Berkeley Sales Tax

The city of Berkeley, located in the vibrant Bay Area of California, has a unique and comprehensive sales tax system that plays a significant role in its economy and the overall retail experience. With a diverse range of businesses and a thriving consumer culture, understanding Berkeley's sales tax is crucial for both local residents and businesses. This article aims to provide an in-depth analysis of Berkeley's sales tax, exploring its structure, rates, exemptions, and the impact it has on the city's commerce and development.

Understanding Berkeley's Sales Tax Structure

Berkeley's sales tax system is a combination of state, county, and city taxes, each with its own purpose and rate. This multi-tiered approach ensures that revenue is generated for various levels of government, contributing to the overall financial stability of the region. The city's sales tax rate is subject to periodic adjustments, influenced by economic trends and the need for funding specific projects or initiatives.

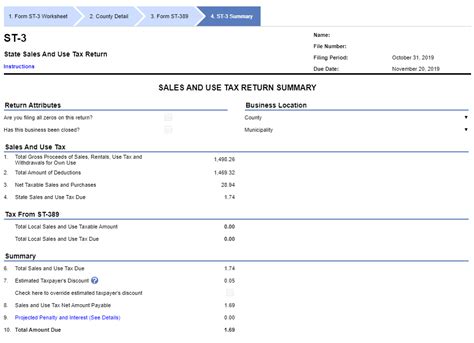

As of the latest update, the sales tax rate in Berkeley is comprised of the following components:

- State Sales Tax: California's base sales tax rate is set at 7.25%. This rate is applicable to most goods and services sold within the state, serving as a foundation for local governments to build upon.

- County Sales Tax: The County of Alameda, in which Berkeley is located, levies an additional sales tax of 0.50%. This tax is allocated towards county-wide projects and services, such as infrastructure development and social welfare programs.

- City Sales Tax: Berkeley imposes a city-specific sales tax of 1.00%, bringing the total sales tax rate within the city limits to 8.75%. This tax contributes directly to the city's budget, supporting local infrastructure, public services, and community initiatives.

The sales tax rate in Berkeley is not static and can be subject to temporary increases through voter-approved measures or special assessments. These additional taxes are typically implemented to fund specific projects with defined timelines, such as infrastructure upgrades or environmental initiatives. Once the project is completed or the assessment period ends, these temporary taxes are usually removed, ensuring a dynamic and responsive tax system.

Exemptions and Special Cases

While most goods and services are subject to sales tax in Berkeley, there are certain exemptions and special cases to consider. These exemptions are designed to encourage specific economic activities or provide relief to targeted sectors. Here are some notable exemptions within Berkeley's sales tax framework:

- Groceries and Food: Sales tax is not applicable to most food items, including groceries and prepared foods, encouraging healthy eating habits and supporting the local food industry.

- Prescription Medications: Pharmaceuticals prescribed by a licensed healthcare professional are exempt from sales tax, ensuring access to essential healthcare without additional financial burden.

- Clothing and Footwear: In a unique approach, Berkeley exempts clothing and footwear items priced below $100 from sales tax, making essential clothing more affordable for residents.

- Nonprofit Organizations: Sales made by registered nonprofit organizations are often exempt from sales tax, enabling these entities to maximize their impact and reach within the community.

- Manufacturing and Resale: Certain raw materials and goods sold for further manufacturing or resale are exempt, supporting the local industrial sector and promoting economic growth.

These exemptions demonstrate Berkeley's commitment to fostering a vibrant and inclusive economy, while also ensuring that the tax system is fair and equitable for both businesses and consumers.

Impact on Local Businesses and Consumers

Berkeley's sales tax structure has a profound impact on the city's business landscape and consumer behavior. For businesses, the sales tax rate can influence pricing strategies, profit margins, and competitive positioning. Businesses must carefully consider the tax rate when setting prices, especially in a competitive market, to ensure they remain attractive to consumers while maintaining profitability.

For consumers, the sales tax is a significant factor in their purchasing decisions. While the tax is an added cost, it is often seen as a necessary contribution to the community's well-being and development. Berkeley's sales tax rate is generally well-received by residents, who understand that it supports essential services and initiatives. However, businesses and consumers alike closely monitor any proposed tax changes, as these can significantly impact their operations and spending habits.

Analysis of Sales Tax Revenue

The revenue generated from Berkeley's sales tax is a crucial component of the city's budget. It funds a wide range of public services, including:

- Public Safety: Sales tax revenue contributes to maintaining a robust police force, ensuring the safety and security of residents and businesses.

- Education: A portion of the sales tax is allocated to local schools and educational initiatives, supporting the city's commitment to providing quality education.

- Infrastructure: Sales tax funds help maintain and upgrade Berkeley's roads, bridges, and public spaces, ensuring a high quality of life for residents and visitors.

- Community Programs: From recreational activities to social services, sales tax revenue supports a range of community programs, fostering a sense of belonging and well-being.

- Economic Development: The sales tax also plays a role in attracting new businesses and supporting existing ones, creating a thriving and diverse local economy.

The city of Berkeley publishes annual financial reports, providing transparency on how sales tax revenue is utilized. These reports demonstrate the city's commitment to fiscal responsibility and effective allocation of resources.

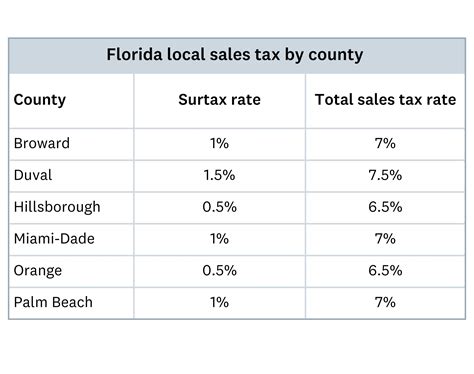

Comparative Analysis with Neighboring Regions

When compared to neighboring cities and regions, Berkeley's sales tax rate is relatively competitive. While some areas have lower tax rates, Berkeley's comprehensive approach to sales taxation ensures that essential services are adequately funded without overburdening businesses or consumers.

For instance, the city of Oakland, located just across the bay, has a slightly lower sales tax rate of 8.50%. However, Berkeley's higher rate is offset by its focus on targeted exemptions and the efficiency of its revenue allocation. This balance ensures that Berkeley remains an attractive destination for businesses and consumers, while also maintaining a high standard of living for its residents.

Future Outlook and Potential Changes

As Berkeley continues to evolve and adapt to economic changes, its sales tax system may also undergo adjustments. Here are some potential future developments:

- Economic Stimulus Measures: In response to economic downturns or crises, Berkeley may implement temporary tax cuts or incentives to boost consumer spending and support local businesses.

- Infrastructure Projects: Large-scale infrastructure initiatives, such as transportation upgrades or environmental projects, may require temporary tax increases to secure the necessary funding.

- Social Welfare Programs: As the city's demographics and needs change, there may be a need to allocate more resources towards social welfare, potentially impacting the sales tax rate or distribution.

- Technological Advancements: The adoption of new technologies in tax collection and management could lead to more efficient systems, potentially reducing administrative costs and freeing up resources for other initiatives.

Berkeley's sales tax system is a dynamic and responsive mechanism, constantly adapting to the city's evolving needs and economic landscape. By carefully balancing tax rates, exemptions, and revenue allocation, Berkeley ensures a healthy and thriving local economy, while also providing essential public services and initiatives that enhance the quality of life for its residents.

Frequently Asked Questions

What is the current sales tax rate in Berkeley?

+

As of our last update, the total sales tax rate in Berkeley is 8.75%, which includes the state, county, and city sales taxes.

Are there any sales tax exemptions in Berkeley?

+

Yes, Berkeley offers exemptions on groceries, prescription medications, clothing under $100, and sales made by registered nonprofit organizations, among other items.

How does Berkeley’s sales tax revenue contribute to the city’s budget?

+

Sales tax revenue is allocated towards various public services, including public safety, education, infrastructure, community programs, and economic development initiatives.

Are there any potential changes to Berkeley’s sales tax system in the future?

+

Berkeley’s sales tax system may undergo adjustments in response to economic stimuli, infrastructure projects, social welfare needs, or technological advancements.

How does Berkeley’s sales tax compare to other cities in the Bay Area?

+

While Berkeley’s sales tax rate is slightly higher than some neighboring cities, its comprehensive approach and targeted exemptions make it an attractive destination for businesses and consumers.