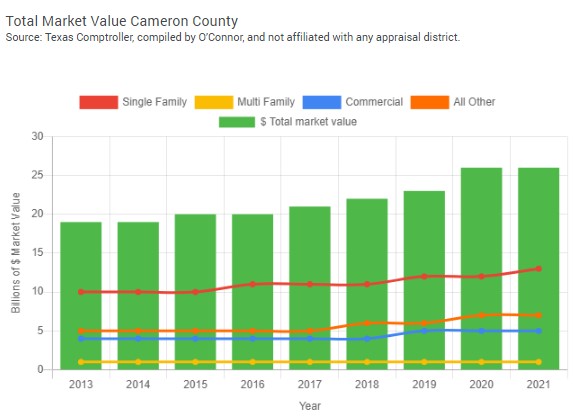

Cameron County Property Taxes

Cameron County, located in the vibrant Rio Grande Valley region of Texas, is a dynamic area known for its rich culture, diverse communities, and unique blend of urban and rural landscapes. As with many regions across the state, property taxes in Cameron County play a significant role in the local economy and are an important consideration for both residents and businesses.

Understanding Property Taxes in Cameron County

Property taxes are a primary source of revenue for local governments in Texas, and they are used to fund essential services such as education, public safety, infrastructure, and community development. In Cameron County, these taxes are determined by a complex process that takes into account various factors, including the value of the property, its location, and the tax rates set by different taxing entities.

The ad valorem property tax system is the primary method used in Cameron County, where the taxable value of a property is assessed based on its estimated market value. This value is then multiplied by the applicable tax rate to determine the amount owed by the property owner. The tax rate is established by various taxing authorities, such as the county, cities, school districts, and special districts, and can vary significantly depending on the specific location of the property.

Taxing Entities in Cameron County

In Cameron County, several taxing entities have jurisdiction over different areas, each setting its own tax rate. These entities include the Cameron County government, various municipalities such as Brownsville, Harlingen, and San Benito, as well as school districts like the Brownsville Independent School District and the Los Fresnos Consolidated Independent School District. Additionally, special districts like the Cameron County Irrigation District and the Cameron County Hospital District also contribute to the overall tax rate.

| Taxing Entity | Tax Rate (Per $100 Valuation) |

|---|---|

| Cameron County | 0.3879 |

| Brownsville ISD | 1.2683 |

| Los Fresnos CISD | 1.1548 |

| City of Brownsville | 0.4350 |

| City of Harlingen | 0.5279 |

| City of San Benito | 0.4900 |

| Cameron County Hospital District | 0.1483 |

| Cameron County Irrigation District | 0.0300 |

It's important to note that these tax rates are subject to change annually, as taxing entities may adjust their rates based on budgetary needs and other factors. Property owners in Cameron County should stay informed about any proposed changes to tax rates to understand the potential impact on their tax liabilities.

Property Valuation Process

The Cameron County Appraisal District (CCAD) is responsible for appraising all taxable property within the county. The CCAD utilizes various methods to determine the market value of properties, including sales data, income approaches, and cost analysis. Properties are appraised annually, and property owners have the right to protest the appraised value if they believe it is inaccurate or unfair.

The protest process allows property owners to present evidence and arguments to support their claim for a lower appraised value. This process is overseen by the Cameron County Appraisal Review Board (ARB), which is an independent body responsible for resolving disputes between property owners and the appraisal district. The ARB's decisions are final and binding, unless further appeals are made to the district court.

Property Tax Rates and Variations

Cameron County, like many other counties in Texas, experiences significant variations in property tax rates across different areas. These variations are primarily due to the diverse mix of taxing entities and their unique funding requirements. As a result, property owners may find themselves paying different tax rates depending on their exact location within the county.

Impact of School District Tax Rates

School districts often have the highest tax rates within a given area, as they rely heavily on property taxes to fund their operations. In Cameron County, school districts like the Brownsville ISD and the Los Fresnos CISD contribute significantly to the overall tax rate. These districts, known for their commitment to providing quality education, invest in infrastructure, teacher salaries, and various educational programs, which can result in higher tax rates.

| School District | Tax Rate (Per $100 Valuation) |

|---|---|

| Brownsville ISD | 1.2683 |

| Los Fresnos CISD | 1.1548 |

It's important for homeowners to consider the quality of local schools and the tax rates associated with them when making decisions about where to purchase property. Higher tax rates can translate to better educational opportunities for children, but they also impact the overall cost of homeownership.

Urban vs. Rural Tax Rates

The urban centers of Cameron County, such as Brownsville and Harlingen, often have higher tax rates compared to the more rural areas. This is due to the increased demand for services and infrastructure in these densely populated areas. Additionally, urban properties may be subject to additional taxes or assessments to fund specific improvements or developments.

On the other hand, rural areas may have lower tax rates, but they may lack certain amenities and services that are readily available in urban centers. Property owners in rural Cameron County may experience lower property taxes, but they may also have to travel further for access to healthcare, shopping, and other urban conveniences.

Tax Relief Programs and Exemptions

Recognizing the potential financial burden of property taxes, Cameron County, along with the state of Texas, offers several tax relief programs and exemptions to eligible property owners. These programs are designed to provide assistance to specific groups of individuals and can significantly reduce the tax liability for those who qualify.

Residential Homestead Exemptions

One of the most significant tax relief measures available to homeowners in Cameron County is the Residential Homestead Exemption. This exemption reduces the appraised value of a primary residence by a set amount, which then lowers the property taxes owed. The exemption amount varies annually and is determined by the Texas Legislature.

To qualify for the Residential Homestead Exemption, a property must be the principal residence of the owner, and the owner must apply for the exemption through the Cameron County Appraisal District. This exemption is renewable annually and provides ongoing tax savings for eligible homeowners.

Over-65 Exemption and Freeze

For homeowners aged 65 or older, the Over-65 Exemption and Freeze program offers significant tax relief. This program allows qualifying seniors to freeze the taxable value of their homes at the value on the year they turn 65, protecting them from increases in property taxes due to rising property values.

To be eligible, homeowners must meet certain income requirements and apply for the exemption. The Over-65 Exemption and Freeze program provides stability and peace of mind for seniors, ensuring that their property taxes remain manageable as they age.

Disability Exemptions

Cameron County also offers tax relief to individuals with disabilities. The Disability Exemption allows qualifying individuals to reduce the taxable value of their primary residence by a set amount, similar to the Residential Homestead Exemption. Additionally, the Totally Disabled Veteran Exemption provides total exemption from property taxes for eligible veterans with a 100% disability rating.

These disability exemptions are an important safety net for individuals with disabilities, ensuring that their financial obligations are manageable and that they can continue to reside in their homes without undue burden.

Tax Payment Options and Due Dates

Property taxes in Cameron County are due annually, and property owners have several options for paying their taxes. The Cameron County Tax Assessor-Collector’s Office provides various payment methods, including online payments, in-person payments at the office, and payments by mail. Property owners can also set up automatic payments to ensure timely payment without the need for manual reminders.

The tax year runs from January 1st to December 31st, and the payment due dates are typically in January and July. However, it's important for property owners to verify the specific due dates each year, as they may vary slightly. Failure to pay taxes by the due date may result in penalties and interest, and in extreme cases, tax liens or foreclosure.

Late Payment Penalties and Interest

Late payments of property taxes in Cameron County are subject to penalties and interest. The penalty for late payments is typically 1% of the total amount due for each month or portion of a month that the taxes remain unpaid. Additionally, interest accrues on the unpaid taxes at a rate of 1% per month, compounding annually.

It's important for property owners to prioritize timely tax payments to avoid these additional costs and potential legal complications. The Cameron County Tax Assessor-Collector's Office provides information and resources to help property owners understand their payment options and due dates.

The Impact of Property Taxes on Local Economy

Property taxes are a critical component of the local economy in Cameron County, providing the necessary funding for vital services and infrastructure development. These taxes contribute to the overall economic health of the region by supporting education, public safety, and community initiatives.

Funding Education and Schools

A significant portion of property tax revenue in Cameron County is allocated to local school districts. This funding is essential for maintaining and improving the quality of education in the region. It supports teacher salaries, curriculum development, extracurricular activities, and infrastructure upgrades, all of which contribute to a robust and competitive educational system.

Investing in education has long-term benefits for the local community, as it fosters a skilled workforce, encourages innovation, and attracts businesses and industries to the region.

Enhancing Public Safety and Infrastructure

Property taxes also play a crucial role in funding public safety services, such as police, fire, and emergency medical services. These taxes ensure that the community has access to well-equipped and well-trained first responders, providing a sense of security and peace of mind to residents and businesses alike.

Additionally, property taxes contribute to the development and maintenance of essential infrastructure, including roads, bridges, water and sewer systems, and public parks. These improvements enhance the overall quality of life in the region and attract new residents and businesses, further boosting the local economy.

Community Development and Initiatives

Beyond funding core services, property taxes in Cameron County also support various community development initiatives. These initiatives may include economic development programs, cultural and recreational activities, and social services that enhance the overall well-being of the community.

By investing in these initiatives, Cameron County can create a vibrant and attractive community that offers a high quality of life to its residents. This, in turn, contributes to a thriving local economy, as a strong community foundation attracts businesses and fosters economic growth.

Conclusion: Navigating Property Taxes in Cameron County

Understanding and managing property taxes in Cameron County requires careful consideration of various factors, including tax rates, valuation processes, relief programs, and payment options. By staying informed and proactive, property owners can effectively navigate the complexities of the local property tax system and ensure that their tax obligations are met in a timely and efficient manner.

Additionally, recognizing the vital role that property taxes play in funding essential services and contributing to the local economy is essential. Property taxes are a shared responsibility that directly impacts the quality of life in Cameron County, and by understanding this connection, property owners can actively contribute to the continued growth and prosperity of their community.

How can I estimate my property taxes in Cameron County?

+

You can estimate your property taxes by multiplying the appraised value of your property by the total tax rate for your specific location. The appraised value is determined by the Cameron County Appraisal District, and the tax rate is the sum of all applicable rates set by the various taxing entities in your area. This calculation will give you a rough estimate of your annual property tax liability.

What happens if I don’t pay my property taxes on time in Cameron County?

+

Failure to pay property taxes by the due date in Cameron County can result in penalties and interest. The penalties typically amount to 1% of the total tax due for each month or portion of a month that the taxes remain unpaid. Additionally, interest accrues on the unpaid taxes at a rate of 1% per month, compounding annually. In extreme cases, non-payment can lead to tax liens or foreclosure.

Are there any tax relief programs for senior citizens in Cameron County?

+

Yes, Cameron County offers the Over-65 Exemption and Freeze program for senior citizens. This program allows qualifying seniors to freeze the taxable value of their homes at the value on the year they turn 65, protecting them from increases in property taxes due to rising property values. To be eligible, homeowners must meet certain income requirements and apply for the exemption.

How can I protest my property’s appraised value in Cameron County?

+

If you believe that your property’s appraised value is inaccurate or unfair, you have the right to protest. You can do this by filing a protest with the Cameron County Appraisal Review Board (ARB). The ARB will review your case and make a decision. It’s important to gather evidence and prepare a strong case to support your claim for a lower appraised value.

What are the tax rates for commercial properties in Cameron County?

+

Commercial property tax rates in Cameron County vary depending on the specific location and the taxing entities that have jurisdiction over the property. Commercial properties are typically subject to higher tax rates compared to residential properties. To determine the exact tax rate for a commercial property, you can contact the Cameron County Tax Assessor-Collector’s Office or refer to their website for more information.