New York Sales Tax Clothing

Understanding New York Sales Tax on Clothing: A Comprehensive Guide

When it comes to shopping for clothing in the bustling city of New York, understanding the sales tax regulations can be a complex matter. With its unique tax laws and exemptions, navigating the sales tax landscape for apparel purchases requires a keen eye for detail. In this comprehensive guide, we will delve into the specifics of New York's sales tax policies, shedding light on the ins and outs of clothing taxation to ensure you make informed purchases.

The Basics of New York Sales Tax

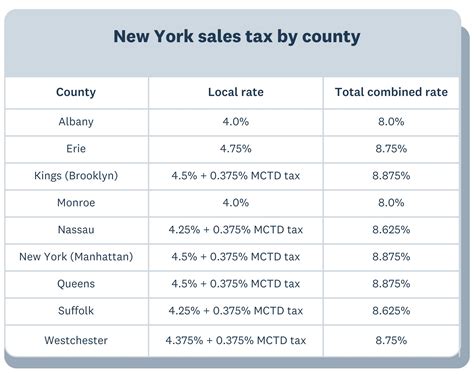

New York State, like many other jurisdictions, imposes a sales tax on various goods and services sold within its borders. This tax is levied on the retail price of an item, and it contributes to the state's revenue stream. The sales tax rate in New York is composed of a state-level tax and an additional local tax, which can vary depending on the county or city where the purchase is made.

As of [current year], the state-level sales tax rate stands at 4%, while local taxes can range from 0% to 4.5%, resulting in a combined tax rate that varies across the state. It's important to note that these rates are subject to change, so it's advisable to refer to the official New York State Department of Taxation and Finance website for the most up-to-date information.

The sales tax in New York applies to a wide range of tangible personal property, including clothing, footwear, and accessories. However, it's crucial to understand that there are specific exemptions and special rules that apply to clothing purchases, which we will explore in detail.

Clothing Exemptions and Special Rules

New York offers certain exemptions and special rules when it comes to the taxation of clothing items. These provisions aim to alleviate the financial burden on consumers, particularly those with lower incomes, and promote specific economic goals.

Clothing Exemption for Low-Cost Items

One notable exemption in New York's sales tax laws pertains to clothing items that fall below a certain price threshold. As of [current year], clothing and footwear items costing $110 or less are exempt from sales tax. This means that when you purchase a shirt for $50 or a pair of shoes for $90, you won't have to pay the additional sales tax on top of the purchase price.

This exemption provides a significant benefit to consumers, especially those who rely on budget-friendly options. It encourages shopping for essential clothing items without incurring additional tax expenses. However, it's important to remember that this exemption only applies to the cost of the clothing itself and does not cover any accessories or additional items purchased together.

Special Rules for Custom-Made Clothing

When it comes to custom-made clothing, New York has unique tax regulations. Custom-made clothing, such as tailored suits or dresses, is generally considered a taxable service rather than a tangible product. This means that the sales tax is calculated based on the labor cost involved in creating the garment, rather than the final selling price.

For example, if you commission a tailor to create a custom-made suit, the sales tax will be applied to the labor charges, which can include design, measurements, and alterations. The materials used in the suit may or may not be taxable, depending on whether they are purchased separately or included in the overall service charge. It's essential to clarify these details with your tailor to understand the tax implications of your custom-made clothing purchases.

Clothing Sales Tax Holidays

New York occasionally offers sales tax holidays, which are specific periods when certain items, including clothing, are exempt from sales tax. These tax-free shopping days provide an opportunity for consumers to save money on their purchases and are typically implemented to boost local economies and encourage spending during off-peak seasons.

During a sales tax holiday, you can purchase clothing items without paying the additional sales tax. However, it's crucial to stay informed about the dates and eligible items for these holidays, as they are temporary measures and may not apply to all types of clothing or accessories. The state usually announces these tax-free periods in advance, so keep an eye out for official announcements and plan your shopping accordingly.

Calculating Sales Tax on Clothing Purchases

Now that we understand the basic sales tax rates and exemptions, let's delve into how to calculate the sales tax on clothing purchases in New York.

First, determine the applicable tax rate for your specific location. As mentioned earlier, the state-level tax rate is 4%, but the local tax rate can vary. You can find the combined tax rate for your county or city by referring to the New York State Department of Taxation and Finance's website or contacting your local tax office.

Once you have the tax rate, calculating the sales tax on a clothing purchase is straightforward. Simply multiply the pre-tax price of the item by the applicable tax rate. For example, if you're buying a dress priced at $200 and the combined tax rate is 8.5% (4% state tax + 4.5% local tax), the sales tax amount would be calculated as follows:

Sales Tax Amount = Pre-Tax Price * Tax Rate Sales Tax Amount = $200 * 0.085 Sales Tax Amount = $17

So, in this case, the sales tax on the dress would be $17, bringing the total purchase price to $217.

It's worth noting that some retailers may display the sales tax amount separately on the price tag or receipt, making it easier for consumers to understand the breakdown of the final cost. Additionally, online retailers often calculate and display the sales tax during the checkout process, providing transparency and convenience for online shoppers.

Impact of Sales Tax on Clothing Retailers

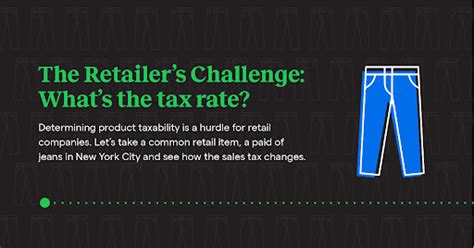

While sales tax regulations primarily affect consumers, they also have implications for clothing retailers operating in New York. Retailers play a crucial role in collecting and remitting sales tax to the state, ensuring compliance with tax laws.

Clothing retailers must register with the New York State Department of Taxation and Finance to obtain a sales tax permit. This permit allows them to collect and remit sales tax on behalf of the state. Retailers are responsible for accurately calculating and charging the appropriate sales tax on each transaction, whether in-store or online.

Compliance with sales tax regulations is essential for retailers to avoid penalties and legal issues. Regularly updating their knowledge of tax laws, including any changes or exemptions, is crucial to ensure accurate tax collection and reporting. Retailers should also maintain proper records and provide clear tax disclosures to their customers, fostering transparency and trust.

Furthermore, clothing retailers may face unique challenges when it comes to tax compliance, especially with the growing popularity of online shopping. They must navigate the complexities of tax laws across different jurisdictions, particularly when shipping goods to customers in various counties or states. Proper understanding and implementation of tax regulations are vital to ensure a smooth shopping experience for customers and maintain a positive relationship with tax authorities.

Future Implications and Tax Reform

As with any tax policy, New York's sales tax on clothing is subject to potential changes and reforms. The state's tax landscape is constantly evolving, influenced by economic conditions, political priorities, and public opinion.

Proposed tax reforms often spark debates among policymakers, economists, and the general public. Some argue for simplifying the tax system, eliminating exemptions, or implementing uniform tax rates across the state to reduce administrative burdens and increase fairness. Others advocate for maintaining or expanding exemptions, particularly for essential items like clothing, to provide financial relief to low-income households.

The future of sales tax policies in New York will depend on various factors, including the state's fiscal health, economic growth, and the political climate. It's essential for stakeholders, including retailers, consumers, and tax professionals, to stay informed about proposed changes and engage in discussions to shape the tax landscape in a way that benefits the community as a whole.

Additionally, the rise of e-commerce and online shopping has prompted discussions about the equitable taxation of online sales. With the increasing popularity of online marketplaces, policymakers are considering measures to ensure that online retailers collect and remit sales tax in a manner similar to traditional brick-and-mortar stores. This aim is to create a level playing field and prevent potential tax evasion or unfair advantages for online retailers.

Conclusion

Understanding New York's sales tax regulations on clothing is essential for both consumers and retailers alike. By navigating the tax landscape, shoppers can make informed decisions and take advantage of exemptions and special rules to save money. Meanwhile, clothing retailers must comply with tax laws to avoid penalties and maintain a positive relationship with customers and tax authorities.

As we've explored in this guide, New York's sales tax system is complex, with varying rates, exemptions, and special rules. Staying informed about these regulations and any changes that may occur is crucial for all parties involved. Whether you're a savvy shopper looking for tax-free deals or a retailer ensuring compliance, knowledge is power when it comes to navigating New York's sales tax landscape.

What is the current sales tax rate in New York State for clothing purchases?

+The current sales tax rate for clothing purchases in New York State is 4% at the state level. Local tax rates can vary and are added to the state tax rate, resulting in a combined tax rate that can range from 4% to 8.5% depending on the county or city.

Are there any exemptions for clothing purchases in New York State?

+Yes, New York State offers an exemption for clothing and footwear items costing 110 or less</strong>. This means that you won't have to pay sales tax on these low-cost items.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How is sales tax calculated on clothing purchases in New York?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>To calculate the sales tax on a clothing purchase, you need to know the applicable tax rate for your location. Multiply the pre-tax price of the item by the combined tax rate (state tax + local tax). For example, if the combined tax rate is <strong>8.5%</strong> and the item costs 200, the sales tax amount would be $17.

Are there any special rules for custom-made clothing in terms of sales tax?

+Yes, custom-made clothing is generally considered a taxable service. The sales tax is calculated based on the labor cost involved in creating the garment, rather than the final selling price. It’s important to discuss tax implications with your tailor.