Philadelphia Wage Tax

The Philadelphia Wage Tax is a vital component of the city's tax system, contributing significantly to its revenue generation. Understanding the intricacies of this tax is essential for residents, businesses, and anyone interested in the economic landscape of Philadelphia.

Understanding the Philadelphia Wage Tax

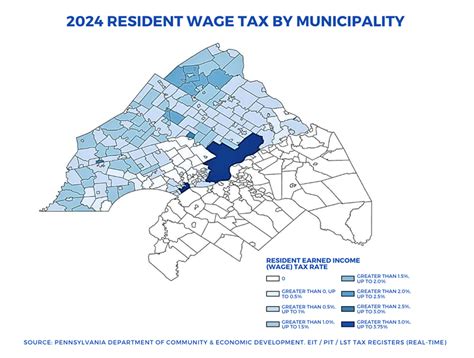

The Philadelphia Wage Tax, often referred to as the Earnings Tax or simply the Wage Tax, is a local tax levied on the income of individuals and businesses operating within the city limits of Philadelphia. It is a progressive tax, meaning the tax rate increases as the income level rises. This tax is a critical source of revenue for the city, funding various public services and infrastructure projects.

The Wage Tax is unique in that it applies to both residents and non-residents earning income within the city. This includes wages, salaries, commissions, bonuses, and other forms of compensation. The tax rate is determined by the location of the workplace, with different rates applicable for residents and non-residents.

Tax Rates and Calculations

As of [current year], the Wage Tax rates in Philadelphia are as follows:

| Category | Tax Rate |

|---|---|

| Philadelphia Resident Wage Tax | 3.8935% |

| Philadelphia Non-Resident Wage Tax | 3.4452% |

| School District of Philadelphia Wage Tax | 1.4733% |

| Philadelphia Net Profits Tax (for businesses) | 6.4428% |

The Wage Tax is calculated based on the employee's gross earnings, and the rate is applied to the entire income, not just the amount over a certain threshold. This means that even those with lower incomes contribute to the city's revenue.

Who Pays the Wage Tax

The Wage Tax is applicable to a wide range of individuals and entities. Here’s a breakdown:

- Residents: Anyone living in Philadelphia, regardless of where they work, is subject to the resident Wage Tax rate on their earnings.

- Non-Residents: Individuals working in Philadelphia but residing outside the city limits are liable for the non-resident Wage Tax rate.

- Businesses: All businesses operating within Philadelphia, including sole proprietorships, partnerships, and corporations, must pay the Wage Tax on the earnings of their employees. Additionally, they are subject to the Net Profits Tax on their business income.

- Contractors and Freelancers: Individuals working as independent contractors or freelancers within Philadelphia are responsible for paying the Wage Tax on their earnings.

Impact and Benefits of the Wage Tax

The Philadelphia Wage Tax plays a pivotal role in the city’s economy and its ability to provide essential services to its residents. The revenue generated from this tax funds a multitude of public initiatives and programs, including:

- Education: A significant portion of the Wage Tax revenue goes towards funding public schools, ensuring quality education for Philadelphia's youth.

- Public Safety: The tax contributes to maintaining a robust police force and fire department, enhancing public safety and emergency response capabilities.

- Infrastructure: Philadelphia's roads, bridges, and public transportation systems are partially funded by the Wage Tax, facilitating smoother travel and connectivity within the city.

- Social Services: The tax supports various social welfare programs, providing assistance to vulnerable populations and promoting community development.

- Cultural and Recreational Amenities: The city's vibrant cultural scene, including museums, parks, and recreational facilities, receives funding from the Wage Tax, enriching the lives of residents and attracting tourists.

Moreover, the Wage Tax promotes fairness and equity in the tax system by ensuring that those who benefit from the city's resources and services contribute accordingly. It also incentivizes businesses to create jobs and foster economic growth within Philadelphia, attracting investment and stimulating the local economy.

Comparative Analysis

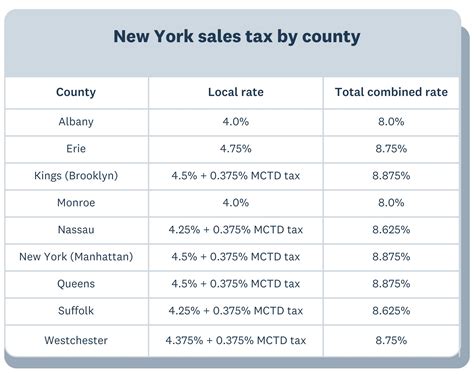

Philadelphia’s Wage Tax rates are competitive when compared to other major cities in the United States. For instance, New York City has a higher resident income tax rate of 3.876%, while Chicago’s non-resident tax rate is set at 5%.

However, it's important to note that the combination of the Wage Tax and other local taxes, such as the School District tax, can result in a higher overall tax burden for Philadelphians compared to some other cities. This is a common challenge faced by many cities that rely heavily on local taxes for funding essential services.

Challenges and Future Considerations

While the Philadelphia Wage Tax is a vital source of revenue, it also presents certain challenges. One of the primary concerns is the potential for tax leakage, where individuals or businesses may avoid paying the tax by misreporting income or relocating to neighboring municipalities with lower tax rates.

To address these challenges, the city has implemented various measures, including enhanced tax enforcement and compliance initiatives. Additionally, there have been discussions about tax reform to ensure the system remains fair and sustainable, especially as the city's demographics and economic landscape continue to evolve.

Looking ahead, the future of the Philadelphia Wage Tax will likely be influenced by several factors, including economic growth, population trends, and the city's commitment to providing high-quality public services. As Philadelphia continues to attract new residents and businesses, the Wage Tax will remain a critical component of the city's fiscal strategy, shaping its economic trajectory and the lives of its residents.

FAQ

How often must Wage Tax be paid in Philadelphia?

+

Wage Tax payments are typically due quarterly for both employers and employees. However, businesses with a monthly payroll tax liability of $10,000 or more must make monthly payments.

Are there any Wage Tax exemptions or credits available in Philadelphia?

+

Yes, there are certain exemptions and credits available. For instance, residents aged 65 or older may be eligible for a tax exemption on their pension income. Additionally, the city offers various tax credits, such as the Business Income and Loss Tax Credit and the Neighborhood Improvement Tax Credit, to promote economic development and community initiatives.

How does the Philadelphia Wage Tax affect remote workers?

+

Remote workers who reside in Philadelphia but work for an out-of-state employer are still subject to the resident Wage Tax rate on their earnings. However, if they work for a Philadelphia-based employer remotely, they may be eligible for the non-resident Wage Tax rate if they can prove their primary workplace is outside the city limits.