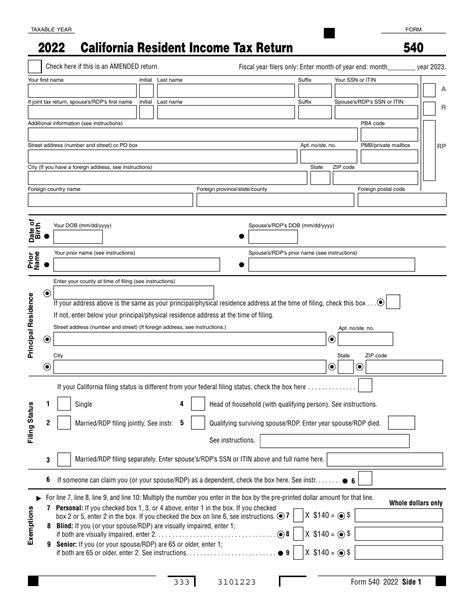

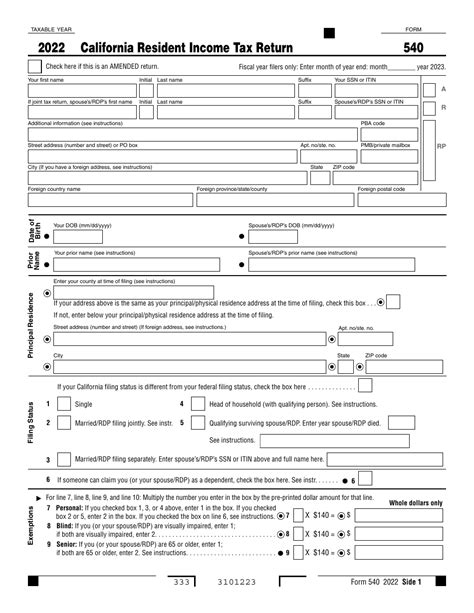

California Tax Form 540

The California Tax Form 540, also known as the California Resident Income Tax Return, is an essential document for residents of the Golden State. This comprehensive guide aims to provide an in-depth analysis of the Form 540, its purpose, and the process of filing it accurately. By understanding the intricacies of this tax form, individuals can navigate their tax obligations efficiently and ensure compliance with California's tax laws.

Understanding the Purpose of Form 540

Form 540 serves as the primary tool for California residents to report their annual income and calculate their state tax liability. It is a crucial document that allows the state to collect revenue for various public services and infrastructure projects. The form is designed to accommodate a wide range of income sources, deductions, and credits, making it suitable for most taxpayers in the state.

The California Franchise Tax Board (FTB), the state's tax agency, oversees the administration of Form 540. The FTB provides detailed instructions, guidelines, and resources to assist taxpayers in completing the form accurately. Additionally, the FTB offers online filing options and support to ensure a smooth and efficient process.

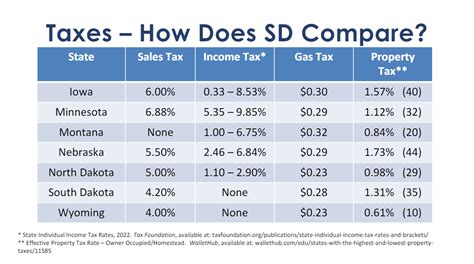

It's important to note that California has a progressive tax system, meaning that higher income levels are subject to higher tax rates. The state also offers various tax credits and deductions to help alleviate the tax burden for eligible residents. Understanding these nuances is essential for accurate tax planning and compliance.

Key Components of Form 540

Form 540 consists of several sections and schedules, each designed to capture specific aspects of an individual’s financial situation. Here’s an overview of the key components:

Income Information

This section requires taxpayers to report their total income from various sources, including wages, salaries, tips, business income, investments, and other taxable earnings. It’s crucial to include all sources of income to ensure an accurate calculation of tax liability.

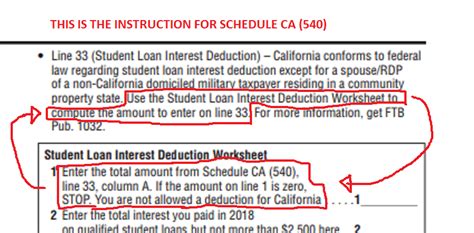

Deductions and Adjustments

Taxpayers can reduce their taxable income by claiming deductions and adjustments. Form 540 allows for deductions such as student loan interest, medical expenses, and certain business expenses. Additionally, taxpayers can choose to take the standard deduction, which simplifies the process and provides a fixed amount based on filing status.

Tax Credits

California offers a range of tax credits to eligible residents, including the California Earned Income Tax Credit (CalEITC), Child and Dependent Care Credit, and the Personal Income Tax Credit. These credits can significantly reduce the amount of tax owed or even result in a refund. It’s essential to understand the eligibility criteria and requirements for each credit.

Tax Calculation and Payment

After reporting income, deductions, and credits, taxpayers can calculate their tax liability using the provided tax tables or online calculators. The form includes spaces for tax payments, including direct debit options and payment vouchers. It’s crucial to ensure accurate calculations and timely payments to avoid penalties and interest.

| Tax Year | Due Date |

|---|---|

| 2022 | April 18, 2023 |

| 2023 | April 17, 2024 |

Filing Form 540: Step-by-Step Guide

Filing Form 540 can be a straightforward process with the right preparation and resources. Here’s a step-by-step guide to assist taxpayers in completing the form accurately:

Gather Necessary Documents

Before starting the filing process, gather all relevant documents, including W-2 forms, 1099 forms, bank statements, investment records, and any other income-related documents. Ensure that you have the necessary information to report your income accurately.

Choose Your Filing Method

California offers multiple filing methods, including online filing through the FTB’s website, paper filing, and e-filing options. Consider your preferences and the complexity of your tax situation when choosing the most suitable method. Online filing is often the most convenient and secure option.

Complete the Form

Follow the instructions provided by the FTB carefully. Start by entering your personal information, including your name, address, and Social Security Number. Proceed to report your income, claiming deductions and credits as applicable. Double-check your calculations and ensure that all fields are completed accurately.

Review and Sign

Once you have completed the form, review it thoroughly to identify any errors or omissions. Ensure that all calculations are correct and that you have attached all necessary supporting documents. Sign and date the form to authorize its submission.

Submit Your Return

If filing online, follow the prompts to transmit your return securely. For paper filings, mail your completed form and any attachments to the address specified by the FTB. Ensure that you meet the filing deadline to avoid late penalties.

Common Challenges and Solutions

While Form 540 is designed to be comprehensive, taxpayers may encounter challenges or have specific concerns. Here are some common issues and solutions to address them:

Complex Tax Situations

If your tax situation is complex, involving multiple income streams, investments, or business activities, consider seeking professional tax advice. A qualified tax professional can guide you through the process and ensure that you claim all applicable deductions and credits.

Errors and Mistakes

It’s essential to double-check your calculations and entries to avoid errors. The FTB provides error correction guidelines and resources to assist taxpayers in rectifying mistakes. If you discover an error after filing, follow the provided instructions to amend your return.

Missing or Lost Documents

If you are missing essential documents, such as W-2 forms or 1099 forms, contact your employer or financial institution to request replacement copies. Ensure that you receive these documents promptly to complete your tax return accurately.

Payment Options

California offers various payment options, including direct debit, credit card payments, and installment agreements. Choose the most suitable payment method based on your financial situation. If you are unable to pay your full tax liability, consider applying for a payment plan to avoid penalties.

Future Implications and Tax Planning

Understanding Form 540 and the California tax system is not only crucial for accurate filing but also for effective tax planning. By familiarizing yourself with the tax laws and potential deductions and credits, you can make informed decisions to optimize your tax situation.

Consider the following strategies for future tax planning:

- Maximize deductions and credits: Review the eligibility criteria for various tax credits and deductions to ensure you are taking advantage of all available benefits.

- Consider tax-efficient investments: Consult a financial advisor to explore investment options that offer tax advantages, such as tax-free municipal bonds or retirement accounts.

- Plan for business expenses: If you own a business, carefully track and document your expenses to maximize deductions and reduce your taxable income.

- Stay informed: Keep up-to-date with any changes to California's tax laws and regulations. The FTB provides regular updates and resources to assist taxpayers in understanding the latest tax developments.

Conclusion

Filing Form 540 is a critical responsibility for California residents, and understanding the process is essential for accurate compliance. By following the step-by-step guide, utilizing the resources provided by the FTB, and staying informed about tax laws, taxpayers can navigate the complexities of Form 540 with confidence. Remember, accurate tax planning and timely filing not only ensure compliance but also contribute to the state’s revenue for essential public services.

Can I e-file my Form 540 if I don’t have a Social Security Number (SSN)?

+Yes, individuals without an SSN can still e-file their Form 540. The FTB provides an Individual Taxpayer Identification Number (ITIN) for tax purposes. To obtain an ITIN, you can complete Form W-7 and submit it along with required documentation to the IRS. Once you receive your ITIN, you can proceed with e-filing your Form 540.

What if I miss the filing deadline for Form 540?

+If you miss the filing deadline, you should file your return as soon as possible to minimize penalties and interest. The FTB may impose late filing penalties, which can be waived under certain circumstances. Contact the FTB to discuss your situation and explore options for late filing relief.

Can I file Form 540 jointly with my spouse if we have different income sources and deductions?

+Yes, married couples can choose to file jointly, even if they have different income sources and deductions. By filing jointly, you may be eligible for a lower tax rate and potentially increase your tax refund. However, it’s important to consider the impact on deductions and credits, as some may be limited or unavailable for joint filers.