State Of Illinois Tax Refund

Tax refunds are an essential aspect of the financial landscape, offering a much-needed boost to taxpayers' financial health. In the United States, each state has its own set of tax regulations and refund processes. This article will delve into the specifics of tax refunds in the State of Illinois, exploring the process, timelines, and key considerations for taxpayers.

Understanding Illinois Tax Refunds

The Illinois Department of Revenue manages the state’s tax refund process, ensuring a fair and efficient system for taxpayers. Illinois, like many other states, offers refunds when the total taxes paid exceed the actual tax liability for a given period. These refunds can provide a significant financial relief to individuals and businesses, especially when planned effectively.

Illinois tax refunds can be a result of various factors, including overpayment of income tax, property tax, sales tax, or even specific tax credits and incentives offered by the state government. The state's tax system is designed to be transparent and accessible, with clear guidelines and resources available for taxpayers to navigate the process.

Eligibility and Requirements

To be eligible for a tax refund in Illinois, taxpayers must meet certain criteria. Firstly, individuals and businesses must have filed their tax returns accurately and on time. Late filings or incomplete information can delay the refund process or, in some cases, result in penalties.

Secondly, taxpayers must ensure they have overpaid their taxes. This can occur due to various reasons, such as changes in income, deductions, or tax credits. It's essential to carefully review tax returns and consider all potential deductions and credits to maximize the refund amount.

Illinois offers a range of tax credits that can significantly impact refund amounts. These credits include but are not limited to, the Earned Income Tax Credit for low- to moderate-income taxpayers, the Property Tax Credit for homeowners, and various Business Tax Credits for eligible companies. Understanding and utilizing these credits can be a strategic way to optimize tax refunds.

| Credit Type | Description |

|---|---|

| Earned Income Tax Credit | A refundable tax credit for low- and moderate-income working individuals and families. |

| Property Tax Credit | Provides a credit for homeowners based on their property taxes paid. |

| Business Tax Credits | Various credits are available for businesses, including job creation, research, and development incentives. |

The Tax Refund Process in Illinois

The process of claiming and receiving a tax refund in Illinois is straightforward, with several key steps.

Filing Tax Returns

The first step is to file tax returns accurately and on time. Illinois taxpayers have the option to file their returns electronically or by mail. Electronic filing is often the preferred method as it is faster and more secure. The Illinois Department of Revenue provides online tools and resources to guide taxpayers through the filing process.

Taxpayers should ensure they have all the necessary documents and information before filing. This includes W-2 forms, 1099 forms, and any other relevant income and expense records. Accurate and complete information is crucial to avoid errors and potential audits.

Claiming Refunds

Once the tax returns are filed, taxpayers can claim their refunds. Illinois offers several refund claiming methods, including direct deposit, check, and debit card. Direct deposit is the fastest and most secure method, with refunds typically appearing in the taxpayer’s account within a few weeks of filing.

Taxpayers can choose their preferred refund method when filing their returns. It's important to note that refunds claimed by check may take slightly longer to process and arrive.

Refund Timelines

The timeline for receiving tax refunds in Illinois depends on various factors, including the filing method and the complexity of the tax return. On average, taxpayers can expect to receive their refunds within 21 days of filing their returns.

For taxpayers who file their returns electronically and choose direct deposit, the refund process can be even faster. In many cases, electronic filers receive their refunds within a week of filing. However, it's important to note that refunds may take longer during peak tax season or if there are issues with the tax return.

Tracking Refunds

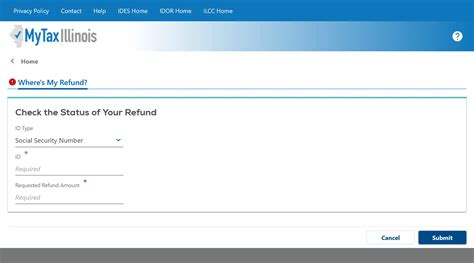

Illinois provides taxpayers with tools to track the status of their refunds. The Illinois Department of Revenue’s website offers a refund status lookup tool, which allows taxpayers to enter their social security number and filing status to check the progress of their refund. This tool provides real-time updates and can help taxpayers plan their finances accordingly.

Maximizing Tax Refunds: Strategies and Tips

Maximizing tax refunds is an art, and with the right strategies, taxpayers can significantly increase their refund amounts. Here are some expert tips to consider:

Take Advantage of Tax Credits

As mentioned earlier, Illinois offers a range of tax credits that can substantially impact refund amounts. Taxpayers should research and understand the various credits available to them. For example, the Earned Income Tax Credit can provide a significant refund for eligible taxpayers. Similarly, homeowners can benefit from the Property Tax Credit, which reduces the overall tax burden.

Optimize Deductions

Maximizing deductions is another effective strategy to increase tax refunds. Taxpayers should carefully review their expenses and consider all eligible deductions. This includes medical expenses, charitable donations, and various other deductions offered by the state. The more deductions claimed, the lower the overall tax liability, leading to a larger refund.

Utilize Tax Preparation Services

For those who find the tax process complex or time-consuming, utilizing tax preparation services can be beneficial. These services, offered by accounting firms or tax software, can help taxpayers navigate the intricacies of tax regulations and ensure they claim all eligible deductions and credits. While there may be a cost associated with these services, they can often result in larger refunds, making them a worthwhile investment.

Stay Informed about Tax Changes

Tax regulations and incentives can change from year to year. Staying informed about these changes is crucial to optimizing tax refunds. Taxpayers should keep an eye on state and federal tax updates, as well as any announcements made by the Illinois Department of Revenue. Being aware of these changes can help taxpayers plan their finances and tax strategies accordingly.

The Future of Tax Refunds in Illinois

The tax landscape is continually evolving, and Illinois is no exception. The state government is actively working to streamline the tax refund process and make it more efficient for taxpayers. One of the key initiatives is the continued development and improvement of online tools and resources.

The Illinois Department of Revenue is investing in technology to enhance the taxpayer experience. This includes upgrading their website to provide more comprehensive information and resources, as well as improving the online filing process. These improvements aim to make tax filing and refund claiming more accessible and user-friendly for all taxpayers.

Additionally, the state is exploring ways to further encourage taxpayers to utilize electronic filing and direct deposit for refunds. By incentivizing these methods, the government aims to reduce processing times and improve overall efficiency.

Conclusion

Understanding the tax refund process in Illinois is crucial for taxpayers to navigate the financial landscape effectively. By staying informed, claiming eligible credits and deductions, and utilizing the right tools and resources, taxpayers can maximize their refunds and improve their financial health. The Illinois Department of Revenue’s commitment to transparency and efficiency ensures a fair and accessible tax system for all.

Frequently Asked Questions

What is the average Illinois tax refund amount?

+The average Illinois tax refund amount varies annually and depends on factors such as income level, deductions, and tax credits claimed. In recent years, the average refund has been in the range of 1,000 to 3,000.

Can I check the status of my Illinois tax refund online?

+Yes, Illinois taxpayers can check the status of their refunds online through the Illinois Department of Revenue’s website. The online tool provides real-time updates and allows taxpayers to track their refund progress.

What if my Illinois tax refund is delayed or hasn’t arrived?

+If your Illinois tax refund is delayed or hasn’t arrived within the expected timeframe, it’s recommended to contact the Illinois Department of Revenue. They can provide specific guidance and help troubleshoot any issues with your refund.

Are there any penalties for late tax filings in Illinois?

+Yes, Illinois imposes penalties for late tax filings. The penalty amount depends on the extent of the delay and the overall tax liability. It’s important to file tax returns on time to avoid these penalties.

Can I amend my Illinois tax return to claim additional refunds?

+Yes, taxpayers can amend their Illinois tax returns to claim additional refunds if they discover errors or overlooked deductions or credits. The process involves filing an amended return, and the refund amount will be adjusted accordingly.