Winnebago County Real Estate Taxes

Understanding the intricacies of real estate taxes is crucial when navigating the world of property ownership, especially in Winnebago County, Illinois. This comprehensive guide aims to demystify the process, providing an in-depth analysis of the tax system and offering valuable insights for both seasoned property owners and those new to the area.

A Comprehensive Guide to Winnebago County Real Estate Taxes

Winnebago County, nestled in the heart of Illinois, boasts a diverse landscape of residential, commercial, and agricultural properties, each contributing to the vibrant tapestry of the local economy. The real estate tax system in this county is designed to support essential services, infrastructure development, and community initiatives, making it an integral part of the property ownership experience.

Tax Assessment Process: A Step-by-Step Breakdown

The journey of a property owner in Winnebago County begins with the tax assessment process, which is conducted by the Winnebago County Assessor’s Office. This office is responsible for evaluating the fair market value of all properties within the county, ensuring that the tax burden is distributed equitably among property owners.

Here’s a simplified breakdown of the assessment process:

- Property Identification and Data Collection: The Assessor’s Office starts by gathering information about each property, including its location, size, type, and any recent improvements or alterations. This data is crucial for determining the property’s value.

- Physical Inspection: In some cases, an assessor may visit the property to conduct a physical inspection, especially if the property has undergone significant changes or if it’s a new construction. This step ensures an accurate assessment.

- Market Analysis: The assessor compares the property to similar ones in the area that have recently sold or leased. This analysis helps in determining the fair market value, which is the price the property would likely fetch in an open market.

- Assessment Calculation: Using the collected data and market analysis, the assessor calculates the property’s assessed value. This value is then used to determine the tax liability.

- Notification and Appeal Process: Property owners are notified of their assessed value and the corresponding tax liability. If an owner believes the assessment is inaccurate, they have the right to appeal, which is a detailed process outlined by the county.

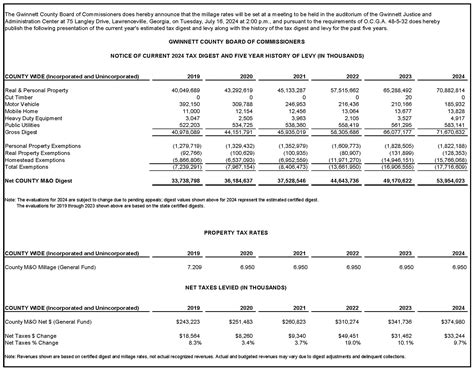

Tax Rates and Calculations: Unraveling the Formula

The tax rate in Winnebago County is expressed as a percentage of the property’s assessed value. This rate is determined annually by the Winnebago County Board and is influenced by the county’s budgetary needs and the assessed value of all properties within the county.

The formula for calculating the real estate tax liability is straightforward: Taxable Value x Tax Rate = Tax Liability. The taxable value is typically a fraction (often 1⁄3) of the assessed value, as set by state law.

For instance, if a property has an assessed value of 200,000 and the taxable value fraction is 1/3, the taxable value would be 66,667. If the tax rate for the year is 2.5%, the tax liability would be calculated as follows: 66,667 x 0.025 = 1,666.68.

It’s important to note that the tax rate can vary depending on the property’s location within the county, as different taxing districts (like schools, municipalities, and special districts) may have different rates.

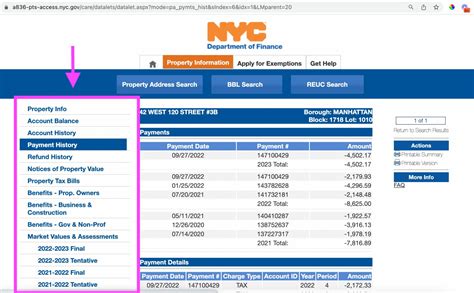

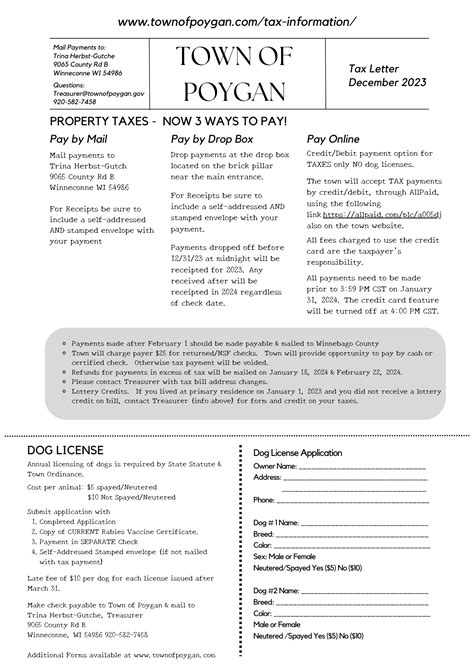

Tax Bills and Payment Options: A Convenient Overview

Winnebago County offers several convenient methods for property owners to receive and pay their tax bills. Tax bills are typically mailed to property owners in the fall, with the first installment due in March and the second in September.

Payment options include:

- Online Payment: Property owners can pay their taxes securely online through the Winnebago County Treasurer’s Office website. This method is fast, convenient, and allows for immediate confirmation of payment.

- Mail-in Payment: Owners can also choose to mail their payment to the Treasurer’s Office. The address is provided on the tax bill, along with detailed instructions.

- In-Person Payment: For those who prefer a personal touch, payments can be made in person at the Treasurer’s Office. This option allows for immediate receipt of payment and any necessary receipts or confirmations.

It’s advisable to pay attention to the due dates to avoid late fees and penalties. The county also offers options for tax payment plans and deferments for eligible property owners, providing flexibility and support during challenging financial times.

Special Assessments: Understanding the Exceptions

In addition to the regular real estate taxes, property owners in Winnebago County may also be subject to special assessments, which are charges levied by local governments or special districts to pay for specific public improvements that benefit the property.

These improvements can include:

- Road construction or repairs

- Sewer or water system upgrades

- Park development or maintenance

- Fire protection services

- Lighting or other infrastructure projects

Special assessments are typically charged as a one-time fee or as an additional tax on the property’s annual tax bill. The amount is determined by the cost of the improvement and the property’s proximity to or direct benefit from the project.

Property owners should carefully review their tax bills to understand any special assessments and their impact on their overall tax liability.

Tax Exemptions and Relief Programs: Support for Eligible Property Owners

Winnebago County recognizes the diverse needs of its property owners and offers several tax exemption programs and relief measures to provide financial support and stability.

Some of the notable exemptions and relief programs include:

| Exemption/Relief Program | Description |

|---|---|

| Homestead Exemption | This exemption reduces the assessed value of a property that is used as the owner’s primary residence, resulting in lower taxes. The exemption amount varies based on income and other factors. |

| Senior Citizen Exemption | Eligible seniors can receive a reduction in their property taxes, with the amount dependent on their income and the assessed value of their home. |

| Veterans Exemption | Veterans and their surviving spouses may be eligible for a property tax exemption, with the amount varying based on their military service and other criteria. |

| Farmland Assessment Program | Farmland is assessed based on its agricultural value rather than its potential market value, providing relief to agricultural property owners. |

| Tax Deferment Program | This program allows eligible seniors to defer their property taxes until the property is sold or transferred, providing financial stability during retirement. |

It’s important for property owners to stay informed about these programs and consult with the Assessor’s Office or a tax professional to determine their eligibility and maximize their benefits.

Future Implications and Ongoing Initiatives

As Winnebago County continues to evolve and adapt to changing economic and demographic trends, the real estate tax system is likely to undergo periodic reviews and adjustments to ensure fairness and sustainability.

Some potential future implications and initiatives include:

- Equity and Fairness: Ongoing efforts to ensure that the tax system treats all property owners fairly, regardless of their location or property type. This may involve reevaluating tax rates and assessment practices to prevent disparities.

- Community Engagement: The county could explore more interactive and transparent tax assessment processes, inviting public input and feedback to build trust and understanding among property owners.

- Technology Integration: Utilizing advanced technologies for more accurate and efficient tax assessments, property record maintenance, and online payment systems.

- Economic Development: Exploring tax incentives and relief measures to attract and retain businesses, foster economic growth, and create job opportunities within the county.

Staying informed about these initiatives and engaging with local government can help property owners navigate the evolving landscape of real estate taxes in Winnebago County.

Frequently Asked Questions

When are real estate taxes due in Winnebago County?

+The first installment of real estate taxes is due in March, and the second installment is due in September. It’s advisable to pay attention to the due dates to avoid late fees and penalties.

How can I appeal my property assessment in Winnebago County?

+If you believe your property assessment is inaccurate, you can file an appeal with the Winnebago County Board of Review. The process involves submitting documentation to support your case and attending a hearing. It’s advisable to consult with a tax professional or the Assessor’s Office for guidance.

Are there any tax relief programs for seniors in Winnebago County?

+Yes, Winnebago County offers several tax relief programs for eligible seniors, including the Senior Citizen Exemption and the Tax Deferment Program. These programs provide financial support and stability to seniors by reducing their property tax burden.

How can I stay updated on changes to the real estate tax system in Winnebago County?

+Staying informed is crucial. You can subscribe to updates from the Winnebago County Treasurer’s Office and Assessor’s Office, follow local news outlets, and attend public meetings or forums where tax-related topics are discussed. Additionally, consulting with a tax professional can provide valuable insights and guidance.

What happens if I fail to pay my real estate taxes in Winnebago County?

+Failing to pay your real estate taxes can result in late fees, penalties, and potential legal action. In severe cases, it may lead to a tax lien on your property, which could ultimately result in the property being sold at a tax sale to satisfy the outstanding debt.