Sales Tax Car North Carolina

The sales tax system in North Carolina, like in many other states, can be a complex and important aspect to understand, especially when it comes to purchasing a vehicle. This article aims to provide a comprehensive guide to help you navigate the sales tax process for car purchases in North Carolina, offering insights and information to ensure a smoother and more informed experience.

Understanding the Sales Tax Structure in North Carolina

North Carolina’s sales tax system is administered by the North Carolina Department of Revenue (NCDOR). The state imposes a uniform sales and use tax on retail sales, leases, or rentals of tangible personal property and certain services. This tax is applied at the time of purchase and is collected by the seller or lessor, who then remits it to the state.

For car purchases, the sales tax is applied to the purchase price of the vehicle, including any additional costs such as dealer fees, optional equipment, and warranty packages. It's important to note that North Carolina does not tax the full purchase price of a vehicle; instead, it calculates the tax based on a sliding scale rate determined by the vehicle's value.

| Vehicle Value | Sales Tax Rate |

|---|---|

| $3000 or less | 3% |

| $3000.01 to $5000 | 4% |

| $5000.01 and above | 5% |

This sliding scale ensures that individuals purchasing more expensive vehicles pay a higher proportion of tax. It's worth mentioning that this rate does not include any local taxes or additional fees that may be applicable in certain counties or municipalities.

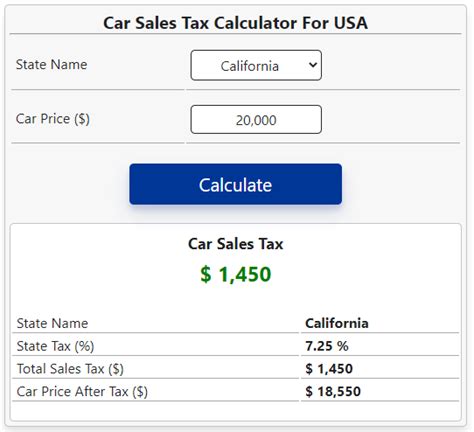

Calculating Sales Tax for Car Purchases

Calculating the sales tax for your car purchase is a straightforward process, but it’s crucial to understand the value of the vehicle you’re buying to ensure an accurate calculation. Here’s a step-by-step guide to help you through this process:

-

Determine the Vehicle's Value: The first step is to establish the purchase price of the car, including any additional costs mentioned earlier. This value is critical as it determines the applicable sales tax rate.

-

Apply the Sliding Scale Rate: Using the table provided earlier, identify the sales tax rate that corresponds to the vehicle's value. For example, if the purchase price is $4,500, the applicable rate would be 4%.

-

Calculate the Tax: Multiply the purchase price by the applicable rate to determine the sales tax amount. For the example above, the sales tax would be $4,500 * 0.04 = $180.

-

Consider Local Taxes: As mentioned, some counties have additional local sales taxes. You'll need to add these to the state sales tax calculated in the previous step. Check with your local tax office or the NCDOR website for specific rates.

By following these steps, you can accurately calculate the sales tax you'll owe on your car purchase in North Carolina. It's a good practice to confirm these calculations with your dealer or a tax professional to ensure accuracy and compliance with state and local regulations.

Exemptions and Special Considerations

While most car purchases in North Carolina are subject to sales tax, there are certain exemptions and special considerations to be aware of. These can significantly impact the amount of tax you pay, so it’s important to understand them:

Trade-Ins and Rebates

When trading in your old vehicle, the value of the trade-in is typically subtracted from the purchase price of the new car. This reduced amount is then used to calculate the sales tax. Additionally, any rebates or discounts you receive from the dealer or manufacturer can also reduce the purchase price and thus, the sales tax.

Military and Veteran Exemptions

Active-duty military personnel, veterans, and their spouses may be eligible for sales tax exemptions on certain vehicle purchases. These exemptions can significantly reduce or even eliminate the sales tax liability. To qualify, you must meet specific criteria and provide appropriate documentation to the dealer or tax authority.

Disabled Veteran Exemptions

Veterans with service-connected disabilities may also be eligible for sales tax exemptions when purchasing a vehicle. These exemptions can apply to the entire purchase price or a portion of it, depending on the disability rating and the type of vehicle purchased. As with military exemptions, documentation is required to prove eligibility.

Alternative Fuel Vehicles

North Carolina offers incentives for the purchase of alternative fuel vehicles, including sales tax exemptions. These vehicles include electric, hybrid, and hydrogen fuel cell cars. The exemptions can vary depending on the type of vehicle and the date of purchase, so it’s important to stay updated on the latest incentives and regulations.

Sales Tax Remittance and Compliance

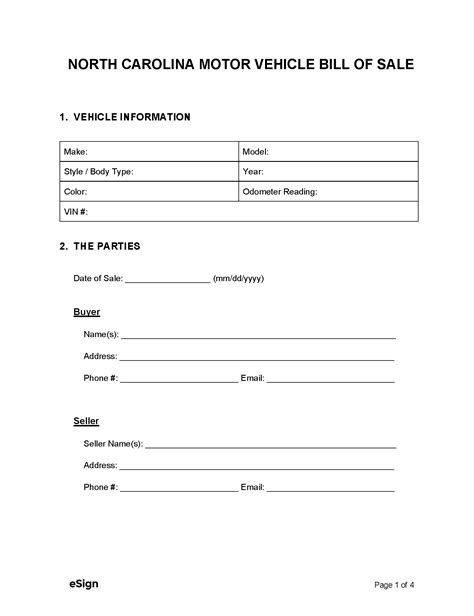

Once you’ve calculated the sales tax for your car purchase, it’s important to understand how and when to remit this tax. Here’s a brief overview of the process:

- At the Time of Purchase: In most cases, the sales tax is collected by the dealer at the time of purchase. They will add the tax to the total amount due, and you'll pay it as part of the transaction.

- Registration and Title: The sales tax information is also included in the vehicle registration and titling process. This information is required by the North Carolina Division of Motor Vehicles (DMV) to complete the registration and title transfer.

- Compliance and Audits: The NCDOR conducts audits to ensure compliance with sales tax regulations. If you're selected for an audit, you'll need to provide documentation to support your tax filings and payments.

It's crucial to keep accurate records of your car purchase, including the sales contract, receipts, and any documentation related to trade-ins, rebates, or exemptions. These records can help you demonstrate compliance and resolve any issues that may arise during an audit.

Conclusion: A Comprehensive Approach to Sales Tax for Car Purchases in North Carolina

Navigating the sales tax system for car purchases in North Carolina can be complex, but with a thorough understanding of the process and the resources available, it can be managed effectively. By calculating the tax accurately, taking advantage of exemptions and incentives, and staying compliant with remittance and documentation requirements, you can ensure a smooth and hassle-free experience.

Remember, the North Carolina Department of Revenue and the Division of Motor Vehicles are excellent resources for detailed information and guidance. Their websites offer a wealth of information to help you understand and comply with the state's sales tax regulations.

How often do sales tax rates change in North Carolina?

+Sales tax rates in North Carolina are subject to change by the state legislature. While they typically remain stable for extended periods, it’s important to stay updated, especially during budget sessions, as changes can occur.

Are there any other fees associated with car purchases in North Carolina besides sales tax?

+Yes, there are additional fees associated with car purchases in North Carolina. These can include registration fees, title fees, and various other charges depending on the county and the specific transaction. It’s advisable to check with your local DMV office or tax authority for a comprehensive list of fees.

Can I negotiate the sales tax on my car purchase?

+No, the sales tax is a mandatory charge set by the state and local governments. While you can negotiate the purchase price of the car, which indirectly affects the sales tax, the tax itself is non-negotiable.