Etowah County Property Tax

Etowah County, located in the northeastern part of Alabama, has a unique property tax system that impacts both residents and investors. Understanding the intricacies of this system is crucial for making informed decisions regarding property ownership and investments. This comprehensive guide will delve into the specifics of Etowah County's property tax, providing an in-depth analysis of its assessment process, rates, and potential implications.

Property Tax Assessment in Etowah County

The process of property tax assessment in Etowah County begins with the determination of the property’s fair market value. This value is established by the Etowah County Tax Assessor’s Office, which conducts regular evaluations to ensure accuracy. The assessment takes into account various factors, including:

- Property Type: Residential, commercial, and industrial properties are subject to different valuation methods.

- Location: The desirability of the neighborhood and proximity to amenities can influence property values.

- Size and Improvements: Larger properties or those with significant improvements may have higher assessments.

- Recent Sales: Market trends and recent property sales in the area are considered.

Once the fair market value is determined, it is subject to a tax rate set by the county. This rate is applied uniformly to all properties within the county, ensuring fairness and consistency.

| Property Type | Assessment Rate |

|---|---|

| Residential | 10% |

| Commercial | 12% |

| Industrial | 15% |

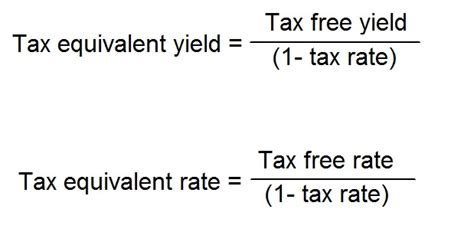

The assessed value is then multiplied by the applicable rate to determine the annual property tax liability. For example, a residential property with a fair market value of $200,000 would have an assessed value of $20,000 (10% of $200,000), and its annual property tax would be calculated as follows:

Assessed Value ($20,000) x Tax Rate (4%) = $800

Thus, the property owner would owe $800 in annual property taxes.

Tax Exemptions and Credits

Etowah County offers certain tax exemptions and credits to eligible property owners, providing relief from the standard tax rates. These include:

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the taxable value of their primary residence. This exemption can significantly lower the property tax liability.

- Veteran's Exemption: Veterans and their surviving spouses may qualify for a partial or full exemption on their property taxes.

- Senior Citizen's Credit: Senior citizens who meet specific income and residency requirements may be eligible for a credit, reducing their property tax burden.

The Impact of Etowah County’s Property Tax System

The property tax system in Etowah County has several notable effects on the local real estate market and the community at large. Understanding these implications is essential for both current and prospective property owners.

Real Estate Market Dynamics

The property tax assessment process directly influences the real estate market in Etowah County. Here’s how it impacts buyers, sellers, and investors:

- Buyers: Potential homebuyers can use the assessed values and tax rates to estimate their future property tax obligations. This information is crucial when budgeting for homeownership.

- Sellers: Accurate assessments ensure fair pricing in the market. Sellers can use the assessed value as a starting point for listing their properties, considering recent sales and market trends.

- Investors: Investors looking to purchase rental properties or engage in real estate development can analyze the potential return on investment by considering the property tax rates and any available exemptions or credits.

Community Development and Services

Property taxes are a significant source of revenue for local governments, and Etowah County is no exception. The funds generated from property taxes are used to support essential community services and infrastructure:

- Education: A portion of the property taxes goes towards funding public schools, ensuring that students have access to quality education.

- Public Safety: Property taxes contribute to maintaining a robust police and fire department, keeping the community safe.

- Infrastructure: Revenue from property taxes is utilized for road maintenance, water and sewer systems, and other vital infrastructure projects.

- Community Programs: The county may allocate funds for recreational facilities, libraries, and other community initiatives.

Potential Challenges and Considerations

While Etowah County’s property tax system has its benefits, there are also considerations and potential challenges to be aware of:

- Assessment Accuracy: Property owners should regularly review their assessments to ensure fairness. If they believe their property is overvalued, they can appeal the assessment.

- Tax Rate Fluctuations: The county may adjust tax rates periodically, impacting property owners' tax liabilities. Staying informed about these changes is essential.

- Exemption Eligibility: Understanding the criteria for tax exemptions and credits is crucial to maximizing potential savings. Property owners should consult with tax professionals or the county's tax assessor's office for guidance.

Expert Insights and Strategies

Navigating the complexities of Etowah County’s property tax system can be simplified with the right strategies and expert advice. Here are some insights from industry professionals:

Conclusion

Understanding Etowah County’s property tax system is crucial for anyone involved in the local real estate market. By comprehending the assessment process, tax rates, and potential exemptions, property owners and investors can make informed decisions. The system’s impact on the community and the real estate market highlights the importance of responsible property ownership and the role of property taxes in supporting local services and development.

How often are property assessments conducted in Etowah County?

+Property assessments in Etowah County are typically conducted every four years. However, the county reserves the right to conduct reassessments at any time if significant changes occur to a property, such as additions or improvements.

Are there any online resources to estimate property taxes in Etowah County?

+Yes, the Etowah County Tax Assessor’s Office provides an online property search tool where you can estimate your property taxes based on the assessed value and tax rates. You can find this tool on the county’s official website.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Absolutely! If you believe your property’s assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal application and providing supporting evidence to justify your claim. It’s advisable to consult the county’s guidelines for a successful appeal.