St Louis Mo Sales Tax

In the vibrant city of St. Louis, Missouri, understanding the intricacies of sales tax is essential for both residents and businesses. The sales tax landscape in St. Louis is a complex yet crucial aspect of the local economy, influencing the purchasing decisions and financial strategies of individuals and enterprises alike. This article aims to provide an in-depth exploration of St. Louis' sales tax, shedding light on its rates, applicability, exemptions, and its broader impact on the city's economic ecosystem.

Unraveling the St. Louis Sales Tax Structure

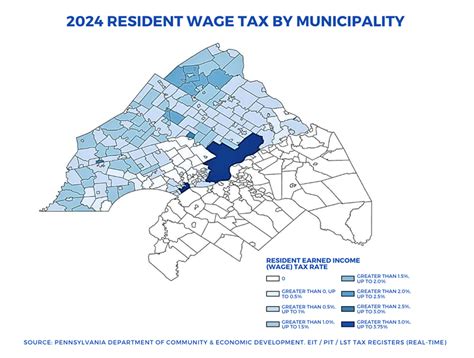

St. Louis boasts a unique sales tax structure, comprising layers of taxation that add up to the final amount paid by consumers. At its core, the sales tax rate in St. Louis is determined by a combination of state, county, and city taxes, each contributing to the overall percentage.

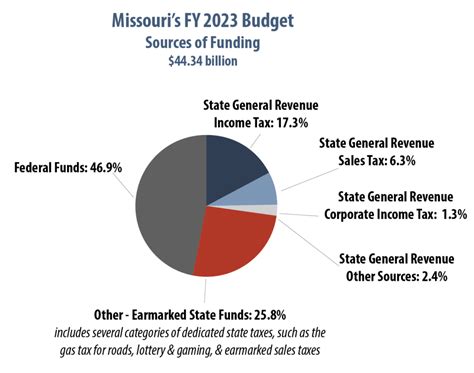

Currently, the state sales tax in Missouri stands at 4.225%, which is levied on most tangible personal property and certain services. This rate, however, serves as a foundation and can be augmented by additional taxes at the local level.

In the case of St. Louis City, a 1% local use tax is applied, bringing the total sales tax rate to 5.225% for most purchases within the city limits. This local use tax is a crucial component, ensuring a stable revenue stream for the city's infrastructure and public services.

But the story doesn't end there. St. Louis County, which encompasses a large portion of the metropolitan area, imposes an additional 0.5% county sales tax, pushing the total sales tax rate to 5.725% for purchases made within the county. This county-level tax is a vital source of funding for essential county services and initiatives.

To illustrate, consider a hypothetical purchase of a new television set, priced at $1000. In St. Louis City, the sales tax calculation would be as follows: $1000 x 0.05225 = $52.25. This means that, in addition to the television's price, the buyer would pay an extra $52.25 in sales tax. In St. Louis County, the calculation would be slightly different, resulting in a sales tax of $57.25 for the same purchase.

Sales Tax Exemptions: Navigating the Fine Print

While sales tax is a ubiquitous part of retail transactions, certain goods and services in St. Louis are exempt from this tax. These exemptions are designed to alleviate the financial burden on specific industries and promote economic growth in targeted sectors.

One notable exemption is on food items. In Missouri, unprepared food, such as fresh produce, meat, and dairy products, is generally not subject to sales tax. This exemption provides a much-needed relief for families and individuals, especially those on a tight budget, by reducing the cost of essential groceries.

However, it's important to note that this exemption doesn't extend to all food-related items. Prepared foods, restaurant meals, and certain beverages are still subject to sales tax. This distinction can be a tricky aspect for businesses in the food industry to navigate, requiring a keen understanding of the state's tax laws.

Another significant exemption in St. Louis pertains to medicines and medical devices. Most prescription and over-the-counter medications, as well as medical equipment, are exempt from sales tax in Missouri. This exemption is a vital measure to ensure affordable access to healthcare for residents, especially those with chronic conditions or limited financial means.

Moreover, Missouri also offers sales tax holidays, during which certain items are temporarily exempt from sales tax. These holidays, often aligned with specific seasons or events, provide an opportunity for shoppers to save significantly on essential purchases. For instance, Missouri has dedicated sales tax holidays for back-to-school shopping, allowing families to stock up on school supplies and clothing without the added tax burden.

The Impact of Sales Tax on St. Louis’ Economy

Sales tax in St. Louis plays a pivotal role in shaping the city’s economic landscape. It serves as a significant source of revenue for both the city and county governments, funding vital services and infrastructure projects that benefit residents and businesses alike.

For instance, the sales tax revenue is instrumental in maintaining and improving the city's transportation network, including roads, bridges, and public transit systems. It also contributes to the funding of public safety services, such as police and fire departments, ensuring the safety and security of the community.

Furthermore, sales tax revenue is a key driver of economic development initiatives in St. Louis. It supports the growth of local businesses, attracts new investments, and fosters job creation. By providing a stable revenue stream, the sales tax enables the city to offer incentives and support to businesses, encouraging innovation and economic growth.

However, it's important to acknowledge the potential burden that sales tax can place on low-income households and small businesses. While sales tax is a necessary component of the city's revenue system, it's crucial to strike a balance between generating revenue and ensuring economic fairness for all segments of the population.

Comparative Analysis: St. Louis vs. Other Major Cities

When it comes to sales tax rates, St. Louis’ structure is relatively moderate compared to other major cities in the United States. Cities like Chicago, with a total sales tax rate of 10.25%, and New York City, with a rate of 8.875%, impose significantly higher taxes on consumer purchases.

However, it's worth noting that sales tax rates can vary widely across different states and even within the same state. For instance, while St. Louis City and County have a combined sales tax rate of 5.725%, other cities in Missouri, such as Kansas City, have slightly lower rates. This variation can influence consumer behavior and business decisions, as individuals and companies may opt for locations with more favorable tax rates.

Additionally, the sales tax landscape in St. Louis is subject to periodic changes and updates. Tax rates can be adjusted to address budget concerns, economic trends, or to support specific initiatives. Staying informed about these changes is crucial for both consumers and businesses to make informed financial decisions.

Tips for Businesses and Consumers in St. Louis

For businesses operating in St. Louis, staying compliant with sales tax laws is paramount. This involves understanding the applicable tax rates, exemptions, and reporting requirements. Failure to comply with sales tax regulations can result in significant penalties and legal consequences.

Businesses can leverage technology to streamline their sales tax compliance processes. Sales tax software and automation tools can simplify tax calculations, filing, and reporting, ensuring accuracy and saving valuable time and resources.

Consumers, on the other hand, can benefit from being aware of the sales tax rates and exemptions in St. Louis. This knowledge can help them budget effectively and make informed purchasing decisions. Additionally, consumers can advocate for fair and transparent tax policies by engaging with local government representatives and staying informed about tax-related issues.

In conclusion, the sales tax landscape in St. Louis is a dynamic and intricate system that impacts both businesses and consumers. By understanding the rates, exemptions, and broader economic implications, individuals and enterprises can navigate this complex terrain with confidence and make informed choices that contribute to the city's vibrant economy.

What is the current state sales tax rate in Missouri?

+The current state sales tax rate in Missouri is 4.225%.

Are there any upcoming changes to the sales tax rates in St. Louis?

+Sales tax rates can be subject to change. It’s advisable to stay updated with local government announcements and news to be aware of any potential changes.

How can businesses stay compliant with sales tax laws in St. Louis?

+Businesses can ensure compliance by staying informed about sales tax laws, using sales tax software for accurate calculations, and maintaining proper record-keeping practices.