Tax Calendar 2025

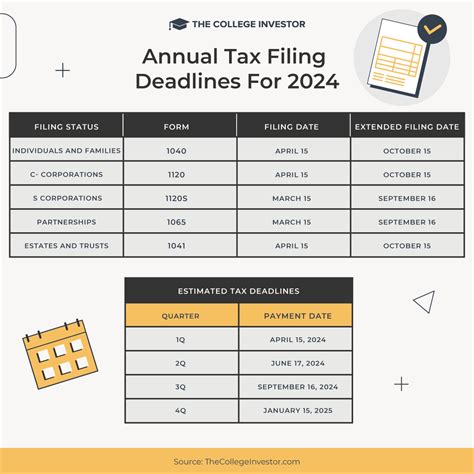

The tax landscape is ever-evolving, and staying updated with tax deadlines and key dates is crucial for both individuals and businesses. This comprehensive guide serves as a 2025 tax calendar, offering an in-depth look at the critical dates and milestones for tax preparation, filing, and compliance. By understanding these deadlines, taxpayers can plan their financial strategies, ensure timely submissions, and avoid potential penalties or missed opportunities.

January to March: Starting the Year with Financial Focus

The beginning of the year sets the tone for tax preparations. Here’s a breakdown of the essential dates during this period:

January 15: Estimated Tax Payment Deadline

Individuals and businesses with estimated tax liabilities are required to make their first-quarter estimated tax payment. This applies to those with income not subject to withholding, such as self-employment income, rental income, or investment gains. Failure to make timely payments may result in penalties and interest.

January 31: Deadline for Furnishing Forms to Employees and Recipients

This date is crucial for employers and payers. They must furnish employees and recipients with necessary tax forms, including W-2 (Wage and Tax Statement) and 1099 series forms. These forms provide detailed information about income and tax withholdings, which employees and recipients need to file their own tax returns.

February 16: Deadline for Filing Forms with the IRS

Employers and payers must submit copies of W-2 and 1099 series forms to the IRS by this date. This ensures that the IRS has the necessary information to process tax returns accurately and efficiently.

March 15: Corporate Tax Return Due Date

Corporations (S Corporations and C Corporations) with a fiscal year ending December 31, 2024, must file their tax returns by this date. This includes Form 1120 (U.S. Corporation Income Tax Return) and any necessary schedules and attachments.

March 31: Estimated Tax Payment Deadline

The second-quarter estimated tax payment is due for individuals and businesses with estimated tax liabilities. This payment is crucial to stay compliant and avoid potential underpayment penalties.

April: Peak Season for Tax Filing and Payments

April is the busiest month for taxpayers, with multiple deadlines and critical milestones. Here’s a detailed breakdown:

April 15: Individual Tax Return Due Date

The most well-known tax deadline, April 15, is the due date for individual tax returns. Taxpayers must file their Form 1040 (U.S. Individual Income Tax Return) and any accompanying schedules and forms. This includes reporting income, deductions, credits, and calculating the tax liability.

April 15: Estimated Tax Payment Deadline

In addition to the individual tax return due date, April 15 marks the deadline for the third-quarter estimated tax payment. This payment is crucial for those with estimated tax liabilities to stay current and avoid penalties.

April 15: Deadline for Filing Forms with the IRS

Similar to the January 31 deadline, employers and payers must submit copies of W-2 and 1099 series forms to the IRS by this date. This ensures the IRS has updated records for the current tax year.

April 15: Deadline for Furnishing Forms to Employees and Recipients

A critical date for employers and payers, this deadline ensures that employees and recipients receive their tax forms for the previous year. This enables them to file their own tax returns accurately and on time.

April 18: State and Local Tax Return Due Date

Many states and local jurisdictions follow the federal tax deadline, but some may have different due dates. Taxpayers should check with their state’s Department of Revenue or local tax authority to ensure they meet the specific state and local tax return deadlines.

May to June: Post-Filing Period and Additional Deadlines

While the peak tax season is over, there are still important dates to consider during this period:

May 15: Corporate Tax Return Due Date (Extended Filing Date)

Corporations that have obtained an automatic extension for filing their tax returns must file by this date. This applies to corporations with a fiscal year ending December 31, 2024, who filed Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns) by March 15.

June 15: Estimated Tax Payment Deadline

The final deadline for estimated tax payments for the year. Individuals and businesses with estimated tax liabilities must make their fourth-quarter payment by this date to avoid any additional penalties.

July to December: Year-End Preparations and Deadlines

As the year comes to a close, taxpayers should focus on year-end tax planning and preparations. Here are some key dates to keep in mind:

December 15: Estimated Tax Payment Deadline

An additional estimated tax payment deadline for individuals and businesses who choose to make a payment during this period. This is an optional payment to ensure they have sufficient funds to cover their tax liabilities.

December 31: Year-End Tax Planning

The end of the year is an excellent time for tax planning. Taxpayers can review their financial strategies, make necessary adjustments, and take advantage of tax-saving opportunities. This includes maximizing deductions, credits, and contributions to retirement accounts.

| Category | Key Dates |

|---|---|

| Estimated Tax Payments | January 15, March 31, April 15, June 15, December 15 |

| Individual Tax Return | April 15 |

| Corporate Tax Return | March 15 (Regular Due Date), May 15 (Extended Filing Date) |

| Forms Furnishing to Employees | January 31, April 15 |

| Forms Filing with the IRS | February 16, April 15 |

Conclusion

The 2025 tax calendar is a comprehensive guide to help taxpayers navigate the critical dates and deadlines. By staying informed and organized, taxpayers can ensure timely compliance, avoid penalties, and make the most of their tax strategies. Remember, tax planning is an ongoing process, and staying updated with the latest tax laws and regulations is essential for optimal financial management.

What happens if I miss a tax deadline?

+

Missing a tax deadline can result in penalties and interest. It’s important to take immediate action and file your tax return or make the necessary payment as soon as possible to minimize penalties. You may also consider seeking professional advice to understand your options and potential consequences.

Can I get an extension for filing my tax return?

+

Yes, you can request an extension for filing your tax return. However, it’s important to note that an extension only extends the filing deadline, not the payment deadline. You must still pay any taxes owed by the original deadline to avoid penalties. To request an extension, you need to file Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) before the tax filing deadline.

Are there any tax deadlines that can be different for certain taxpayers?

+

Yes, some tax deadlines may vary depending on the taxpayer’s circumstances. For example, taxpayers affected by a federally declared disaster may have extended deadlines for filing and paying taxes. Additionally, certain states and local jurisdictions may have different tax return due dates. It’s essential to check with the relevant tax authorities for specific deadlines.