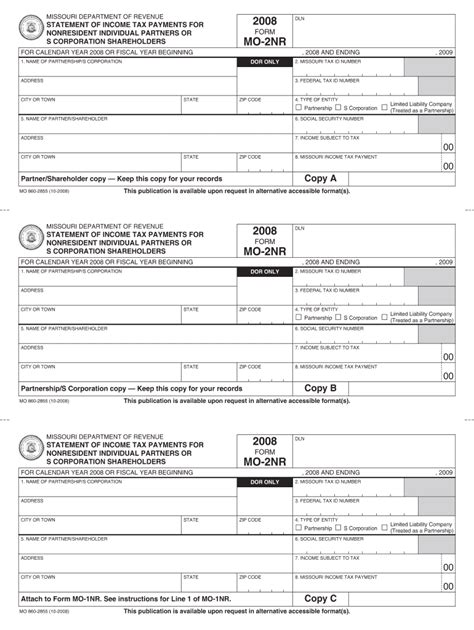

Missouri Income Tax Payment

In the state of Missouri, residents and businesses are required to contribute to the state's revenue through various forms of taxation. Income tax is one such component, and understanding the process of making income tax payments in Missouri is crucial for individuals and entities alike. This comprehensive guide aims to shed light on the ins and outs of Missouri income tax payments, offering a detailed breakdown of the process, including deadlines, payment methods, and relevant resources.

Understanding Missouri’s Income Tax System

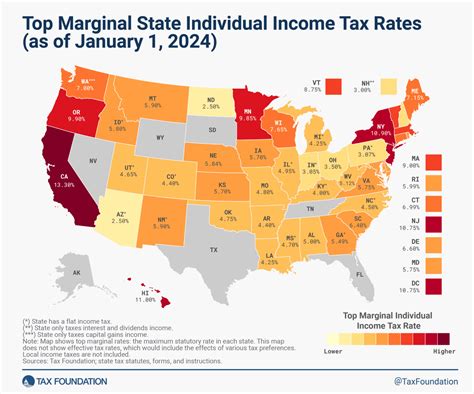

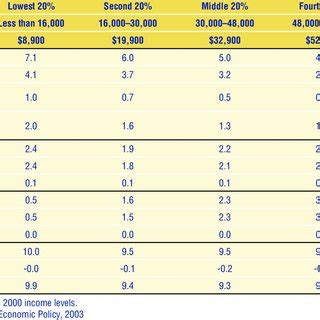

Missouri’s income tax system is structured around a progressive tax rate, meaning that the tax rate increases as income levels rise. This system ensures that individuals with higher incomes contribute a larger proportion of their earnings towards the state’s revenue. The state’s income tax rates are currently set at 1.5%, 2.0%, 3.0%, 4.0%, and 5.9%, depending on the taxpayer’s income bracket.

Additionally, Missouri offers various tax credits and deductions to reduce the tax burden on individuals and businesses. These incentives aim to promote economic growth, encourage investment, and support specific sectors of the state's economy. Some of the notable tax credits include the Low Income Housing Tax Credit, the Quality Jobs Tax Credit, and the Research Activities Tax Credit.

Income Tax Payment Deadlines

Meeting the income tax payment deadlines is crucial to avoid penalties and interest charges. Missouri’s tax year follows the federal tax year, starting from January 1st and ending on December 31st. The deadlines for income tax payments are typically as follows:

- Quarterly Estimated Tax Payments: Missouri requires individuals and businesses to make estimated tax payments throughout the year if their tax liability exceeds certain thresholds. These payments are due on April 15th, June 15th, September 15th, and January 15th of the following year.

- Annual Income Tax Return: For most individuals, the deadline to file their annual income tax return is April 15th. However, if this date falls on a weekend or a state holiday, the deadline is extended to the next business day.

- Extension for Filing: In certain circumstances, taxpayers can request an extension for filing their income tax return. The extension provides an additional six months to file the return, pushing the deadline to October 15th. However, it's important to note that an extension for filing does not extend the deadline for paying taxes owed.

Methods of Income Tax Payment

Missouri offers a range of convenient payment methods to cater to different preferences and needs. Here are the primary methods:

- Online Payment: The Missouri Department of Revenue provides an online payment portal, MyTax MO, which allows taxpayers to securely make payments using their credit or debit cards. This method is efficient and provides real-time confirmation of the payment.

- Electronic Funds Transfer (EFT): EFT payments can be made through the taxpayer's financial institution, allowing for direct transfers from their bank account to the state's revenue department. This method is secure and often preferred for larger payments.

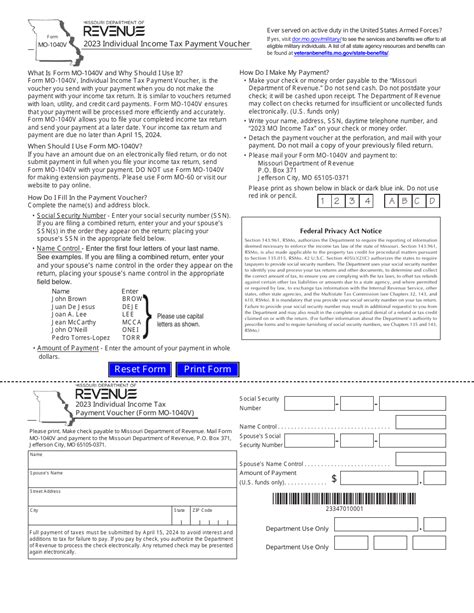

- Check or Money Order: Traditional payment methods such as checks or money orders are still accepted. Taxpayers can mail their payment, along with the appropriate voucher or form, to the Missouri Department of Revenue. It's crucial to ensure that the payment is received by the deadline to avoid late fees.

- Credit Card Payment by Phone: For those who prefer a more personal approach, the state offers the option to make credit card payments over the phone. Taxpayers can call the designated phone number and make their payment using their credit card details.

Resources and Assistance

The Missouri Department of Revenue provides a wealth of resources to assist taxpayers in navigating the income tax payment process. These resources include:

- Online Tools: The department's website offers various online tools and calculators to help taxpayers estimate their tax liability, calculate their quarterly estimated tax payments, and determine the correct amount to pay.

- Instruction Booklets: Detailed instruction booklets are available for different types of taxpayers, including individuals, businesses, and fiduciaries. These booklets provide step-by-step guidance on filling out tax forms and understanding tax regulations.

- Taxpayer Assistance Centers: Missouri operates Taxpayer Assistance Centers across the state, where taxpayers can receive in-person assistance with their tax-related queries. These centers provide help with filling out forms, understanding tax laws, and resolving tax issues.

- Phone Support: The Missouri Department of Revenue offers phone support for taxpayers who prefer to discuss their tax matters over the phone. Trained professionals are available to answer questions and provide guidance.

Performance Analysis and Tax Revenue

An analysis of Missouri’s income tax revenue reveals some interesting trends. Over the past decade, the state has seen a steady increase in tax revenue, with a notable spike in the years following the 2008 financial crisis. This growth can be attributed to various factors, including economic recovery, population growth, and the implementation of tax reform measures.

| Fiscal Year | Income Tax Revenue (in millions) |

|---|---|

| 2013 | 4,350 |

| 2014 | 4,520 |

| 2015 | 4,780 |

| 2016 | 4,950 |

| 2017 | 5,200 |

The table above illustrates the growth in income tax revenue from 2013 to 2017. It's worth noting that Missouri's income tax revenue represents a significant portion of the state's overall tax revenue, contributing to essential services such as education, healthcare, and infrastructure development.

Future Implications and Tax Reform

Looking ahead, Missouri’s tax landscape is likely to undergo further changes. The state government is actively engaged in discussions and initiatives to reform the tax system, aiming to enhance economic growth and competitiveness. Some of the proposed reforms include:

- Flat Tax Rate: There have been suggestions to move towards a flat tax rate, eliminating the progressive system. This change would simplify the tax structure and potentially reduce the administrative burden on taxpayers and the state.

- Increased Deductions: Discussions are underway to increase the standard deduction, providing taxpayers with more opportunities to reduce their taxable income. This move could result in a more favorable tax position for individuals and businesses.

- Tax Incentives for Businesses: The state is considering expanding tax incentives for businesses, particularly those investing in research and development or creating jobs. Such incentives could attract more businesses to Missouri, boosting the economy.

Frequently Asked Questions

What happens if I miss the income tax payment deadline?

+Missing the income tax payment deadline can result in penalties and interest charges. The state of Missouri assesses a late payment penalty of 5% of the unpaid tax for each month (or part of a month) the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 0.5% per month, or portion of a month, until the tax is paid in full.

Can I make income tax payments online using a credit card?

+Yes, Missouri provides an online payment portal, MyTax MO, which accepts credit and debit card payments. This method is convenient and provides instant confirmation of payment. However, please note that there is a convenience fee associated with credit card payments, which is charged by the payment processor and not the state.

Are there any tax credits or deductions available in Missouri?

+Absolutely! Missouri offers a range of tax credits and deductions to reduce the tax burden on individuals and businesses. Some popular credits include the Low Income Housing Tax Credit, the Quality Jobs Tax Credit, and the Research Activities Tax Credit. It’s important to review the eligibility criteria and requirements for each credit to determine if you qualify.