Car Sales Tax Tn

The car sales tax in Tennessee, also known as the Vehicle Sales Tax, is an important consideration for residents when purchasing a new or used vehicle. Understanding how this tax works and its implications can help buyers make informed decisions and potentially save money. In this comprehensive guide, we will delve into the intricacies of the car sales tax in Tennessee, providing valuable insights and expert analysis.

Understanding the Tennessee Car Sales Tax

Tennessee imposes a sales tax on the purchase of motor vehicles, including cars, trucks, motorcycles, and recreational vehicles. This tax is collected by the Tennessee Department of Revenue and is an essential source of revenue for the state. The car sales tax rate in Tennessee is a flat rate, which means it remains the same regardless of the vehicle’s price or location within the state.

The current car sales tax rate in Tennessee is 7% as of my last update. This rate is applicable to the total purchase price of the vehicle, including any additional fees and charges. It's important to note that this tax is separate from other taxes and fees associated with vehicle registration and titling.

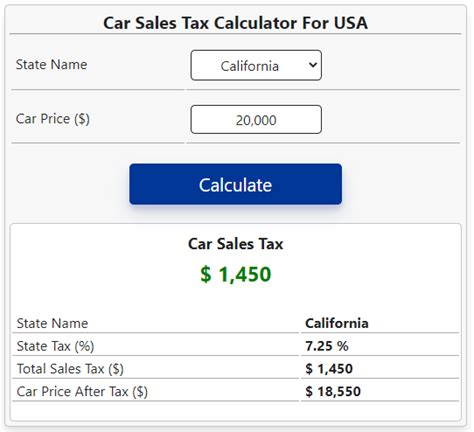

When purchasing a vehicle in Tennessee, the sales tax is calculated based on the vehicle's purchase price. This means that the higher the vehicle's cost, the more sales tax you will pay. The tax is calculated as a percentage of the purchase price, and the total amount is due at the time of registration.

Example of Car Sales Tax Calculation

Let’s illustrate this with an example. If you purchase a new car for $30,000 in Tennessee, the car sales tax you would owe is calculated as follows:

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $30,000 | 7% | $2,100 |

So, in this case, you would pay a sales tax of $2,100 on top of the vehicle's purchase price.

Exemptions and Special Considerations

While the car sales tax in Tennessee applies to most vehicle purchases, there are certain exemptions and special considerations to be aware of. These can help reduce the overall tax burden for specific individuals or situations.

Tax Exemptions for Specific Groups

Tennessee offers sales tax exemptions for certain groups, including:

- Active-duty military personnel and their spouses

- Disabled veterans

- Senior citizens (over the age of 65)

- Individuals with certain disabilities

These individuals may be eligible for reduced or waived sales tax when purchasing a vehicle. However, they must provide proper documentation and meet specific criteria to qualify for these exemptions.

Trade-Ins and Sales Tax

When trading in an old vehicle for a new one, the sales tax calculation can be a bit more complex. Tennessee has a provision known as the “trade-in allowance,” which allows for a reduction in the sales tax based on the trade-in value. This means that the sales tax is calculated on the difference between the new vehicle’s purchase price and the trade-in allowance.

For example, if you trade in a vehicle valued at $10,000 towards the purchase of a new car priced at $30,000, the sales tax would be calculated on the remaining $20,000. This trade-in allowance can significantly reduce the overall sales tax liability.

Online and Out-of-State Vehicle Purchases

Purchasing a vehicle online or from an out-of-state dealer can present unique challenges when it comes to sales tax. Tennessee has specific rules and regulations in place to ensure that sales tax is collected even in these scenarios.

Online Vehicle Purchases

If you purchase a vehicle online from a Tennessee-based dealer, the sales tax will be included in the final price. However, if you buy a vehicle from an out-of-state dealer online, you are still required to pay sales tax to the Tennessee Department of Revenue. The department has specific guidelines for registering and paying sales tax on out-of-state purchases.

Out-of-State Purchases

When purchasing a vehicle from another state and bringing it into Tennessee, you are responsible for paying the appropriate sales tax. The tax is calculated based on the vehicle’s purchase price, and you must register the vehicle within 30 days of becoming a Tennessee resident. Failure to do so can result in penalties and fines.

Sales Tax and Vehicle Registration

It’s important to understand the relationship between sales tax and vehicle registration in Tennessee. While the sales tax is a one-time payment, vehicle registration is an annual process. The sales tax paid at the time of purchase is separate from the annual registration fee, which is based on the vehicle’s value and other factors.

When registering your vehicle, you will need to provide proof of sales tax payment. This ensures that the state receives the appropriate revenue for the vehicle's purchase. Failure to pay sales tax can result in registration issues and potential legal consequences.

Strategies for Minimizing Sales Tax

While the car sales tax in Tennessee is a fixed rate, there are strategies and considerations that can help minimize your overall tax liability.

Timing Your Purchase

In some cases, timing your vehicle purchase can make a difference. Certain dealerships or manufacturers may offer incentives or promotions that can reduce the overall purchase price. By taking advantage of these offers, you can potentially lower the sales tax you owe.

Negotiating the Purchase Price

Negotiating the purchase price of a vehicle is a common strategy to reduce the sales tax. By bargaining with the dealer or seller, you may be able to secure a lower price, which directly impacts the sales tax calculation. Keep in mind that negotiation skills and market knowledge can play a significant role in this process.

Utilizing Tax Credits and Incentives

Tennessee offers various tax credits and incentives for specific types of vehicles, such as electric or hybrid cars. These credits can reduce the overall tax burden when purchasing environmentally friendly vehicles. Staying informed about these incentives and meeting the necessary requirements can provide significant savings.

The Impact of Car Sales Tax on the Market

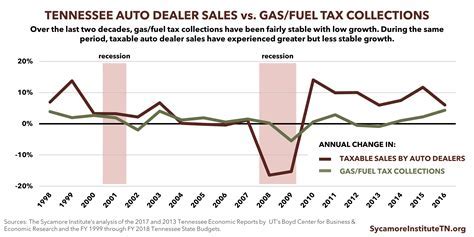

The car sales tax in Tennessee, like in many other states, has a significant impact on the automotive market. It influences consumer behavior, dealership strategies, and overall sales trends.

Consumer Behavior

The sales tax can be a deciding factor for many car buyers. It adds a substantial amount to the overall cost of a vehicle, which can influence purchase decisions. Some consumers may opt for less expensive vehicles or explore financing options to manage the tax liability.

Dealership Strategies

Dealerships in Tennessee are well-versed in the state’s sales tax regulations. They often incorporate these taxes into their pricing strategies and may offer incentives or discounts to make their vehicles more competitive. Understanding the sales tax landscape can help dealerships attract customers and negotiate effectively.

Market Trends

The car sales tax can influence market trends in Tennessee. It may impact the popularity of certain vehicle types, with buyers potentially favoring more affordable options. Additionally, the tax can affect the resale value of vehicles, as buyers consider the tax implications when purchasing used cars.

Future Implications and Changes

As with any tax system, the car sales tax in Tennessee is subject to potential changes and updates. Staying informed about these changes is crucial for both buyers and sellers.

Proposed Changes and Amendments

There have been discussions and proposals for modifying the car sales tax in Tennessee. These proposals often aim to simplify the tax structure, make it more equitable, or generate additional revenue. Staying updated on these proposals can help buyers and sellers anticipate any potential changes.

Impact of Economic Factors

Economic factors, such as inflation and market fluctuations, can also influence the car sales tax. In times of economic uncertainty, states may consider adjusting tax rates to maintain revenue streams. Understanding these economic factors can provide insights into potential tax changes.

Conclusion

The car sales tax in Tennessee is a crucial aspect of vehicle purchasing that requires careful consideration. By understanding the tax rate, exemptions, and strategies for minimizing liability, buyers can make more informed decisions. For sellers and dealerships, staying updated on tax regulations and market trends is essential for successful operations.

As the automotive market continues to evolve, keeping a close eye on tax-related developments ensures that buyers and sellers remain adaptable and proactive. Whether it's negotiating a better deal, exploring tax incentives, or staying informed about potential changes, knowledge is power when it comes to navigating the world of car sales tax in Tennessee.

How often does Tennessee update its car sales tax rate?

+Tennessee’s car sales tax rate is subject to legislative changes. While it remains at 7% as of my last update, it’s important to stay informed about any potential changes. The state may consider adjustments to the tax rate to align with economic conditions or revenue needs.

Are there any additional fees or surcharges associated with the car sales tax in Tennessee?

+In addition to the 7% sales tax, Tennessee may impose other fees and surcharges based on the vehicle’s type and purpose. These fees can include registration fees, title fees, and additional surcharges for certain vehicle classifications. It’s advisable to check with the Department of Revenue for a comprehensive breakdown of fees.

Can I negotiate the sales tax with the dealership?

+The sales tax in Tennessee is a legally mandated tax, and dealerships are required to collect it. However, you can negotiate the overall purchase price of the vehicle, which directly impacts the sales tax calculation. By negotiating a lower price, you can effectively reduce the sales tax you owe.

Are there any tax breaks or incentives for purchasing electric or hybrid vehicles in Tennessee?

+Yes, Tennessee offers tax incentives for the purchase of electric and hybrid vehicles. These incentives can include reduced or waived sales tax, as well as other benefits. It’s advisable to research the specific incentives available at the time of your purchase to take advantage of these opportunities.

What happens if I fail to pay the sales tax when purchasing a vehicle in Tennessee?

+Failing to pay the sales tax when purchasing a vehicle in Tennessee can result in significant penalties and fines. It’s crucial to ensure that you pay the sales tax in full and on time to avoid legal consequences and potential registration issues.