Az Tax Return

The Arizona (AZ) Tax Return is an essential process for residents and businesses operating within the state, ensuring compliance with state tax regulations. This comprehensive guide will delve into the intricacies of the AZ Tax Return, offering an expert-level analysis to help navigate this critical financial obligation.

Understanding the AZ Tax Return

The AZ Tax Return is an annual filing requirement for individuals and entities earning income or conducting business activities within Arizona. It involves reporting income, deductions, credits, and other financial information to the Arizona Department of Revenue (ADOR) to calculate and pay the appropriate state taxes.

For individuals, the AZ Tax Return includes federal adjusted gross income (AGI), deductions, and credits specific to Arizona, such as the homeowner's exemption or the property tax credit. Businesses, on the other hand, must report their business income, expenses, and any applicable taxes, including transaction privilege tax (TPT) and use tax.

Tax Forms and Schedules

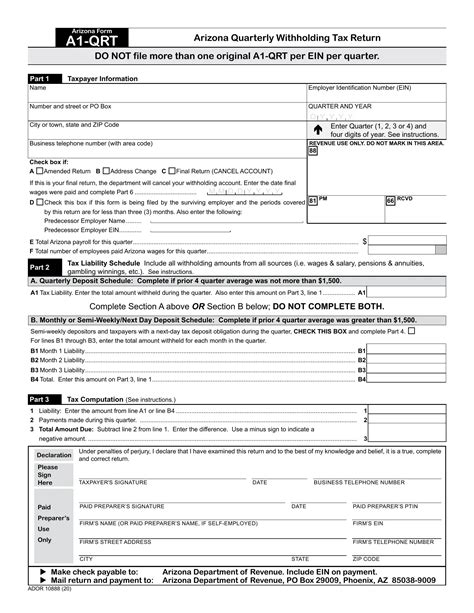

The specific tax forms and schedules required for the AZ Tax Return depend on the filer’s income source, business structure, and tax obligations. Here’s an overview of some common forms:

- Form 140: Individual Income Tax Return - Used by individuals to report personal income and claim deductions and credits.

- Form 167: Business Income Tax Return - Designed for businesses to report income, expenses, and taxes.

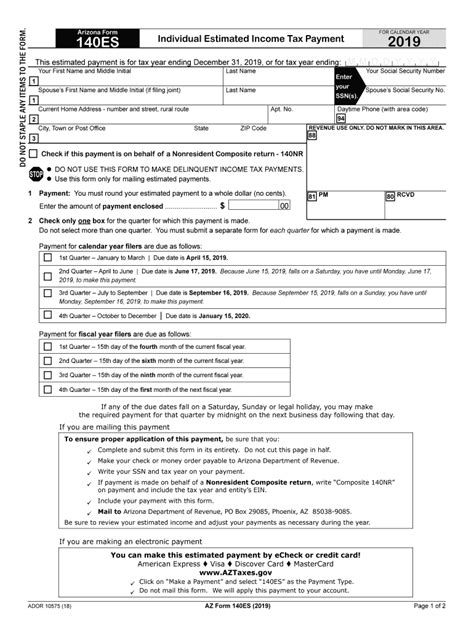

- Form 140ES: Estimated Tax Payment Voucher - Required for individuals and businesses to make quarterly estimated tax payments.

- Schedule P: Property Tax Refund - Used to claim the property tax refund for eligible homeowners.

- Schedule T: Transaction Privilege and Use Tax - Businesses use this schedule to report and calculate TPT and use tax.

Other forms and schedules may be necessary depending on the filer's unique circumstances, such as Schedule A for additional income sources or Schedule K for partnership income.

Filing Deadlines and Payment Options

The AZ Tax Return has specific filing deadlines, which are typically aligned with the federal tax deadlines. For individuals, the standard deadline is April 15th, but this can be extended to October 15th if necessary. Businesses, on the other hand, have varying deadlines depending on their entity type and tax year.

When it comes to payment options, taxpayers have several choices. They can pay by check, money order, or electronic funds transfer (EFT) through the ADOR's online payment system. Additionally, taxpayers can choose to pay using a credit or debit card, although a convenience fee applies.

Estimated Tax Payments

For individuals and businesses with significant income fluctuations or tax liabilities, estimated tax payments are required to ensure sufficient funds are remitted throughout the year. These payments are due quarterly and help taxpayers avoid penalties for underpayment of taxes.

Estimated tax payments are calculated based on the taxpayer's expected income, deductions, and credits for the current year. The ADOR provides resources and worksheets to assist taxpayers in determining their estimated tax liability.

Deductions and Credits in Arizona

Arizona offers various deductions and credits to help reduce the tax burden for individuals and businesses. Understanding these deductions and credits is crucial for optimizing the AZ Tax Return.

Individual Deductions and Credits

Individuals can take advantage of several deductions and credits, including:

- Standard Deduction - A set amount that taxpayers can deduct from their taxable income. The standard deduction varies based on filing status.

- Itemized Deductions - Includes expenses such as mortgage interest, medical expenses, charitable contributions, and state and local taxes.

- Homeowner's Exemption - A credit for eligible homeowners that reduces their property taxes.

- Property Tax Credit - Provides a credit for homeowners based on their property taxes paid during the tax year.

- Dependent Care Credit - Offers a credit for childcare expenses incurred while the taxpayer works or attends school.

Business Deductions and Credits

Businesses have access to a range of deductions and credits, including:

- Business Expenses - Various business-related expenses can be deducted, such as rent, utilities, salaries, and marketing costs.

- Depreciation - Allows businesses to recover the cost of assets over their useful life.

- Research and Development Credit - Provides a credit for businesses engaged in research and development activities.

- Job Creation Tax Credit - Encourages businesses to create new jobs by offering a credit for eligible hires.

- Enterprise Zone Tax Credit - Offers a credit for businesses operating in designated enterprise zones to promote economic development.

Tax Refunds and Adjustments

Taxpayers who overpay their taxes are entitled to a refund. The ADOR processes tax refunds throughout the year, with the majority issued within 21 days of filing.

Tax Refund Options

Taxpayers can choose to receive their refund via direct deposit or by check. Direct deposit is the fastest and most secure method, as it eliminates the risk of a lost or stolen check. The ADOR provides taxpayers with the option to split their refund, allowing them to deposit a portion into a bank account and receive the remainder as a check.

Amended Returns and Adjustments

In certain situations, taxpayers may need to file an amended return to correct errors or make adjustments to their original return. This could be due to missing information, overlooked deductions or credits, or changes in financial circumstances.

The process for filing an amended return involves completing Form 140X and attaching any necessary supporting documentation. Taxpayers should carefully review their amended return to ensure accuracy and avoid further complications.

Taxpayer Assistance and Resources

The ADOR provides extensive resources and assistance to taxpayers, ensuring they have the support they need to navigate the AZ Tax Return process effectively.

Online Resources and Tools

The ADOR’s website offers a wealth of information, including tax forms, instructions, and publications. Taxpayers can access interactive tools and calculators to estimate their tax liability, determine estimated tax payments, and calculate refunds.

Additionally, the ADOR provides online services such as My Account, which allows taxpayers to manage their tax obligations, view account information, and make payments securely online.

Taxpayer Assistance Centers

For taxpayers who prefer in-person assistance, the ADOR operates Taxpayer Assistance Centers (TACs) across the state. TACs provide face-to-face support, offering guidance on tax forms, deductions, and credits. Taxpayers can schedule appointments to receive personalized assistance from knowledgeable tax professionals.

Voluntary Tax Preparation Programs

Arizona recognizes the importance of accurate tax preparation and offers voluntary tax preparation programs to assist taxpayers. These programs provide free tax preparation services to eligible individuals and families, ensuring they receive the deductions and credits they deserve.

Conclusion

The AZ Tax Return is a critical obligation for residents and businesses in Arizona. By understanding the filing requirements, deadlines, payment options, deductions, and credits, taxpayers can ensure compliance and optimize their tax liability. With the support of the ADOR’s resources and assistance programs, navigating the AZ Tax Return process becomes more manageable and less daunting.

When is the deadline for filing the AZ Tax Return for individuals?

+The standard deadline for individuals to file their AZ Tax Return is April 15th. However, this deadline can be extended to October 15th if necessary.

What forms are required for businesses to file their AZ Tax Return?

+Businesses typically use Form 167 to report their business income and expenses. However, the specific forms required depend on the business structure and tax obligations.

How can I estimate my AZ tax liability before filing my return?

+The ADOR provides online tools and calculators to help taxpayers estimate their tax liability. These resources consider income, deductions, and credits to provide an accurate estimate.

What happens if I miss the AZ Tax Return deadline?

+Missing the AZ Tax Return deadline can result in penalties and interest charges. It’s important to file your return as soon as possible to avoid these additional costs.

Can I file my AZ Tax Return electronically?

+Yes, taxpayers have the option to file their AZ Tax Return electronically through the ADOR’s website. This method is secure, efficient, and reduces the risk of errors.