Governor Kemp Tax Refund 2025

In a move that has caught the attention of Georgians and tax experts alike, Governor Brian Kemp has proposed a significant tax refund initiative for the state's residents. The Governor Kemp Tax Refund 2025 plan is an ambitious undertaking that aims to provide substantial relief to taxpayers while also stimulating economic growth in the state. With a focus on supporting individuals and businesses, this initiative has the potential to significantly impact Georgia's economy and its residents' financial well-being.

Understanding the Governor Kemp Tax Refund Plan

The Governor Kemp Tax Refund 2025 plan is a comprehensive strategy designed to put money back into the pockets of Georgians. It is a part of Governor Kemp’s broader tax relief efforts, which have been a key focus of his administration. The plan proposes a one-time tax refund to be distributed to eligible taxpayers in the state, with the aim of providing immediate financial relief and boosting consumer spending.

The refund is expected to be a significant amount, and the eligibility criteria are designed to ensure that a wide range of taxpayers can benefit from this initiative. According to the proposed plan, individual taxpayers, as well as small businesses, will be eligible for the refund, providing a much-needed boost to both personal finances and the state's small business community.

One of the unique aspects of the Governor Kemp Tax Refund 2025 plan is its timing. By offering a refund in 2025, the initiative is poised to provide a strategic boost to the state's economy during a period of expected growth and recovery. This strategic timing allows the tax relief to have a more significant impact, potentially stimulating investment and job creation.

Eligibility and Criteria

The eligibility criteria for the Governor Kemp Tax Refund 2025 are designed to be inclusive. Individual taxpayers who have filed their state income tax returns for the 2024 tax year will be considered for the refund. Additionally, small businesses with a certain threshold of annual revenue will also be eligible, ensuring that the initiative supports the backbone of Georgia’s economy.

The exact amount of the refund is yet to be finalized and will be announced closer to the distribution date. However, preliminary estimates suggest that the refund could be a substantial percentage of the taxes paid, providing a significant boost to taxpayers' financial stability.

Economic Impact and Benefits

The Governor Kemp Tax Refund 2025 plan is anticipated to have a positive and far-reaching impact on Georgia’s economy. By putting money directly into the hands of taxpayers, the initiative is expected to stimulate consumer spending, which, in turn, will drive economic growth. Increased spending can lead to higher sales for businesses, creating a ripple effect that benefits the entire state.

For individuals, the tax refund will provide a much-needed financial cushion. Whether it's used to pay off debts, save for the future, or invest in personal goals, the refund has the potential to improve financial literacy and security among Georgians. Moreover, for small businesses, the refund can serve as a much-needed injection of capital, allowing them to expand operations, hire more employees, or invest in new ventures.

Stimulating Investment and Job Creation

The strategic timing of the Governor Kemp Tax Refund 2025 plan is designed to align with a period of expected economic growth. By providing tax relief during a time of recovery and expansion, the initiative can encourage investment in Georgia’s economy. Businesses, both local and national, may be more inclined to invest in the state, creating new job opportunities and contributing to long-term economic sustainability.

The increased consumer spending resulting from the tax refund can also create a positive feedback loop. As businesses experience higher sales, they may be motivated to expand their operations, leading to increased job openings. This cycle of economic growth and job creation can have a lasting impact on Georgia's workforce and overall prosperity.

Implementation and Distribution

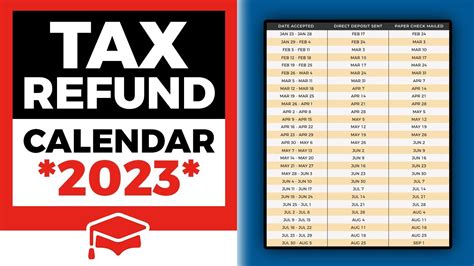

The implementation and distribution of the Governor Kemp Tax Refund 2025 plan will be a carefully coordinated effort. The state’s tax authorities will work closely with financial institutions and relevant stakeholders to ensure a smooth process. The distribution method will likely involve direct deposits or mailed checks, with clear communication channels established to inform taxpayers of their eligibility and the refund amount.

To ensure transparency and accountability, the state government will provide regular updates and progress reports on the implementation of the tax refund plan. This includes publishing eligibility criteria, estimated refund amounts, and any relevant updates on the official state government websites and through various communication channels.

Community Engagement and Awareness

Governor Kemp’s administration recognizes the importance of community engagement and awareness in the successful implementation of the Governor Kemp Tax Refund 2025 plan. The state will undertake a comprehensive communication strategy to reach out to taxpayers, small businesses, and community leaders. This includes educational campaigns, town hall meetings, and online resources to ensure that all eligible residents understand the benefits and requirements of the tax refund initiative.

By fostering a culture of financial literacy and awareness, the state aims to empower Georgians to make the most of their tax refund. This includes providing resources and guidance on responsible financial management, investment opportunities, and ways to maximize the impact of the refund on personal and community well-being.

Future Implications and Potential Challenges

The Governor Kemp Tax Refund 2025 plan has the potential to be a game-changer for Georgia’s economy and its residents’ financial health. However, like any significant initiative, it also presents certain challenges and considerations.

One of the key challenges is ensuring that the tax refund reaches the intended beneficiaries. The state will need to navigate potential issues such as inaccurate or outdated taxpayer information, ensuring that the right individuals and businesses receive the refund. Additionally, the state must balance the distribution of funds with maintaining a stable fiscal environment to avoid any long-term negative impacts on the state's finances.

Long-Term Sustainability and Future Initiatives

The success of the Governor Kemp Tax Refund 2025 plan can set a precedent for future tax relief initiatives. If the plan achieves its intended economic and social goals, it could pave the way for similar programs in the future. This would provide ongoing support to taxpayers and businesses, creating a more sustainable and resilient economy for Georgia.

Furthermore, the lessons learned from the implementation of this tax refund initiative can inform future policy decisions. The state can analyze the economic impact, taxpayer feedback, and any challenges encountered to refine and improve future tax relief measures. This iterative process can lead to more effective and targeted tax policies that benefit Georgians over the long term.

Conclusion

The Governor Kemp Tax Refund 2025 plan represents a significant step towards supporting Georgia’s residents and businesses. By providing a substantial tax refund, the initiative has the potential to stimulate economic growth, improve financial well-being, and create a more resilient economy. With careful planning, transparent communication, and community engagement, the plan can achieve its goals and leave a positive legacy for the state’s future.

FAQs

What is the Governor Kemp Tax Refund 2025 plan?

+

The Governor Kemp Tax Refund 2025 plan is a proposed initiative by Governor Brian Kemp to provide a one-time tax refund to eligible taxpayers in Georgia. It aims to stimulate economic growth and provide financial relief to individuals and small businesses.

Who is eligible for the tax refund?

+

Individual taxpayers who have filed their state income tax returns for the 2024 tax year and small businesses with a certain annual revenue threshold are eligible for the refund.

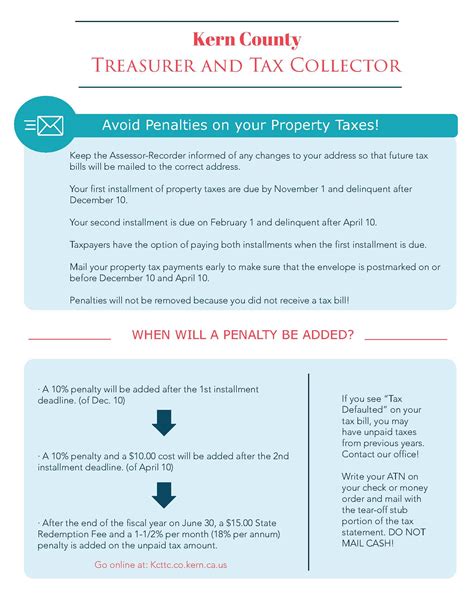

When will the tax refund be distributed?

+

The tax refund is scheduled to be distributed in 2025, providing a strategic boost to the state’s economy during a period of expected growth.

How will the tax refund be distributed?

+

The distribution method will likely involve direct deposits or mailed checks, with clear communication from the state government regarding eligibility and refund amounts.

What are the potential challenges of the tax refund plan?

+

Potential challenges include ensuring accurate taxpayer information, balancing the distribution of funds with fiscal stability, and reaching out to all eligible beneficiaries.