Indiana Tax Warrants

Indiana Tax Warrants are a serious matter for residents and businesses alike, as they can lead to significant financial consequences and legal repercussions. These warrants are issued by the Indiana Department of Revenue when individuals or entities fail to pay their state taxes, including income tax, sales tax, or other applicable levies. In this comprehensive guide, we will delve into the intricacies of Indiana Tax Warrants, exploring their implications, the process involved, and the potential outcomes.

Understanding Indiana Tax Warrants

A tax warrant is a legal instrument that empowers the state to collect outstanding taxes through various enforcement actions. In Indiana, tax warrants are typically issued after multiple attempts to collect the owed taxes have been unsuccessful. The process begins with the taxpayer receiving notices and reminders from the Department of Revenue, urging them to settle their tax liabilities.

If the taxpayer fails to respond or make the necessary payments, the Department of Revenue has the authority to escalate the matter and issue a tax warrant. This warrant serves as a formal notification of the taxpayer's outstanding debt and grants the state the power to take aggressive measures to recover the owed taxes.

Types of Taxes Covered

Indiana Tax Warrants can be issued for various types of taxes, including:

- Income Tax: Warrants may be issued for individuals or businesses that have failed to pay their state income taxes.

- Sales and Use Tax: Businesses that collect sales tax but fail to remit it to the state can face tax warrants.

- Corporate Taxes: Corporations with outstanding tax liabilities may also find themselves dealing with tax warrants.

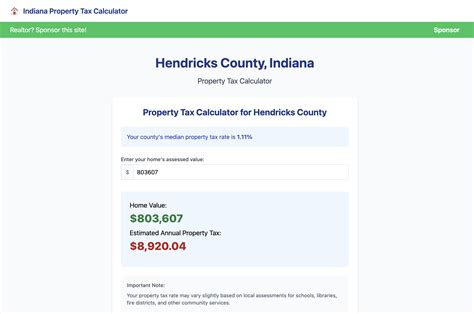

- Property Taxes: In certain cases, unpaid property taxes can lead to the issuance of tax warrants.

Consequences of Tax Warrants

The consequences of having a tax warrant issued against you can be severe and far-reaching. Here are some of the potential outcomes:

- Asset Seizure: The state has the legal right to seize assets, including bank accounts, vehicles, real estate, and even personal property, to satisfy the tax debt.

- Liens: Tax warrants can result in the placement of liens on the taxpayer’s property, encumbering their ability to sell or refinance.

- Garnishment: Wages, commissions, or other income sources may be subject to garnishment, meaning a portion of the taxpayer’s earnings is directly withheld to pay off the tax debt.

- Revocation of Licenses: Certain licenses, such as business licenses or professional licenses, may be revoked or suspended until the tax debt is resolved.

- Criminal Charges: In extreme cases, individuals may face criminal charges for tax evasion or fraud, leading to potential jail time and additional penalties.

The Process of Tax Warrant Issuance

The process of issuing a tax warrant in Indiana follows a structured sequence, ensuring due process and providing opportunities for taxpayers to resolve their tax liabilities.

Notice and Demand

Before issuing a tax warrant, the Indiana Department of Revenue sends a series of notices to the taxpayer, outlining the amount owed and the due date for payment. These notices serve as a final reminder before legal action is taken.

Warrant Application

If the taxpayer fails to respond to the notices or make the necessary payments, the Department of Revenue initiates the warrant application process. This involves submitting a detailed application that provides evidence of the taxpayer’s non-compliance and the efforts made to collect the taxes.

Review and Approval

The application undergoes a review process, where tax authorities assess the validity of the claim and ensure that all legal requirements have been met. If the application is approved, a tax warrant is issued, authorizing the state to take enforcement actions.

Enforcement Actions

Once the tax warrant is issued, the Department of Revenue has a range of enforcement tools at its disposal, including:

- Bank Levy: The state can freeze and seize funds from the taxpayer’s bank accounts to satisfy the tax debt.

- Property Seizure: Tangible assets, such as vehicles, equipment, or real estate, may be seized and sold to recover the owed taxes.

- Wage Garnishment: Regular deductions from the taxpayer’s wages are implemented to repay the tax debt over time.

- Public Auction: In some cases, seized assets may be auctioned off to the highest bidder, with the proceeds going towards the tax debt.

Resolving Tax Warrants

While tax warrants can be intimidating, there are avenues for taxpayers to resolve their tax liabilities and avoid further legal complications.

Payment Plans

Taxpayers can negotiate with the Department of Revenue to set up a payment plan, allowing them to repay their tax debt over an agreed-upon period. This option is particularly beneficial for those who are unable to pay the full amount immediately.

Offer in Compromise

In certain circumstances, taxpayers may be eligible for an Offer in Compromise, where they can settle their tax debt for less than the full amount owed. This option is typically considered when the taxpayer faces financial hardship or other extenuating circumstances.

Appealing the Warrant

If a taxpayer believes that a tax warrant has been issued in error or due to extenuating circumstances, they have the right to appeal the decision. The appeal process involves presenting evidence and arguments to demonstrate why the warrant should be rescinded or modified.

Professional Assistance

Navigating the complexities of tax warrants and resolving tax liabilities can be challenging. Engaging the services of a tax professional or attorney who specializes in tax matters can provide valuable guidance and support throughout the process.

Impact on Credit and Reputation

Tax warrants can have long-lasting effects on a taxpayer’s credit score and overall financial reputation. Here’s how:

- Credit Score: Tax liens and other enforcement actions associated with tax warrants can significantly impact a person’s credit score, making it challenging to obtain loans or favorable interest rates in the future.

- Public Record: Tax warrants become part of the public record, which can be accessed by potential lenders, employers, and other interested parties. This may affect future financial and career opportunities.

- Reputation: The negative publicity associated with tax warrants can damage a person’s or business’s reputation, leading to potential loss of clients, customers, or partners.

Prevention and Compliance

The best approach to dealing with Indiana Tax Warrants is to avoid them altogether through proactive tax compliance. Here are some strategies to consider:

- Stay Informed: Keep up-to-date with Indiana tax laws and regulations to ensure compliance with all applicable requirements.

- File Taxes Promptly: Ensure that all tax returns are filed on time and accurately to avoid penalties and interest charges.

- Pay Taxes on Time: Make it a priority to pay your taxes as soon as they become due to avoid late payment penalties and the risk of tax warrants.

- Seek Professional Advice: If you have complex tax situations or are unsure about your obligations, consult a tax professional to ensure proper compliance.

Conclusion

Indiana Tax Warrants are a serious matter that can have significant financial and legal consequences. By understanding the process, consequences, and avenues for resolution, taxpayers can better navigate this challenging situation. Proactive tax compliance and seeking professional guidance are key to avoiding tax warrants and maintaining a positive financial standing in Indiana.

Can I ignore a tax warrant and hope it goes away?

+Ignoring a tax warrant is not advisable. The consequences of non-compliance can be severe, leading to asset seizures, liens, and even criminal charges. It is best to address the issue promptly and seek guidance from tax professionals.

How long does a tax warrant remain active?

+The duration of a tax warrant’s effectiveness can vary. In Indiana, tax warrants remain active until the tax debt is fully satisfied or until the warrant is formally discharged through legal processes.

Can a tax warrant be removed from my credit report?

+Yes, a tax warrant can be removed from your credit report once the tax debt is resolved. However, the removal process may take time, and it is essential to address the underlying tax issue to ensure a positive credit standing.

What happens if I cannot afford to pay the full tax debt?

+If you are unable to pay the full tax debt, you can explore payment plans or an Offer in Compromise with the Department of Revenue. These options allow for more manageable repayment terms or a reduced settlement amount.