New York City Real Estate Tax Rates

New York City, a vibrant metropolis known for its iconic skyline and bustling streets, has a complex real estate landscape. Understanding the tax rates associated with owning property in this dynamic city is crucial for both residents and prospective buyers. In this comprehensive guide, we delve into the intricacies of New York City real estate tax rates, exploring the various factors that influence these assessments and providing a detailed breakdown of the tax structure.

Unraveling the Complexity of NYC Real Estate Tax Rates

The real estate tax system in New York City is a multifaceted structure, designed to fund the city's infrastructure, services, and operations. It is a significant source of revenue for the city, with property taxes accounting for a substantial portion of the municipal budget. The tax rates, however, vary depending on several key factors, creating a unique and often confusing landscape for property owners and investors.

One of the primary determinants of real estate tax rates in NYC is the property's location. The five boroughs—Manhattan, Brooklyn, Queens, the Bronx, and Staten Island—each have their own distinct tax rates, influenced by factors such as property values, local amenities, and the cost of providing municipal services. For instance, properties in Manhattan, the financial and cultural hub of the city, often face higher tax rates due to the higher property values and the extensive infrastructure and services required to support its bustling population.

Understanding Property Assessment and Tax Classes

The real estate tax assessment process in New York City involves the valuation of properties by the Department of Finance. This valuation determines the taxable value of a property, which is then used to calculate the tax liability. The Department of Finance conducts regular assessments to ensure that property values are up-to-date and reflect the current market conditions.

New York City also employs a tax class system, which categorizes properties based on their use and ownership. There are several tax classes, each with its own unique rate structure. For instance, Class 1 includes one-, two-, and three-family homes, while Class 4 encompasses commercial and rental properties. This classification system ensures that properties are taxed fairly based on their specific characteristics and use.

| Tax Class | Description | Tax Rate (%) |

|---|---|---|

| Class 1 | One-, two-, and three-family homes | 1.474 |

| Class 2 | Condos and co-ops | 2.361 |

| Class 4 | Commercial and rental properties | 3.888 |

| Class 5 | Utilities and railroad properties | 2.000 |

| Class 6 | Property owned by government entities | 0.000 |

It's important to note that these tax rates are subject to change annually, and property owners should refer to the official New York City Department of Finance website for the most current information. The tax rates are typically set by the city government and can be influenced by various factors, including budget requirements and economic conditions.

Factors Influencing NYC Real Estate Tax Rates

Several factors contribute to the variability of real estate tax rates in New York City. Market conditions, such as property values and sales trends, play a significant role. As property values fluctuate, so do the assessments and, consequently, the tax rates. For instance, a surge in property values in a particular neighborhood might lead to higher tax assessments and, subsequently, increased tax rates for residents in that area.

The cost of municipal services is another crucial factor. New York City's extensive public transportation system, extensive park network, and various cultural institutions require substantial funding. Property taxes help support these services, and areas with higher concentrations of such amenities might see slightly higher tax rates to cover the associated costs.

Additionally, the budgetary needs of the city influence tax rates. During times of economic hardship or when the city requires additional funding for specific initiatives, tax rates might be adjusted to meet these financial requirements. It's a delicate balance between maintaining a stable tax structure and ensuring the city's financial sustainability.

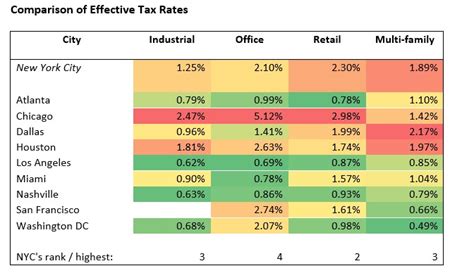

Analyzing Real-World Examples: Tax Rates Across NYC's Boroughs

To provide a clearer picture of the real estate tax landscape in New York City, let's examine the tax rates in each of the five boroughs. These examples offer a glimpse into the unique tax structures and how they vary across the city.

Manhattan: The Epicenter of NYC's Real Estate Market

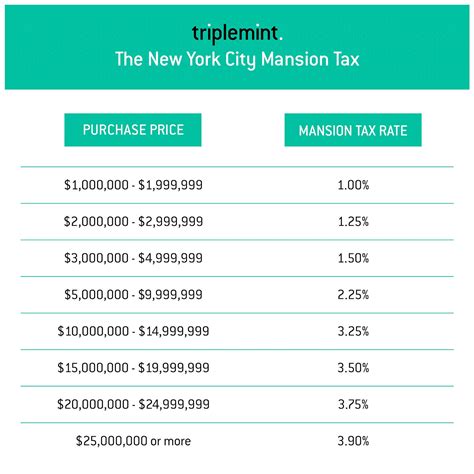

Manhattan, the iconic heart of New York City, boasts some of the most sought-after real estate in the world. With its renowned skyscrapers, cultural institutions, and financial district, Manhattan's property values are among the highest in the city. As a result, the real estate tax rates in Manhattan are correspondingly high.

For residential properties in Manhattan, the tax rate for Class 1 properties (one-, two-, and three-family homes) stands at 1.474% of the assessed value. This means that for a property assessed at $1 million, the annual tax liability would be approximately $14,740. For Class 2 properties, such as condos and co-ops, the tax rate is slightly higher at 2.361%, reflecting the higher property values and the unique challenges of maintaining these types of residences.

Commercial properties in Manhattan, classified as Class 4, face an even higher tax rate of 3.888%. This rate reflects the significant costs associated with maintaining the infrastructure and services required to support Manhattan's bustling business district. For a commercial property assessed at $5 million, the annual tax liability would be a substantial $194,400.

Brooklyn: A Diverse Borough with Varied Tax Rates

Brooklyn, the most populous borough in New York City, offers a diverse real estate landscape. From historic brownstones in Park Slope to the vibrant neighborhoods of Williamsburg and Bushwick, Brooklyn's property market is dynamic and varied. As such, the tax rates across Brooklyn can differ significantly.

In the residential neighborhoods of Brooklyn, the tax rate for Class 1 properties is typically 1.389%, slightly lower than Manhattan's rate. This reflects the generally lower property values in Brooklyn compared to Manhattan. However, it's important to note that Brooklyn's tax rates can vary significantly depending on the specific neighborhood and its unique characteristics.

Commercial properties in Brooklyn, like in Manhattan, fall under Class 4. The tax rate for these properties is 3.417%, which is slightly lower than Manhattan's rate. This difference can be attributed to the varying costs of doing business and the different amenities and infrastructure required in each borough.

Queens: A Large and Diverse Borough with Affordable Tax Rates

Queens, the largest borough in New York City by area, is known for its diverse neighborhoods and affordable housing options. From the vibrant streets of Astoria to the tranquil beaches of the Rockaways, Queens offers a wide range of real estate opportunities. As a result, the tax rates in Queens are generally more affordable compared to Manhattan and Brooklyn.

For residential properties in Queens, the tax rate for Class 1 properties is 1.288%, one of the lowest in the city. This makes Queens an attractive option for homeowners seeking more affordable tax liabilities. However, it's important to consider that property values in Queens can vary significantly, and certain neighborhoods might have higher assessments, leading to increased tax liabilities.

Commercial properties in Queens, like in the other boroughs, are classified as Class 4. The tax rate for these properties is 3.000%, which is significantly lower than Manhattan's rate. This reflects the different business landscape and cost of doing business in Queens compared to Manhattan.

Future Implications and Strategies for NYC Real Estate Tax Planning

As the real estate market in New York City continues to evolve, understanding the future implications of tax rates is crucial for both current and prospective property owners. The city's dynamic nature, coupled with its unique tax structure, presents both challenges and opportunities for tax planning.

One of the key trends in NYC's real estate market is the increasing focus on sustainable and energy-efficient buildings. The city has set ambitious goals for reducing carbon emissions, and property owners are encouraged to adopt sustainable practices. This trend might influence future tax rates, with potential incentives or tax breaks for properties that meet certain sustainability criteria. Staying informed about these initiatives and taking proactive steps towards sustainability could be a strategic move for property owners.

Additionally, the impact of remote work and changing office dynamics cannot be overlooked. With the rise of remote work, there has been a shift in commercial real estate demand, and certain areas might see a decrease in office space requirements. This could lead to adjustments in commercial property tax rates, as the city adapts to the changing landscape. Property owners should stay abreast of these changes and consider how they might affect their tax liabilities.

For homeowners, the importance of regular property assessments cannot be overstated. Property values can fluctuate, and it's crucial to ensure that assessments are accurate and up-to-date. Regularly reviewing and, if necessary, challenging assessments can help homeowners avoid overpaying on taxes. It's a delicate balance between staying compliant and ensuring that tax liabilities are fair and reflective of the property's actual value.

Lastly, for both homeowners and commercial property owners, strategic tax planning is essential. This involves understanding the tax class system, the various deductions and exemptions available, and how to maximize these benefits. Working with tax professionals who specialize in NYC real estate can provide valuable insights and ensure that property owners are taking advantage of all the available tax strategies.

Conclusion: Navigating NYC's Real Estate Tax Landscape

New York City's real estate tax rates are a complex but crucial aspect of owning property in this vibrant metropolis. Understanding the various factors that influence these rates, from property assessments to tax classes and market conditions, is essential for making informed financial decisions. By staying informed and proactive, property owners can navigate the tax landscape effectively and ensure that their tax liabilities are fair and reflective of their unique circumstances.

As the city continues to evolve, the real estate tax structure will likely adapt to meet the changing needs of the market and the city's residents. Staying ahead of these changes and being prepared for future trends is key to successful tax planning in New York City's dynamic real estate market.

How often are real estate tax rates updated in New York City?

+Real estate tax rates in New York City are typically updated annually, reflecting changes in market conditions, budgetary needs, and other relevant factors. Property owners should refer to the official NYC Department of Finance website for the most current information on tax rates.

Can property owners appeal their tax assessments in NYC?

+Yes, property owners in New York City have the right to appeal their tax assessments if they believe the assessed value is inaccurate or unfair. The process involves filing an appeal with the NYC Tax Commission, providing evidence to support the claim, and potentially attending a hearing to present the case.

Are there any tax incentives or exemptions available for NYC property owners?

+Yes, New York City offers various tax incentives and exemptions to eligible property owners. These can include exemptions for senior citizens, veterans, and properties used for certain purposes, such as religious or charitable organizations. It’s advisable to consult with a tax professional to explore these options.