Sales Tax In California 2025

California's sales tax system is an integral part of the state's revenue generation and has a significant impact on businesses and consumers alike. As we approach 2025, it is crucial to understand the current landscape and future trends in sales tax regulations to navigate the complex tax environment effectively. This comprehensive guide will delve into the specifics of California's sales tax, exploring the latest rates, rules, and potential changes on the horizon.

Understanding California's Sales Tax Landscape in 2025

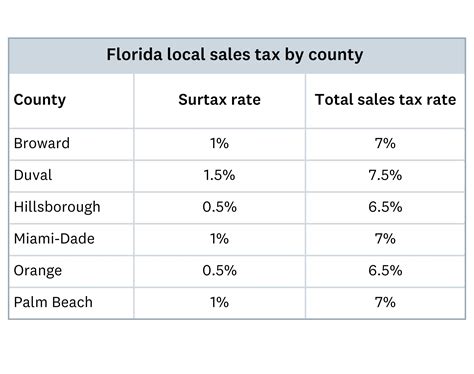

As of January 1, 2025, California's statewide sales and use tax rate stands at 7.25%, which is applicable to most tangible personal property and certain services. However, it is essential to note that this is just the base rate, and local jurisdictions may impose additional sales taxes, leading to varying effective tax rates across the state.

Local Sales Tax Rates

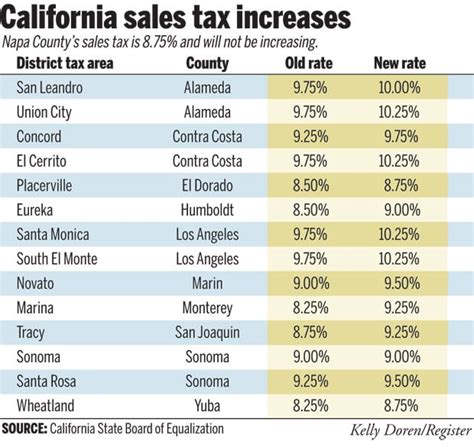

California is unique in its local sales tax structure, with cities, counties, and districts levying their own supplemental sales taxes. These local rates can significantly impact the total sales tax burden for businesses and consumers. As of our last update, here are some examples of local sales tax rates in different regions:

| City/County | Sales Tax Rate |

|---|---|

| Los Angeles County | 9.25% |

| San Francisco | 8.75% |

| San Diego | 8.00% |

| Orange County | 7.75% |

| Sacramento County | 8.50% |

These rates are subject to change, and it is crucial for businesses to stay updated on the specific rates applicable to their locations. The California State Board of Equalization provides an interactive map and a comprehensive database to help businesses and individuals understand the sales tax rates in their areas.

Sales Tax Registration and Compliance

Any business selling taxable goods or services in California is required to register with the California Department of Tax and Fee Administration (CDTFA) and obtain a seller's permit. This permit allows the business to collect and remit sales tax to the state. Failure to register and comply with sales tax regulations can result in significant penalties and legal consequences.

The CDTFA provides resources and guidance to help businesses understand their sales tax obligations. This includes information on when to register, how to calculate sales tax, and the proper methods for reporting and remitting taxes.

Sales Tax Exemption and Special Considerations

California's sales tax regulations also include exemptions and special considerations for certain goods, services, and entities. For instance, certain foods, prescription medications, and some agricultural equipment are exempt from sales tax. Additionally, nonprofit organizations and governmental entities often qualify for sales tax exemptions.

It is crucial for businesses to understand these exemptions and ensure they are correctly applying them to their sales transactions. Misapplication of exemptions can lead to tax liabilities and potential audits.

Future Outlook: Sales Tax Trends and Potential Changes

Looking ahead to 2025 and beyond, several trends and potential changes in California's sales tax landscape are worth noting:

Online Sales Tax Collection

With the increasing prevalence of e-commerce, the collection of sales tax on online transactions has become a critical issue. California has been at the forefront of implementing laws to ensure online retailers collect and remit sales tax on transactions with California-based customers. As of 2025, the Marketplace Facilitator Law continues to require online marketplaces and third-party sellers to collect and remit sales tax on behalf of their vendors.

Sales Tax Simplification Efforts

California's sales tax system is often criticized for its complexity, especially with the multitude of local tax rates. In response, the state has made efforts to simplify the system, such as the Small Business Sales Tax Simplification Act, which provides a sales tax rate cap for small businesses based on their annual sales. This act, while a step towards simplification, still requires careful monitoring as businesses grow.

Potential Tax Rate Changes

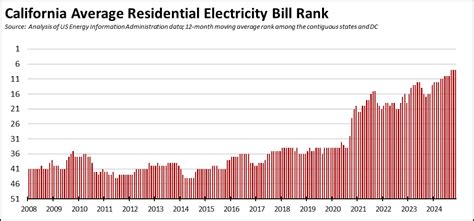

Sales tax rates in California are subject to change, often influenced by economic conditions and legislative decisions. While it is challenging to predict exact rate changes, it is essential for businesses to stay informed about any proposed or upcoming alterations. Monitoring local news, industry publications, and official state websites can help businesses stay updated on potential tax rate shifts.

Expanding Sales Tax Base

California has been exploring ways to broaden the sales tax base to generate additional revenue. This could include taxing additional services or reconsidering exemptions for certain goods. While these changes may impact businesses, they can also provide opportunities for increased revenue and better tax compliance.

Expert Insights and Recommendations

As an industry expert, here are some key insights and recommendations for businesses operating in California's sales tax environment:

- Stay Informed: The sales tax landscape in California is dynamic, so it is crucial to regularly update your knowledge of sales tax rates, rules, and exemptions. Utilize resources provided by the CDTFA and industry associations to stay ahead of any changes.

- Automate Compliance: Consider utilizing sales tax automation software to simplify the process of calculating, collecting, and remitting sales tax. This can reduce the risk of errors and free up resources for other business operations.

- Review Exemption Claims: Ensure that your business is correctly applying sales tax exemptions. Misapplication of exemptions can lead to costly errors and audits. Regularly review your sales tax processes to maintain compliance.

- Plan for Growth: If your business is expanding or considering expansion, be mindful of potential changes in sales tax rates and obligations. Plan your financial strategies with an eye on the evolving tax landscape to avoid unexpected liabilities.

By staying informed, compliant, and proactive, businesses can navigate California's sales tax system effectively and contribute to the state's economic growth while minimizing tax-related challenges.

Frequently Asked Questions

What is the current statewide sales tax rate in California?

+

The statewide sales and use tax rate in California is currently set at 7.25% as of January 1, 2025.

Are there any local sales tax rates in addition to the statewide rate?

+

Yes, California allows local jurisdictions such as cities, counties, and districts to levy supplemental sales taxes. These local rates can vary significantly, resulting in different effective tax rates across the state.

How can I stay updated on the latest sales tax rates and regulations in California?

+

You can stay informed by regularly checking the California Department of Tax and Fee Administration’s website, which provides updates on sales tax rates and regulations. Additionally, industry publications and local news sources can provide valuable insights into potential changes.

What are some common sales tax exemptions in California?

+

Common sales tax exemptions in California include certain foods, prescription medications, and agricultural equipment. Nonprofit organizations and governmental entities often qualify for sales tax exemptions as well.

How can I ensure my business remains compliant with California’s sales tax regulations?

+

To ensure compliance, register with the California Department of Tax and Fee Administration and obtain a seller’s permit. Utilize sales tax automation software to simplify the process, and regularly review your sales tax processes to stay updated on changing regulations.