Putnam County Tax Collector

The Putnam County Tax Collector's office plays a vital role in the financial administration and governance of Putnam County, Florida. It serves as the central hub for various tax-related services and functions, impacting the lives of residents and businesses within the county. This article delves into the workings of the Putnam County Tax Collector, exploring its responsibilities, services, and significance within the local community.

A Vital Administrative Body: The Putnam County Tax Collector

The Putnam County Tax Collector’s office is an essential governmental entity, tasked with efficiently managing and collecting various taxes and fees. These taxes include property taxes, vehicle registration fees, and other revenue sources mandated by the state and county regulations. The office acts as a critical liaison between the county government and its citizens, facilitating compliance with tax laws and ensuring the smooth functioning of the local economy.

Key Responsibilities and Services

The Putnam County Tax Collector’s responsibilities encompass a broad range of services vital to the county’s financial and administrative landscape.

- Property Tax Assessment and Collection: The tax collector’s office is responsible for assessing property taxes based on the appraised value of properties within the county. It sends out tax bills, collects payments, and provides assistance to homeowners and businesses in understanding their tax obligations.

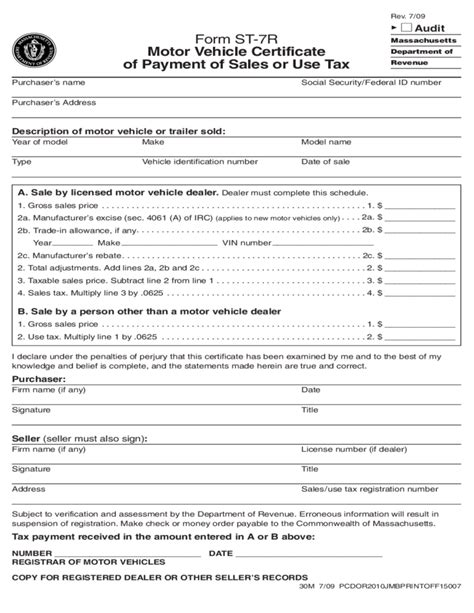

- Vehicle Registration and Titling: Residents and businesses turn to the tax collector’s office for vehicle registration, titling, and related services. This includes issuing new registrations, renewing existing ones, and handling title transfers. The office ensures compliance with state vehicle regulations and collects associated fees.

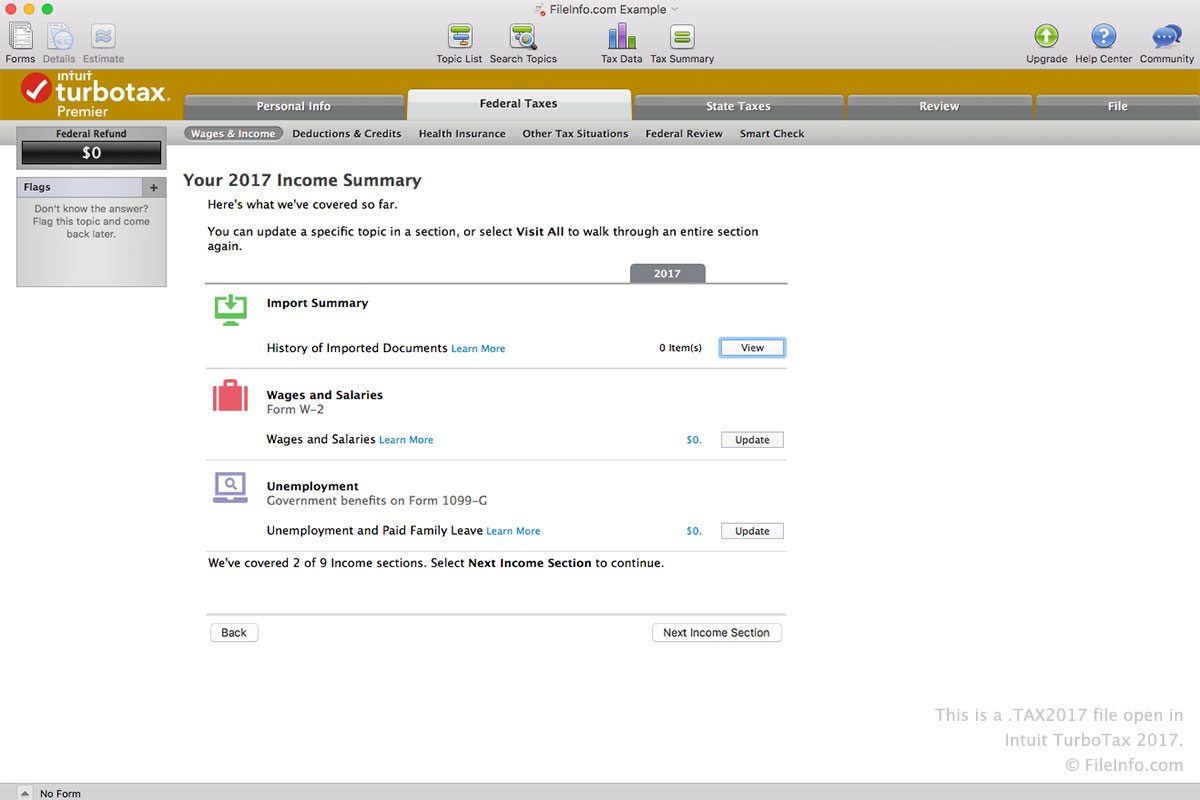

- Tax Payment Options and Assistance: The tax collector’s office offers various payment methods, including online payments, e-checks, credit/debit cards, and in-person payments at designated locations. It also provides assistance to taxpayers facing financial difficulties, offering payment plans or other solutions to ensure timely tax payments.

- License Plate and Decal Services: In addition to vehicle registration, the office issues and replaces license plates and decals. This service ensures that vehicles remain compliant with registration requirements and are easily identifiable on the road.

- Business Tax Receipts: For businesses operating within Putnam County, the tax collector’s office issues business tax receipts, which are required for legal operation. The office guides businesses through the application process and ensures they comply with local business tax regulations.

- Specialty License Plates: The office also offers a range of specialty license plates, allowing residents to personalize their vehicles and support specific causes or organizations. Proceeds from these plates often benefit charitable initiatives or specific causes.

- Notary Public Services: The tax collector’s office provides notary public services, a vital administrative function for legal documents. This service is accessible to both individuals and businesses, ensuring the authenticity and legality of important paperwork.

| Service | Description |

|---|---|

| Property Tax Assessment | Accurate property valuation and tax assessment for homeowners and businesses. |

| Vehicle Registration | Registration, titling, and renewal services for vehicles. |

| Tax Payment Options | Diverse payment methods and assistance for taxpayers. |

| License Plate Services | Issuance and replacement of license plates and decals. |

| Business Tax Receipts | Issuance of business tax receipts for legal operation. |

| Specialty License Plates | Offer personalized license plates with proceeds benefiting specific causes. |

| Notary Public Services | Authenticating legal documents through notary public services. |

Performance and Efficiency: A Critical Analysis

The Putnam County Tax Collector’s office is known for its efficiency and dedication to serving the community. It employs a well-structured system to manage tax assessments, collections, and various services. The office leverages technology to streamline processes, making tax payments and other services more accessible to residents and businesses.

One of the key strengths of the Putnam County Tax Collector is its commitment to transparency. The office provides detailed information on tax rates, assessment procedures, and due dates on its official website. This transparency builds trust and ensures that taxpayers are well-informed about their obligations.

Moreover, the tax collector’s office actively engages with the community through various outreach programs and initiatives. It participates in local events, conducts educational workshops, and maintains an open-door policy, encouraging taxpayers to seek assistance or clarify doubts.

Community Impact and Future Initiatives

The Putnam County Tax Collector’s office has a significant impact on the local community. Beyond its administrative responsibilities, the office often collaborates with local charities and organizations, contributing to community development and welfare. Proceeds from specialty license plates, for instance, have funded various initiatives, supporting education, healthcare, and environmental conservation efforts within the county.

Looking ahead, the Putnam County Tax Collector aims to further enhance its services through technological advancements. The office plans to introduce more online services, making tax-related transactions even more convenient and efficient. Additionally, it is working towards integrating advanced data analytics to improve tax assessment accuracy and enhance overall operational efficiency.

The Putnam County Tax Collector’s office, through its dedicated services and community engagement, plays a pivotal role in the financial health and well-being of the county. Its efforts not only ensure compliance with tax laws but also contribute to the overall development and prosperity of the local community.

FAQs

What are the office hours for the Putnam County Tax Collector’s office?

+The office is open from 8:30 a.m. to 4:30 p.m., Monday through Friday, excluding public holidays. For specific details, it’s recommended to check the official website or contact the office directly.

How can I pay my property taxes in Putnam County?

+There are several payment options available. You can pay online through the official website, by mail, or in person at the tax collector’s office. The office also offers e-check and credit/debit card payment options.

What happens if I miss the property tax deadline in Putnam County?

+Late payments are subject to penalties and interest. It’s essential to pay your taxes on time to avoid additional fees. The tax collector’s office can provide guidance on payment plans or other options if you’re facing financial difficulties.

How often do vehicle registrations need to be renewed in Putnam County?

+Vehicle registrations typically need to be renewed annually. The specific renewal date is based on the month your vehicle was first registered. The tax collector’s office will send a renewal notice to your registered address, reminding you of the upcoming deadline.

Can I get a specialty license plate in Putnam County?

+Absolutely! Putnam County offers a range of specialty license plates, each supporting a specific cause or organization. You can choose from various designs and themes, and your purchase helps fund important initiatives in the county.