Connecticut Automobile Tax

The Connecticut automobile tax, also known as the vehicle property tax, is an annual assessment levied on registered vehicle owners in the state. It is an important revenue stream for local governments and municipalities, contributing significantly to the funding of various public services and infrastructure projects. Understanding the intricacies of this tax is essential for both vehicle owners and policymakers, as it impacts personal finances and shapes the state's fiscal landscape.

Understanding the Connecticut Automobile Tax

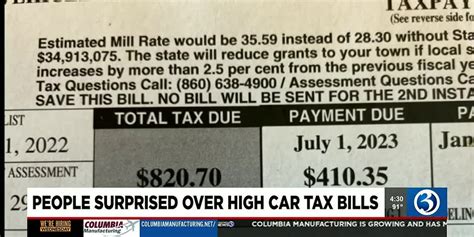

The Connecticut automobile tax is a flat rate tax based on the value of the vehicle and the location of the owner’s residence. This tax is distinct from other vehicle-related fees, such as registration fees and fuel taxes, and is primarily used to fund local services like road maintenance, emergency response, and education.

The tax is assessed annually and is typically due by April 1st each year. Failure to pay this tax can result in late fees, penalties, and even suspension of vehicle registration, highlighting the importance of timely payments.

While the basic structure of the automobile tax is consistent statewide, there are some nuances and variations that can impact the final amount owed. These variations are primarily driven by the locality in which the vehicle owner resides, as each town or city in Connecticut has the autonomy to set its own tax rate within the state's guidelines.

Tax Calculation: A Step-by-Step Guide

The process of calculating the Connecticut automobile tax involves several steps, each of which is critical to the final assessment.

- Vehicle Value Determination: The first step involves determining the value of the vehicle. This value is typically based on the fair market value of the vehicle as determined by the Connecticut Department of Motor Vehicles (DMV) or a third-party valuation service.

- Local Tax Rate Application: Once the vehicle's value is established, the appropriate tax rate for the owner's locality is applied. These tax rates are set by local governments and can vary significantly from one town to another.

- Assessment Finalization: After the value is determined and the tax rate is applied, the final tax assessment is calculated. This amount is what the vehicle owner will be responsible for paying to their local tax authority by the due date.

It's important to note that while the calculation process is standardized, the specifics can vary based on the type of vehicle, its age, and other local factors. For instance, certain localities may offer tax exemptions or discounts for hybrid or electric vehicles, or for vehicles owned by military personnel or veterans.

The Impact on Vehicle Owners

The Connecticut automobile tax has a direct impact on the financial obligations of vehicle owners in the state. This tax is an additional cost to consider when purchasing or owning a vehicle, and it can significantly impact the overall cost of vehicle ownership, especially for those with higher-value vehicles.

Financial Considerations

The financial implications of the automobile tax are twofold. Firstly, it increases the cost of vehicle ownership, which can be a significant burden, especially for those on a tight budget. Secondly, it influences purchasing decisions, as individuals may opt for more affordable vehicles to minimize their tax liability.

| Vehicle Type | Estimated Value | Tax Rate (Example) | Annual Tax |

|---|---|---|---|

| Sedan | $20,000 | 1.5% | $300 |

| SUV | $35,000 | 1.75% | $612.50 |

| Luxury Car | $100,000 | 2.25% | $2,250 |

The table above provides a simplified example of how the automobile tax can vary based on vehicle type and value. In this example, a luxury car owner could pay significantly more in taxes compared to a sedan owner, highlighting the financial considerations associated with vehicle choice.

Tax Planning and Strategies

Given the impact of the automobile tax, many vehicle owners engage in tax planning to optimize their financial obligations. This can involve strategies such as:

- Vehicle Selection: Choosing a vehicle with a lower value or opting for a used vehicle can result in a lower tax assessment.

- Exemptions and Discounts: Understanding and taking advantage of available exemptions or discounts, such as those for green vehicles or veteran-owned vehicles, can reduce tax liability.

- Timing of Purchase: Purchasing a vehicle towards the end of the tax year can provide a longer period before the next tax assessment, thus deferring the tax payment.

The Role in Local Government Funding

The Connecticut automobile tax plays a critical role in funding local government operations and public services. It is a significant revenue source for towns and cities, providing the financial resources necessary to maintain and improve the quality of life for residents.

Funding Local Services

The revenue generated from the automobile tax is used to fund a wide range of local services, including:

- Road Maintenance: Repair and upkeep of local roads, bridges, and highways.

- Emergency Services: Funding for fire departments, ambulances, and other emergency response teams.

- Education: Supporting local schools and educational initiatives.

- Public Safety: Funding for police departments and other public safety measures.

- Parks and Recreation: Maintenance and development of public parks, recreational facilities, and community centers.

By providing a steady stream of revenue, the automobile tax ensures that these essential services are adequately funded, benefiting the entire community.

Balancing the Budget

The automobile tax is an important tool for local governments to balance their budgets. It provides a predictable and stable source of revenue, which is crucial for planning and executing long-term projects and initiatives. The tax rate can be adjusted by local authorities to meet budgetary needs, although this is typically done with caution to avoid excessive tax burdens on residents.

Furthermore, the automobile tax contributes to the overall economic health of the state. By funding essential services and infrastructure, it fosters an environment conducive to business growth and development, which in turn generates more tax revenue and benefits the state as a whole.

Comparative Analysis: Connecticut vs. Other States

When compared to other states, Connecticut’s automobile tax system stands out for its simplicity and local autonomy. While the basic structure is similar to many other states, the ability for local governments to set their own tax rates adds a layer of complexity and variation.

State-by-State Comparison

Each state has its own unique approach to vehicle taxation, with variations in tax rates, valuation methods, and exemptions. Here’s a simplified comparison of Connecticut’s automobile tax system with those of a few other states:

| State | Tax Rate | Valuation Method | Exemptions |

|---|---|---|---|

| Connecticut | Varies by locality (e.g., 1.5% - 2.25%) | Fair market value | Hybrid/electric vehicle discounts, veteran/military discounts |

| California | 1% | Purchase price | Newly purchased vehicles exempt for first year |

| Texas | Varies by county (e.g., 0.5% - 2%) | Market value | None |

| New York | Varies by county (e.g., 0.25% - 1.5%) | Market value | Certain types of alternative fuel vehicles |

As shown above, Connecticut's system allows for more localized control over tax rates, which can result in significant variations across the state. In contrast, states like California and Texas have more uniform tax rates but may have different valuation methods and exemptions.

Implications for Residents and Businesses

The variations in automobile tax systems across states can have significant implications for both residents and businesses. For residents, it can impact the overall cost of living and the affordability of vehicle ownership. For businesses, especially those with fleets of vehicles, these variations can influence operational costs and tax planning strategies.

Future Outlook and Potential Reforms

As with any tax system, the Connecticut automobile tax is subject to ongoing evaluation and potential reform. The state and local governments regularly assess the fairness and effectiveness of the tax, considering factors such as revenue needs, economic conditions, and resident feedback.

Potential Reforms

Some of the potential reforms that have been proposed or are under consideration include:

- Standardizing Tax Rates: Moving towards a more uniform tax rate across the state to simplify the system and reduce variations.

- Adjusting Valuation Methods: Exploring alternative methods for determining vehicle values to ensure fairness and accuracy.

- Expanding Exemptions: Considering additional exemptions or discounts to support certain sectors, such as green energy or veteran-owned businesses.

- Introducing Hybrid Systems: Combining elements of the current system with other tax models, such as a flat rate plus a small percentage of the vehicle's value, to balance simplicity and fairness.

These potential reforms aim to strike a balance between the needs of local governments for stable revenue and the interests of vehicle owners for a fair and transparent tax system.

Long-Term Implications

The future of the Connecticut automobile tax will likely be influenced by several key factors, including:

- Technological Advances: The rise of electric and autonomous vehicles may necessitate changes to the tax system to ensure continued revenue generation.

- Economic Conditions: Economic downturns or periods of inflation can impact vehicle values and tax revenues, requiring adaptive measures.

- Public Opinion: Resident feedback and preferences play a crucial role in shaping tax policies, especially with increasing calls for tax fairness and simplicity.

As the state and local governments navigate these factors, they will continue to adapt and refine the automobile tax system to meet the evolving needs of their residents and businesses.

What is the average automobile tax rate in Connecticut?

+The average automobile tax rate in Connecticut varies depending on the locality, ranging from approximately 1.5% to 2.25%. However, it’s important to note that this rate can fluctuate, and some towns may have higher or lower rates.

Are there any exemptions or discounts available for the automobile tax?

+Yes, Connecticut offers certain exemptions and discounts for the automobile tax. For example, hybrid and electric vehicles may be eligible for a reduced tax rate or a tax credit. Additionally, veterans and active-duty military personnel may also qualify for exemptions or discounts.

How often is the automobile tax assessed in Connecticut?

+The automobile tax in Connecticut is typically assessed on an annual basis, meaning vehicle owners are required to pay this tax once every year. The due date for payment is generally April 1st, and failure to pay by this date may result in late fees and penalties.