is it important for Ohioans?

+

Tax Free Day is the day when the average worker has earned enough to cover their total tax obligations for the year. It’s important for Ohioans as it highlights the cumulative impact of taxes and provides a financial milestone to assess tax burdens and advocate for reform.

How is Tax Free Day calculated in Ohio?

+

Tax Free Day is calculated by considering various tax rates, including income tax, sales tax, and property tax. It takes into account federal and state taxes, social security contributions, and other deductions to determine the point at which workers retain more of their earnings.

What impact does Tax Free Day have on Ohio’s economy and personal finances?

+

Tax Free Day boosts consumer spending and stimulates economic activity. It provides individuals with increased purchasing power and an opportunity to review their finances and tax strategies. For businesses, it can lead to increased sales and investment opportunities.

How does Ohio’s tax system compare to other states?

+

Ohio’s tax system varies from state to state. Some states have no income tax, leading to earlier Tax Free Days, while others have higher tax rates. Ohio’s Tax Free Day falls in the middle range, influenced by its moderate tax rates and the cumulative effect of various taxes.

What potential tax reform initiatives could Ohio explore in the future?

+

Ohio could consider income tax rate adjustments, sales tax modifications, property tax relief, and tax incentives for businesses to reduce the tax burden and promote economic growth. These reforms would aim to create a more favorable tax environment for residents and businesses.