Minnesota Tax Brackets

Understanding Minnesota's tax system is crucial for individuals and businesses alike. The state's progressive income tax structure means that as your income increases, so does the tax rate you pay. In this comprehensive guide, we'll delve into the intricacies of Minnesota's tax brackets, providing you with the knowledge to navigate this complex system effectively.

A Comprehensive Guide to Minnesota's Tax Brackets

Minnesota's tax system is designed to ensure a fair distribution of tax obligations based on an individual's or entity's income. The state's income tax is divided into several brackets, each with its own tax rate. Let's explore these brackets and uncover the key details.

Income Tax Brackets for Individuals

Minnesota's tax brackets for individuals are structured to accommodate a wide range of income levels. As of the 2023 tax year, the brackets and their corresponding tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0% on the first $14,000 | 0% |

| $14,001 - $33,500 | 5.35% |

| $33,501 - $78,000 | 7.05% |

| $78,001 - $156,000 | 7.85% |

| Over $156,000 | 9.85% |

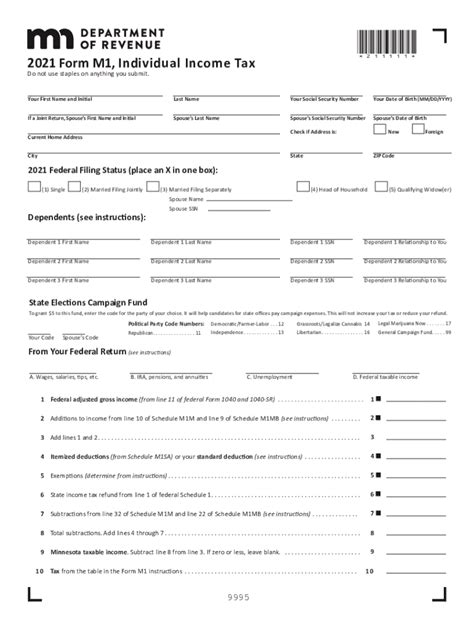

It's important to note that these brackets apply to taxable income, which is calculated after deductions and exemptions. Minnesota allows for various deductions, including standard deductions and itemized deductions, which can reduce your taxable income and potentially lower your overall tax liability.

Tax Brackets for Married Filing Jointly

When it comes to married couples filing jointly, Minnesota offers a slightly different set of tax brackets. Here's an overview of the brackets and rates for the 2023 tax year:

| Tax Bracket | Tax Rate |

|---|---|

| 0% on the first $22,000 | 0% |

| $22,001 - $52,500 | 5.35% |

| $52,501 - $126,000 | 7.05% |

| $126,001 - $252,000 | 7.85% |

| Over $252,000 | 9.85% |

Married couples have the advantage of combining their incomes, which can potentially move them into lower tax brackets and reduce their overall tax liability. However, it's essential to consider the joint income when determining the applicable tax bracket.

Minnesota's Tax Rates for Corporations

Minnesota imposes a corporate income tax on businesses operating within the state. The tax rates for corporations are different from those for individuals. As of the 2023 tax year, the corporate tax brackets and rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| First $150,000 of income | 7.5% |

| $150,001 - $500,000 | 9.8% |

| Over $500,000 | 9.8% |

Corporations in Minnesota have a flat tax rate of 9.8% for income above $150,000. However, the initial bracket of 7.5% for the first $150,000 of income provides a slight relief for smaller businesses.

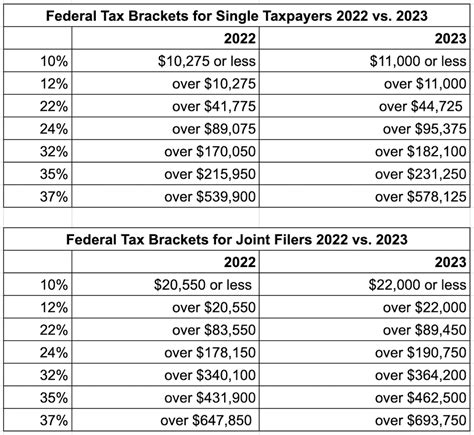

Comparing Minnesota's Tax Rates

When compared to other states, Minnesota's tax rates are relatively competitive. The state's progressive income tax structure ensures that those with higher incomes contribute a larger share, promoting economic fairness. Additionally, the availability of deductions and exemptions can further reduce tax liabilities for individuals and businesses.

For instance, Minnesota's top tax rate of 9.85% for individuals is higher than many neighboring states, such as Wisconsin (7.65%) and Iowa (8.53%). However, it's lower than states like California (13.3%) and New York (8.82%). The corporate tax rate of 9.8% is also competitive when compared to other states, providing a balanced approach to taxation.

Navigating Minnesota's Tax Landscape

Understanding Minnesota's tax brackets is a crucial step towards effective tax planning. Whether you're an individual taxpayer or a business owner, knowing the applicable tax rates can help you make informed decisions regarding your financial strategies.

Minnesota's tax system offers various deductions and credits that can further reduce your tax burden. Exploring these options and staying updated with any changes in tax laws is essential to optimize your tax situation. Consulting with tax professionals or utilizing reliable tax preparation software can also provide valuable guidance.

By staying informed and proactive, you can navigate Minnesota's tax landscape with confidence and ensure compliance with the state's tax regulations. Remember, a well-planned tax strategy can not only save you money but also contribute to the state's economic growth and development.

FAQs

How often do Minnesota’s tax brackets change?

+Minnesota’s tax brackets are subject to periodic adjustments, typically occurring annually or biennially. These changes are based on factors such as inflation and economic conditions. It’s essential to stay updated with the latest tax laws to ensure compliance and accurate tax planning.

Are there any tax credits or deductions available in Minnesota?

+Yes, Minnesota offers a range of tax credits and deductions to help reduce tax liabilities. These include credits for low-income earners, property tax refunds, and deductions for medical expenses, charitable contributions, and mortgage interest. Exploring these options can provide significant tax savings.

How does Minnesota’s tax system compare to other states for businesses?

+Minnesota’s corporate tax rate of 9.8% is competitive when compared to other states. However, the availability of tax incentives and business-friendly policies can make Minnesota an attractive location for businesses. It’s essential to consider the overall business environment and tax structure when making business decisions.

Are there any special tax considerations for remote workers in Minnesota?

+Minnesota has specific tax rules for remote workers, particularly those working for out-of-state employers. Remote workers may be subject to nonresident tax obligations, which require them to file tax returns in both their home state and Minnesota. Understanding these rules is crucial for accurate tax reporting.