Pennsylvania Property Tax

Pennsylvania's property tax system is a complex and often misunderstood aspect of homeownership in the state. This article aims to provide a comprehensive guide to understanding Pennsylvania's property taxes, including how they are calculated, who pays them, and the various relief programs available to homeowners. By delving into the specifics, we can empower homeowners to make informed decisions and navigate the tax landscape with confidence.

The Fundamentals of Pennsylvania Property Taxes

Property taxes in Pennsylvania are a significant source of revenue for local governments, including municipalities, counties, and school districts. These taxes contribute to funding essential public services such as education, infrastructure maintenance, and emergency response. While the state sets the framework for property tax collection, it is the local taxing authorities that determine the tax rates and assess property values.

The property tax system in Pennsylvania operates on an annual basis, with tax bills typically issued in the spring or summer. The tax liability for a given year is calculated based on the assessed value of the property and the applicable tax rate for that jurisdiction. It's important to note that property taxes can vary significantly from one locality to another within the state.

How Property Taxes Are Calculated

The calculation of property taxes in Pennsylvania involves several key factors. Firstly, the property’s assessed value is determined through a process known as assessment. Assessments are conducted by local tax assessors, who evaluate the property’s worth based on factors such as location, size, condition, and recent sales of comparable properties. The assessed value is not necessarily the same as the market value, as it may be subject to assessment ratios or other adjustments set by the local authorities.

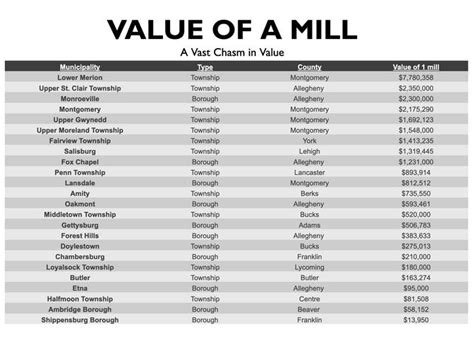

Once the assessed value is established, it is multiplied by the tax rate to determine the property tax liability. Tax rates are expressed as millage rates, which represent the amount of tax owed per thousand dollars of assessed value. For instance, a millage rate of 15 mills would mean that for every $1,000 of assessed value, the property owner would owe $15 in taxes. These rates are set by the local taxing authorities and can vary widely across the state.

To illustrate, let's consider an example. If a homeowner has a property with an assessed value of $150,000 and the applicable tax rate is 10 mills, the calculation would be as follows:

| Assessed Value | $150,000 |

|---|---|

| Tax Rate (in mills) | 10 |

| Tax Liability | $1,500 |

In this case, the homeowner would owe $1,500 in property taxes for the year.

Who Pays Property Taxes in Pennsylvania

Property taxes in Pennsylvania are primarily the responsibility of homeowners. However, it’s important to note that other types of property owners, such as businesses and landlords, also pay property taxes on their respective properties. These taxes are typically passed on to tenants or customers in the form of higher rental or product prices.

For homeowners, property taxes are often one of the largest annual expenses associated with homeownership. It's essential to consider these taxes when budgeting for home-related costs and when making decisions about purchasing or selling a property. The tax liability can significantly impact the overall affordability of a home, especially in areas with high tax rates.

Understanding Property Assessments

Property assessments are a critical component of the Pennsylvania property tax system, as they determine the assessed value upon which taxes are calculated. These assessments are conducted by local tax assessors, who have the authority to evaluate and reassess properties within their jurisdiction.

The Assessment Process

The assessment process in Pennsylvania typically involves the following steps:

- Data Collection: Assessors gather information about properties, including their physical characteristics, such as size, number of rooms, and amenities. They may also consider factors like recent sales of similar properties in the area.

- Market Analysis: Assessors analyze the local real estate market to determine the value of properties based on their features and market trends. This step helps ensure that assessments are in line with the current market conditions.

- Assessment Calculation: Using the collected data and market analysis, assessors calculate the assessed value of each property. This value is often a percentage of the property's estimated market value.

- Notice of Assessment: Once the assessments are complete, homeowners receive a notice of assessment, which informs them of the new assessed value and any changes from the previous year.

It's important for homeowners to review their assessment notices carefully and understand the factors that contributed to the assessed value. If they believe the assessment is inaccurate or unfair, they have the right to appeal the decision through a formal assessment appeal process.

Assessment Appeals

Homeowners in Pennsylvania have the right to appeal their property assessments if they believe the assessed value is too high or inaccurate. The assessment appeal process varies depending on the local jurisdiction, but it generally involves the following steps:

- Filing an Appeal: Homeowners must file an appeal within a specified timeframe, usually within 45 days of receiving the assessment notice. This process typically requires a fee, which is often refundable if the appeal is successful.

- Documentation: During the appeal, homeowners must provide evidence to support their claim. This may include recent sales of similar properties, appraisals, or other relevant documentation.

- Hearing: If the appeal is not resolved through documentation, a hearing may be scheduled. Homeowners have the opportunity to present their case and provide additional evidence to support their appeal.

- Decision: After considering the evidence and hearing arguments, the assessment board or relevant authority will make a decision. If the appeal is successful, the assessed value may be adjusted, resulting in a lower tax liability.

It's important to note that assessment appeals can be complex, and it may be beneficial for homeowners to seek professional guidance or legal representation to increase their chances of a successful appeal.

Tax Relief Programs for Pennsylvania Homeowners

Pennsylvania offers several tax relief programs aimed at easing the financial burden of property taxes for eligible homeowners. These programs provide various forms of assistance, such as discounts, exemptions, or deferrals, to help make property taxes more affordable.

The Homestead/Farmstead Exemption

The Homestead/Farmstead Exemption is a significant tax relief program in Pennsylvania. This exemption reduces the assessed value of a property for tax purposes, resulting in lower property taxes. To qualify for this exemption, homeowners must meet specific requirements, including:

- Owning and occupying the property as their primary residence.

- Having a combined household income that does not exceed certain limits (varies by county).

- Filing an application with the local tax assessor's office.

The Homestead/Farmstead Exemption can provide substantial savings for eligible homeowners, especially those with lower incomes or fixed incomes. It's important to note that this exemption does not apply to all taxes, such as school district taxes, and the savings may vary depending on the locality.

The Circuit Breaker Program

The Circuit Breaker Program is another valuable tax relief initiative in Pennsylvania. This program provides a refund or credit to eligible homeowners who meet certain income and property tax criteria. To qualify, homeowners must have a combined household income below a specified limit and pay a certain percentage of their income in property taxes.

The Circuit Breaker Program aims to assist homeowners who are struggling to afford their property taxes. The refund or credit can significantly reduce the financial burden and make property ownership more sustainable for eligible individuals and families. It's essential to note that the program has specific guidelines and requirements, and homeowners should consult their local tax authority for detailed information.

Other Tax Relief Options

In addition to the Homestead/Farmstead Exemption and the Circuit Breaker Program, Pennsylvania offers several other tax relief options for homeowners. These include:

- Senior Citizen Tax Relief: Provides a discount on property taxes for homeowners aged 65 or older with limited income.

- Veterans' Exemption: Offers a partial or full exemption from property taxes for eligible veterans and their spouses.

- Tax Deferral Programs: Allows eligible homeowners to defer their property taxes, providing short-term financial relief.

- Local Tax Relief Programs: Some counties and municipalities have their own tax relief programs, so it's important for homeowners to explore these options as well.

Homeowners should research and understand the specific requirements and benefits of each program to determine their eligibility and make the most of the available tax relief options.

Pennsylvania Property Tax: A Case Study

To better understand the practical implications of Pennsylvania’s property tax system, let’s consider a case study involving a fictional homeowner, Sarah, who recently purchased a home in the city of Philadelphia.

Sarah’s Property Tax Journey

Sarah, a young professional, purchased her first home in Philadelphia, a vibrant city with a diverse range of neighborhoods and property values. As a new homeowner, she was eager to understand her financial obligations, particularly regarding property taxes.

Upon receiving her assessment notice, Sarah discovered that her property had an assessed value of $250,000. The local tax rate in her neighborhood was 12 mills. Using the formula mentioned earlier, Sarah calculated her property tax liability as follows:

| Assessed Value | $250,000 |

|---|---|

| Tax Rate (in mills) | 12 |

| Tax Liability | $3,000 |

Initially, Sarah was surprised by the amount, as she had not fully considered the impact of property taxes on her monthly budget. However, she quickly learned about the various tax relief programs available in Pennsylvania.

Sarah discovered that she qualified for the Homestead/Farmstead Exemption due to her modest income and primary residence status. This exemption reduced her assessed value by 50%, resulting in a new assessed value of $125,000. With the reduced assessed value, her property tax liability decreased to $1,500.

Additionally, Sarah explored the Circuit Breaker Program and found that she was eligible for a refund of $750 based on her income and the percentage of income she paid in property taxes. This refund further eased the financial burden of her property taxes.

The Impact of Tax Relief

By taking advantage of the Homestead/Farmstead Exemption and the Circuit Breaker Program, Sarah was able to significantly reduce her property tax liability. The savings allowed her to budget more effectively and feel more financially secure in her new home.

Furthermore, Sarah's experience highlights the importance of understanding the property tax system and the available relief programs. By staying informed and proactive, homeowners like Sarah can navigate the tax landscape and make the most of the opportunities to ease their financial obligations.

The Future of Pennsylvania Property Taxes

As Pennsylvania continues to evolve, the property tax system is likely to undergo changes and reforms to adapt to the needs of homeowners and local governments. While the state has taken steps to provide tax relief and improve the assessment process, there are ongoing discussions and proposals aimed at further enhancing the system.

Proposed Reforms and Future Considerations

Some of the key areas of focus for future reforms in Pennsylvania’s property tax system include:

- Assessment Accuracy: Improving the accuracy and fairness of property assessments to ensure that homeowners are not overburdened with excessive tax liabilities.

- Tax Relief Expansion: Expanding tax relief programs to reach a broader range of homeowners, especially those with lower incomes or specific circumstances, such as seniors or veterans.

- Simplification of the System: Streamlining the tax calculation process and providing clearer guidelines to reduce confusion and administrative burdens for homeowners and local authorities.

- Online Services and Transparency: Enhancing online platforms and transparency measures to provide homeowners with easy access to information, tax records, and assessment details.

- Revenue Generation and Equity: Balancing the need for revenue generation with equitable tax distribution to ensure that property taxes are fair and do not disproportionately impact certain communities.

While these reforms are in various stages of discussion and implementation, they highlight the state's commitment to improving the property tax system and ensuring it remains fair and sustainable for all stakeholders.

The Role of Technology

Technology is expected to play a significant role in shaping the future of Pennsylvania’s property tax system. Online platforms and digital tools can enhance the efficiency and accessibility of tax-related services, allowing homeowners to manage their tax obligations more conveniently.

For instance, homeowners may be able to file tax returns, appeal assessments, and access relevant information through secure online portals. This digital transformation can reduce paperwork, speed up processes, and provide a more transparent and user-friendly experience for taxpayers.

Frequently Asked Questions

How often are property assessments conducted in Pennsylvania?

+Property assessments in Pennsylvania are typically conducted every few years, although the frequency may vary by county. Some counties may assess properties annually, while others may do so less frequently. Homeowners should consult their local tax assessor’s office for specific information regarding assessment cycles in their area.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Yes, homeowners in Pennsylvania have the right to appeal their property assessments if they believe the assessed value is inaccurate or unfair. The appeal process involves submitting an application, providing supporting evidence, and potentially attending a hearing. It’s advisable to seek guidance from the local tax assessor’s office or legal professionals for a successful appeal.

Are there any income-based tax relief programs for homeowners in Pennsylvania?

+Absolutely! Pennsylvania offers income-based tax relief programs such as the Circuit Breaker Program and the Homestead/Farmstead Exemption. These programs provide discounts, refunds, or exemptions to eligible homeowners based on their income levels and property tax obligations. It’s essential to review the specific requirements and guidelines for each program to determine eligibility.

How can I stay informed about changes to Pennsylvania’s property tax system and relief programs?

+Staying informed about property tax changes and relief programs is crucial for homeowners. They can subscribe to newsletters or updates from their local tax assessor’s office or county government websites. Additionally, local media outlets and community organizations often provide valuable information and updates on tax-related matters.

What happens if I fail to pay my property taxes in Pennsylvania?

+Failure to pay property taxes in Pennsylvania can result in significant consequences. Local taxing authorities may impose penalties, interest, and fees for late or non-payment. In severe cases, the taxing authority may initiate a tax sale process, which could lead to the loss of ownership rights over the property. Homeowners should prioritize paying their property taxes to avoid such adverse outcomes.