Unlocking Minnesota Sales Tax: What You Need to Know

When considering Minnesota’s sales tax landscape, the nuances and intricacies of its regulatory framework often pose challenges for consumers, retailers, and tax professionals alike. As the state continues to adapt its tax codes to accommodate e-commerce growth, local fiscal needs, and economic shifts, a detailed comparison of the core mechanisms—namely, the state sales tax system versus local option taxes—becomes essential for understanding how sales tax functions across different contexts within Minnesota. This analysis provides clarity on the structures, benefits, and limitations of these components, enabling stakeholders to navigate this economically significant terrain with confidence and strategic foresight.

Understanding Minnesota’s State Sales Tax System

Minnesota’s state sales tax is primarily governed by a uniform rate, designed to generate broad-based revenue that supports state-level services including transportation, health, and education. As of October 2023, the statewide base sales tax rate is set at 6.875%, but this figure can fluctuate slightly depending on legislative adjustments. This rate is applied to tangible personal property and certain services, with specific exemptions and liabilities tailored for different categories of goods and services.

The core of Minnesota’s sales tax legislation rests on the Minnesota Statutes Chapter 297A, which delineates taxable items, exemption criteria, and collection procedures. Retailers are responsible for collecting and remitting this tax to the Minnesota Department of Revenue periodically, often quarterly. The process necessitates meticulous record-keeping, adherence to compliance deadlines, and the ability to differentiate between taxable and exempt sales effectively. For consumers, the legislative setting concretely influences purchasing decisions, especially when considering the affordability of goods or services subject to combined tax implications.

Taxable Goods and Services in Minnesota

The list of taxable goods extends beyond basic retail merchandise to encompass digital products, certain restaurant services, and tangible personal property. For example, standard items like clothing, electronics, and furniture are subject to tax unless specifically exempted. Conversely, medical devices, prescription medications, and some food items for home consumption are exempt, highlighting nuanced classifications within the system.

Services such as repair work, legal consulting, and certain digital services are also taxable under specific conditions. This expansion of taxable activities aligns with legislative efforts to broaden the tax base and ensure fiscal sustainability amid evolving economic activities. Notably, digital product sales, including downloadable media or software, have seen adjustments in tax treatment reflective of changing consumption patterns.

| Relevant Category | Substantive Data |

|---|---|

| Statewide Sales Tax Rate | 6.875%, adjusted periodically based on legislative regulation |

| Taxable Digital Products | Downloadable media, software, streaming services (variable by policy) |

| Exemptions | Prescription medications, groceries for home consumption, certain medical devices |

The Role of Local Option Sales Taxes in Minnesota

Beyond the state’s foundational sales tax, Minnesota empowers counties and municipalities with the authority to impose local option sales taxes—adding an additional layer of fiscal capacity to fund local infrastructure, public safety, and community development projects. This decentralized element of sales taxation introduces variability but also enhances localized control, which can lead to significant differences in effective tax rates across regions.

Local option taxes are typically enacted through voter approval or legislative authorization, with rates generally ranging from 0.25% to 1.5%. For example, Hennepin County and Ramsey County have enacted local sales taxes for transit projects and infrastructure upgrades, which are added to the statewide base rate at the point of sale. Retailers tasked with collecting these taxes need to stay informed of jurisdictional boundaries and applicable rates to ensure compliance.

Comparison of Local Option vs Statewide Sales Tax

The primary distinction lies in scope and flexibility. Statewide sales tax offers consistency, simplifying compliance and administration on a broad scale. In contrast, local option taxes reflect regional economic priorities and community preferences, often resulting in slightly higher total rates in specific areas. This can influence purchasing behaviors, particularly in areas where local taxes add significantly to the total transaction cost.

| Aspect | Statewide Sales Tax | Local Option Sales Taxes |

|---|---|---|

| Rate Scope | Uniform across the state (6.875%) | Varying, based on jurisdiction (additional 0.25%-1.5%) |

| Administrative Burden | Centralized collection and remittance | Requires awareness of jurisdictional boundaries |

| Local Benefits | Funding for statewide programs | Funding for regional projects (e.g., transit, local infrastructure) |

Legal and Regulatory Challenges

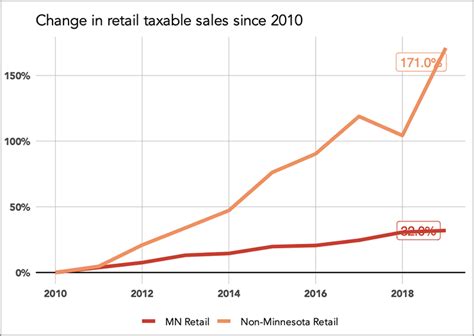

Both layers of sales tax administration face a series of legal and regulatory challenges. Foremost, the increasing prevalence of e-commerce complicates the collection process, especially with remote sales involving out-of-state vendors. The U.S. Supreme Court’s South Dakota v. Wayfair, Inc. decision in 2018 redefined nexus standards, compelling Minnesota to adapt its collection liabilities to encompass remote sellers exceeding certain thresholds.

Compliance complexities are further compounded by the classification of digital products, services, and hybrid transactions, often leading to litigation or administrative review. Particularly, small retailers may struggle to interpret and implement the precise rate calculations, especially when local tax rates change or multiple jurisdictions overlap.

| Relevant Category | Substantive Data |

|---|---|

| Out-of-State Seller Nexus | Thresholds based on economic activity, e.g., $100,000 in sales or 200 transactions annually |

| Legal Compliance Rate | Requires real-time updates to reflect legislative modifications |

| Digital Goods Classification | Continually evolving, with recent clarifications on streaming and downloadable content |

Implications for Businesses and Consumers

For businesses operating within Minnesota, understanding the layered structure of sales tax directly influences pricing strategies and compliance costs. Robuste systems that integrate real-time rate adjustments and jurisdictional rules provide a competitive edge while curbing risk exposure.

Consumers, on the other hand, experience the tangible impact of these policies in their everyday purchases. Disparities in total sales tax rates across geographic locations can affect shopping behavior and economic mobility. Recognizing exemptions and taxable categories helps in making informed decisions, especially in a landscape where digital and in-person shopping intertwine seamlessly.

Strategies for Effective Tax Management

Businesses should prioritize integrating comprehensive sales tax management software capable of handling multi-jurisdictional rate calculations, exemption schema, and audit trail support. Moreover, ongoing staff training and legislative updates dissemination improve compliance accuracy and reduce penalties. For consumers, awareness of local tax rates and eligible exemptions can translate into cost savings over time.

| Actionable Insights | Implementation Examples |

|---|---|

| Utilize POS systems with real-time rate updates | Integration with state and local databases |

| Track jurisdictional boundaries meticulously | Geolocation and mapping tools |

| Educate staff on exemptions and collections | Regular training sessions and compliance protocols |

Conclusion: Navigating the Minnesota Sales Tax Terrain

The landscape of Minnesota sales tax remains complex but navigable with a nuanced understanding of its statutory framework, regional variations, and compliance demands. As digital transformation accelerates and jurisdictional policies evolve, stakeholders must stay informed, agile, and proactive. Balancing the needs of state funding with local priorities, all while ensuring a fair and transparent system, underscores the importance of continuous adaptation and expert guidance in this fiscal ecosystem.

How does Minnesota determine which goods and services are taxable?

+Minnesota classifies taxable goods and services based on detailed statutes that specify categories and exemptions, considering factors like purpose, classification, and consumption context, with ongoing legislative updates adapting to economic shifts.

Are digital products taxed differently from tangible goods?

+Yes, digital products such as downloadable media or streaming services are subject to specific classification rules, which have been evolving to match changing consumption patterns, often requiring careful interpretation of current statutes.

What should businesses do to stay compliant with local and state sales tax laws?

+Businesses need to implement real-time sales tax calculation systems, continuously monitor legislative changes, train staff appropriately, and consider consulting with tax professionals to navigate complex jurisdictional requirements effectively.