Tax Equivalent Yield Calculator

The concept of tax equivalent yield is an essential aspect of financial planning, particularly for investors who are subject to different tax rates and structures. This tool empowers investors to make informed decisions about their investment strategies, especially when considering the impact of taxes on their returns. In this comprehensive article, we will delve into the intricacies of the Tax Equivalent Yield Calculator, exploring its functionality, importance, and real-world applications.

Understanding Tax Equivalent Yield

Tax equivalent yield is a financial metric that allows investors to compare the returns of taxable investments with those of tax-exempt investments, such as municipal bonds. It provides a standardized way to evaluate the attractiveness of various investment options, taking into account the investor’s marginal tax rate. By calculating the tax equivalent yield, investors can make more accurate comparisons and optimize their portfolios.

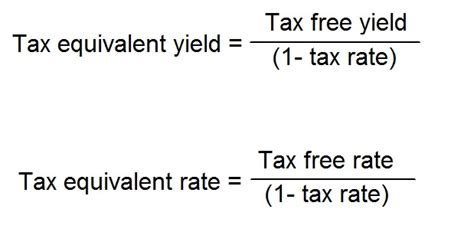

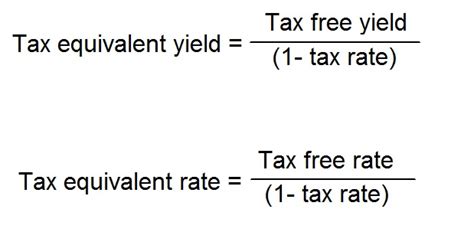

The formula for tax equivalent yield is as follows:

Tax Equivalent Yield = Taxable Yield / (1 - Marginal Tax Rate)

Here, the taxable yield represents the return an investor receives from a taxable investment, while the marginal tax rate is the rate at which an additional dollar of income is taxed. This calculation provides a crucial insight into the effective return of an investment after considering tax implications.

The Significance of Tax Equivalent Yield Calculator

The Tax Equivalent Yield Calculator is a powerful tool for financial professionals and investors alike. It offers several key advantages and insights:

Portfolio Optimization

By utilizing the calculator, investors can determine the minimum tax-exempt yield required to match the return of a taxable investment. This information is invaluable when constructing a well-balanced portfolio, ensuring that tax considerations are adequately addressed.

Tax-Efficient Decision Making

The calculator enables investors to make tax-conscious choices. For instance, it helps determine whether it is more beneficial to invest in a taxable bond fund or a tax-exempt municipal bond fund, considering the investor’s specific tax situation.

Assessment of Municipal Bond Attractiveness

Municipal bonds are often touted as tax-efficient investments. The calculator allows investors to assess whether the tax benefits of these bonds outweigh their potentially lower yields, providing a clear picture of their attractiveness relative to other investment options.

Practical Application of Tax Equivalent Yield Calculator

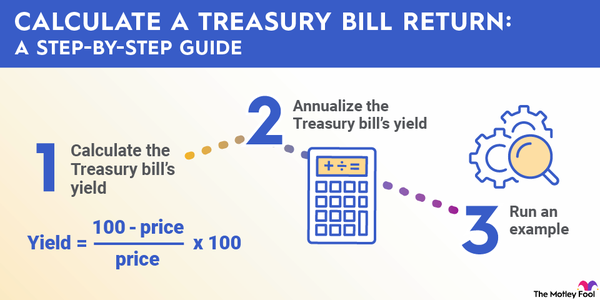

Let’s illustrate the application of the Tax Equivalent Yield Calculator with a real-world example. Consider an investor with a marginal tax rate of 30% who is considering two investment options: a taxable corporate bond fund with a yield of 5% and a tax-exempt municipal bond fund with a yield of 4%.

Using the calculator, we can determine the tax equivalent yield for the municipal bond fund as follows:

Tax Equivalent Yield = 4% / (1 - 0.3) = 5.71%

This means that the municipal bond fund, with its 4% yield, is equivalent to a taxable investment with a yield of 5.71%, given the investor's 30% marginal tax rate. This comparison provides a clear indication that the municipal bond fund is a more tax-efficient option for this particular investor.

Factors Influencing Tax Equivalent Yield

The tax equivalent yield is influenced by several key factors, each of which can significantly impact investment decisions:

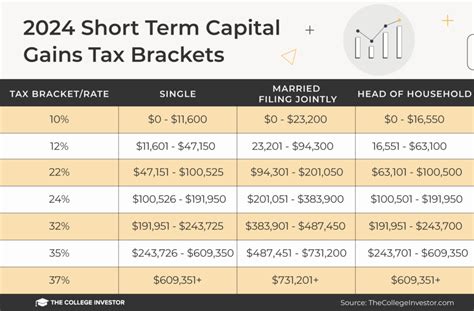

Marginal Tax Rate

The investor’s marginal tax rate is a critical determinant. A higher tax rate generally increases the tax equivalent yield, making tax-exempt investments relatively more attractive.

Taxable Investment Yield

The yield of the taxable investment is another crucial factor. A higher taxable yield will result in a higher tax equivalent yield, making it more challenging for tax-exempt investments to compete.

Tax Treatment of Municipal Bonds

The tax treatment of municipal bonds can vary based on factors such as the investor’s residency and the type of bond. Some bonds may be subject to alternative minimum tax (AMT), which can affect their tax equivalence.

Advantages and Limitations

The Tax Equivalent Yield Calculator offers numerous advantages, including:

- Simplicity: It provides a straightforward way to compare taxable and tax-exempt investments, making complex tax considerations more accessible.

- Personalization: By inputting an investor's specific tax rate, the calculator offers tailored results, ensuring that investment decisions are aligned with individual circumstances.

- Educational Tool: It serves as an excellent educational resource, helping investors understand the impact of taxes on their investment returns.

However, it's essential to acknowledge some limitations. The calculator assumes a steady tax rate and does not account for potential changes in tax laws or the investor's financial situation over time. Additionally, it focuses on the yield aspect, neglecting other factors like capital gains and investment duration.

Real-World Implications and Strategies

The tax equivalent yield concept has significant implications for investors and financial advisors. It highlights the importance of tax planning in investment strategies, especially for high-net-worth individuals and those with complex tax situations.

Financial advisors can use the calculator to:

- Construct tax-efficient portfolios by allocating investments strategically.

- Educate clients about the benefits of tax-exempt investments and how they can enhance overall portfolio returns.

- Stay updated on tax laws and their impact on investment options, ensuring clients are well-informed.

Conclusion

In the world of finance, where taxes play a pivotal role, the Tax Equivalent Yield Calculator emerges as a valuable tool. It empowers investors and financial professionals to make informed decisions, optimize portfolios, and navigate the complex landscape of taxable and tax-exempt investments. By understanding and utilizing this calculator, investors can ensure their hard-earned money works efficiently, even in the face of tax considerations.

How often should I use the Tax Equivalent Yield Calculator?

+

It’s recommended to use the calculator annually or whenever there is a significant change in your tax situation or investment portfolio. This ensures your investment strategy remains aligned with your financial goals and tax obligations.

Can the calculator be used for all types of investments?

+

While the calculator is primarily designed for comparing taxable and tax-exempt bonds, its principles can be applied to other investment types. However, it’s important to consider the specific tax implications of each investment.

What if my tax situation is complex, with multiple income sources and deductions?

+

In such cases, it’s advisable to consult a tax professional or financial advisor who can provide personalized guidance. They can help determine your effective tax rate and how it impacts your investment decisions.