Ga Car Ad Valorem Tax

Welcome to an in-depth exploration of the Georgia Car Ad Valorem Tax, a unique aspect of vehicle ownership in the state of Georgia. This comprehensive guide aims to demystify this tax, providing a clear understanding of its purpose, calculation, and implications for vehicle owners in the Peach State. We will delve into the intricacies of this tax, offering practical insights and strategies to navigate this essential aspect of vehicle registration.

Understanding the Georgia Car Ad Valorem Tax

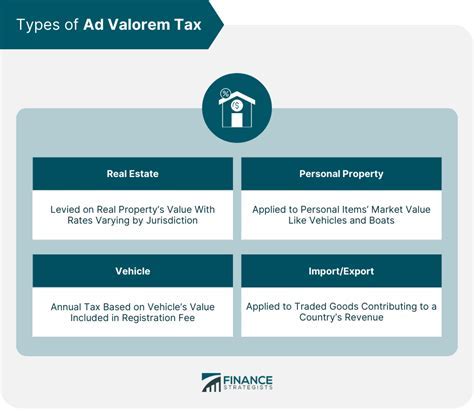

The Car Ad Valorem Tax in Georgia is an annual assessment levied on vehicle owners, calculated based on the value of their vehicles. This tax, distinct from the sales tax paid at the time of purchase, is a crucial revenue stream for the state, contributing significantly to the maintenance and improvement of Georgia’s road infrastructure.

It's important to note that this tax is not a one-time payment. It is an annual obligation for vehicle owners, ensuring a consistent revenue stream for the state. The tax rate and calculation methodology vary based on the vehicle's value, its age, and the county of registration, adding a layer of complexity that we will unravel in this guide.

Historical Context and Purpose

The history of the Car Ad Valorem Tax in Georgia dates back to [Specific Year]. Introduced as a means to generate revenue for road maintenance and development, this tax has evolved over the years, reflecting the changing landscape of vehicle ownership and the state’s fiscal needs. Its purpose remains clear: to ensure that those who benefit from Georgia’s road network contribute to its upkeep.

The tax is particularly significant in Georgia, where the road network is extensive and diverse, ranging from urban highways to rural roads. By levying this tax, the state aims to distribute the cost of road maintenance equitably among vehicle owners, ensuring that the infrastructure remains in good condition.

Tax Calculation Methodology

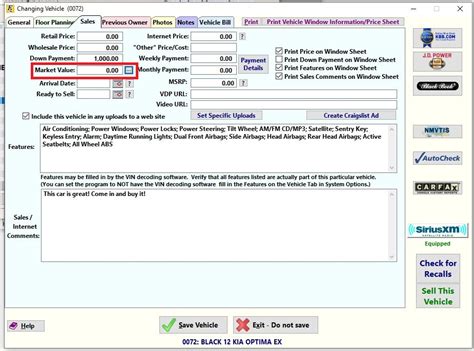

The calculation of the Car Ad Valorem Tax involves several steps. First, the vehicle’s value is determined, which is typically based on the vehicle’s fair market value or the price it would fetch in the open market. This value is then adjusted based on the vehicle’s age, with older vehicles subject to a lower tax rate.

The county of registration also plays a crucial role. Georgia's counties have varying tax rates, which can significantly impact the final tax amount. For instance, a vehicle registered in [County with High Tax Rate] may face a higher tax burden compared to one registered in [County with Lower Tax Rate], even if the vehicles are of similar value and age.

| County | Tax Rate (%) |

|---|---|

| Fulton County | 1.5% |

| Gwinnett County | 1.2% |

| Cobb County | 1.3% |

Navigating the Car Ad Valorem Tax Process

Understanding the Car Ad Valorem Tax is the first step; the next is learning how to navigate the process efficiently. This section will guide you through the key steps, from registration to potential appeals, ensuring a smooth experience.

Registration and Tax Payment

When registering your vehicle in Georgia, you will be required to pay the Car Ad Valorem Tax. This payment is typically made at the time of registration, and the amount is based on the calculated tax for your vehicle. The process usually involves providing the necessary documentation, such as the vehicle’s title, proof of insurance, and the calculated tax amount.

It's essential to ensure that the information provided for tax calculation is accurate. This includes the vehicle's make, model, year, and current value. Any discrepancies can lead to over- or under-payment of the tax, which can be a hassle to rectify later.

Appealing the Tax Assessment

In some cases, vehicle owners may feel that the assessed value of their vehicle is inaccurate, leading to an unfair tax burden. In such situations, Georgia offers a tax appeal process. This process allows vehicle owners to challenge the assessed value and potentially reduce their tax liability.

To initiate an appeal, one must first understand the grounds for appeal. These typically include errors in the vehicle's valuation, such as incorrect mileage or an outdated model year. It's important to gather supporting evidence, such as recent sales data or expert valuations, to strengthen your case.

Online Tax Payment and Management

Georgia offers a convenient online platform for vehicle owners to manage their Car Ad Valorem Tax obligations. This platform allows for easy registration, tax payment, and management of tax records. It also provides a transparent view of the tax calculation, helping vehicle owners understand the breakdown of their tax liability.

The online system often offers features such as tax estimate calculators, payment plan options, and reminders for upcoming tax deadlines. This digital approach not only simplifies the tax management process but also ensures that vehicle owners can stay on top of their obligations without the need for in-person visits.

The Impact of Car Ad Valorem Tax on Vehicle Ownership

The Car Ad Valorem Tax has a significant impact on vehicle ownership in Georgia. It influences purchasing decisions, resale values, and overall vehicle maintenance costs. Understanding this impact is crucial for vehicle owners to make informed choices and plan their finances effectively.

Influencing Vehicle Purchase Decisions

When considering a vehicle purchase, the Car Ad Valorem Tax is a significant factor. Buyers often weigh the initial purchase cost against the ongoing tax obligations. Vehicles with higher values or those registered in counties with higher tax rates may deter buyers due to the associated tax burden.

Conversely, vehicles with lower values or those eligible for tax incentives may be more attractive to buyers. This dynamic can influence the market for used vehicles, as older vehicles with lower tax rates may be more appealing to budget-conscious buyers.

Impact on Resale Values

The Car Ad Valorem Tax also affects the resale value of vehicles in Georgia. Vehicles with a history of lower tax payments due to their age or county of registration may retain a higher resale value. Buyers often consider the tax implications when purchasing a used vehicle, making vehicles with lower tax histories more desirable.

Conversely, vehicles with a history of high tax payments may face a resale value penalty. This is particularly true for luxury or high-value vehicles, which typically face higher tax rates. As such, the Car Ad Valorem Tax can significantly influence the used vehicle market in Georgia.

Vehicle Maintenance and Upkeep

The Car Ad Valorem Tax is an annual obligation, and vehicle owners must budget for this expense. This tax can influence the decision to maintain a vehicle or opt for an upgrade. For some, the annual tax payment may be a significant expense, prompting a consideration of more fuel-efficient or lower-value vehicles to reduce the tax burden.

Additionally, the tax can impact the decision to keep a vehicle for an extended period. Older vehicles, while potentially more reliable, may face higher tax rates, leading to a potential shift towards newer, more tax-efficient vehicles. This dynamic influences the overall vehicle maintenance and ownership landscape in Georgia.

Conclusion: A Comprehensive Guide to Georgia’s Car Ad Valorem Tax

In conclusion, the Car Ad Valorem Tax in Georgia is a vital component of vehicle ownership in the state. It is a complex tax, with calculations based on vehicle value, age, and county of registration. Understanding this tax is crucial for vehicle owners to make informed decisions and navigate the registration process effectively.

This guide has aimed to provide a comprehensive understanding of the Car Ad Valorem Tax, from its historical context and purpose to its practical implications for vehicle owners. By offering insights into tax calculation, registration, and appeal processes, we hope to empower vehicle owners with the knowledge to manage their tax obligations efficiently.

As with any tax, staying informed and proactive is key. The Car Ad Valorem Tax, while a necessary obligation, can be navigated with the right knowledge and strategies. We encourage vehicle owners to stay updated on tax regulations and to utilize the resources available, such as the online tax management platform, to ensure a smooth and stress-free experience.

Frequently Asked Questions

How is the Car Ad Valorem Tax calculated in Georgia?

+

The Car Ad Valorem Tax in Georgia is calculated based on the vehicle’s fair market value, adjusted for its age. The tax rate varies depending on the county of registration, with some counties having higher tax rates than others.

Can I appeal my Car Ad Valorem Tax assessment?

+

Yes, you can appeal your Car Ad Valorem Tax assessment if you believe it is inaccurate. You will need to provide evidence, such as recent sales data or expert valuations, to support your case.

How can I manage my Car Ad Valorem Tax obligations online?

+

Georgia offers an online platform for vehicle owners to manage their Car Ad Valorem Tax obligations. This platform allows you to register, pay taxes, and manage your tax records digitally. It also provides tax estimate calculators and payment plan options.

What is the impact of the Car Ad Valorem Tax on vehicle purchase decisions?

+

The Car Ad Valorem Tax can influence vehicle purchase decisions. Buyers often consider the initial purchase cost alongside the ongoing tax obligations. Vehicles with higher values or those registered in counties with higher tax rates may be less appealing due to the associated tax burden.

How does the Car Ad Valorem Tax affect the resale value of vehicles in Georgia?

+

The Car Ad Valorem Tax can impact the resale value of vehicles in Georgia. Vehicles with a history of lower tax payments due to their age or county of registration may retain a higher resale value, as buyers often consider the tax implications when purchasing a used vehicle.