Kern County Tax Collector

The Kern County Tax Collector plays a vital role in the financial administration of the region, ensuring that property owners and businesses fulfill their tax obligations while also managing various other revenue streams for the county. This article aims to provide an in-depth look at the operations, services, and impact of the Kern County Tax Collector's office, offering valuable insights into its functions and significance within the local community.

Overview of the Kern County Tax Collector's Office

The Kern County Tax Collector's office is a vital government department responsible for collecting various forms of taxes and revenue within the county. Headquartered in Bakersfield, California, this office serves the entire county, encompassing diverse regions such as the Tehachapi Mountains, the southern Sierra Nevada, and the fertile San Joaquin Valley. With a population of over 880,000 residents and a land area of approximately 8,161 square miles, Kern County is the 12th most populous county in California.

The tax collector's office is entrusted with collecting and managing a wide range of taxes and fees, including but not limited to property taxes, vehicle license fees, business taxes, and more. Their operations are governed by the Revenue and Taxation Code, which outlines the procedures and timelines for tax collection and enforcement. This code ensures that the tax collection process is fair, transparent, and in line with state regulations.

Key Responsibilities and Services

The primary responsibility of the Kern County Tax Collector is to ensure the timely and accurate collection of taxes. This involves sending out tax bills, processing payments, and providing assistance to taxpayers. The office offers a variety of payment methods, including online payments, direct debit, and in-person payments at their various offices located throughout the county. This ensures convenience and accessibility for taxpayers.

In addition to tax collection, the office also manages other financial services. These include issuing vehicle license plates and registration, handling business tax registration and compliance, and administering various fees related to property transactions. They also play a role in debt collection, working with taxpayers to resolve outstanding debts and ensuring compliance with tax laws.

Furthermore, the Kern County Tax Collector's office provides valuable resources and information to the public. Their website offers a wealth of resources, including tax guides, forms, and important deadlines. They also conduct outreach programs and educational initiatives to ensure that taxpayers understand their obligations and can access the necessary support.

Property Tax Administration

Property tax is a significant source of revenue for Kern County and plays a crucial role in funding various public services and infrastructure projects. The Kern County Tax Collector's office is responsible for assessing, billing, and collecting property taxes from residential, commercial, and industrial properties within the county.

Assessment Process

The assessment process involves evaluating the value of each property within the county. This is done by the Kern County Assessor's office, which determines the assessed value of properties based on factors such as market value, improvements, and other relevant criteria. The assessed value is then used to calculate the property tax liability for each property owner.

| Property Type | Assessment Ratio | Tax Rate |

|---|---|---|

| Residential | 1.0% | Varies by district |

| Commercial | 1.1% | Varies by district |

| Industrial | 1.2% | Varies by district |

The assessment ratio and tax rate can vary depending on the property type and the specific tax district in which the property is located. This ensures that the tax burden is distributed fairly across different types of properties and that the revenue generated supports the unique needs of each district.

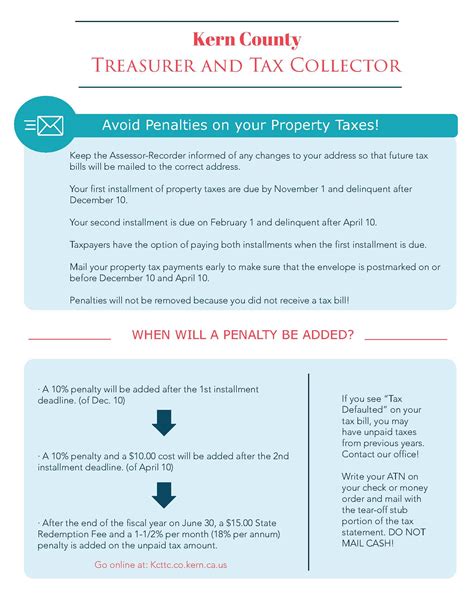

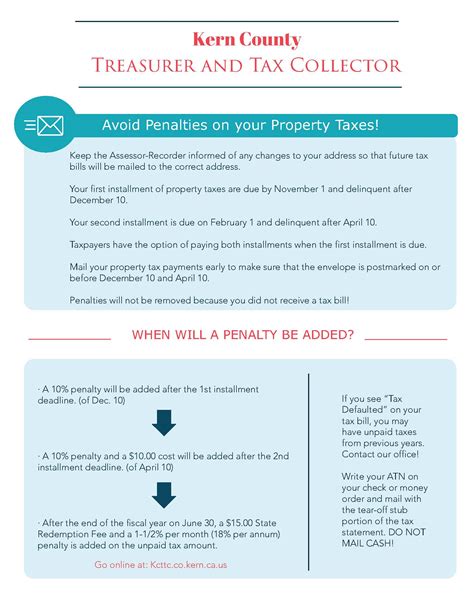

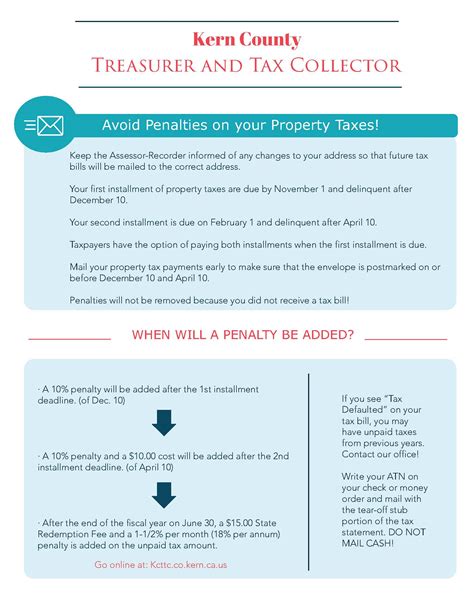

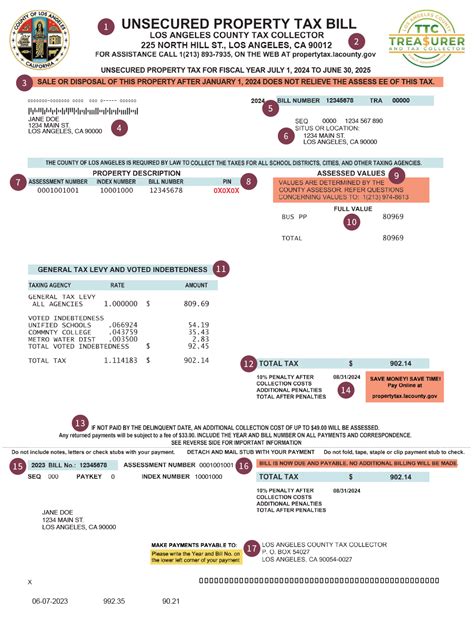

Billing and Collection

Once the assessed values are determined, the Kern County Tax Collector's office generates tax bills and sends them to property owners. These bills outline the property's assessed value, the applicable tax rate, and the total tax amount due. Taxpayers have the option to pay their property taxes in two installments, typically due in November and February. However, they also have the flexibility to pay the full amount in one installment if they prefer.

The tax collector's office offers various payment methods, including online payments through their secure website, payments by mail, and in-person payments at their offices. They also provide options for direct debit and electronic funds transfer, ensuring convenience and efficiency for taxpayers.

Appeals and Exemptions

If a property owner believes that their assessed value is incorrect or that they qualify for an exemption, they have the right to appeal. The Kern County Tax Collector's office works closely with the Assessor's office to handle these appeals. Property owners can submit their appeals to the Assessment Appeals Board, which reviews and makes decisions on these cases.

Exemptions are also available for certain properties, such as those owned by non-profit organizations, churches, and government entities. The tax collector's office ensures that these exemptions are properly applied and that eligible properties are not subject to property taxes.

Vehicle License Fees and Registration

In addition to property taxes, the Kern County Tax Collector's office is also responsible for collecting vehicle license fees and handling vehicle registration. This service is crucial for ensuring that vehicles operated within the county are properly registered and that owners comply with state regulations.

Vehicle License Fee Structure

Vehicle license fees in Kern County are calculated based on the vehicle's value and weight. The fee is determined using a formula that considers the vehicle's year, make, model, and other factors. These fees are an important source of revenue for the county and are used to fund various services and infrastructure projects.

| Vehicle Type | Fee Range |

|---|---|

| Passenger Cars | $30 - $200 |

| Trucks and SUVs | $40 - $300 |

| Motorcycles | $20 - $150 |

| Commercial Vehicles | Varies by weight and use |

The fee structure takes into account the impact of different vehicle types on roads and infrastructure. For instance, heavier vehicles like trucks and SUVs typically incur higher fees to account for the additional wear and tear they cause on roads.

Registration Process

The registration process involves providing the necessary documentation, such as proof of ownership, vehicle identification number (VIN), and insurance coverage. The tax collector's office verifies this information and, if all requirements are met, issues a registration certificate and license plates. This process ensures that vehicles are properly identified and that owners have the necessary documentation to operate their vehicles legally.

The registration process also includes the issuance of various vehicle-related stickers and tags. These include smog check stickers, which indicate that the vehicle has passed an emissions test, and registration stickers, which indicate that the vehicle is currently registered and insured.

Renewal and Transfer

Vehicle registration renewal is a critical aspect of the tax collector's responsibilities. They send out renewal notices to vehicle owners, reminding them to update their registration. This process ensures that vehicles remain in compliance with state regulations and that owners maintain their registration status.

The tax collector's office also handles vehicle transfers, whether it be due to a sale, gift, or inheritance. They ensure that the necessary paperwork is completed and that the transfer is properly documented. This process helps maintain an accurate record of vehicle ownership and ensures that all applicable fees and taxes are collected.

Business Taxes and Compliance

The Kern County Tax Collector's office also plays a vital role in ensuring that businesses operating within the county comply with tax regulations. This includes collecting various business taxes, managing business registrations, and providing support and resources to businesses.

Business Tax Types

Businesses in Kern County are subject to different types of taxes, depending on their nature and operations. These taxes include sales and use taxes, business license taxes, and various fees related to specific business activities. The tax collector's office is responsible for collecting and administering these taxes, ensuring that businesses fulfill their tax obligations.

| Business Tax Type | Rate | Description |

|---|---|---|

| Sales Tax | 7.25% | Tax on retail sales of goods and services |

| Use Tax | 7.25% | Tax on the storage, use, or consumption of goods and services purchased outside the county |

| Business License Tax | Varies | Annual tax based on business type and gross receipts |

| Transitional Tax | Varies | Tax on businesses that have relocated or expanded within the county |

Business Registration and Compliance

Businesses operating in Kern County are required to register with the tax collector's office. This registration process involves providing essential information such as the business's legal name, address, type of business, and estimated gross receipts. The tax collector's office verifies this information and issues a business registration certificate.

Once registered, businesses are required to comply with various tax obligations. This includes filing tax returns, making timely payments, and maintaining accurate records. The tax collector's office provides resources and guidance to help businesses understand their tax responsibilities and ensure compliance.

Support and Resources

The Kern County Tax Collector's office recognizes the importance of supporting local businesses. They offer a range of resources and services to assist businesses in navigating the tax landscape. This includes providing tax guides, offering workshops and seminars on tax compliance, and maintaining a dedicated business assistance team.

The tax collector's office also works closely with other county departments and agencies to promote business growth and development. They participate in economic development initiatives, provide tax incentives for business expansion, and collaborate with local chambers of commerce to support business communities.

Conclusion

The Kern County Tax Collector's office is a critical component of the county's financial administration, ensuring the collection of various taxes and fees while also providing essential services to taxpayers and businesses. Their role extends beyond tax collection, encompassing a range of financial responsibilities that contribute to the county's overall prosperity and development.

By efficiently managing property taxes, vehicle license fees, and business taxes, the tax collector's office plays a vital role in funding public services, maintaining infrastructure, and supporting economic growth. Their commitment to fairness, transparency, and accessibility ensures that taxpayers and businesses have the support they need to fulfill their financial obligations and contribute to the well-being of the community.

Frequently Asked Questions

How can I pay my property taxes in Kern County?

+

You can pay your property taxes in Kern County through various methods, including online payments via the tax collector’s secure website, payments by mail, and in-person payments at their offices. The office also offers direct debit and electronic funds transfer options for added convenience.

What is the deadline for paying property taxes in Kern County?

+

The deadline for paying property taxes in Kern County is typically the last business day of November and February for the two installment payments. However, you have the option to pay the full amount in one installment if you prefer.

How do I register my vehicle in Kern County?

+

To register your vehicle in Kern County, you need to provide the necessary documentation, such as proof of ownership, vehicle identification number (VIN), and insurance coverage. The tax collector’s office will verify this information and, if all requirements are met, issue a registration certificate and license plates.

What are the business taxes I need to pay in Kern County?

+

Business taxes in Kern County include sales tax, use tax, business license tax, and transitional tax. The specific taxes and rates depend on the nature and operations of your business. The tax collector’s office can provide guidance and resources to help you understand your tax obligations.

How can I get assistance with my tax-related queries in Kern County?

+

The Kern County Tax Collector’s office provides a range of resources and support to assist taxpayers and businesses. You can visit their website for tax guides and forms, or contact their office directly for personalized assistance. They also offer outreach programs and educational initiatives to ensure you have the necessary support.