Types Of Tax

Taxation is a fundamental concept in economics and a crucial component of any functioning society. It serves as the primary means through which governments fund public services, infrastructure, and social welfare programs. The different types of taxes play a pivotal role in shaping the economic landscape, influencing consumer behavior, business strategies, and overall economic growth.

In this article, we will delve into the various types of taxes, exploring their unique characteristics, purposes, and implications. By understanding the diverse tax landscape, we can gain insights into how governments raise revenue, allocate resources, and shape the economic environment.

Direct Taxes

Direct taxes are levied directly on individuals or entities and are based on their income, profits, or wealth. These taxes are considered more progressive, as they are typically structured to require higher-income earners to pay a larger proportion of their earnings.

Income Tax

Income tax is a key component of the direct tax system. It is imposed on the income earned by individuals, businesses, or other entities. Income tax rates often vary based on income brackets, with higher rates applicable to higher income levels. This progressive nature ensures that those with greater financial means contribute more to the tax revenue.

For instance, consider the case of Jane, a successful entrepreneur who owns a thriving tech startup. As her business prospers, her income rises, pushing her into a higher tax bracket. Consequently, a larger portion of her earnings is subject to income tax, reflecting the progressive nature of the system.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $50,000 | 10% |

| $50,001 - $100,000 | 20% |

| $100,001 and above | 30% |

Corporate Tax

Corporate tax is imposed on the profits earned by corporations and businesses. Similar to income tax, corporate tax rates can vary based on the size and profitability of the business. Many governments offer tax incentives or reduced rates for certain industries or investments to encourage economic growth and job creation.

Imagine a multinational corporation, ABC Inc., which operates in multiple countries. The company's profits are subject to corporate tax in each jurisdiction where it operates, and the tax rates may differ significantly between these locations.

| Country | Corporate Tax Rate |

|---|---|

| Country A | 15% |

| Country B | 25% |

| Country C | 30% |

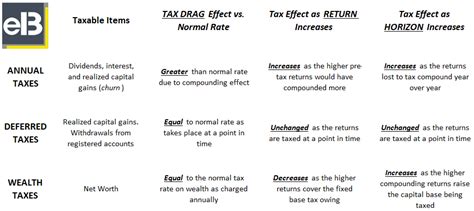

Wealth Tax

Wealth tax, also known as net worth tax, is levied on an individual’s or entity’s net worth, which includes assets such as real estate, investments, and cash holdings. This type of tax aims to capture the value of wealth accumulated over time, regardless of income sources.

Let's consider a high-net-worth individual, Mr. Smith, who owns multiple properties, a substantial investment portfolio, and a private jet. His net worth is subject to wealth tax, which can be a significant source of revenue for the government.

| Wealth Bracket | Tax Rate |

|---|---|

| $1 million - $5 million | 0.5% |

| $5 million - $10 million | 1% |

| Above $10 million | 2% |

Indirect Taxes

Indirect taxes are imposed on goods and services and are typically paid by consumers when they purchase these items. Unlike direct taxes, indirect taxes are not directly linked to an individual’s income or wealth. Instead, they are included in the price of the product or service, making them less visible to consumers.

Sales Tax

Sales tax is applied to the sale of goods and services and is typically charged as a percentage of the purchase price. It is often levied by state or local governments and can vary significantly between jurisdictions. Sales tax can be a significant source of revenue for local authorities, funding public services and infrastructure projects.

For example, when purchasing a new laptop, consumers may notice a sales tax amount added to the final bill. This tax is usually included in the displayed price, making it an essential consideration for consumers when making purchasing decisions.

| Jurisdiction | Sales Tax Rate |

|---|---|

| State A | 6% |

| State B | 8% |

| State C | 10% |

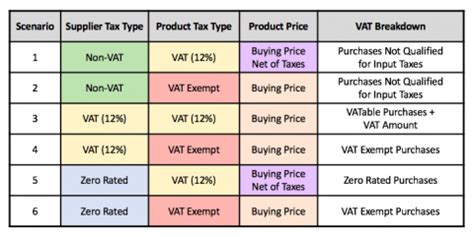

Value Added Tax (VAT)

Value Added Tax, or VAT, is a consumption tax levied on the value added at each stage of the production and distribution chain. It is charged on the difference between the price of a product or service at each stage of production and its final sale price. VAT is typically imposed by national governments and can be a significant source of revenue.

Consider a manufacturer, XYZ Ltd., producing electronic devices. At each stage of production, from raw material procurement to final assembly, VAT is added to the value of the product. This tax is eventually passed on to the consumer, who bears the burden of VAT when purchasing the electronic device.

| Country | Standard VAT Rate |

|---|---|

| Country D | 10% |

| Country E | 15% |

| Country F | 20% |

Excise Tax

Excise tax is a type of indirect tax imposed on specific goods or services, often those considered harmful or luxury items. It is typically levied at a fixed rate or as a percentage of the product’s value. Excise taxes are commonly applied to items such as tobacco, alcohol, fuel, and certain luxury goods.

For instance, when purchasing a bottle of imported wine, consumers may notice an excise tax amount added to the price. This tax is often higher for luxury or harmful items, reflecting the government's policy to discourage excessive consumption or generate revenue from specific industries.

| Product | Excise Tax Rate |

|---|---|

| Tobacco | $2 per pack |

| Alcohol | 15% of the value |

| Fuel | $0.50 per gallon |

Other Types of Taxes

Beyond direct and indirect taxes, there are several other types of taxes that serve specific purposes and target particular economic activities.

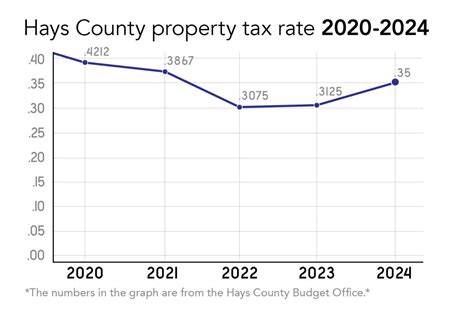

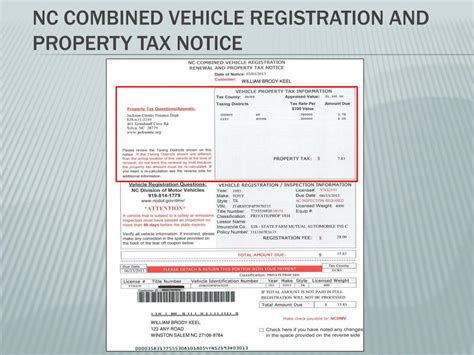

Property Tax

Property tax is levied on the ownership of real estate, such as land, buildings, and other immovable assets. It is often assessed based on the value of the property and is typically paid annually. Property tax is a significant source of revenue for local governments, funding schools, infrastructure, and public services.

Imagine a homeowner, Ms. Johnson, who owns a residential property in a suburban neighborhood. Each year, she receives a property tax bill based on the assessed value of her home. This tax contributes to the maintenance and improvement of the local community.

| Property Value | Tax Rate |

|---|---|

| $200,000 - $300,000 | 1.5% |

| $300,001 - $500,000 | 2% |

| Above $500,000 | 2.5% |

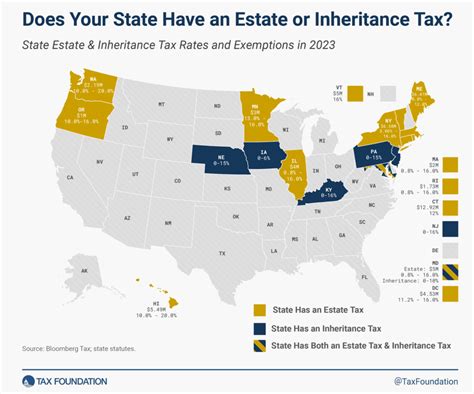

Estate Tax

Estate tax, also known as inheritance tax, is imposed on the transfer of assets from a deceased person’s estate to their beneficiaries. It is designed to capture the value of wealth passed down and can vary significantly between jurisdictions. Estate tax rates and exemptions often depend on the value and nature of the assets involved.

Consider a wealthy individual, Mr. Williams, who passes away, leaving behind a substantial estate consisting of real estate, investments, and personal belongings. The value of this estate may be subject to estate tax, ensuring a portion of the wealth is directed towards the government's coffers.

| Estate Value | Tax Rate |

|---|---|

| $1 million - $5 million | 10% |

| $5 million - $10 million | 15% |

| Above $10 million | 20% |

Capital Gains Tax

Capital gains tax is imposed on the profits realized from the sale of assets, such as stocks, bonds, real estate, or other investments. It is typically levied on the difference between the purchase price and the sale price of the asset. Capital gains tax rates can vary based on the type of asset and the duration of ownership.

For instance, an investor who buys shares of a company and holds them for several years may be subject to capital gains tax when selling those shares. The tax is calculated based on the increase in value of the investment during the holding period.

| Holding Period | Tax Rate |

|---|---|

| Short-term (less than 1 year) | 30% |

| Long-term (more than 1 year) | 15% |

Conclusion

The tax system is a complex and multifaceted entity, with various types of taxes serving different purposes and impacting different segments of society. Direct taxes, such as income and corporate taxes, ensure a progressive approach to taxation, while indirect taxes, like sales and VAT, provide a more indirect means of revenue generation. Other taxes, such as property, estate, and capital gains taxes, target specific economic activities and transactions.

Understanding the diverse landscape of taxes is crucial for individuals, businesses, and policymakers alike. It enables informed decision-making, strategic planning, and a deeper appreciation of the economic and social implications of taxation policies. As we navigate the intricate world of taxes, we gain a clearer understanding of the intricate mechanisms that shape our economies and societies.

How do taxes impact the economy and society as a whole?

+Taxes play a crucial role in shaping the economy and society. They provide the revenue needed to fund public services, infrastructure, and social programs. Taxes can influence consumer behavior, business strategies, and investment decisions. Additionally, the distribution of taxes can impact income inequality and social welfare.

Are there any tax exemptions or deductions available to individuals and businesses?

+Yes, many tax systems offer exemptions and deductions to individuals and businesses. These can include deductions for certain expenses, such as business costs or charitable donations, as well as exemptions for specific types of income or assets. Tax laws and regulations vary by jurisdiction, so it’s important to consult with a tax professional for specific advice.

How do governments use tax revenue, and what are the priorities for spending it?

+Governments allocate tax revenue to various areas, including education, healthcare, infrastructure development, social welfare programs, defense, and more. The priorities for spending tax revenue can vary depending on the government’s policies, economic conditions, and the needs of the population.