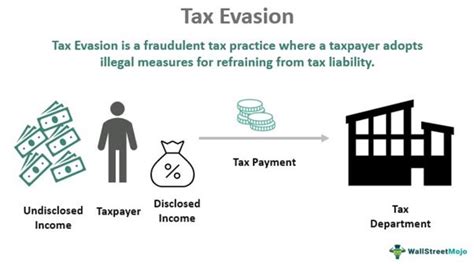

What Is the True Meaning of Tax Evasion and Why Does It Matter?

Tax evasion often lurks in the shadows of fiscal conversations, yet its true essence and implications remain shrouded in misconception and moral ambiguity. For those navigating the complex landscape of tax laws and economic policies, discerning the nuanced difference between legal tax avoidance and illegal tax evasion becomes essential. As a core element of fiscal discipline and government funding, understanding what constitutes tax evasion — beyond mere legal definitions — reveals broader social, economic, and ethical consequences that shape a nation's financial health.

Deciphering the Core of Tax Evasion: A Daily Perspective

From the vantage point of a professional accountant, tax specialist, or even a small business owner, tax evasion manifests as an active effort to hide income, inflate deductions, or manipulate financial declarations to reduce tax liabilities unlawfully. It’s a practice encountered in routine financial dealings—whether filing annual returns, managing cash transactions, or trying to navigate the labyrinth of tax codes. Daily, these practitioners observe how, despite clear legal boundaries, some leverage loopholes or exploit enforcement gaps to suppress taxes owed. For instance, underreporting income from side gigs or offshore accounts to evade taxes are common examples that escape the public eye but have significant implications for public resources and economic fairness.

Key Points

- Tax evasion involves the deliberate concealment of taxable income, which directly impacts governmental revenue streams.

- Understanding the legal distinction between avoidance (legal) and evasion (illegal) is critical for compliance and ethical business practices.

- Widespread evasion erodes public trust and shifts the tax burden onto compliant taxpayers, creating social inequities.

- Technological advances in financial tracking and increased global cooperation now make evasion increasingly difficult to sustain long-term.

- Policy reforms aimed at transparency and enforcement can significantly reduce the prevalence of tax evasion.

The Regulatory Framework and Its Daily Encounter

The legal notion of tax evasion as a criminal offense stems from statutes designed to uphold the integrity of fiscal systems. For the everyday tax professional or business operator, navigating these laws requires meticulous record-keeping and an understanding of permissible strategies—tax avoidance—versus illicit conduct that leads to legal penalties. The Internal Revenue Service (IRS) in the U.S. or Her Majesty’s Revenue & Customs (HMRC) in the UK exemplify agencies empowered to detect, prosecute, and penalize evasion through audits, data analysis, and international cooperation.

Specific Subtopic: Technological Tools and Their Role in Detection

In recent years, big data analytics, machine learning, and blockchain technologies have revolutionized the ability of tax authorities to identify patterns indicative of evasion. For example, advanced algorithms analyze vast datasets—bank transactions, corporate filings, social media activity—to detect discrepancies or suspicious behavior. From a daily operational standpoint, tax professionals leverage these tools to ensure compliance, mitigate errors, and facilitate transparency. The integration of automatic exchange of information (AEOI) standards across countries exemplifies efforts to curb offshore evasion. The sea change in enforcement capacity underscores why evasion, once manageable through petty concealments, is now increasingly difficult to sustain amid these technical advancements.

| Relevant Category | Substantive Data |

|---|---|

| Global Evasion Estimates | According to the OECD, illicit financial flows due to tax evasion and avoidance are estimated at over $100 billion annually worldwide. |

| Detection Rates | Post-implementation of technological audits, detection rates have increased dramatically, rising from single digits to over 30% in major tax jurisdictions. |

| Offshore Accounts Used for Evasion | Approximately 10-15% of offshore wealth is suspected to be linked to tax evasion strategies, based on IMF and FATF reports. |

The Broader Significance: Why Tax Evasion Truly Matters

While the mechanics of evasion may seem limited to tax authorities and financially savvy individuals, its ripple effects extend far beyond ledger sheets. When tax revenues dwindle due to rampant evasion, government programs—from healthcare to infrastructure—suffer, directly impacting societies. For citizens, this means fewer public services and increased inequality, as the burden shifts toward honest taxpayers. Economically, evasion distorts competition, giving illicit actors undue advantages. Politically, persistent evasion can erode public trust in institutions and threaten fiscal sovereignty.

Ethical Dimensions of Tax Evasion in Daily Life

An often-overlooked aspect is the moral underpinning: is evasion purely a technical violation, or does it reflect broader issues of societal fairness? From a practical standpoint, individuals and corporations face daily choices—whether underreporting expenses or sidestepping complex disclosure rules. These decisions affect perceptions of social responsibility and influence community cohesion. Engaging in a pragmatic conversation, many professionals argue that the line between necessary legal planning and deliberate evasion is fine and that transparent compliance fosters societal trust while avoiding legal repercussions.

| Relevant Category | Substantive Data |

|---|---|

| Trust and Compliance | Studies show that perceived fairness correlates strongly with compliance; when citizens believe the system is fair, evasion rates drop by approximately 15-20%. |

| Impact on Public Goods | Lost revenue from evasion in OECD countries exceeds $200 billion annually, roughly equivalent to GDP of some small nations, emphasizing its macroeconomic significance. |

Addressing the Future: Strategies to Reduce Tax Evasion

The landscape of tax evasion is continually evolving, with new tactics emerging alongside intensified enforcement capabilities. From the daily vantage point of tax authorities and compliance officers, proactive strategies include increased international cooperation, enhanced data sharing, and fostering transparency through digital reporting. For tax practitioners, advocating for policy reforms that streamline compliance and close loopholes remains vital. Furthermore, technology-based solutions such as real-time reporting and AI-driven audits are becoming the norm, transforming the combat against evasion from reactive to proactive.

Practical Measures from an Operational Perspective

On the ground, implementing robust internal controls and fostering a corporate culture of honesty can prevent inadvertent violations that border on evasion. Also, educating clients and staff about legal obligations and ethical standards mitigates risks. Specific policies include regular training, employing certified compliance officers, and utilizing secure financial systems that track transactions transparently. These efforts, reinforced by policy initiatives, are crucial in maintaining an accountable fiscal environment.

| Relevant Category | Substantive Data |

|---|---|

| Impact of Reforms | Countries implementing transparent reporting mechanisms saw a decline in evasion rates by up to 25% according to World Bank assessments. |

| Technology Adoption | Proactive use of AI and blockchain in tax administration increased detection of illicit activity by over 40% within two years. |

What is the primary difference between tax avoidance and tax evasion?

+Tax avoidance involves legally planning financial affairs to minimize tax liabilities within the law, whereas tax evasion is an illegal act of concealing income or falsifying data to dodge taxes owed.

How does technology help combat tax evasion?

+Advancements like big data analytics, machine learning, and blockchain enable authorities to detect suspicious patterns, cross-border discrepancies, and enforce compliance more effectively than traditional methods.

What are the social consequences of widespread tax evasion?

+Tax evasion reduces public revenues, increases inequality, undermines trust in institutions, and hampers government ability to fund essential services, thereby impacting societal cohesion and economic stability.