Does Delaware Have Sales Tax

When discussing tax policies and regulations, it's essential to delve into the specifics of each state, as the tax landscape in the United States can vary significantly. Today, we will explore the topic of sales tax in Delaware, a state known for its unique approach to taxation and business-friendly environment.

Sales Tax in Delaware: A Comprehensive Overview

Delaware, a small yet economically vibrant state, has implemented a sales and use tax system that plays a crucial role in its overall tax structure. This system is designed to generate revenue for the state while also supporting its robust business climate.

The sales tax in Delaware is levied on the retail sale, lease, or rental of tangible personal property and certain services. It is an essential source of revenue for the state, contributing to its ability to fund various public services and infrastructure projects.

Delaware’s Sales Tax Rate and Exemptions

As of my last update in January 2023, Delaware imposes a statewide sales and use tax rate of 6%. This rate is applicable to most retail transactions within the state, including the sale of goods and certain services.

However, it's important to note that Delaware, much like many other states, offers specific exemptions and reduced tax rates for certain goods and services. These exemptions are designed to encourage economic growth and support specific industries or initiatives.

| Category | Tax Rate |

|---|---|

| General Sales Tax | 6% |

| Groceries and Food | 0% |

| Prescription Drugs | 0% |

| Manufacturing Equipment | 0% |

| Certain Agricultural Products | 0% |

The above table provides a glimpse of some of the exemptions and reduced tax rates offered by Delaware. For instance, groceries and food, prescription drugs, and certain agricultural products are exempt from sales tax, which benefits consumers and supports essential industries.

Remote Sellers and Sales Tax Nexus

With the rise of e-commerce, the concept of sales tax nexus has become increasingly important. In Delaware, a remote seller is required to collect and remit sales tax if they have a certain level of economic or physical presence within the state.

This means that online retailers with significant sales or interactions with Delaware consumers may be obligated to register with the state and collect sales tax. Delaware's nexus thresholds and guidelines are subject to change, so it's crucial for businesses to stay informed and compliant with the latest regulations.

Impact on Consumers and Businesses

The sales tax in Delaware has a direct impact on both consumers and businesses operating within the state. For consumers, it adds a certain percentage to their purchases, influencing their spending decisions and overall budget planning.

On the business side, sales tax compliance can be complex, especially for businesses with a significant online presence or multiple sales channels. Accurate record-keeping, timely filing, and understanding the nuances of Delaware's sales tax regulations are essential for businesses to avoid penalties and maintain a positive relationship with the state.

Comparative Analysis: Delaware vs. Other States

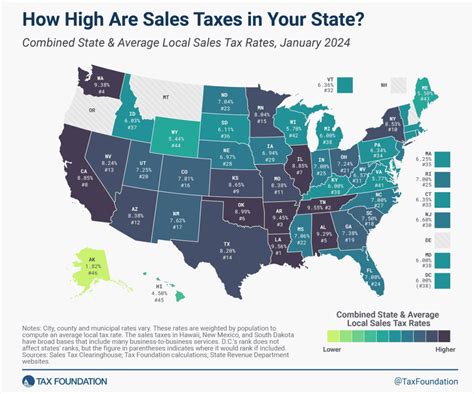

When comparing Delaware’s sales tax system to other states, it’s evident that Delaware’s approach is relatively moderate. With a 6% sales tax rate, it ranks below many other states in terms of the tax burden on consumers.

For instance, states like California, Illinois, and Tennessee have sales tax rates exceeding 7%, making Delaware's tax environment more favorable for both consumers and businesses.

However, it's important to consider the overall tax climate and business incentives offered by each state. Delaware's exemption for manufacturing equipment, for example, is a unique advantage that can attract specific industries and promote economic growth.

Conclusion: Delaware’s Sales Tax Strategy

In conclusion, Delaware’s sales tax system is a carefully crafted component of its tax policy, designed to balance revenue generation with business incentives. The state’s approach, with its moderate sales tax rate and strategic exemptions, aims to foster economic growth while providing essential public services.

For businesses and consumers alike, understanding Delaware's sales tax regulations is crucial for compliance and informed decision-making. As the state continues to evolve its tax policies, staying updated with the latest changes will be key to navigating the tax landscape successfully.

Does Delaware have any sales tax holidays?

+Yes, Delaware has implemented sales tax holidays in the past to encourage consumer spending and support specific industries. These holidays typically waive sales tax on certain items, such as school supplies or clothing, for a limited time.

How often are sales tax rates updated in Delaware?

+Sales tax rates in Delaware are subject to legislative changes, and any updates are typically announced through official state publications. It’s advisable to stay informed through the Delaware Division of Revenue’s website for the latest information.

Are there any special tax incentives for startups in Delaware?

+Delaware offers a range of tax incentives for businesses, including startups. These incentives can vary based on the industry and the specific initiatives supported by the state. It’s recommended to consult with a tax professional or refer to the state’s official resources for detailed information.