San Antonio Real Estate Taxes

Understanding real estate taxes is an essential aspect of homeownership, especially when navigating the vibrant market of San Antonio, Texas. These taxes play a crucial role in shaping the financial landscape for homeowners and investors alike. This comprehensive guide aims to shed light on the intricacies of San Antonio real estate taxes, providing a deep dive into the current rates, calculation methods, and strategies to optimize tax obligations. By delving into the specificities of this topic, we hope to empower individuals with the knowledge they need to make informed decisions regarding their property investments.

The Landscape of San Antonio Real Estate Taxes

San Antonio, with its thriving economy and diverse real estate market, imposes taxes on property owners to fund essential services and infrastructure. These taxes are a significant component of the city’s revenue stream and are used to maintain public facilities, support education, and ensure the overall well-being of the community. The real estate tax system in San Antonio is a complex interplay of various factors, including property value, location, and tax rates set by different jurisdictions.

Understanding Property Tax Rates

The property tax rate in San Antonio is expressed as a percentage and is applied to the appraised value of a property. As of our latest data, the average effective property tax rate in San Antonio is approximately 1.66%, which is slightly higher than the national average. However, it’s important to note that this rate can vary significantly depending on the specific location within the city and the tax jurisdictions that a property falls under.

| Taxing Jurisdiction | Tax Rate (%) |

|---|---|

| City of San Antonio | 0.5733 |

| San Antonio ISD | 1.2739 |

| Bexar County | 0.4043 |

| Various Utility Districts | Varies |

The table above provides a simplified view of the tax rates for some of the major jurisdictions in San Antonio. It's important to remember that a single property may be subject to taxes from multiple jurisdictions, leading to a cumulative tax rate that can be significantly higher than the individual rates.

Property Appraisal and Assessment

The process of property appraisal is a critical step in determining the tax obligations for a given property. In San Antonio, the Bexar County Appraisal District (BCAD) is responsible for appraising all taxable property within the county, including residential, commercial, and agricultural properties. The BCAD employs various methods to determine property values, such as market value analysis, income approaches, and cost approaches.

Once the appraised value is determined, it is subject to various exemptions and limitations based on state and local laws. For instance, the State of Texas offers a homestead exemption, which reduces the appraised value of a property for homeowners who use it as their primary residence. Additionally, certain historical properties or properties with renewable energy installations may be eligible for specific tax abatements or incentives.

Calculating Your Real Estate Taxes

Calculating real estate taxes in San Antonio involves a multi-step process. First, the appraised value of your property is determined by the BCAD. This value is then subject to any applicable exemptions or limitations. Once the taxable value is established, it is multiplied by the cumulative tax rate for all jurisdictions that the property is subject to. This results in the total tax liability for the year.

For instance, let's consider a hypothetical residential property in San Antonio with an appraised value of $250,000. After applying the homestead exemption, the taxable value becomes $200,000. The property is located within the boundaries of the City of San Antonio, San Antonio ISD, and Bexar County, with an additional utility district tax. Using the tax rates from our previous table, the calculation would look like this:

Taxable Value ($200,000) x (City Rate + ISD Rate + County Rate + Utility District Rate) = Total Tax Liability

Total Tax Liability = $200,000 x (0.5733 + 1.2739 + 0.4043 + 0.15) = $5,539.60

This example demonstrates how the cumulative tax rates can significantly impact the overall tax liability. It's essential to carefully review your tax bill and understand the components that make up your tax obligation.

Strategies for Tax Optimization

Optimizing your real estate tax obligations in San Antonio requires a strategic approach. Here are some key strategies to consider:

- Exemptions and Incentives: Familiarize yourself with the various exemptions and incentives offered by the state and local governments. These can significantly reduce your taxable value and, consequently, your tax liability. Keep in mind that some exemptions, like the homestead exemption, require annual renewal.

- Appealing Your Appraised Value: If you believe that the appraised value of your property is inaccurate, you have the right to appeal. The BCAD provides a detailed process for property owners to challenge their appraised values. A successful appeal can lead to a reduced taxable value and lower taxes.

- Property Tax Loans: For those facing financial difficulties, property tax loans can provide a temporary solution. These loans allow homeowners to pay their taxes in installments, easing the financial burden. However, it's important to carefully consider the terms and interest rates associated with such loans.

- Tax Abatements and Incentive Programs: Depending on the location and nature of your property, you may be eligible for tax abatements or incentive programs. These programs are often designed to encourage specific types of development or to support certain industries. Stay informed about these opportunities and how they might benefit your property.

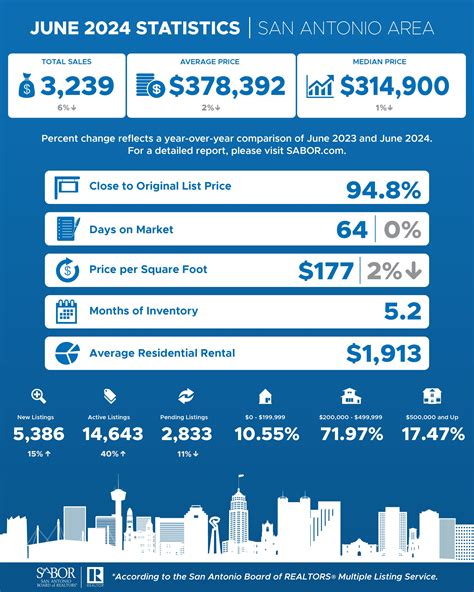

The Impact of Real Estate Taxes on San Antonio’s Market

Real estate taxes in San Antonio play a significant role in shaping the local market dynamics. For potential homebuyers, understanding the tax implications can be a critical factor in their decision-making process. Higher tax rates can affect the affordability of a property, especially for first-time homebuyers or those on a tight budget. On the other hand, lower tax rates can make an area more attractive and drive up property values.

From an investor's perspective, real estate taxes are a key consideration when evaluating the potential returns on an investment property. A property with a higher tax liability may have a lower cash flow, affecting the overall profitability. Conversely, properties with lower taxes may be more desirable and could command a premium in the market.

Furthermore, the distribution of tax revenues across different jurisdictions within San Antonio can have a significant impact on the allocation of resources and the overall development of the city. Higher tax revenues can lead to improved infrastructure, better public services, and enhanced quality of life, making an area more desirable for residents and businesses alike.

The Future of Real Estate Taxes in San Antonio

As San Antonio continues to grow and evolve, the landscape of real estate taxes is likely to undergo changes as well. The city’s expanding population and increasing demand for housing are putting pressure on the existing infrastructure and public services. This could lead to adjustments in tax rates or the introduction of new taxes to fund infrastructure projects and support the growing community.

Additionally, the ongoing advancements in technology and data analysis are likely to impact the property appraisal process. More accurate and efficient methods of valuation could lead to a fairer distribution of tax obligations. However, it's important for property owners to stay informed and actively participate in the tax assessment process to ensure their interests are represented.

The future of real estate taxes in San Antonio is intertwined with the city's economic growth and development. By staying informed and engaged, homeowners and investors can navigate these changes effectively and make the most of their real estate investments.

Conclusion

Understanding the intricacies of San Antonio real estate taxes is a critical aspect of successful homeownership and investment in this vibrant city. From the calculation methods to the strategies for optimization, this guide has provided a comprehensive overview of the current tax landscape. By staying informed and actively managing their tax obligations, individuals can make the most of their real estate investments and contribute to the continued growth and prosperity of San Antonio.

How often are real estate taxes assessed in San Antonio?

+Real estate taxes in San Antonio are typically assessed annually. The Bexar County Appraisal District conducts appraisals and determines the appraised value of properties once a year. However, certain changes to a property, such as improvements or damage, may trigger a reappraisal during the year.

What is the deadline for paying real estate taxes in San Antonio?

+The deadline for paying real estate taxes in San Antonio varies depending on the taxing authority. For most jurisdictions, the deadline is typically around January 31st of each year. However, it’s important to check with the specific taxing authority to confirm the exact deadline and any potential grace periods.

Can I appeal my property’s appraised value in San Antonio?

+Yes, if you believe that the appraised value of your property is inaccurate, you have the right to appeal. The Bexar County Appraisal District provides a formal protest process. It’s important to gather supporting evidence, such as recent sales data or appraisals of comparable properties, to strengthen your case.