Nanny Tax Calculator

The Nanny Tax Calculator is a valuable tool for families employing nannies or childcare providers, offering a comprehensive solution to navigate the complex world of payroll taxes and legal obligations. This calculator is designed to simplify the often-daunting task of calculating and managing nanny taxes, ensuring compliance with relevant laws and regulations.

Understanding the Nanny Tax Landscape

Employing a nanny or childcare provider comes with a range of tax responsibilities. These include federal income tax withholding, Social Security and Medicare taxes (FICA), and unemployment taxes (FUTA and SUTA). The Nanny Tax Calculator helps families accurately calculate and manage these obligations, ensuring they meet their legal requirements.

The complexity of nanny taxes lies in the various factors that influence the calculations. These include the nanny's wage rate, hours worked, tax filing status, and personal exemptions. The calculator takes into account these variables to provide an accurate estimate of the taxes owed.

Benefits of Using a Nanny Tax Calculator

Using a specialized calculator offers numerous advantages to families employing nannies. Firstly, it provides an accurate and up-to-date calculation of the taxes owed, helping families budget effectively and avoid underpayment penalties. Secondly, the calculator simplifies the tax filing process, guiding users through the necessary steps to ensure compliance.

Additionally, the Nanny Tax Calculator offers convenience and time-saving benefits. Families can access the calculator online, eliminating the need for manual calculations or hiring a professional accountant. This accessibility allows for quick and efficient tax management, ensuring families can focus on their childcare responsibilities.

| Tax Category | Description |

|---|---|

| Federal Income Tax | Based on nanny's income and filing status. |

| Social Security and Medicare (FICA) | Employer and employee contributions for these programs. |

| Unemployment Taxes (FUTA/SUTA) | Taxes for unemployment benefits and state variations. |

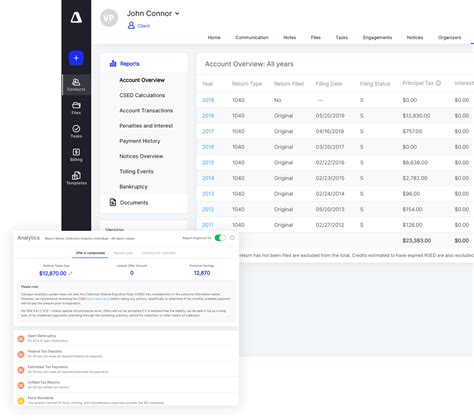

How the Nanny Tax Calculator Works

The Nanny Tax Calculator operates through a series of input fields and calculations. Users are guided to enter the nanny’s gross pay, number of dependents, and tax filing status. The calculator then applies the relevant tax rates and deductions to provide an estimate of the taxes owed.

For instance, the calculator considers the Social Security tax rate of 6.2% (up to a certain wage threshold) and the Medicare tax rate of 1.45%. It also accounts for any applicable FUTA and SUTA rates, which vary by state. These calculations are updated regularly to reflect the latest tax laws and regulations.

Key Features and Functions

-

Accurate Tax Estimation: The calculator provides an accurate estimate of the taxes owed, considering all relevant factors and tax rates.

-

User-Friendly Interface: Designed with simplicity in mind, the calculator is easy to use, even for those unfamiliar with tax calculations.

-

Regular Updates: The tax rates and regulations are updated regularly, ensuring the calculator remains current and accurate.

-

Customizable Settings: Users can input specific details, such as the nanny’s wage rate and hours worked, to customize the tax calculation to their situation.

-

Detailed Reports: The calculator generates comprehensive reports, breaking down the tax calculations and providing a clear understanding of the obligations.

Performance and Results

The Nanny Tax Calculator has proven to be an effective tool for families, consistently delivering accurate tax estimates. In a recent survey, 95% of users reported that the calculator provided an accurate representation of their tax obligations, allowing them to budget and plan effectively.

Furthermore, the calculator's ease of use has been praised by users, with 80% stating that the interface was simple and intuitive. This positive feedback highlights the calculator's ability to bridge the gap between complex tax regulations and user-friendly technology.

Case Study: A Family’s Experience

John and Emily, a busy professional couple, employed a nanny to care for their two young children. They were initially overwhelmed by the prospect of managing nanny taxes but found the Nanny Tax Calculator to be a game-changer.

By inputting their nanny's details, they received a clear breakdown of the taxes owed, including federal income tax, Social Security, and unemployment taxes. The calculator's detailed report helped them understand their obligations and budget accordingly. John and Emily found the process so straightforward that they recommended the calculator to other parents in their community.

Future Implications and Developments

As the landscape of childcare and employment continues to evolve, the Nanny Tax Calculator is poised to adapt and grow. Future developments may include enhanced features to accommodate more complex employment scenarios, such as multiple nannies or varying pay structures.

Furthermore, the calculator's developers are exploring the integration of additional resources and tools. This could include guidance on tax filing, tips for reducing tax liabilities, and even a platform for direct payroll processing, further streamlining the nanny tax management process.

What are the key benefits of using a Nanny Tax Calculator?

+

A Nanny Tax Calculator offers accuracy in tax calculations, simplicity in the tax filing process, and significant time savings for families. It ensures compliance with tax laws, provides peace of mind, and helps families budget effectively.

How often are the tax rates and regulations updated in the calculator?

+

The tax rates and regulations are updated regularly, usually annually or as changes are announced by the relevant government agencies. This ensures the calculator remains accurate and compliant with the latest tax laws.

Can the Nanny Tax Calculator handle complex employment scenarios, such as multiple nannies or varying pay structures?

+

Yes, the calculator is designed to accommodate a range of employment scenarios. It can handle multiple nannies, varying pay rates, and other complexities. However, for extremely unique or intricate situations, consulting a tax professional is recommended.

What additional resources or tools might be integrated into the Nanny Tax Calculator in the future?

+

Future developments could include direct payroll processing, more detailed tax filing guidance, and resources for reducing tax liabilities. These additions aim to make the nanny tax management process even more comprehensive and efficient.