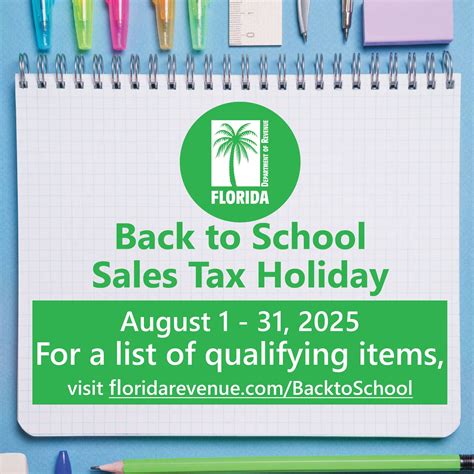

No Sales Tax Weekend Florida

The No Sales Tax Weekend in Florida is an exciting event that attracts shoppers and businesses alike, offering a unique opportunity to save on various items. This tax-free shopping extravaganza has become an annual tradition in the Sunshine State, providing a boost to the economy and a chance for consumers to stretch their dollars further. In this comprehensive guide, we delve into the intricacies of Florida's No Sales Tax Weekend, covering its history, the items eligible for tax exemption, and how it benefits both shoppers and the state's economy.

A Brief History of Florida’s No Sales Tax Weekend

Florida’s No Sales Tax Weekend, also known as the Back-to-School Sales Tax Holiday, was first introduced in 1998 as a way to ease the financial burden on families during the back-to-school season. The initiative was a collaborative effort between state legislators and education advocates, aiming to provide relief to parents and guardians as they prepared for the upcoming academic year.

Over the years, this event has evolved and expanded, with the tax-free period now covering a broader range of items beyond just school supplies. The state government recognizes the importance of this weekend, not only for its economic impact but also for the convenience it brings to residents, making essential purchases more affordable.

Eligible Items and Categories

Florida’s No Sales Tax Weekend applies to a wide array of items, ensuring that shoppers can find great deals on various products they need. Here’s a breakdown of the categories and specific items that are typically included in the tax exemption:

Clothing and Footwear

During this weekend, clothing and footwear items are exempt from sales tax, making it an excellent time to update your wardrobe or stock up on essentials. Whether you’re shopping for trendy fashion pieces, comfortable shoes, or durable work attire, you can save significantly.

| Category | Items |

|---|---|

| Clothing | Shirts, pants, dresses, jackets, and more |

| Footwear | Sneakers, sandals, boots, and formal shoes |

School Supplies

The event’s original focus remains a key part of the tax-free weekend. A wide range of school supplies are eligible for tax exemption, helping families save on essential items needed for the new school year.

| Category | Items |

|---|---|

| Writing Instruments | Pens, pencils, markers, and highlighters |

| Notebooks and Paper | Composition books, spiral notebooks, and printer paper |

| Backpacks and Bags | Book bags, lunch bags, and messenger bags |

| Art Supplies | Paint sets, crayons, scissors, and glue |

Computers and Technology

In today’s digital age, computers and technology play a vital role in education and daily life. Florida’s No Sales Tax Weekend includes a variety of tech-related items, making it an opportune time to upgrade your devices or invest in new technology.

| Category | Items |

|---|---|

| Laptops and Tablets | Various brands and models, including accessories |

| Printers and Scanners | Inkjet, laser, and all-in-one devices |

| Software | Educational software, productivity suites, and creative tools |

| Computer Accessories | Mice, keyboards, webcams, and storage devices |

Additional Eligible Items

Beyond the categories mentioned above, Florida’s No Sales Tax Weekend often includes other items that can vary from year to year. These may include:

- Sports equipment

- Books

- Certain types of furniture

- Musical instruments

- Bedding and linens

It's essential to check the official guidelines and announcements released by the Florida Department of Revenue to stay updated on the specific items and categories included in the tax exemption for each year's event.

Benefits for Shoppers and the State

Florida’s No Sales Tax Weekend offers a multitude of advantages for both shoppers and the state’s economy. Let’s explore some of the key benefits:

Financial Relief for Families

The primary objective of this event is to provide financial relief to families, especially those with school-going children. By eliminating sales tax on essential items, parents can save a considerable amount of money, making it easier to afford necessary purchases without straining their budgets.

Boost to Local Businesses

The tax-free weekend is a boon for local businesses, particularly retail stores. The increased foot traffic and sales during this period can significantly impact their revenue, helping them thrive and create more job opportunities. Additionally, it encourages shoppers to support their local economy, fostering a sense of community.

Encouraging Smart Spending

With the tax exemption, shoppers are more inclined to make thoughtful purchases. They can compare prices, seek out deals, and make informed choices, ensuring they get the best value for their money. This promotes a culture of conscious consumerism, benefiting both shoppers and businesses.

Impact on the State Economy

From an economic standpoint, Florida’s No Sales Tax Weekend has a positive effect on the state’s revenue. While sales tax is temporarily waived, the overall increase in sales during this period offsets the loss, leading to a net gain for the state. This additional revenue can be invested back into the community, improving public services and infrastructure.

Community Engagement

The event serves as a community-building initiative, bringing people together to celebrate and save. Many stores organize special promotions and events, creating a festive atmosphere that enhances the shopping experience. It’s an opportunity for residents to connect, share tips, and enjoy the benefits of tax-free shopping.

Tips for a Successful Shopping Experience

To make the most of Florida’s No Sales Tax Weekend, here are some practical tips to ensure a smooth and rewarding shopping journey:

- Plan your shopping list in advance, considering the eligible items and categories.

- Compare prices and look for deals to maximize your savings.

- Shop early to avoid crowds and ensure availability of your preferred items.

- Check store hours and locations to plan your itinerary efficiently.

- Consider online shopping for a wider selection and convenient delivery options.

- Stay updated on any last-minute changes or additions to the eligible items list.

Remember, while the tax-free weekend is an excellent opportunity to save, it's essential to maintain a balanced approach to spending. Stick to your budget and focus on the items you genuinely need.

Conclusion

Florida’s No Sales Tax Weekend is a win-win for everyone involved. It provides financial relief to families, supports local businesses, and boosts the state’s economy. With careful planning and a strategic approach, shoppers can make the most of this exciting event, enjoying significant savings on a wide range of essential items. So, mark your calendars, create your shopping lists, and get ready to embrace the benefits of tax-free shopping in the Sunshine State!

When is Florida’s No Sales Tax Weekend typically held?

+Florida’s No Sales Tax Weekend, also known as the Back-to-School Sales Tax Holiday, is usually held during the last weekend of July or the first weekend of August. The exact dates can vary slightly from year to year, so it’s advisable to check the official announcements from the Florida Department of Revenue for the specific dates.

Are there any price limits on eligible items during the tax-free weekend?

+Yes, there are typically price limits on certain items. For instance, clothing items priced at $60 or less per item are usually exempt from sales tax. However, these limits can vary for different categories, so it’s crucial to review the official guidelines to understand the specific price thresholds for each eligible item.

Can I purchase items online and still benefit from the tax exemption?

+Absolutely! Many online retailers participate in the No Sales Tax Weekend, offering tax-free deals on eligible items. When shopping online, ensure that the retailer is based in Florida or has a physical presence in the state to qualify for the tax exemption. Always check the retailer’s policies and terms regarding the tax-free weekend.

Are there any restrictions on the quantity of items I can purchase tax-free?

+Generally, there are no restrictions on the quantity of items you can purchase tax-free during the weekend. However, some stores may have their own policies regarding bulk purchases, so it’s a good idea to check with individual retailers to understand any potential limitations.