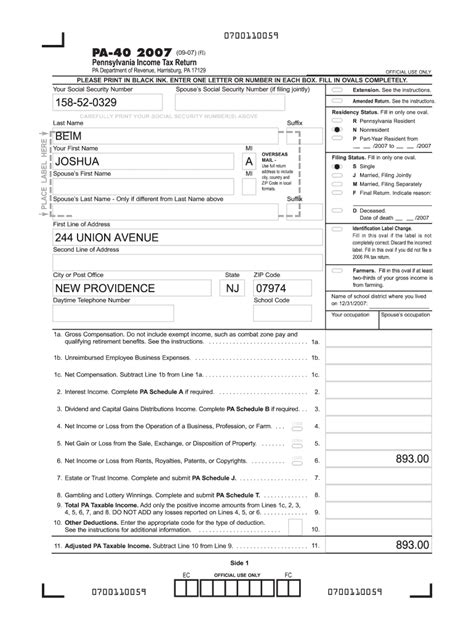

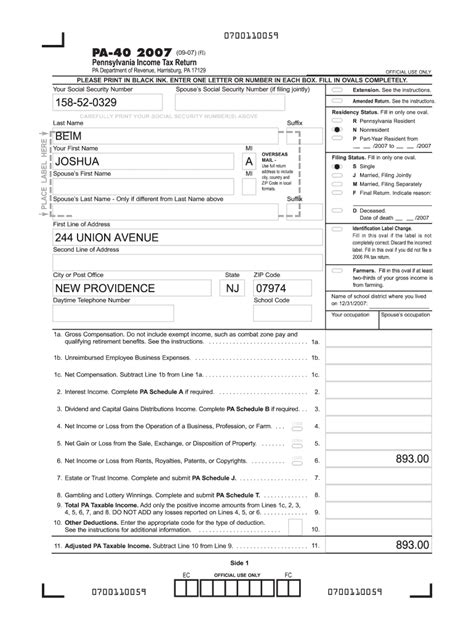

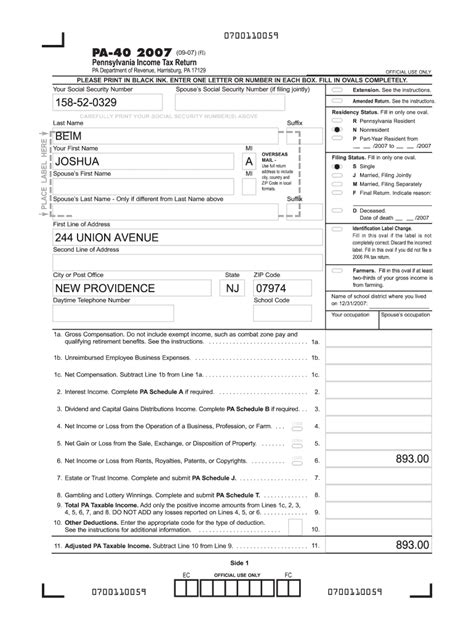

Pa 40 Tax Form

The PA-40 Tax Form is an essential document for Pennsylvania residents and businesses, playing a crucial role in the state's revenue collection and financial management. This form, officially known as the Pennsylvania Personal Income Tax Return, is a comprehensive tool that allows individuals and entities to report their income and calculate their tax liabilities accurately.

In this article, we will delve into the intricacies of the PA-40 Tax Form, exploring its purpose, key components, and the impact it has on the financial landscape of Pennsylvania. By understanding this form and its implications, taxpayers can navigate the tax filing process with confidence and ensure compliance with state regulations.

Understanding the PA-40 Tax Form

The PA-40 Tax Form is a mandated annual requirement for Pennsylvania residents and businesses to report their income and pay the corresponding taxes. It serves as a critical tool for the state to assess and collect taxes, ensuring the smooth functioning of various public services and infrastructure projects.

The form itself is a multi-page document, designed to capture a wide range of income sources and deductions. It is structured to accommodate the diverse financial situations of taxpayers, from those with simple tax profiles to complex business entities with multiple income streams.

Key Components of the PA-40

The PA-40 Tax Form is divided into several sections, each catering to specific aspects of a taxpayer’s financial life.

- Personal Information: This section requires basic details such as name, address, and taxpayer identification information. It is crucial to ensure accuracy to avoid processing delays.

- Income Reporting: The heart of the form lies in the income reporting section. Here, taxpayers list their various income sources, including wages, salaries, dividends, interest, and business income. Each income type has its own set of guidelines for reporting.

- Deductions and Credits: Taxpayers can reduce their tax liabilities by claiming eligible deductions and credits. The PA-40 provides a dedicated section for claiming deductions, such as student loan interest, medical expenses, and charitable contributions. Additionally, it includes provisions for claiming various tax credits, including the Earned Income Tax Credit and the Child and Dependent Care Credit.

- Calculations and Tax Payment: Once all income and deductions are reported, the form guides taxpayers through the process of calculating their tax liability. This section includes worksheets and tables to determine the correct tax amount. Taxpayers then remit the calculated amount along with their tax return.

The PA-40 Tax Form is a complex document, but it is designed to be user-friendly and accessible. The Pennsylvania Department of Revenue provides extensive resources and guidance to assist taxpayers in completing the form accurately.

Filing the PA-40: A Step-by-Step Guide

Filing the PA-40 Tax Form is a straightforward process when approached systematically. Here’s a step-by-step guide to help taxpayers navigate this crucial task:

- Gather Your Documents: Before starting, collect all relevant financial documents, including W-2 forms, 1099 forms, bank statements, and records of any other income sources. Ensure you have a clear understanding of your income for the tax year.

- Obtain the PA-40 Form: You can download the latest version of the PA-40 Tax Form from the Pennsylvania Department of Revenue's official website. Alternatively, you can request a paper copy by mail or pick one up at a local tax assistance center.

- Complete the Personal Information Section: Start by filling out your personal details accurately. This includes your name, address, Social Security Number (SSN), and taxpayer identification information.

- Report Your Income: Move on to the income reporting section. List all your income sources, such as wages, salaries, business income, rental income, and any other taxable income. Be sure to reference the relevant instructions and guidelines for each income type.

- Claim Deductions and Credits: Review your financial records to identify eligible deductions and credits. The PA-40 provides a comprehensive list of deductions and credits that you may be entitled to. Claim these deductions to reduce your taxable income and potential tax liability.

- Calculate Your Tax Liability: Using the provided worksheets and tables, calculate your total tax liability. This involves adding up your taxable income, subtracting deductions, and applying any applicable credits. The resulting amount is the tax you owe to the state of Pennsylvania.

- Remit Your Payment: Along with your completed PA-40 form, you must remit the calculated tax amount. You can pay by check, money order, or electronic payment methods. Ensure you include the correct payment information and reference number on your payment.

- Review and Sign: Before submitting your tax return, carefully review all the information for accuracy. Once satisfied, sign and date the form. If you are filing jointly with a spouse, both of you must sign the form.

- Submit Your Return: Finally, submit your completed PA-40 form and payment to the Pennsylvania Department of Revenue. You can mail the return or use the department's secure online filing system. Keep a copy of your return for your records.

Filing the PA-40 Tax Form accurately and on time is crucial to avoid penalties and ensure a smooth tax-filing experience. By following this step-by-step guide, taxpayers can navigate the process with confidence and meet their tax obligations efficiently.

PA-40 Tax Form: A Pillar of Pennsylvania’s Financial System

The PA-40 Tax Form is more than just a legal requirement; it is a vital component of Pennsylvania’s financial ecosystem. By filing this form, taxpayers contribute to the state’s revenue stream, which, in turn, supports essential public services and infrastructure development.

The revenue collected through the PA-40 Tax Form is directed towards various critical areas, including education, healthcare, public safety, and transportation. It also plays a role in funding social programs that benefit Pennsylvania's residents, such as assistance for low-income families and support for senior citizens.

Beyond its financial implications, the PA-40 Tax Form serves as a tool for economic analysis and planning. It provides valuable data to policymakers, allowing them to make informed decisions about budget allocations and tax policies. This data-driven approach ensures that Pennsylvania's resources are allocated efficiently and effectively.

Impact on Individuals and Businesses

For individuals, the PA-40 Tax Form is an opportunity to fulfill their civic duty and contribute to the state’s prosperity. It also provides a platform for taxpayers to claim deductions and credits, reducing their tax burden and improving their financial well-being.

Businesses, too, play a significant role in the PA-40 process. By accurately reporting their income and paying their taxes, businesses contribute to the state's economic growth and stability. Moreover, the PA-40 Tax Form allows businesses to claim deductions and credits specific to their operations, helping them manage their tax liabilities effectively.

In summary, the PA-40 Tax Form is a cornerstone of Pennsylvania's financial system, serving as a bridge between taxpayers and the state's fiscal needs. Its impact extends beyond revenue collection, influencing the state's economic landscape and the lives of its residents.

Future Implications and Technological Advances

As technology continues to evolve, the future of tax filing, including the PA-40 Tax Form, holds exciting possibilities. The Pennsylvania Department of Revenue is committed to embracing digital innovations to enhance the tax filing experience for taxpayers.

One of the key areas of focus is streamlining the filing process through the use of online platforms. The department aims to make the PA-40 Tax Form more accessible and user-friendly by offering digital tools and resources. This includes online filing options, real-time assistance, and the ability to save and resume tax returns.

Additionally, the department is exploring the integration of artificial intelligence and machine learning technologies to automate certain aspects of tax filing. These advancements could simplify the process, reduce errors, and provide taxpayers with real-time guidance and feedback.

Looking ahead, the PA-40 Tax Form is expected to become even more efficient and secure, ensuring a seamless tax filing experience for Pennsylvania residents and businesses. These technological advancements not only improve convenience but also enhance data security and privacy, protecting taxpayer information.

The Role of Tax Professionals

While technological advancements aim to make the tax filing process more accessible, the role of tax professionals remains invaluable. Tax advisors, accountants, and legal experts play a crucial role in guiding taxpayers through complex tax scenarios and ensuring compliance with state regulations.

For taxpayers with unique financial circumstances, such as business owners, investors, or those with complex investment portfolios, tax professionals offer specialized knowledge and expertise. They can provide tailored advice, helping taxpayers optimize their tax strategies and navigate potential pitfalls.

Furthermore, tax professionals can assist in resolving tax-related issues, representing taxpayers in audits, and advocating for their rights and interests. Their expertise is particularly beneficial in cases where taxpayers face complex tax situations or have historical tax issues to address.

In conclusion, while technology enhances the tax filing experience, the human element remains essential. Tax professionals bring a depth of knowledge and personalized attention that cannot be replicated by digital tools alone.

FAQs

What is the PA-40 Tax Form, and who needs to file it?

+The PA-40 Tax Form is the official Pennsylvania Personal Income Tax Return. It is a mandatory filing for all Pennsylvania residents and businesses with taxable income. Whether you are an individual, a sole proprietor, or a corporation, if you have income sourced from Pennsylvania, you are typically required to file the PA-40.

When is the deadline for filing the PA-40 Tax Form?

+The deadline for filing the PA-40 Tax Form is typically aligned with the federal tax deadline, which is April 15th. However, it’s essential to check the official Pennsylvania Department of Revenue website for any updates or changes to the deadline, especially in light of potential tax law amendments or special circumstances.

Can I file the PA-40 Tax Form electronically, and what are the benefits of doing so?

+Yes, you can file the PA-40 Tax Form electronically through the Pennsylvania Department of Revenue’s secure online filing system. Electronic filing offers several advantages, including real-time error detection, faster processing, and the ability to track the status of your return. It also reduces the risk of errors and delays associated with traditional paper filing.

What happens if I miss the PA-40 Tax Form filing deadline, and are there any penalties for late filing?

+If you miss the filing deadline for the PA-40 Tax Form, you may be subject to late filing penalties and interest charges. The specific penalties can vary based on the amount of tax owed and the length of the delay. It is advisable to file your return as soon as possible to minimize penalties and maintain compliance with state regulations.

Are there any deductions or credits I should be aware of when filing the PA-40 Tax Form, and how do I claim them?

+Yes, there are various deductions and credits available to Pennsylvania taxpayers, which can reduce their tax liabilities. These include deductions for medical expenses, charitable contributions, and student loan interest. To claim these deductions, you must meet specific eligibility criteria and provide supporting documentation. The PA-40 Tax Form includes a dedicated section for claiming deductions and credits, and the Pennsylvania Department of Revenue provides detailed instructions and guidelines.