Tax Percentage In New Mexico

New Mexico, a state rich in cultural heritage and diverse landscapes, is a hub of economic activity and unique business opportunities. One key aspect that influences the business landscape here is the tax structure, particularly the tax percentages applicable to various economic activities. Understanding these tax rates is crucial for businesses and individuals alike, as it impacts financial planning and decision-making. In this comprehensive guide, we will delve into the intricacies of tax percentages in New Mexico, exploring the various types of taxes, their rates, and how they affect the state's economy.

A Comprehensive Guide to Tax Percentages in New Mexico

New Mexico, with its vibrant economy and diverse tax structure, offers a unique fiscal landscape for businesses and individuals. The state's tax system, while comprehensive, can be complex to navigate, especially for those new to the region. This guide aims to provide an in-depth understanding of the tax percentages in New Mexico, offering insights into the various taxes, their rates, and their implications.

State Income Tax Rates

One of the key revenue generators for New Mexico is the state income tax. The income tax rate in New Mexico varies based on an individual's or a business's taxable income. The state has five income tax brackets, ranging from 1.7% to 4.9% for individuals, and a flat rate of 4.8% for corporations.

| Income Tax Bracket | Tax Rate |

|---|---|

| 0 to $5,500 | 1.7% |

| $5,500 to $11,000 | 3.2% |

| $11,000 to $16,000 | 3.5% |

| $16,000 to $24,000 | 4.2% |

| Above $24,000 | 4.9% |

These rates are applicable for tax year 2023 and may be subject to change in future years. It's important to note that New Mexico offers various tax credits and deductions that can reduce the taxable income, thereby impacting the effective tax rate.

Sales and Use Tax

New Mexico imposes a sales and use tax on the sale of tangible personal property and certain services within the state. The combined state and local sales tax rate in New Mexico varies depending on the location of the sale, with a state-wide base rate of 5.125%. Local governments can add their own sales tax, resulting in rates as high as 9.1875% in some areas.

For example, the city of Albuquerque has a total sales tax rate of 8.375%, consisting of the state base rate plus additional local taxes. This rate is applicable to most goods and services, except for certain exemptions like groceries, prescription drugs, and certain agricultural equipment.

| Location | Sales Tax Rate |

|---|---|

| Statewide Base Rate | 5.125% |

| Albuquerque | 8.375% |

| Santa Fe | 7.125% |

| Las Cruces | 6.625% |

Businesses operating in New Mexico are required to register for a sales tax permit and collect the appropriate tax rate based on the location of the sale. Failure to do so can result in penalties and interest charges.

Property Taxes

Property taxes in New Mexico are levied on real estate and personal property. The tax rate varies across the state and is determined by the county in which the property is located. The median property tax rate in New Mexico is approximately 0.67%, which is below the national average. However, rates can be significantly higher or lower depending on the specific county.

| County | Effective Property Tax Rate |

|---|---|

| Bernalillo County | 0.74% |

| Santa Fe County | 0.61% |

| Doña Ana County | 0.57% |

| San Juan County | 0.79% |

Property taxes are a significant source of revenue for local governments in New Mexico, funding various public services like schools, roads, and emergency services.

Other Taxes and Fees

New Mexico imposes various other taxes and fees to generate revenue and regulate certain industries. These include:

- Gross Receipts Tax: A tax on the gross receipts of businesses operating in New Mexico, with rates varying based on the type of business and location.

- Motor Vehicle Excise Tax: A tax on the sale or transfer of vehicles, calculated as a percentage of the sales price.

- Severance Tax: A tax on the extraction of natural resources, such as oil and gas.

- Lodgers Tax: A tax on the rental of hotel rooms and other accommodations, often used to fund tourism promotion and development.

Tax Incentives and Credits

New Mexico offers a range of tax incentives and credits to encourage economic development, attract new businesses, and support existing industries. These incentives can significantly reduce the tax burden for qualifying businesses and individuals.

- Job Creation Tax Credit: Offers a credit against state income tax for businesses that create new jobs in New Mexico.

- Film Production Tax Credit: Provides a credit for qualified film and television production expenditures in the state.

- Angel Investment Tax Credit: Encourages investment in New Mexico startups by offering a credit to investors.

- Research and Development Tax Credit: Incentivizes research and development activities by providing a credit for qualifying expenses.

Impact on the Economy

The tax structure in New Mexico plays a significant role in shaping the state's economy. The state's competitive tax rates, particularly in terms of income and sales tax, make it an appealing location for businesses and individuals. The diverse range of tax incentives further enhances the state's attractiveness, encouraging investment and economic development.

However, the complexity of the tax system, with its varying rates and numerous taxes, can pose challenges for businesses, especially small and medium-sized enterprises. Effective tax planning and compliance are crucial to ensure businesses can maximize the benefits of the tax structure without incurring penalties.

Conclusion

Understanding the tax percentages in New Mexico is essential for any business or individual considering operating in the state. With its unique blend of tax rates, incentives, and fees, New Mexico offers both opportunities and challenges. By staying informed about the tax landscape and leveraging the available incentives, businesses can thrive and contribute to the state's vibrant economy.

Frequently Asked Questions

What is the average income tax rate in New Mexico for individuals?

+The average income tax rate for individuals in New Mexico is approximately 4.2%, though it can vary based on taxable income.

Are there any sales tax exemptions in New Mexico?

+Yes, New Mexico offers sales tax exemptions for certain goods and services, including groceries, prescription drugs, and agricultural equipment.

How often do tax rates in New Mexico change?

+Tax rates in New Mexico can change annually, typically based on legislative decisions and economic considerations. It’s essential to stay updated with the latest tax rates.

Are there any tax incentives for renewable energy projects in New Mexico?

+Yes, New Mexico offers tax incentives for renewable energy projects, including a Renewable Energy Production Tax Credit and a Property Tax Exemption for qualifying projects.

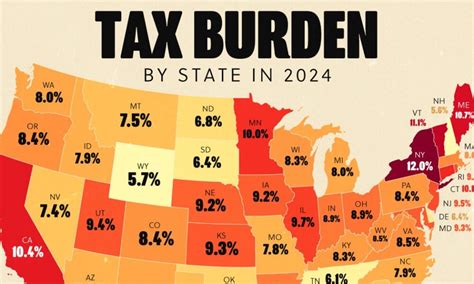

How does New Mexico’s tax structure compare to other states in the region?

+New Mexico’s tax structure, particularly its income and sales tax rates, is relatively competitive compared to neighboring states like Texas and Arizona.