Ct Tax Brackets

The Connecticut tax system, including its income tax brackets, plays a crucial role in shaping the financial landscape of the state. Understanding these brackets is essential for residents and businesses alike, as they directly impact personal finances and the state's economic environment.

A Comprehensive Overview of Connecticut's Tax Brackets

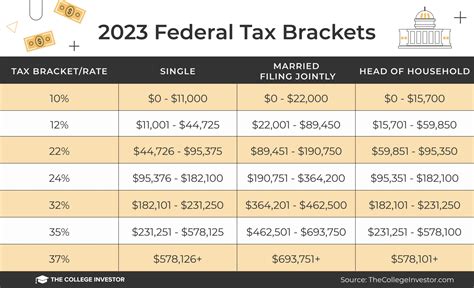

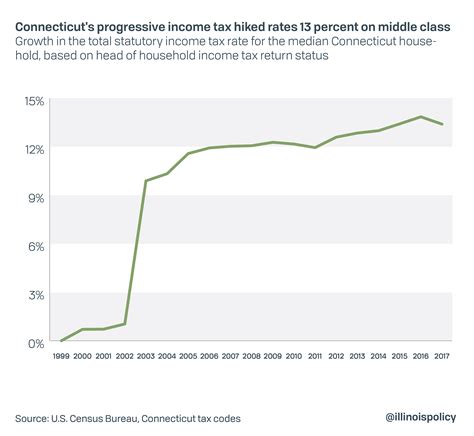

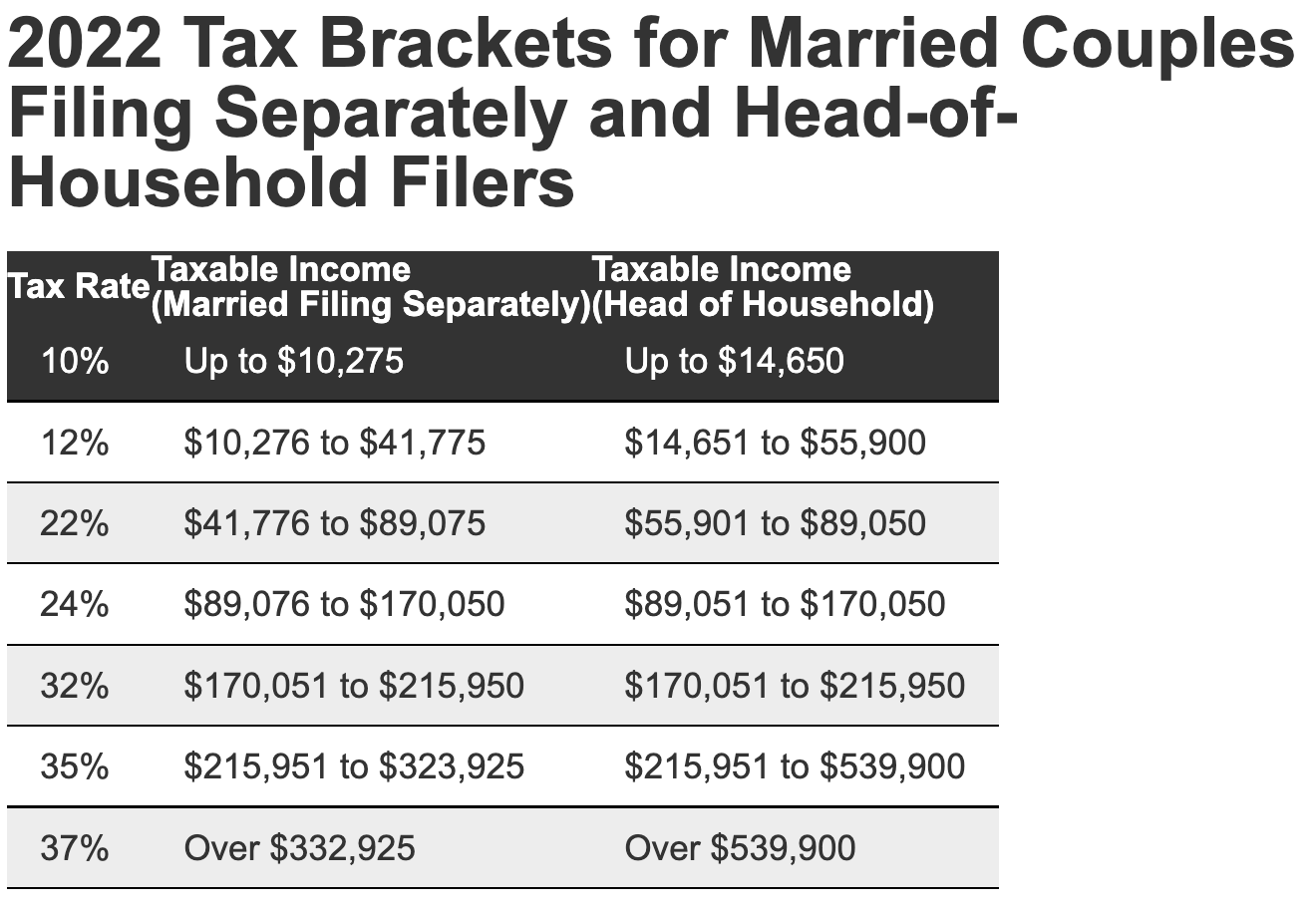

Connecticut's income tax system operates on a progressive scale, meaning that higher income levels are taxed at progressively higher rates. This structure aims to maintain a balance between individual contributions and equitable financial responsibility. The state's tax brackets are periodically adjusted to account for inflation and economic shifts, ensuring the system remains fair and sustainable.

As of the most recent adjustments, Connecticut's tax brackets are as follows:

| Income Range | Tax Rate |

|---|---|

| $10,000 - $50,000 | 3.07% |

| $50,001 - $100,000 | 5.06% |

| $100,001 - $200,000 | 5.50% |

| $200,001 - $250,000 | 6.33% |

| $250,001 - $500,000 | 6.70% |

| $500,001 and above | 6.99% |

These brackets apply to Connecticut residents' taxable income, which includes all earnings and certain types of unearned income. Notably, Connecticut does not tax Social Security benefits, a benefit for many retirees in the state.

How Connecticut's Tax Brackets Impact Residents

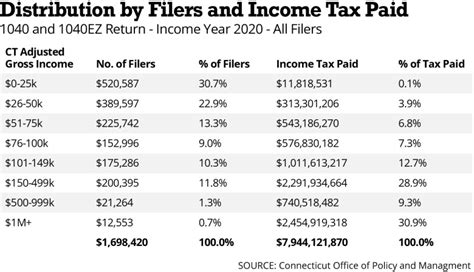

The progressive nature of Connecticut's tax system means that those with higher incomes contribute a larger proportion of their income to the state. This structure is designed to support the state's social services, infrastructure, and public programs, ensuring a balanced approach to public spending.

For instance, consider a resident with an annual income of $75,000. According to the above brackets, they would fall into the 5.50% tax rate range, meaning they would pay approximately $4,125 in state income tax. This tax amount is calculated as a percentage of the income earned above the previous bracket's threshold, in this case, $25,000.

Comparative Analysis with Other States

Connecticut's tax system can be compared with those of other states to provide a broader context. For example, while some states like Florida and Texas do not have an income tax, Connecticut's system is more in line with states like California and New York, which also have progressive tax structures.

Furthermore, Connecticut's highest tax bracket of 6.99% is relatively competitive when compared to other high-income states. For instance, California's top rate is 13.3%, more than double Connecticut's.

Impact on Businesses and Economic Growth

The tax environment is a critical factor in business decisions and economic development. Connecticut's tax structure, including its income tax brackets, can influence a company's decision to operate or expand within the state.

Businesses, especially those with high-income employees or substantial profits, may find Connecticut's tax rates a significant consideration in their financial planning. The state offers various incentives and tax credits to attract and retain businesses, which can help offset the impact of these tax rates.

Future Implications and Potential Changes

Connecticut's tax system, like those of other states, is subject to change and reform. Economic shifts, political priorities, and public sentiment can all influence future adjustments to the state's tax brackets.

For instance, in recent years, there have been discussions about potential reforms to Connecticut's tax system to address budget deficits and economic challenges. These proposals have included changes to the tax brackets, such as introducing new brackets for higher incomes or adjusting the rates within existing brackets.

The state's leadership and legislature continually evaluate the tax system's effectiveness and fairness, considering the needs of residents, businesses, and the overall economic health of Connecticut.

Potential Benefits of Tax Reform

Proposed reforms to Connecticut's tax system could offer several potential benefits. Firstly, adjusting the tax brackets could provide a more balanced distribution of tax contributions, ensuring that those with higher incomes contribute proportionally more. This could help address budget concerns and support essential public services.

Secondly, tax reform could introduce new incentives or credits to encourage business growth and investment, potentially boosting the state's economy. This could include targeted tax breaks for specific industries or businesses, or incentives for job creation and expansion.

Challenges and Considerations

While tax reform can offer benefits, it also presents challenges. Adjusting tax brackets or introducing new taxes can impact residents and businesses, potentially affecting their financial planning and decision-making. It's crucial that any reforms are carefully considered and implemented to minimize negative impacts on the state's economy and its residents.

Additionally, the state must balance the need for increased revenue with maintaining a competitive tax environment to attract and retain businesses. Finding this balance is a complex task that requires a comprehensive understanding of the state's economic landscape and the potential impacts of various tax scenarios.

Conclusion

Connecticut's tax brackets play a critical role in the state's financial landscape, impacting residents, businesses, and the overall economic environment. Understanding these brackets and their potential for future reform is essential for making informed financial decisions and staying abreast of the state's economic developments.

As the state continues to navigate economic challenges and opportunities, the tax system, including its brackets, will remain a key focus for policymakers and the public alike. The ongoing dialogue around tax reform reflects Connecticut's commitment to maintaining a fair and sustainable financial system, supporting both its residents and its economic growth.

How often are Connecticut’s tax brackets adjusted?

+Connecticut’s tax brackets are typically adjusted annually to account for inflation and economic shifts. These adjustments are made based on the Consumer Price Index (CPI) and other economic indicators.

Are there any tax credits or deductions available in Connecticut?

+Yes, Connecticut offers various tax credits and deductions to residents and businesses. These include credits for energy-efficient home improvements, dependent care expenses, and business investment incentives. It’s recommended to consult a tax professional for a comprehensive list of available credits and deductions.

How do Connecticut’s tax rates compare to other states in the region?

+Connecticut’s tax rates are generally in line with other northeastern states. While some states like New Hampshire and Oregon have no income tax, most states in the region have progressive tax systems similar to Connecticut’s. However, Connecticut’s top tax rate is relatively competitive when compared to its neighbors.