Santa Rosa County Fl Tax Collector

The Santa Rosa County Tax Collector's Office is an integral part of the county's administration, serving as a vital link between the residents and the local government. This office plays a crucial role in managing various financial transactions and services, ensuring the efficient collection of taxes and providing essential support to the community. With a dedicated team and a commitment to transparency, the Santa Rosa County Tax Collector's Office strives to make tax-related processes accessible and straightforward for all residents.

A Comprehensive Guide to the Santa Rosa County Tax Collector’s Office

In this comprehensive guide, we will delve into the various aspects of the Santa Rosa County Tax Collector’s Office, exploring its services, responsibilities, and the impact it has on the local community. From tax payments to vehicle registrations, we will uncover the key functions and initiatives undertaken by this essential governmental department.

Services and Responsibilities

The Santa Rosa County Tax Collector’s Office is tasked with a diverse range of responsibilities, each crucial to the smooth functioning of the county’s financial ecosystem. These responsibilities include:

Tax Collection and Payment Processing

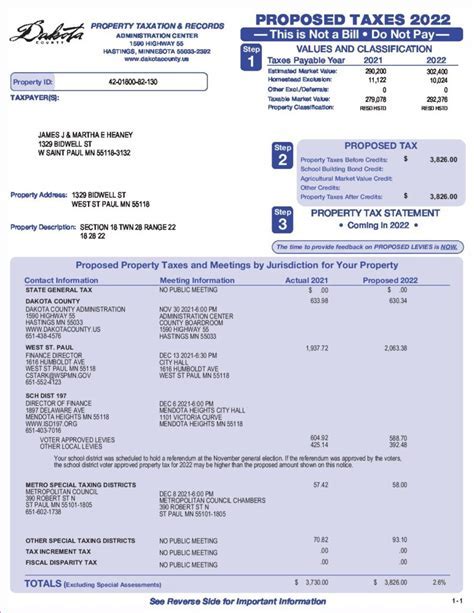

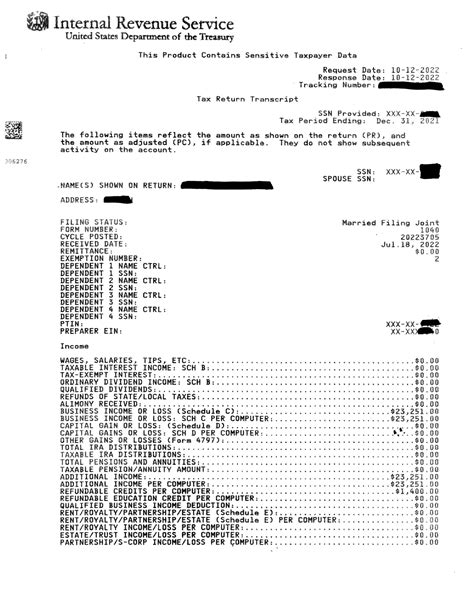

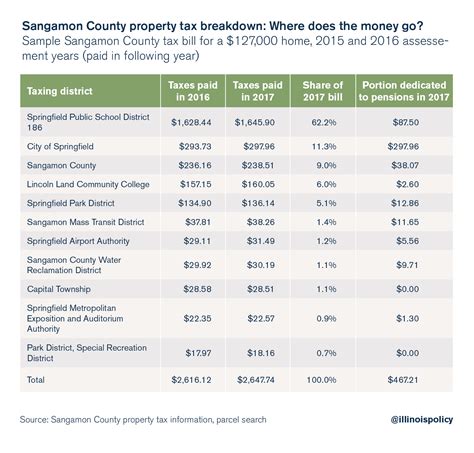

At the heart of the Tax Collector’s Office lies the critical function of tax collection. The office is responsible for collecting various taxes, including property taxes, tangible personal property taxes, and various other county, city, and district taxes. The team ensures that tax payments are processed efficiently and securely, providing multiple payment options to cater to the diverse needs of the community.

| Tax Type | Collection Period |

|---|---|

| Property Taxes | Due by March 31st annually |

| Tangible Personal Property Taxes | Due by April 1st annually |

| County, City, and District Taxes | Varies based on the specific tax |

To facilitate timely payments, the Tax Collector's Office offers a range of payment methods, including online payments, walk-in payments, and even a convenient drive-through service. The office also provides resources and assistance to taxpayers, ensuring they understand their obligations and can navigate the payment process seamlessly.

Vehicle Registrations and Titling

The Santa Rosa County Tax Collector’s Office is the go-to destination for all vehicle-related transactions. This includes vehicle registrations, title transfers, and the issuance of various vehicle-related documents. The office ensures that vehicle owners can complete these processes efficiently, maintaining the county’s vehicle records accurately and securely.

| Vehicle Service | Description |

|---|---|

| Vehicle Registration | New registrations, renewals, and changes of address |

| Title Transfers | Processing title transfers for bought or sold vehicles |

| Specialty Plates | Issuing and renewing specialty license plates |

With a user-friendly online system, residents can complete many vehicle-related transactions from the comfort of their homes. The Tax Collector's Office also provides in-person assistance for more complex or unique situations, ensuring a personalized approach to vehicle registration and titling.

Driver License and Identification Services

Beyond tax collection and vehicle services, the Tax Collector’s Office also serves as a designated Department of Highway Safety and Motor Vehicles office, offering a range of driver license and identification services. This includes driver license renewals, replacements, and the issuance of Florida identification cards.

| Driver License Service | Description |

|---|---|

| Driver License Renewal | Processing renewals for existing driver licenses |

| Replacement Driver License | Issuing replacements for lost or stolen licenses |

| Florida ID Card | Providing identification cards for non-drivers |

By offering these services, the Tax Collector's Office simplifies the process of obtaining and maintaining valid driver licenses and identification documents, contributing to the overall safety and efficiency of the county's transportation system.

Community Initiatives and Support

The Santa Rosa County Tax Collector’s Office is dedicated to supporting the community beyond its core responsibilities. This commitment is evident in various initiatives and programs aimed at enhancing the well-being and prosperity of the county’s residents.

Financial Assistance Programs

Recognizing the financial challenges that some residents face, the Tax Collector’s Office actively participates in and promotes financial assistance programs. These programs aim to provide relief to eligible taxpayers, helping them meet their tax obligations without undue hardship.

- Senior Homestead Exemption: This program offers a reduction in property taxes for eligible senior citizens, helping them manage their financial responsibilities and maintain their homes.

- Low-Income Tax Deferral: Aimed at low-income residents, this program allows for the deferral of certain taxes, providing much-needed financial breathing room during challenging times.

Community Outreach and Education

The Tax Collector’s Office understands the importance of community engagement and education. Through various outreach initiatives, the office strives to educate residents about their tax responsibilities, ensuring they have the knowledge and resources to navigate the tax system effectively.

- Tax Workshops: The office organizes regular workshops to provide residents with practical guidance on tax-related matters, from understanding tax notices to managing tax payments.

- Community Events: By participating in local events and festivals, the Tax Collector's Office creates opportunities to connect with residents, answer their queries, and promote the various services and resources available to them.

Environmental Initiatives

In its commitment to sustainability, the Tax Collector’s Office actively promotes and participates in environmental initiatives. These efforts not only contribute to the well-being of the county but also set an example for responsible governance.

- Electronic Waste Recycling: The office organizes e-waste recycling events, encouraging residents to responsibly dispose of electronic devices, reducing the environmental impact of electronic waste.

- Paperless Options: To minimize paper waste, the Tax Collector's Office actively promotes online services, providing residents with the option to receive and manage their tax documents electronically.

Conclusion: A Dedicated Team, Serving the Community

The Santa Rosa County Tax Collector’s Office stands as a pillar of support and efficiency in the community. Through its diverse range of services, the office ensures that residents can navigate their financial obligations and access essential government services with ease. With a commitment to transparency, accessibility, and community well-being, the Tax Collector’s Office continues to play a vital role in the county’s administration and development.

What are the office hours for the Santa Rosa County Tax Collector’s Office?

+

The Santa Rosa County Tax Collector’s Office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding official holidays. During these hours, residents can visit the office for assistance with tax payments, vehicle registrations, and other services.

How can I pay my property taxes in Santa Rosa County?

+

There are multiple ways to pay your property taxes in Santa Rosa County. You can pay online through the official website, visit the Tax Collector’s Office in person, or utilize the convenient drive-through payment option. The office also accepts payments by mail and offers a payment plan for eligible taxpayers.

What documents do I need for vehicle registration in Santa Rosa County?

+

To register your vehicle in Santa Rosa County, you will typically need your vehicle title, proof of insurance, and a valid identification document. If you are transferring a title, additional documents such as a bill of sale or odometer disclosure statement may be required. The Tax Collector’s Office can provide a detailed list of required documents based on your specific situation.