North Carolina State Tax Forms

Welcome to our comprehensive guide on North Carolina state tax forms, a crucial aspect of financial management for individuals and businesses operating within the state. Understanding the tax landscape is essential to ensure compliance and take advantage of any available benefits or deductions. In this article, we will delve into the specifics of North Carolina's tax system, providing you with the knowledge and resources to navigate the process seamlessly.

Unraveling the Complexity of North Carolina State Taxes

North Carolina, like many other states, has its unique tax structure and requirements. Whether you’re a resident, non-resident, or a business owner, being aware of the state’s tax forms and regulations is imperative. Let’s explore the key aspects to ensure a smooth tax filing experience.

Resident Individual Tax Forms

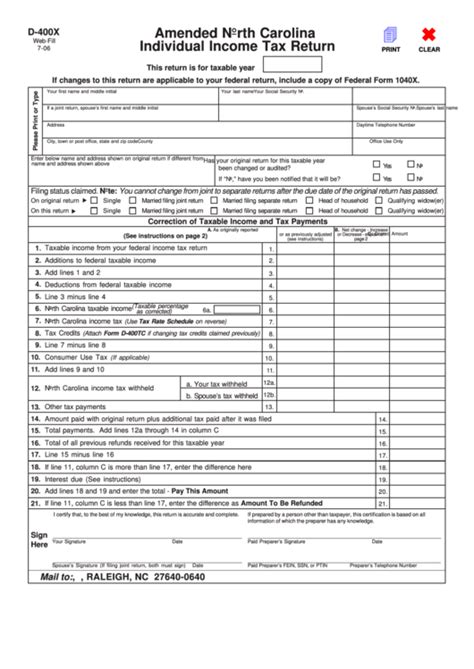

For individuals residing in North Carolina, the primary tax form is the NC-4, which is the North Carolina Individual Income Tax Return. This form is used to report various sources of income, including wages, salaries, investments, and business profits. The NC-4 is a comprehensive document that allows taxpayers to claim deductions, credits, and exemptions, ensuring they pay the correct amount of state tax.

Additionally, North Carolina offers specific tax forms for different income streams. For instance, Schedule NC-150 is dedicated to reporting capital gains and losses, while Form D-400 is designed for individuals with disability income. These specialized forms ensure accurate reporting and compliance with state regulations.

| Form Name | Description |

|---|---|

| NC-4 | Standard income tax return for residents |

| Schedule NC-150 | Capital gains and losses reporting |

| Form D-400 | Disability income reporting |

North Carolina also recognizes the importance of tax planning and offers resources to help individuals maximize their deductions. The state's Department of Revenue provides detailed guidelines and worksheets to assist taxpayers in calculating their standard deductions or itemized deductions accurately.

Non-Resident and Part-Year Resident Forms

Individuals who are not residents of North Carolina but earn income within the state, or those who are part-year residents, have specific tax obligations. The NC-4 PY form is designed for part-year residents, allowing them to report income earned during their time in the state. Non-residents, on the other hand, use the NC-4 NR form to report North Carolina-sourced income, such as wages or business profits.

| Form Name | Description |

|---|---|

| NC-4 PY | Part-year resident income tax return |

| NC-4 NR | Non-resident income tax return |

These forms require careful consideration of the taxpayer's residency status and the sources of their income. Non-residents may also need to file additional forms, such as the NC-4 EZ, which is a simplified version of the NC-4 for certain non-residents with limited income sources.

Business Tax Forms and Obligations

North Carolina imposes taxes on various types of businesses, including corporations, partnerships, and sole proprietorships. The specific tax forms and obligations depend on the business structure and industry.

Corporations, for instance, must file the NC Corporate Income Tax Return (Form 200), which reports the corporation's income and expenses. Partnerships, on the other hand, use the NC Partnership Return (Form 201) to report the partnership's income and distribute the tax liability to its partners.

| Business Type | Form Name |

|---|---|

| Corporation | Form 200 |

| Partnership | Form 201 |

| Sole Proprietorship | NC-4 (individual tax return) |

Additionally, businesses may need to file other forms, such as the NC Sales and Use Tax Return (Form E-500) if they engage in retail sales or use taxable services. The state also has specific forms for various tax credits and incentives, allowing businesses to take advantage of opportunities to reduce their tax liability.

Tax Credits and Incentives in North Carolina

North Carolina offers a range of tax credits and incentives to support businesses and individuals. These incentives aim to encourage economic growth, promote sustainability, and assist low-income individuals.

Business Tax Credits

Businesses in North Carolina can benefit from various tax credits, including the Job Development Investment Grant (JDIG), which provides tax credits to companies creating new jobs and investing in the state. Additionally, the One North Carolina Fund offers performance-based grants to businesses that create new jobs and make significant capital investments.

Other notable business tax credits include the Film and Entertainment Grant, which supports the film industry, and the Historic Preservation Tax Credit, encouraging the rehabilitation of historic structures.

Individual Tax Credits and Deductions

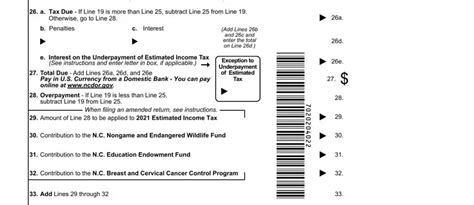

Individuals in North Carolina can take advantage of several tax credits and deductions to reduce their tax liability. The Earned Income Tax Credit (EITC) is a federal and state-level credit that benefits low- to moderate-income working individuals and families. The state also offers a Child and Dependent Care Tax Credit, providing relief for childcare expenses.

Additionally, North Carolina allows itemized deductions for various expenses, such as medical and dental costs, state and local taxes paid, and charitable contributions. These deductions can significantly reduce the taxable income of individuals, making tax planning an essential strategy.

Filing and Payment Options

North Carolina offers multiple avenues for taxpayers to file their tax returns and make payments. The state’s Department of Revenue provides an online filing system, Taxpayer Access Point (TAP), which allows individuals and businesses to file their returns electronically. TAP also offers a payment portal for taxpayers to remit their tax liabilities.

For those who prefer traditional methods, paper tax forms are available for download from the Department of Revenue's website. Taxpayers can complete the forms, attach any necessary schedules or supporting documents, and mail them to the appropriate address.

North Carolina also provides payment options beyond traditional methods. Taxpayers can pay their taxes using credit or debit cards, through direct withdrawal from a bank account, or by using third-party payment processors. These options ensure flexibility and convenience for taxpayers.

Conclusion: Empowering Compliance and Financial Planning

Understanding North Carolina’s state tax forms and obligations is crucial for individuals and businesses operating within the state. By being aware of the specific forms, credits, and deductions available, taxpayers can ensure compliance and take advantage of opportunities to reduce their tax burden.

This comprehensive guide aims to provide a solid foundation for navigating North Carolina's tax landscape. Remember, staying informed and seeking professional advice when needed is essential to make the most of your tax obligations and plan your financial future effectively.

When is the tax filing deadline for North Carolina residents?

+The tax filing deadline for North Carolina residents is typically aligned with the federal tax deadline, which is typically April 15th. However, it’s important to note that this date can be extended under certain circumstances, such as natural disasters or technical issues with the state’s filing system.

Can I file my North Carolina tax return electronically?

+Yes, North Carolina offers an electronic filing system called Taxpayer Access Point (TAP). This system allows individuals and businesses to file their tax returns online, providing a convenient and efficient way to meet their tax obligations.

Are there any tax credits available for renewable energy investments in North Carolina?

+Absolutely! North Carolina offers the Renewable Energy Investment Tax Credit, which provides a credit for investments in renewable energy sources such as solar, wind, and geothermal. This credit encourages the adoption of sustainable energy practices and supports the state’s commitment to a greener future.